Investment analysis is a systematic approach to evaluating the potential profitability and risks associated with various investment opportunities. It involves examining financial data, market trends, and economic indicators to make informed decisions about where to allocate capital. This process is crucial for both individual investors and institutions seeking to maximize returns while minimizing risks.

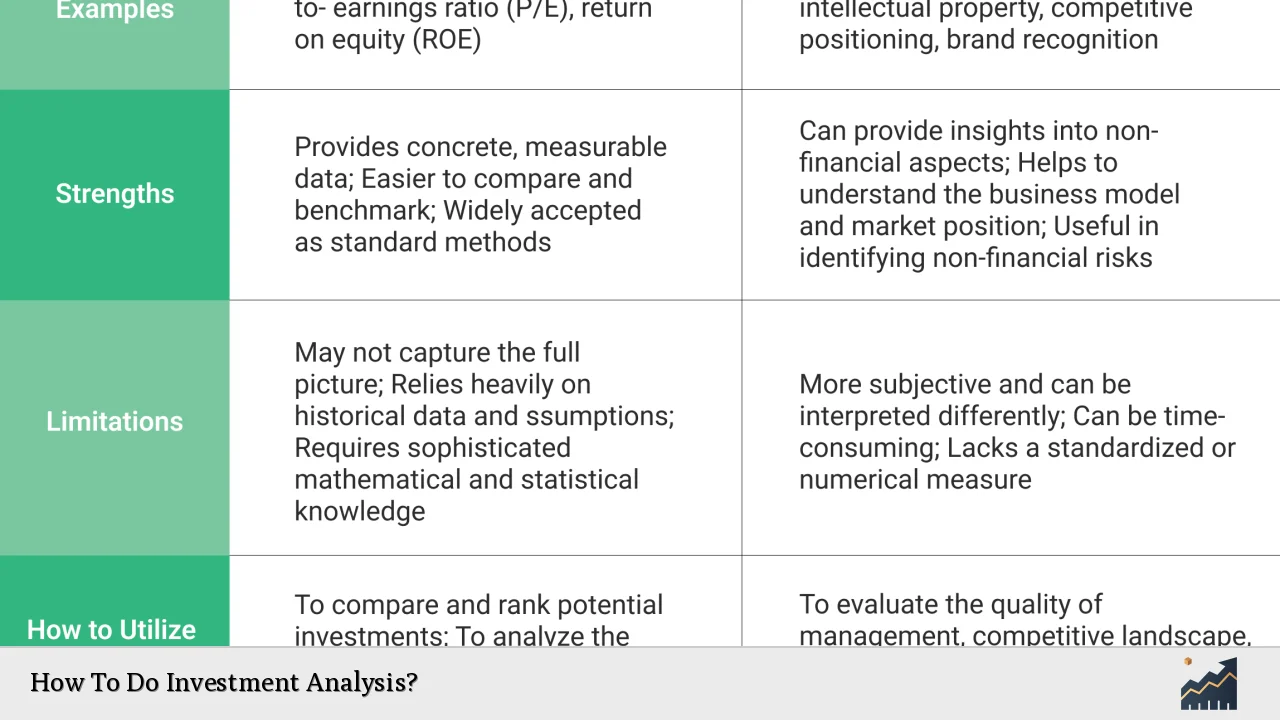

Investment analysis can be performed using various methods, including fundamental analysis, which focuses on financial statements and company performance, and technical analysis, which examines price movements and market trends. Understanding these methods allows investors to choose the right strategy for their specific goals.

| Investment Analysis Method | Description |

|---|---|

| Fundamental Analysis | Evaluates a company’s financial health through its financial statements. |

| Technical Analysis | Analyzes price movements and trading volumes to predict future trends. |

Understanding the Purpose of Investment Analysis

The primary purpose of investment analysis is to help investors make informed decisions regarding their investments. This involves identifying potential opportunities and assessing the associated risks. By understanding the market landscape and evaluating specific investments, investors can determine whether an opportunity aligns with their financial goals.

Investment analysis serves several key functions:

- Identifying Opportunities: Investors can uncover undervalued assets that may provide high returns.

- Risk Assessment: Understanding the potential risks involved helps in making educated decisions.

- Performance Evaluation: Analyzing past performance enables investors to predict future outcomes.

- Strategic Planning: Investment analysis aids in developing strategies that align with an investor’s risk tolerance and financial objectives.

In summary, investment analysis is essential for making sound investment decisions that can lead to financial success.

