Investing can be an intimidating prospect for many, especially for those just starting out. The vast array of options, strategies, and potential risks can make it difficult to know where to begin. However, with the right guidance and a clear plan, anyone can successfully navigate the world of investing. This guide will provide you with essential steps to start your investing journey, helping you build a solid foundation for your financial future.

| Step | Description |

|---|---|

| 1 | Identify your financial goals |

| 2 | Choose an investment account |

| 3 | Understand different asset classes |

| 4 | Develop an investment strategy |

| 5 | Start investing with small amounts |

| 6 | Monitor and adjust your portfolio |

Identify Your Financial Goals

The first step in getting into investing is to identify your financial goals. Understanding what you want to achieve will guide your investment decisions. Are you saving for retirement, a child’s education, or a major purchase? Each goal may require a different investment approach.

When setting goals, consider the following:

- Time Horizon: Determine when you will need the money. Short-term goals (1-3 years) may require safer investments, while long-term goals (10+ years) can afford more risk.

- Amount Needed: Estimate how much money you will need to achieve your goal. This will help you understand how much you need to save and invest.

- Risk Tolerance: Assess how comfortable you are with taking risks. This will influence the types of investments that are suitable for you.

By having clear financial goals, you can create a focused investment strategy that aligns with your objectives.

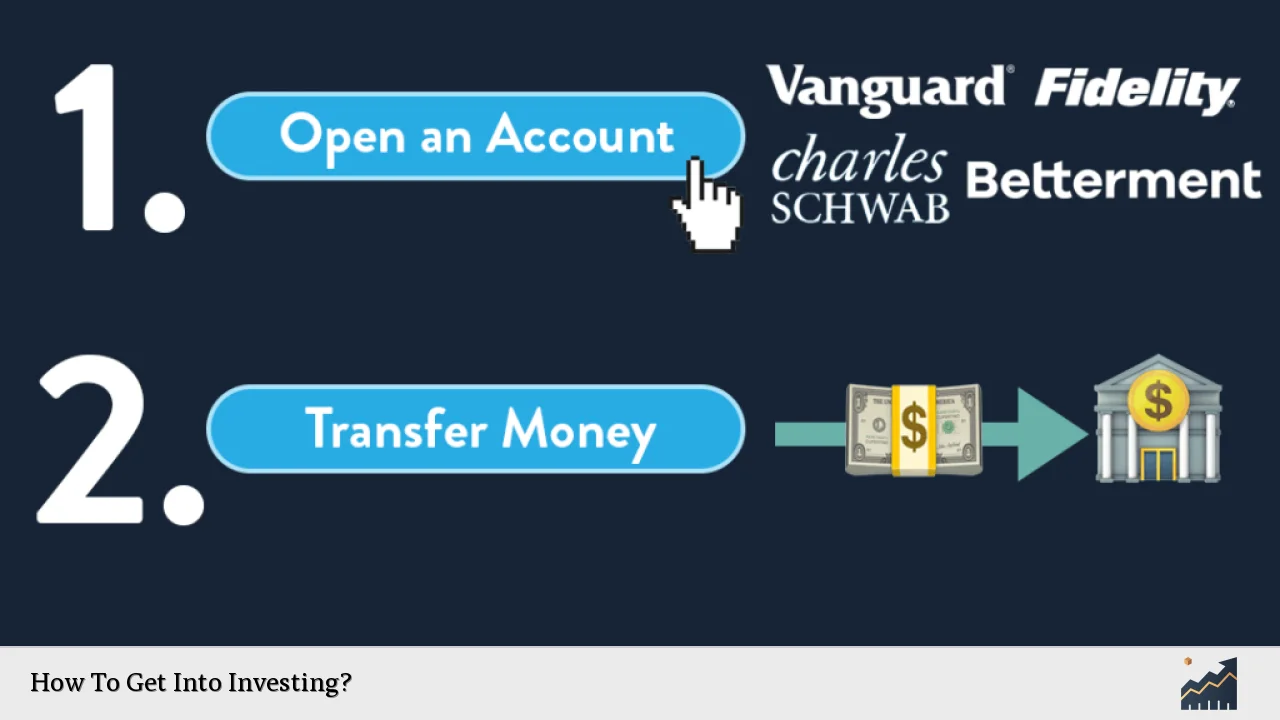

Choose an Investment Account

Once you’ve established your financial goals, the next step is to choose an investment account that suits your needs. There are several types of accounts available:

- Brokerage Accounts: These accounts allow you to buy and sell various investments like stocks, bonds, and mutual funds. They offer flexibility but may have tax implications.

