As cryptocurrency continues to gain traction among individual and institutional investors, the need for effective portfolio diversification strategies becomes increasingly important. By 2025, cryptocurrencies are expected to play a significant role in investment portfolios, driven by mainstream adoption, regulatory developments, and technological advancements. This article explores the current market landscape, implementation strategies for diversification, risk considerations, regulatory aspects, and future outlooks for cryptocurrency investments.

| Key Concept | Description/Impact |

|---|---|

| Market Growth | The total cryptocurrency market capitalization is projected to reach $7.5 trillion by 2025, with Bitcoin potentially surpassing $210,000. |

| Institutional Adoption | Increased participation from institutional investors is expected to stabilize the market and enhance liquidity. |

| Regulatory Clarity | Upcoming regulations may provide a clearer framework for cryptocurrency investments, boosting investor confidence. |

| Volatility Reduction | Mainstream adoption is anticipated to reduce price volatility, making cryptocurrencies more attractive to conservative investors. |

| Diverse Investment Vehicles | The emergence of specialized funds and ETFs will offer investors more options for exposure to cryptocurrencies. |

Market Analysis and Trends

The cryptocurrency market has experienced explosive growth over the past few years, with Bitcoin leading the charge. As of December 2024, Bitcoin’s market cap surpassed $2 trillion, and its price reached an all-time high of approximately $106,400. Analysts predict that by 2025, Bitcoin could exceed $210,000 due to increasing institutional adoption and favorable regulatory developments.

Current Market Statistics

- Bitcoin (BTC): Price around $106,400; Market Cap: $2.068 trillion.

- Ethereum (ETH): Price around $3,891; Market Cap: $582 billion.

- Total Cryptocurrency Market Cap: Expected to hit $7.5 trillion by 2025.

The compound annual growth rate (CAGR) for cryptocurrencies has been impressive, with Bitcoin alone demonstrating a CAGR of over 52% in recent years. The approval of spot Bitcoin ETFs has legitimized cryptocurrencies as an asset class and attracted more institutional investors.

Implementation Strategies

To effectively diversify a portfolio with cryptocurrencies in 2025, investors should consider the following strategies:

