Securing pre-approval for an investment property is a critical step in the real estate investment process. It not only provides clarity on your borrowing capacity but also enhances your credibility with sellers, allowing you to navigate the competitive property market with confidence. This comprehensive guide delves into the market analysis, implementation strategies, risk considerations, regulatory aspects, and future outlook surrounding the pre-approval process for investment properties.

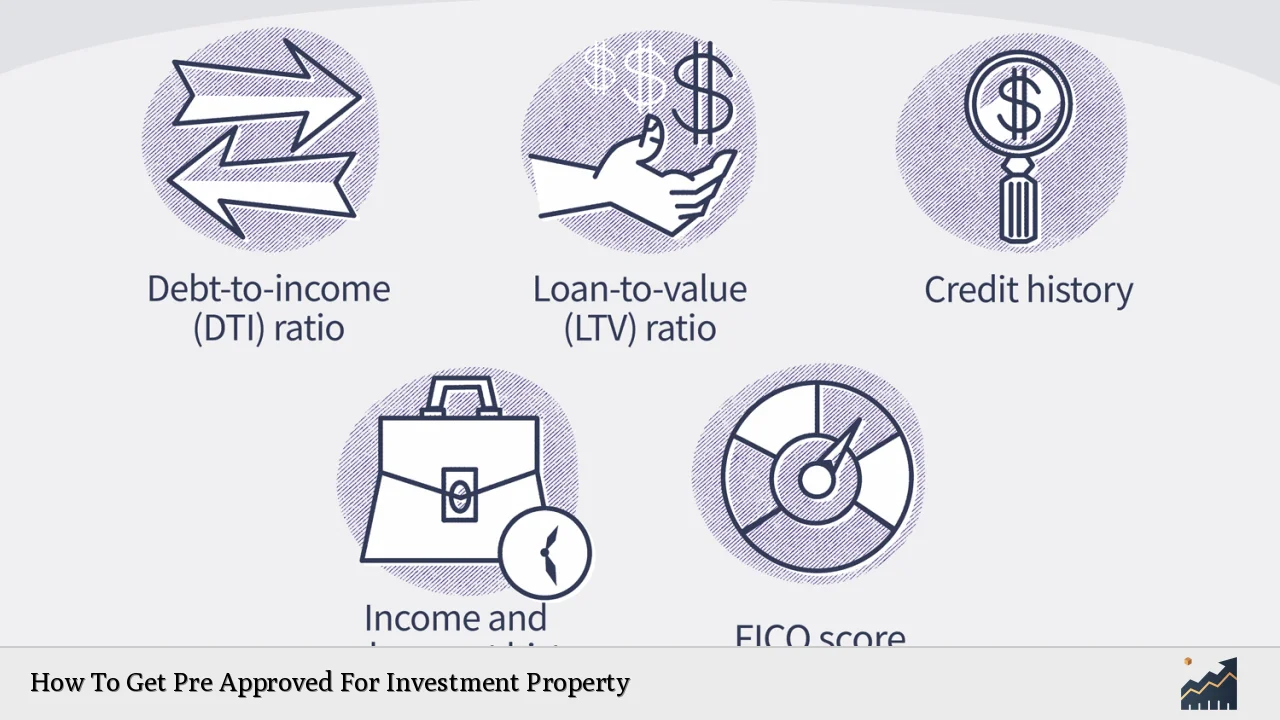

| Key Concept | Description/Impact |

|---|---|

| Pre-Approval Process | A formal evaluation by lenders assessing your financial status to determine how much you can borrow. |

| Credit Score | Your credit score significantly influences your loan terms; higher scores typically yield better rates. |

| Debt-to-Income Ratio | This ratio helps lenders gauge your ability to manage monthly payments alongside existing debts. |

| Down Payment Requirements | Investment properties often require larger down payments (20-30%) compared to primary residences. |

| Market Trends | Understanding current real estate trends can inform your investment decisions and pre-approval strategy. |

| Regulatory Compliance | Staying updated with local and national regulations is essential for successful property investment. |

Market Analysis and Trends

The real estate market is currently experiencing significant shifts influenced by various economic factors. As of late 2024, the housing market has shown resilience despite challenges such as rising interest rates and inflation.

- Interest Rates: Mortgage rates are projected to hover around 6.3% in 2025, slightly lower than the 6.7% average expected at the end of 2024. This decline is anticipated as the Federal Reserve makes minor adjustments to its benchmark rate due to improving economic conditions.

- Property Values: According to KPMG’s Residential Property Market Outlook, national house prices are expected to rise by approximately 5.3% in 2024 and continue increasing into 2025. This growth is attributed to limited housing supply and increased buyer confidence as interest rates stabilize.

