Investing can seem daunting, especially for beginners. However, understanding the basics and following a structured approach can simplify the process significantly. This guide will help you navigate the world of investing, from setting your financial goals to choosing the right investment vehicles and strategies.

Investing is essentially putting your money to work with the expectation of generating a profit. This can be done through various asset classes such as stocks, bonds, real estate, and mutual funds. Each asset class has its own risk and return profile, and understanding these differences is crucial for building a successful investment portfolio.

To help you get started, here’s a brief overview of the key steps involved in investing:

| Step | Description |

|---|---|

| Set Clear Goals | Determine what you want to achieve with your investments. |

| Understand Risk Tolerance | Assess how much risk you are willing to take. |

| Choose Investment Accounts | Select the right accounts for your investment goals. |

| Research Investment Options | Explore different asset classes and their potential returns. |

| Create a Diversified Portfolio | Spread your investments across various asset classes. |

Setting Your Investment Goals

The first step in your investing journey is to set clear financial goals. Important info: These goals will guide your investment decisions and help you stay focused. Consider both short-term and long-term objectives.

- Short-term goals may include saving for a vacation or a new car within the next few years.

- Long-term goals often focus on retirement savings or funding a child’s education.

Once you have defined your goals, quantify them by attaching a specific amount of money and a timeline. For example, if you’re aiming to save $50,000 for a down payment on a house in five years, you’ll need to break this down into monthly savings targets.

Understanding your motivations for investing will also help clarify your goals. Are you looking to build wealth over time, generate passive income, or save for retirement? Knowing this will shape your investment strategy.

Assessing Your Risk Tolerance

Important info: Risk tolerance is the degree of variability in investment returns that you are willing to withstand. It is crucial to assess this before diving into investments.

To determine your risk tolerance:

- Reflect on your financial situation: Consider your income, expenses, debts, and how much you can afford to invest without affecting your lifestyle.

- Think about your emotional response: Are you comfortable with market fluctuations? Would you panic if your investments lost value temporarily?

Generally, younger investors can afford to take more risks since they have time to recover from market downturns. Conversely, those closer to retirement might prefer more conservative investments to preserve capital.

Choosing the Right Investment Accounts

Selecting the appropriate investment accounts is vital for reaching your financial goals efficiently. There are various types of accounts available:

- Brokerage Accounts: These are general accounts that allow you to buy and sell stocks, bonds, ETFs, and mutual funds without tax advantages.

- Retirement Accounts: Options like 401(k)s or IRAs offer tax benefits but come with restrictions on withdrawals until retirement age.

When choosing an account type, consider your investment horizon and whether you need immediate access to funds or if you’re planning for long-term growth.

Researching Investment Options

With clear goals and an understanding of risk tolerance, it’s time to explore different investment options. Important info: Familiarize yourself with various asset classes:

- Stocks: Ownership shares in companies that can provide high returns but also come with higher risks.

- Bonds: Loans made to corporations or governments that typically offer lower returns but are generally safer than stocks.

- Mutual Funds/ETFs: Pooled investments that allow you to invest in a diversified portfolio without having to select individual securities.

Researching these options involves understanding their historical performance, volatility, and how they fit into your overall investment strategy.