Key Components of Investment Analysis

Investment analysis encompasses several critical components that contribute to a comprehensive evaluation of an investment opportunity. These components include:

- Financial Analysis: This involves examining a company’s financial statements, such as balance sheets, income statements, and cash flow statements. Key metrics like earnings per share (EPS) and price-to-earnings (P/E) ratios provide insights into a company’s profitability and valuation.

- Risk Analysis: Assessing the potential risks associated with an investment is crucial. This includes evaluating market volatility, economic conditions, and industry-specific risks that could impact returns.

- Valuation: Determining the intrinsic value of an asset helps investors identify whether it is undervalued or overvalued compared to its market price. Common valuation methods include discounted cash flow (DCF) analysis and comparative analysis with similar companies.

- Market Trends: Understanding broader market trends and economic indicators can provide context for individual investments. Factors such as interest rates, inflation, and geopolitical events can significantly influence market performance.

By focusing on these components, investors can develop a well-rounded view of potential investments.

Types of Investment Analysis

There are two primary types of investment analysis: top-down analysis and bottom-up analysis. Each approach offers unique insights into investment opportunities.

Top-Down Analysis

Top-down analysis begins with a macroeconomic perspective, examining global economic trends before narrowing down to specific sectors or companies. This method typically involves:

- Analyzing economic indicators such as GDP growth, unemployment rates, and inflation.

- Identifying sectors that are expected to perform well based on economic conditions.

- Evaluating individual companies within those sectors for potential investments.

This approach is beneficial for large institutional investors who need to understand broader market dynamics before making specific investment choices.

Bottom-Up Analysis

In contrast, bottom-up analysis focuses on individual companies rather than macroeconomic factors. This method involves:

- Conducting detailed research on a company’s financial health, management quality, and competitive positioning.

- Analyzing historical performance metrics to assess growth potential.

- Considering qualitative factors such as brand strength and customer loyalty.

Bottom-up analysis is often preferred by individual investors who want to identify promising companies regardless of broader market trends.

Steps in Conducting Investment Analysis

Conducting effective investment analysis involves several structured steps:

1. Define Investment Goals: Clearly outline what you aim to achieve with your investments, whether it’s capital appreciation, income generation, or diversification.

2. Gather Data: Collect relevant data about the investment opportunity, including financial statements, market reports, and industry analyses.

3. Evaluate Financial Performance: Analyze the company’s financial health by reviewing key performance indicators (KPIs) over multiple years.

4. Assess Risks: Identify potential risks associated with the investment by considering market volatility, competition, regulatory changes, and economic conditions.

5. Determine Valuation: Use valuation techniques to estimate the intrinsic value of the asset compared to its current market price.

6. Make Informed Decisions: Based on your analysis, decide whether to invest in the opportunity or seek alternatives that better align with your goals.

By following these steps diligently, investors can enhance their decision-making process and improve their chances of achieving favorable outcomes.

Tools for Investment Analysis

Various tools are available for conducting investment analysis effectively:

- Financial Ratios: Ratios such as P/E ratio, return on equity (ROE), and debt-to-equity ratio help evaluate a company’s financial performance relative to its peers.

- Valuation Models: Models like discounted cash flow (DCF) allow investors to estimate the present value of future cash flows generated by an investment.

- Market Research Reports: Accessing industry reports from reputable sources provides insights into market trends and competitive landscapes.

- Analytical Software: Tools like Bloomberg Terminal or Morningstar Direct offer advanced analytics capabilities for in-depth investment research.

Using these tools can streamline the analysis process and provide deeper insights into potential investments.

The Importance of Continuous Learning

The investment landscape is dynamic; therefore, continuous learning is vital for successful investment analysis. Investors should stay updated on market trends, economic developments, and emerging technologies that could impact their portfolios. Engaging in ongoing education through seminars, webinars, books, or online courses can enhance analytical skills and knowledge about new methodologies in investment research.

Investors should also be open to adapting their strategies based on new information or changing market conditions. By fostering a mindset of continuous improvement and learning, individuals can position themselves for long-term success in their investment endeavors.

FAQs About How To Do Investment Analysis

- What is the primary goal of investment analysis?

The primary goal is to evaluate potential investments’ profitability while assessing associated risks. - What are common methods used in investment analysis?

Common methods include fundamental analysis and technical analysis. - How do I assess risk in my investments?

Assess risk by analyzing market volatility, economic conditions, and company-specific factors. - What tools are helpful for conducting investment analysis?

Helpful tools include financial ratios, valuation models, market research reports, and analytical software. - Why is continuous learning important in investment analysis?

Continuous learning helps investors adapt to changing markets and improve their analytical skills.

By following these guidelines for conducting thorough investment analyses, individuals can make informed decisions that align with their financial objectives while navigating the complexities of financial markets effectively.