- Investor Sentiment: A recent survey indicated that over half of property investors remain optimistic about their investments, with many expecting a decrease in interest rates in the coming year. However, concerns about potential economic downturns and regulatory changes persist.

Understanding these trends is crucial for investors seeking pre-approval for investment properties, as they directly impact borrowing capacity and investment viability.

Implementation Strategies

To successfully obtain pre-approval for an investment property, follow these key steps:

- Assess Your Financial Health: Before approaching lenders, evaluate your credit score and debt-to-income ratio. Aim for a credit score above 700 for favorable loan terms.

- Gather Necessary Documentation: Prepare essential documents such as:

- Recent tax returns

- Pay stubs or proof of income

- Bank statements

- Details of existing debts

- Choose the Right Lender: Research various lenders or mortgage brokers who specialize in investment properties. Compare their offerings, fees, and customer service reviews.

- Submit Your Application: Once you’ve selected a lender, submit your pre-approval application along with the required documentation. Be prepared for a credit check and further inquiries about your financial situation.

- Understand Loan Terms: Review the terms of your pre-approval carefully, including interest rates, repayment periods, and any conditions attached to the approval.

- Maintain Financial Stability: Avoid taking on new debts or making significant financial changes during the pre-approval process to ensure your application remains strong.

Risk Considerations

Investing in real estate carries inherent risks that can impact your pre-approval process:

- Market Volatility: Economic fluctuations can affect property values and rental income potential. Investors should stay informed about local market trends and economic indicators.

- Interest Rate Changes: Rising interest rates can increase borrowing costs, impacting cash flow from rental properties. It’s essential to factor potential rate hikes into your financial planning.

- Regulatory Risks: Changes in housing regulations can affect property management practices and investor returns. Keeping abreast of local laws and compliance requirements is crucial.

To mitigate these risks, conduct thorough market research and consider consulting with financial advisors or real estate professionals before making significant investment decisions.

Regulatory Aspects

Understanding the regulatory landscape is vital for securing pre-approval for an investment property:

- Lending Regulations: Lenders are required to adhere to specific guidelines set forth by regulatory bodies such as the Consumer Financial Protection Bureau (CFPB). These regulations dictate lending practices and borrower protections.

- Property Management Laws: Familiarize yourself with landlord-tenant laws in your area to ensure compliance when managing rental properties.

- Tax Implications: Investment properties come with unique tax considerations, including potential deductions for mortgage interest and depreciation. Consulting a tax professional can help optimize your tax strategy.

Staying informed about these regulations will help you navigate the complexities of real estate investing more effectively.

Future Outlook

The outlook for obtaining pre-approval for investment properties appears promising as economic conditions improve:

- Increased Access to Credit: As interest rates stabilize and lender competition increases, investors may find more favorable lending options available in 2025.

- Growing Investor Confidence: With many investors expressing optimism about future property values and economic stability, demand for investment properties is likely to rise.

- Technological Advancements: The use of digital platforms for mortgage applications is expected to streamline the pre-approval process further, making it easier for investors to secure financing quickly.

Investors should remain proactive in monitoring market conditions and adapting their strategies accordingly to capitalize on emerging opportunities.

Frequently Asked Questions About How To Get Pre Approved For Investment Property

- What does it mean to be pre-approved for an investment property?

Pre-approval indicates that a lender has evaluated your financial situation and conditionally agreed to lend you a specific amount based on that assessment. - How long does the pre-approval process take?

The pre-approval process typically takes anywhere from a few days to a couple of weeks, depending on how quickly you provide necessary documentation. - Can I get pre-approved if I have bad credit?

While it may be challenging, some lenders offer options for borrowers with lower credit scores; however, expect higher interest rates or additional requirements. - How long does a pre-approval last?

A pre-approval letter usually remains valid for 60 to 90 days; after that period, you may need to reapply or update your financial information. - Is there a difference between pre-qualification and pre-approval?

Yes, pre-qualification provides an estimate based on self-reported information, while pre-approval involves a thorough review of your financial history by a lender. - What are common reasons for being denied pre-approval?

Common reasons include low credit scores, high debt-to-income ratios, insufficient income documentation, or recent major financial changes. - Do I need a down payment for an investment property?

Yes, most lenders require a down payment ranging from 20% to 30% of the property’s purchase price for investment properties. - Can I get multiple pre-approvals?

Yes, you can seek multiple pre-approvals from different lenders; however, be cautious as multiple credit checks can temporarily impact your credit score.

In conclusion, obtaining pre-approval for an investment property is an essential step that requires careful planning and understanding of both personal finances and market conditions. By following strategic steps outlined above and staying informed about industry trends and regulations, investors can position themselves effectively in the competitive real estate landscape.