Total Value Locked (TVL) is a critical metric in the decentralized finance (DeFi) ecosystem, representing the total value of assets locked within a DeFi protocol’s smart contracts. This metric provides insights into the health and popularity of DeFi projects, serving as an indicator of user engagement, liquidity, and overall market sentiment. Evaluating TVL effectively requires understanding its calculation, significance, market trends, and the various factors influencing it.

| Key Concept | Description/Impact |

|---|---|

| Definition of TVL | TVL quantifies the total monetary value deposited within a DeFi platform, reflecting user trust and liquidity. |

| Calculation Method | TVL is calculated by summing the current values of all digital assets locked in a platform’s smart contracts, typically expressed in USD. |

| Market Trends | TVL trends can indicate overall market health, investor confidence, and the attractiveness of specific protocols. |

| Risk Assessment | A high TVL often suggests a reliable and trusted platform, while low TVL may indicate potential risks or lack of interest. |

| Regulatory Considerations | The evolving regulatory landscape can impact TVL by influencing user participation and institutional investments in DeFi. |

| Future Outlook | As DeFi matures, TVL is expected to grow with increased adoption and innovation in blockchain technologies. |

Market Analysis and Trends

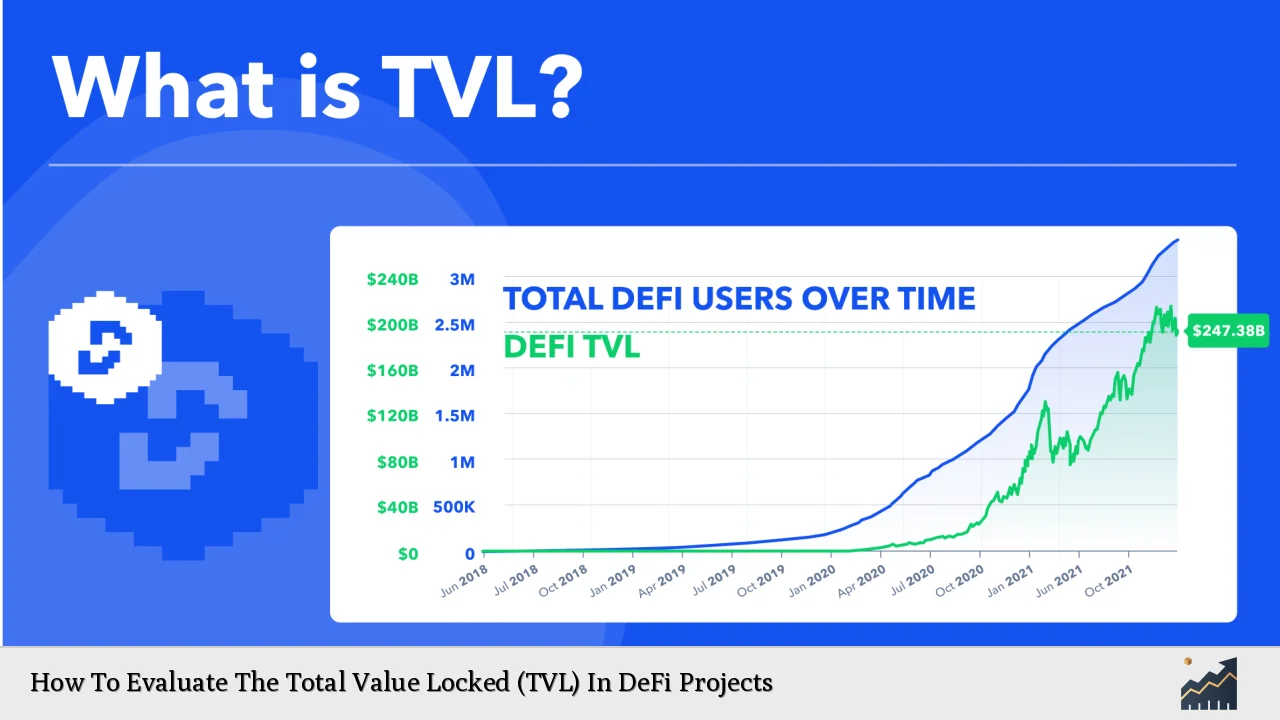

The DeFi sector has witnessed significant fluctuations in Total Value Locked (TVL) over recent years. As of January 2024, approximately $55.95 billion is locked in DeFi platforms, reflecting substantial growth from $9.1 billion in July 2020. This growth trajectory underscores the increasing interest in decentralized finance solutions as alternatives to traditional financial systems.

