Tokenomics, a blend of “token” and “economics,” is crucial in assessing the viability and potential of cryptocurrency projects, particularly smart contract platforms. This evaluation involves analyzing various factors such as token supply, distribution, utility, and governance mechanisms. Understanding tokenomics helps investors gauge the sustainability and growth prospects of a project, making it an essential aspect of investment strategy in the blockchain space.

| Key Concept | Description/Impact |

|---|---|

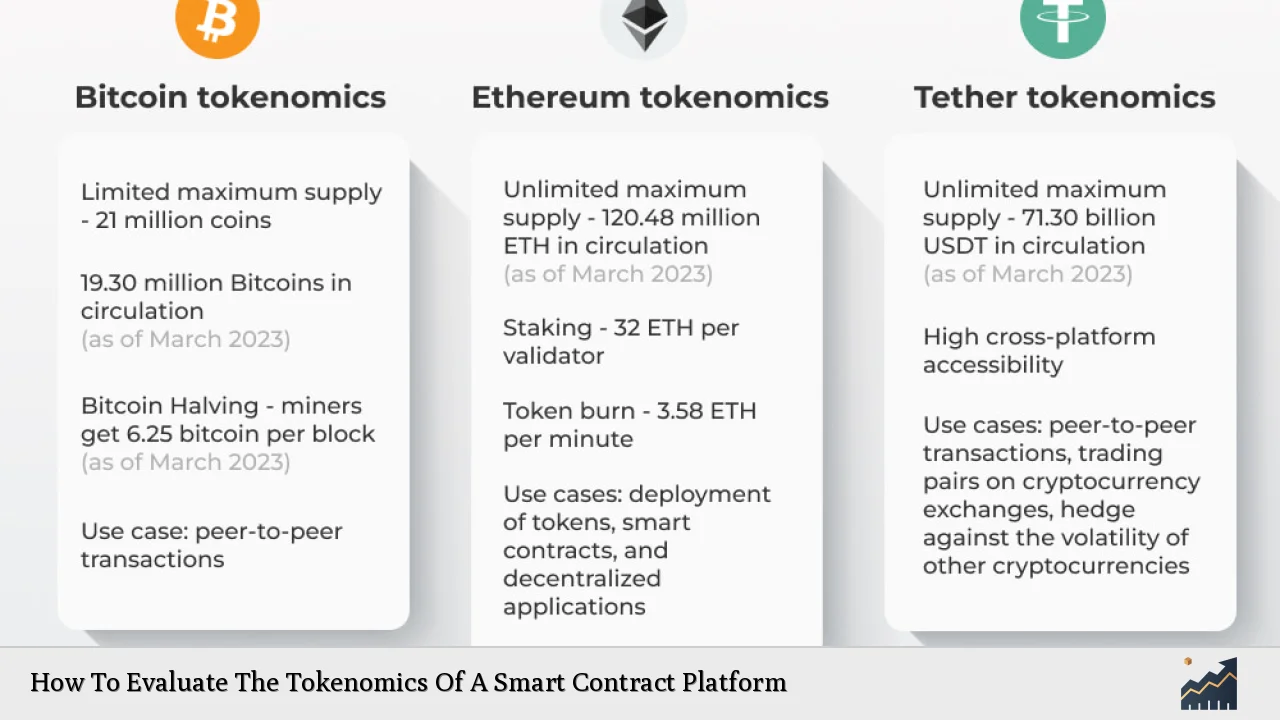

| Token Supply | The total number of tokens created and available for circulation. A limited supply can create scarcity, enhancing value over time. |

| Token Distribution | How tokens are allocated among stakeholders (team, investors, community). Fair distribution can prevent centralization and promote community trust. |

| Token Utility | The functional use of a token within its ecosystem (e.g., transaction fees, governance). Higher utility often correlates with increased demand. |

| Governance Mechanisms | Processes that allow token holders to influence decisions within the platform. Robust governance can enhance community engagement and project longevity. |

| Incentive Structures | Rewards designed to encourage specific behaviors (e.g., staking rewards). Effective incentives can drive user engagement and ecosystem growth. |

| Market Dynamics | The interplay of supply and demand factors that affect a token’s price. Understanding market trends is essential for predicting future performance. |

| Regulatory Compliance | Adherence to legal standards governing cryptocurrencies. Compliance can enhance credibility and reduce risks associated with legal challenges. |

Market Analysis and Trends

The smart contract platform market is witnessing rapid growth, driven by increased adoption across various sectors. As of 2023, the global smart contracts market was valued at approximately USD 1.71 billion, with projections indicating it could reach USD 12.55 billion by 2032, reflecting a compound annual growth rate (CAGR) of 24.7% from 2024 to 2032. This growth is fueled by advancements in blockchain technology and rising demand for decentralized applications (DApps) in finance, healthcare, and supply chain management.