Asset Allocation

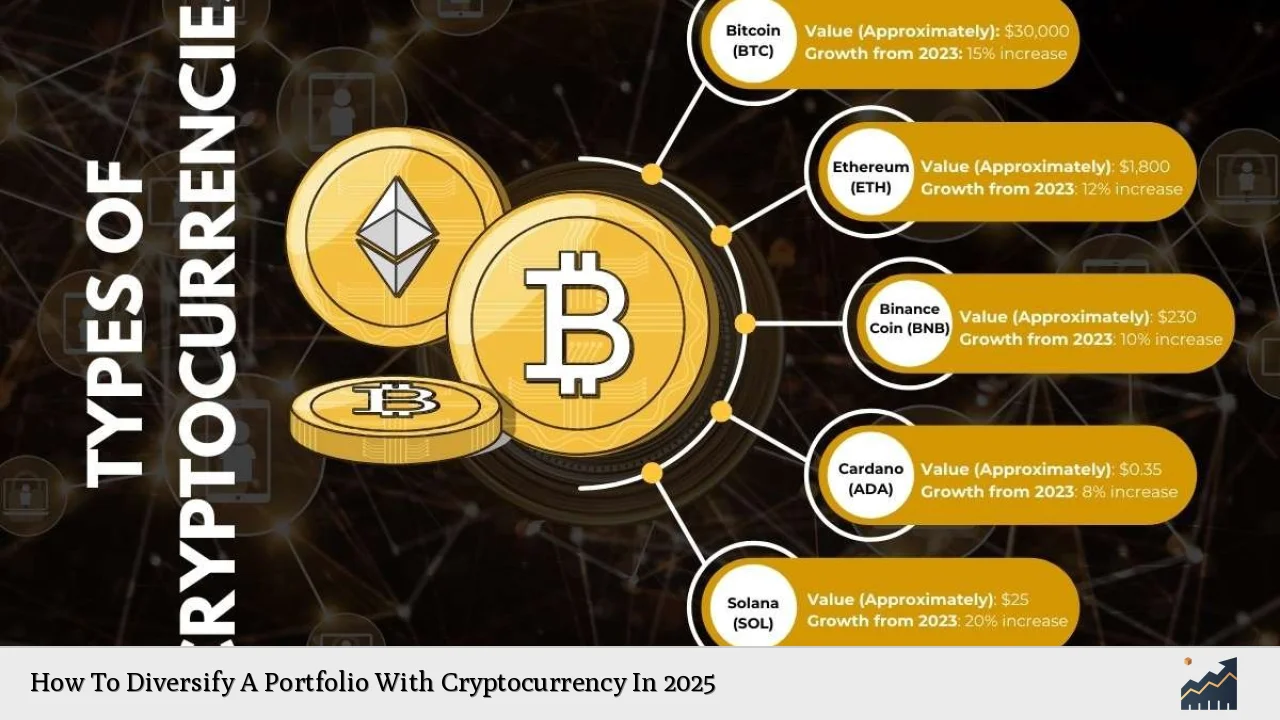

- Core Holdings: Maintain a core position in major cryptocurrencies like Bitcoin and Ethereum.

- Alternative Assets: Allocate a portion of the portfolio (e.g., 5-10%) to promising altcoins such as Solana or Cardano, which have shown potential for significant growth.

Investment Vehicles

- ETFs and Funds: Utilize cryptocurrency ETFs or specialized funds that provide diversified exposure to multiple cryptocurrencies without the need for direct management.

- Direct Investment: For more hands-on investors, direct purchases through exchanges can be beneficial but come with increased risks related to custody and security.

Dollar-Cost Averaging

Implementing a dollar-cost averaging strategy allows investors to mitigate volatility by purchasing fixed amounts of cryptocurrencies at regular intervals. This approach can help reduce the impact of price fluctuations over time.

Risk Considerations

Investing in cryptocurrencies carries inherent risks that must be carefully evaluated:

- Volatility: Cryptocurrencies are known for their price volatility. While mainstream adoption may reduce this risk over time, significant price swings are still possible.

- Regulatory Risks: Changes in regulations can impact market dynamics significantly. Investors should stay informed about potential regulatory changes in their respective jurisdictions.

- Security Risks: The risk of hacking and fraud remains high in the crypto space. Utilizing secure wallets and exchanges is crucial for protecting assets.

Regulatory Aspects

The regulatory landscape for cryptocurrencies is evolving rapidly. In 2025, we expect:

- Increased Clarity: New regulations will likely emerge that clarify the legal status of various cryptocurrencies and investment vehicles.

- Institutional Frameworks: With the anticipated appointment of pro-crypto regulators in key positions (e.g., SEC), institutional participation is expected to increase.

- Global Standards: As countries develop their regulatory frameworks, a more cohesive international standard may emerge, fostering greater confidence among global investors.

Future Outlook

The outlook for cryptocurrency investments in 2025 is optimistic but requires cautious navigation:

- Continued Growth: The market is expected to grow significantly as more investors recognize the potential benefits of including cryptocurrencies in their portfolios.

- Technological Advancements: Innovations such as decentralized finance (DeFi) and blockchain technology will likely create new investment opportunities and enhance existing ones.

- Market Maturity: As liquidity improves and volatility decreases, cryptocurrencies may become a staple in diversified investment portfolios alongside traditional assets like stocks and bonds.

Frequently Asked Questions About How To Diversify A Portfolio With Cryptocurrency In 2025

- What percentage of my portfolio should be allocated to cryptocurrencies?

Experts suggest starting with a small allocation (around 5-10%) and adjusting based on individual risk tolerance and investment goals. - How can I minimize risks when investing in cryptocurrencies?

Diversifying across different assets within the crypto space and using secure wallets can help mitigate risks. - What are some promising altcoins to consider for diversification?

Solana (SOL), Cardano (ADA), and Polkadot (DOT) are examples of altcoins with strong growth potential. - How do I stay informed about regulatory changes affecting cryptocurrencies?

Following reputable financial news sources and regulatory bodies’ announcements can keep you updated on relevant changes. - Is it better to invest directly in cryptocurrencies or through funds?

This depends on your investment style; direct investment offers control but comes with higher risk compared to managed funds. - What role do stablecoins play in a diversified crypto portfolio?

Stablecoins can provide stability during volatile periods while allowing for easy conversion into other assets. - How can I assess the long-term viability of a cryptocurrency?

Evaluating factors such as technology development, community support, use cases, and market trends can help gauge long-term potential. - What should I consider before investing in new cryptocurrency projects?

Conduct thorough research on the project’s team, technology, market demand, and community engagement before investing.

In conclusion, diversifying a portfolio with cryptocurrency in 2025 presents both opportunities and challenges. By understanding market trends, implementing strategic allocation methods, managing risks effectively, staying informed about regulations, and maintaining an optimistic yet cautious outlook on future developments in the crypto space, investors can enhance their portfolios while navigating this dynamic asset class.