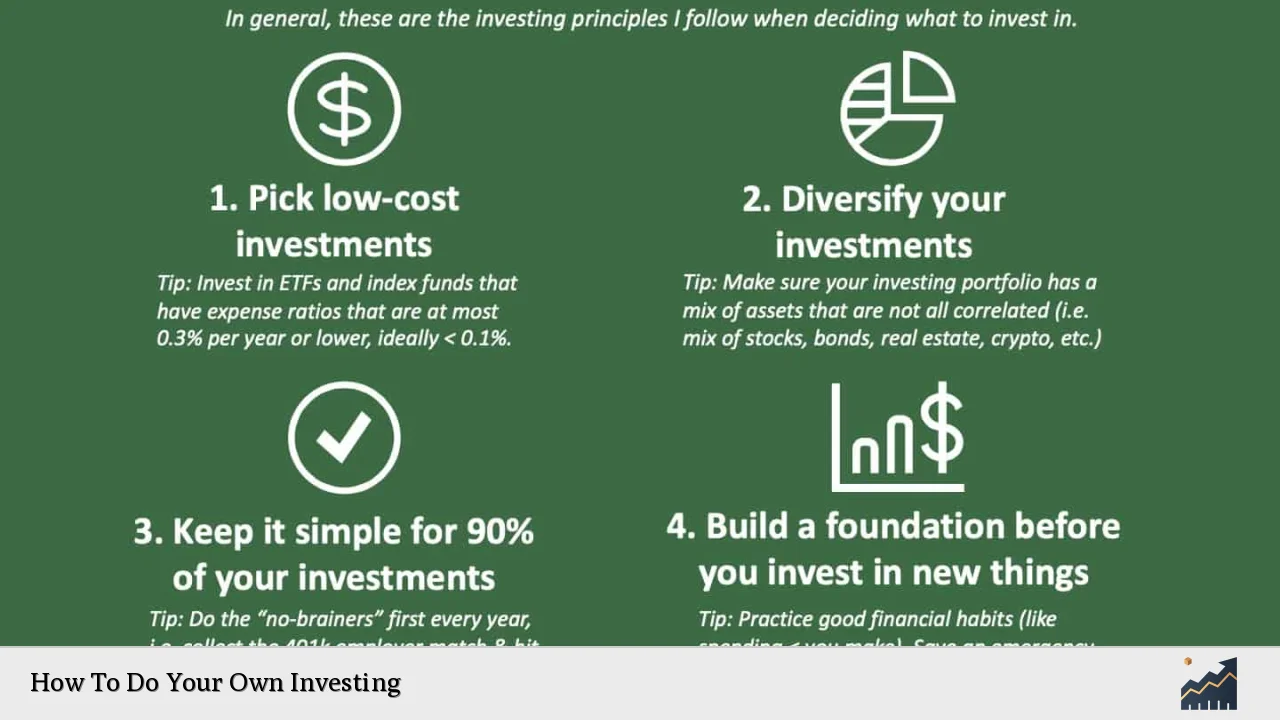

Creating a Diversified Portfolio

Diversification is key to managing risk in investing. By spreading investments across different asset classes and sectors, you reduce the impact of any single investment’s poor performance on your overall portfolio.

Important info: A well-diversified portfolio might include:

- A mix of stocks from various industries (technology, healthcare, consumer goods).

- Bonds with different maturities (short-term vs. long-term).

- Alternative investments like real estate or commodities if appropriate for your risk profile.

Regularly reviewing and rebalancing your portfolio ensures that it aligns with your risk tolerance and financial goals as market conditions change.

Making Your First Investment

Once you’ve set up an account and researched potential investments, it’s time to make your first investment. Important info: Start small if you’re nervous; many platforms allow you to invest with minimal amounts.

Follow these steps:

1. Fund your account: Deposit money into your brokerage account.

2. Choose an investment: Based on your research and strategy.

3. Execute the trade: Use the brokerage platform’s tools to buy shares or funds.

Remember that investing is a long-term commitment. Avoid making impulsive decisions based on short-term market movements; instead, focus on your overall strategy.

Monitoring Your Investments

After making investments, it’s essential to monitor their performance regularly. However, frequent checking can lead to emotional reactions based on market fluctuations.

Important info: Set a schedule for reviewing your portfolio—perhaps quarterly or semi-annually—and stick to it. During these reviews:

- Assess whether each investment aligns with your overall strategy.

- Rebalance if necessary by selling overperforming assets or buying underperforming ones.

This disciplined approach helps maintain focus on long-term objectives rather than getting caught up in daily market noise.

Staying Informed

The financial markets are dynamic; staying informed about economic trends and news can enhance decision-making. Follow reputable financial news sources and consider joining investment forums or groups where you can learn from others’ experiences.

Important info: Continuous education about investing strategies and market conditions will empower you as an investor.

FAQs About How To Do Your Own Investing

- What is the best way for beginners to start investing?

Beginners should start by setting clear financial goals and understanding their risk tolerance before choosing suitable investment options. - How much money do I need to start investing?

You can start investing with as little as $1; many platforms allow small initial investments. - What types of investments should I consider?

Consider diversifying across stocks, bonds, mutual funds, and ETFs based on your risk tolerance. - How often should I review my investments?

You should review your portfolio at least quarterly or semi-annually. - Is it necessary to hire a financial advisor?

While not necessary, hiring a financial advisor can provide personalized guidance tailored to your specific needs.

By following these steps and maintaining discipline in your approach, you’ll be well-equipped to manage your own investments successfully. Remember that patience is key; successful investing often requires time and perseverance.