- Retirement Accounts: Options like IRAs and 401(k)s are designed for retirement savings and often come with tax advantages. They may have contribution limits and withdrawal restrictions.

- Robo-Advisors: These automated platforms create and manage a diversified portfolio for you based on your risk tolerance and goals, making investing easier for beginners.

Selecting the right account is crucial as it affects how you invest and the potential tax implications of your earnings.

Understand Different Asset Classes

To make informed investment decisions, it’s essential to understand different asset classes. Investments typically fall into several categories:

- Stocks: Represent ownership in companies and can offer high returns but come with higher risk.

- Bonds: Loans made to corporations or governments that pay interest over time. They are generally considered safer than stocks but offer lower returns.

- Mutual Funds/ETFs: Pooled investments that allow investors to buy a diversified portfolio of stocks or bonds in one transaction. They are ideal for beginners seeking diversification.

- Real Estate: Investing in property can provide rental income and potential appreciation but requires more capital and management effort.

By familiarizing yourself with these asset classes, you can better assess which investments align with your goals and risk tolerance.

Develop an Investment Strategy

Creating a well-defined investment strategy is critical for success. This strategy should reflect your financial goals, risk tolerance, and time horizon. Here are some common approaches:

- Buy and Hold: This long-term strategy involves purchasing investments and holding them over time to benefit from market growth.

- Dollar-Cost Averaging: Invest a fixed amount regularly regardless of market conditions. This approach reduces the impact of volatility by averaging out the purchase price over time.

- Diversification: Spread investments across various asset classes to minimize risk. A diversified portfolio is less likely to suffer significant losses if one sector underperforms.

Your strategy should be adaptable; as your financial situation changes or market conditions shift, be prepared to review and adjust your approach accordingly.

Start Investing with Small Amounts

Many beginners hesitate to invest due to concerns about needing large sums of money. However, it’s important to remember that you can start investing with small amounts. Many platforms allow fractional shares or low minimum investments in mutual funds or ETFs.

Consider these points:

- Set Up Automatic Contributions: Automate regular contributions from your bank account into your investment account. This helps build your portfolio over time without requiring active management.

- Utilize Investment Apps: Many investment apps cater specifically to beginners, offering user-friendly interfaces and educational resources that make it easy to start investing without feeling overwhelmed.

Starting small allows you to gain experience while minimizing risk as you learn about the market dynamics.

Monitor and Adjust Your Portfolio

Once you’ve begun investing, it’s crucial to regularly monitor and adjust your portfolio. Market conditions change, as do personal circumstances; therefore, maintaining an active approach is essential for long-term success.

Key actions include:

- Review Performance Regularly: Assess how your investments are performing relative to your goals at least annually. This helps ensure you’re on track toward achieving them.

- Rebalance Your Portfolio: As certain assets grow faster than others, rebalancing ensures that your asset allocation remains aligned with your risk tolerance and investment strategy.

- Stay Informed: Keep up with market trends and economic news that could impact your investments. Knowledge empowers better decision-making regarding when to buy or sell assets.

By actively managing your portfolio, you can adapt to changes in the market or personal circumstances while staying focused on achieving your financial goals.

FAQs About How To Get Into Investing

- What is the best way for beginners to start investing?

The best way is to identify financial goals, choose an appropriate investment account, and start small with regular contributions. - How much money do I need to start investing?

You can start investing with as little as $100 or even less through platforms that allow fractional shares. - What types of investments should beginners consider?

Beginners should consider low-cost index funds or ETFs for diversification along with individual stocks if they feel comfortable. - How often should I review my investments?

You should review your investments at least once a year or more frequently if market conditions change significantly. - Is it necessary to hire a financial advisor?

No, it’s not necessary; many beginners successfully manage their own portfolios using online resources and tools.

Investing is not just about making money; it’s about building wealth over time through informed decisions and strategic planning. By following these steps—identifying goals, choosing accounts wisely, understanding asset classes, developing strategies, starting small, and monitoring progress—you’ll be well on your way toward becoming a successful investor. Remember that patience and discipline are key components of any successful investing journey.