Stablecoins have emerged as a pivotal component within the cryptocurrency landscape, offering a semblance of stability amidst the inherent volatility of traditional cryptocurrencies. Their value is typically pegged to stable assets such as fiat currencies or commodities, making them attractive for various applications, including trading, remittances, and decentralized finance (DeFi). Evaluating the market capitalization and liquidity of stablecoins is crucial for investors and finance professionals seeking to navigate this evolving market effectively.

Market capitalization (market cap) serves as a primary indicator of a stablecoin’s size and relevance in the market. It is calculated by multiplying the current price of the stablecoin by its circulating supply. Liquidity, on the other hand, refers to how easily a stablecoin can be bought or sold in the market without causing significant price fluctuations. Understanding these two metrics helps investors assess the stability and usability of stablecoins in different market conditions.

| Key Concept | Description/Impact |

|---|---|

| Market Capitalization | The total value of a stablecoin calculated by multiplying its price by circulating supply, indicating its market presence. |

| Liquidity | The ease with which a stablecoin can be converted into cash or other assets without affecting its price significantly. |

| Liquidity Concentration Metric (LCM) | A measure of how liquidity is distributed across different trading platforms, indicating potential slippage during trades. |

| Cost of Liquidity | The expense associated with executing large trades within liquidity pools, reflecting market efficiency. |

| Regulatory Compliance | Stablecoins must adhere to regulations that can affect their liquidity and market cap, impacting investor confidence. |

| Market Trends | Current trends in cryptocurrency markets influence both liquidity and market cap, requiring ongoing analysis for informed decision-making. |

Market Analysis and Trends

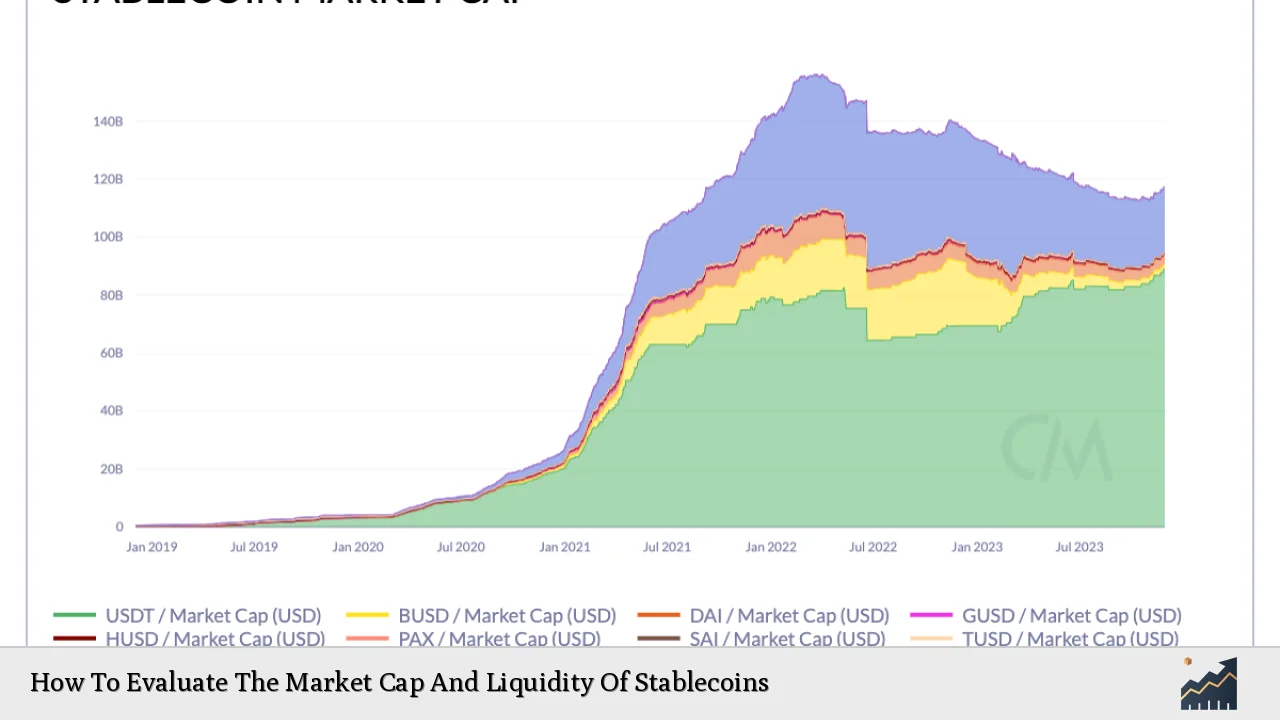

The stablecoin market has witnessed significant growth, with its total market capitalization peaking at over $175 billion in December 2021 before experiencing fluctuations due to regulatory scrutiny and market dynamics. As of mid-2023, the market cap for major stablecoins like Tether (USDT) and USD Coin (USDC) remains dominant, accounting for over 90% of the total stablecoin market.