Current Market Trends

- Ethereum Dominance: Ethereum continues to dominate the smart contract landscape, hosting around 70% of all deployed smart contracts as of 2024. However, competitors like Binance Smart Chain and Polkadot are gaining traction due to their scalability and lower transaction costs.

- DeFi Growth: Decentralized finance (DeFi) applications account for a significant portion of smart contracts, with over $200 billion locked in DeFi protocols. This sector’s growth highlights the increasing reliance on smart contracts for financial transactions.

- Regional Insights: North America leads in smart contract adoption due to its robust technological infrastructure. The Asia Pacific region is expected to exhibit the highest growth rate as blockchain investments surge.

Implementation Strategies

To effectively evaluate the tokenomics of a smart contract platform, investors should consider several implementation strategies:

- Research Whitepapers: Thoroughly analyze the project’s whitepaper, which outlines the tokenomics framework including supply limits, distribution plans, and utility.

- Community Engagement: Assess the project’s community through forums and social media to gauge sentiment and support levels. A vibrant community often indicates a healthy project.

- Utility Assessment: Evaluate the practical applications of the token within its ecosystem. Tokens with clear use cases tend to have higher demand.

- Incentive Mechanisms: Look for well-defined incentive structures that encourage user participation and long-term holding.

- Security Audits: Ensure that the platform has undergone third-party security audits to identify vulnerabilities in its smart contracts.

Risk Considerations

Investing in smart contract platforms carries inherent risks that must be carefully evaluated:

- Market Volatility: Cryptocurrency markets are notoriously volatile; price fluctuations can significantly impact investment value.

- Regulatory Risks: Changes in regulations can affect project viability. Platforms that do not comply with legal requirements may face operational challenges or shutdowns.

- Technological Risks: Bugs or vulnerabilities in smart contracts can lead to significant financial losses. Continuous monitoring and updates are essential for maintaining security.

- Competition: The rapid evolution of blockchain technology means new competitors can emerge quickly, potentially overshadowing established platforms.

Regulatory Aspects

Understanding regulatory frameworks is essential for evaluating tokenomics:

- Compliance Standards: Projects must adhere to local regulations regarding cryptocurrency issuance and trading. Non-compliance can lead to penalties or bans.

- KYC/AML Requirements: Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations are increasingly being enforced in many jurisdictions, impacting how projects operate.

- Tax Implications: Investors should be aware of tax obligations related to cryptocurrency transactions in their respective countries.

Future Outlook

The future of smart contract platforms appears promising as technology continues to evolve:

- Interoperability Enhancements: The development of cross-chain solutions will likely enhance the utility of smart contracts by allowing them to interact across different blockchain networks.

- Increased Institutional Adoption: As more institutions explore blockchain technology for operational efficiencies, demand for robust smart contract solutions is expected to rise.

- Innovative Use Cases: Emerging applications in areas like supply chain management, real estate tokenization, and identity verification will drive further adoption of smart contracts.

Frequently Asked Questions About How To Evaluate The Tokenomics Of A Smart Contract Platform

- What is tokenomics?

Tokenomics refers to the study of economic models behind cryptocurrency tokens, focusing on aspects like supply, distribution, utility, and governance. - Why is token supply important?

The total supply impacts scarcity; limited supply can enhance value over time as demand increases. - How do I assess a project’s governance?

Evaluate how decisions are made within the ecosystem—look for transparency in voting mechanisms and community involvement. - What role do incentives play in tokenomics?

Incentives encourage user engagement; effective structures can drive participation and long-term holding. - How can I mitigate risks when investing?

Diversify your portfolio, stay informed about regulatory changes, and conduct thorough research before investing. - What should I look for in a whitepaper?

A comprehensive whitepaper should detail the project’s goals, technical specifications, tokenomics structure, and roadmap. - Are there specific regulations I should be aware of?

Yes, regulations vary by jurisdiction; familiarize yourself with local laws regarding cryptocurrency trading and taxation. - What is the significance of community engagement?

A strong community often indicates project health; active participation suggests confidence in the project’s future.

Evaluating the tokenomics of a smart contract platform requires a multifaceted approach that encompasses market analysis, implementation strategies, risk considerations, regulatory aspects, and future outlooks. By understanding these elements thoroughly, investors can make informed decisions that align with their financial goals while navigating this dynamic landscape effectively.