Key Market Insights:

- Dominance of Ethereum: Ethereum continues to dominate the DeFi landscape, accounting for over 58% of total liquidity. However, Layer 2 solutions like Arbitrum and Optimism are gaining traction due to their scalability and lower transaction costs.

- Recent Recovery: Following a decline post-2022’s market turmoil involving major players like FTX and Terra, TVL has rebounded significantly. For instance, it surged from around $38 billion at the beginning of 2023 to a high of $52 billion by year-end.

- Sector Performance: Specific sectors within DeFi, such as lending and liquidity pools, have shown stronger performance compared to others like decentralized insurance or payments. This disparity highlights varied user engagement levels across different DeFi applications.

Implementation Strategies

Evaluating TVL involves several strategic approaches:

- Using Analytics Tools: Leverage platforms like DeFiLlama or Token Terminal to track real-time TVL data across various protocols. These tools provide comprehensive dashboards that display current asset values locked in smart contracts.

- Comparative Analysis: Compare TVL across similar projects to gauge relative performance. A project with a significantly higher TVL than its competitors may indicate better user trust or superior offerings.

- Understanding Market Sentiment: Monitor social media trends and community discussions around specific protocols to assess investor sentiment that may influence TVL.

- Evaluating Project Fundamentals: Look beyond TVL; assess the underlying technology, team expertise, and use cases of the protocol to make informed investment decisions.

Risk Considerations

Investing in DeFi projects based on TVL requires careful consideration of associated risks:

- Volatility: The value of assets locked can fluctuate significantly due to market conditions. A sudden drop in cryptocurrency prices can lead to drastic changes in TVL.

- Smart Contract Risks: Bugs or vulnerabilities in smart contracts can expose funds to hacks or exploits. High-profile incidents have shown that even established protocols are not immune to security breaches.

- Regulatory Risks: As governments worldwide develop regulations surrounding cryptocurrencies and DeFi, compliance issues may arise that could impact user participation and ultimately affect TVL.

Regulatory Aspects

The regulatory environment for cryptocurrencies and DeFi is rapidly evolving. Key considerations include:

- Compliance Requirements: Projects must navigate complex regulatory landscapes that vary by jurisdiction. Non-compliance can lead to penalties or shutdowns.

- Impact on User Trust: Clear regulatory frameworks can enhance user confidence in DeFi platforms, potentially leading to increased participation and higher TVLs.

- Institutional Involvement: Regulatory clarity may attract institutional investors who were previously hesitant due to uncertainty surrounding legal frameworks.

Future Outlook

The future of Total Value Locked in DeFi appears promising:

- Continued Growth: As more users become aware of DeFi’s advantages—such as yield farming and decentralized lending—TVL is expected to rise further.

- Technological Innovations: Advancements in blockchain technology will likely lead to more efficient protocols that can handle larger volumes of transactions with lower fees.

- Integration with Traditional Finance: The blending of traditional finance with decentralized finance could open new avenues for growth. Real-world asset tokenization is one such area gaining traction.

Frequently Asked Questions About How To Evaluate The Total Value Locked (TVL) In DeFi Projects

- What does Total Value Locked (TVL) represent?

TVL indicates the total value of assets locked within a DeFi protocol’s smart contracts, reflecting user trust and liquidity. - How is TVL calculated?

TVL is calculated by summing the current values of all digital assets deposited within a platform at any given moment. - Why is TVL important for investors?

TVL serves as an indicator of a project’s health; higher TVLs generally suggest greater trust from users and potential for returns. - What factors influence changes in TVL?

Market sentiment, price fluctuations of underlying assets, protocol upgrades, and external economic conditions can all impact TVL. - How can I track the latest TVL figures?

You can use analytics tools like Token Terminal or DeFiLlama for real-time tracking of TVLs across various protocols. - What are the risks associated with investing based on TVL?

The primary risks include market volatility, smart contract vulnerabilities, and regulatory uncertainties that could affect user participation. - How does regulatory change impact TVL?

Clear regulations can enhance user confidence and institutional investment, potentially leading to increased TVLs across compliant platforms. - What is the future outlook for TVL in DeFi?

The outlook remains positive as technological advancements continue to improve efficiency and attract more users into the DeFi space.

In conclusion, evaluating Total Value Locked (TVL) in DeFi projects requires a multifaceted approach that considers market trends, implementation strategies, risk management practices, regulatory aspects, and future growth potential. By understanding these elements thoroughly, individual investors and finance professionals can make informed decisions regarding their investments within this dynamic sector.