The liquidity landscape has also evolved, with metrics such as the Liquidity Concentration Metric (LCM) providing insights into how liquidity is distributed across exchanges. A lower LCM indicates a more evenly distributed liquidity pool, allowing for larger trades with minimal price impact. Conversely, higher values suggest concentrated liquidity that may lead to significant slippage during transactions.

Current Market Statistics

- As of November 2024, USDT and USDC consistently demonstrate low liquidity costs, reflecting deep liquidity pools that accommodate large trades efficiently.

- In contrast, TrueUSD (TUSD) exhibits higher volatility in liquidity costs, indicating structural limitations.

Implementation Strategies

Investors looking to evaluate stablecoins should adopt a multifaceted approach that incorporates both quantitative and qualitative analyses:

- Assess Market Cap:

- Calculate the current market cap using the formula:

$$

\text{Market Cap} = \text{Price} \times \text{Circulating Supply}

$$ - Monitor historical trends to identify growth patterns or potential declines.

- Evaluate Liquidity:

- Analyze order book depth on centralized exchanges to gauge available liquidity.

- Utilize decentralized exchange (DEX) metrics such as Cost of Liquidity and LCM to understand trading efficiency.

- Diversification:

- Consider holding multiple stablecoins to mitigate risks associated with individual asset volatility.

- Explore different platforms to identify where specific stablecoins exhibit better liquidity characteristics.

- Monitor Regulatory Developments:

- Stay informed about regulatory changes that could impact stablecoin operations and investor confidence.

- Engage with resources from regulatory bodies like the SEC for updates on compliance requirements.

Risk Considerations

Investing in stablecoins is not without risks. Key considerations include:

- Market Risks: Sudden shifts in demand can lead to depegging events where a stablecoin’s value deviates from its intended peg.

- Liquidity Risks: In times of market stress, liquidity may dry up quickly, making it difficult to execute trades without incurring significant costs.

- Regulatory Risks: Ongoing scrutiny from regulators can affect operational capabilities and investor confidence in stablecoins.

- Operational Risks: Technical issues related to blockchain networks can hinder transaction speeds and affect liquidity availability.

Regulatory Aspects

The regulatory environment surrounding stablecoins is complex and continually evolving. Stablecoins face scrutiny due to their potential impact on financial systems:

- Compliance Requirements: Stablecoin issuers must adhere to anti-money laundering (AML) and know your customer (KYC) regulations.

- Transparency Obligations: Issuers are encouraged to provide clear insights into their reserve assets and operational practices to build trust among users.

- Potential Legislation: Future regulations may impose stricter requirements on collateralization and reserve management practices.

Future Outlook

The future of stablecoins appears promising but fraught with challenges. As digital currencies gain acceptance globally, the demand for stablecoins is likely to increase:

- Technological Innovations: Advances in blockchain technology may enhance the efficiency and security of stablecoin transactions.

- Increased Adoption: More businesses are likely to adopt stablecoins for payments due to their stability compared to volatile cryptocurrencies.

- Regulatory Developments: Ongoing discussions among regulators could lead to clearer frameworks that foster growth while ensuring consumer protection.

Investors must remain vigilant about emerging trends and adapt their strategies accordingly.

Frequently Asked Questions About How To Evaluate The Market Cap And Liquidity Of Stablecoins

- What factors influence the market capitalization of a stablecoin?

The market cap is influenced by the price per unit of the stablecoin multiplied by its circulating supply; factors include demand dynamics, regulatory changes, and overall cryptocurrency market conditions. - How can I measure the liquidity of a stablecoin?

Liquidity can be measured through order book depth on exchanges or metrics like Cost of Liquidity which indicate how easily trades can be executed without significant price impact. - What are some risks associated with investing in stablecoins?

Risks include market volatility leading to depegging events, regulatory scrutiny affecting operations, and operational risks related to blockchain technology. - Why is regulatory compliance important for stablecoins?

Compliance ensures stability in operations, builds consumer trust, and mitigates risks associated with legal repercussions or loss of access to markets. - How do I choose which stablecoin to invest in?

Consider factors like market cap size, liquidity metrics, historical performance during market stress events, and adherence to regulatory standards. - What role do decentralized exchanges play in stablecoin liquidity?

Decentralized exchanges provide an alternative trading venue where users can trade directly without intermediaries; they often have unique liquidity dynamics compared to centralized exchanges. - Can economic indicators affect the valuation of stablecoins?

Yes, economic indicators such as inflation rates or changes in monetary policy can influence investor sentiment towards fiat-pegged assets like stablecoins. - What should I monitor regularly when investing in stablecoins?

Regularly monitor market cap changes, liquidity metrics across exchanges, regulatory updates, and overall cryptocurrency market trends.

In conclusion, evaluating the market capitalization and liquidity of stablecoins requires a comprehensive understanding of various factors influencing these metrics. By implementing effective strategies and staying informed about regulatory developments and market trends, investors can make more informed decisions within this dynamic landscape.