Diversification is a fundamental strategy for managing investment risk and optimizing returns, particularly in the current volatile stock market. With economic uncertainty, fluctuating interest rates, and geopolitical tensions, investors must adopt a diversified approach to safeguard their portfolios and capitalize on growth opportunities. This article explores effective strategies for diversifying a portfolio in today’s market, analyzing current trends, implementation tactics, risk considerations, regulatory aspects, and future outlooks.

| Key Concept | Description/Impact |

|---|---|

| Asset Allocation | Strategically distributing investments across various asset classes (stocks, bonds, real estate) to balance risk and return. |

| Geographic Diversification | Investing in different regions to mitigate country-specific risks and capture global growth opportunities. |

| Alternative Investments | Including non-traditional assets (e.g., commodities, private equity) that often have low correlation with traditional markets. |

| Sector Diversification | Spreading investments across various sectors (technology, healthcare, energy) to reduce exposure to sector-specific downturns. |

| Regular Rebalancing | Adjusting the portfolio periodically to maintain desired asset allocation and respond to market changes. |

Market Analysis and Trends

The current stock market is characterized by significant volatility influenced by various factors:

- Economic Indicators: Recent data indicates a mixed economic outlook. The S&P 500 recently reached its 47th all-time high, reflecting strong performance in sectors like technology and healthcare. However, concerns about rising interest rates and inflation persist, leading to cautious investor sentiment.

- Interest Rates: The Federal Reserve’s monetary policy plays a crucial role in market dynamics. With expectations of interest rate cuts in the near future, investors are closely monitoring how these changes will affect bond markets and equity valuations.

- Sector Performance: Technology stocks have dominated recent gains but are facing headwinds due to potential regulatory scrutiny and market saturation. In contrast, sectors like energy and healthcare are gaining traction as investors seek value opportunities amidst economic shifts.

- Global Markets: Emerging markets are showing promise with robust growth potential driven by expanding middle classes in countries like India and Brazil. However, geopolitical tensions and currency fluctuations pose risks that investors must navigate carefully.

Implementation Strategies

To effectively diversify a portfolio in the current stock market environment, consider the following strategies:

- Diversify Across Asset Classes: Incorporate a mix of equities, fixed income, real estate, and alternative investments. For example:

- Equities: 60%

- Bonds: 30%

- Real Estate/Alternatives: 10%

- Geographic Exposure: Allocate investments not just domestically but also internationally. A suggested allocation might be:

- Domestic (U.S.): 50%

- International Developed Markets: 30%

- Emerging Markets: 20%

- Alternative Investments: Explore non-traditional assets such as private equity or commodities. These can provide unique opportunities that are less correlated with stock market movements.

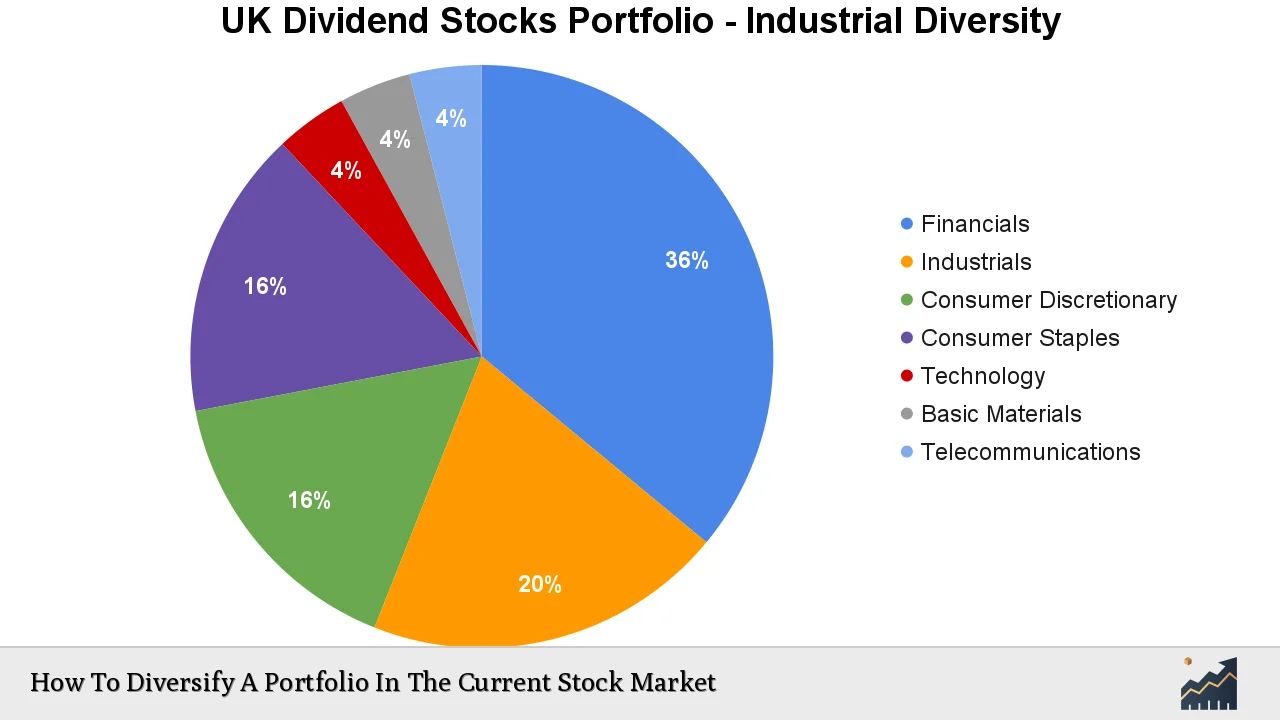

- Sector Allocation: Maintain exposure across various sectors to avoid concentration risk. A balanced approach might include:

- Technology: 25%

- Healthcare: 20%

- Energy: 15%

- Consumer Discretionary: 15%

- Financials: 10%

- Utilities & Others: 15%

- Utilize ETFs and Mutual Funds: These funds can provide instant diversification within specific asset classes or sectors while minimizing costs associated with individual stock purchases.

Risk Considerations

While diversification can mitigate risks, it does not eliminate them entirely. Key considerations include:

- Market Volatility: Economic downturns can impact all asset classes; thus, maintaining an emergency fund or cash reserves is advisable.

- Correlation Risks: During extreme market conditions, correlations between asset classes may increase unexpectedly. Regularly reviewing the correlation of your investments helps ensure they behave independently under stress.

- Regulatory Risks: Changes in regulations can impact certain sectors more than others. Staying informed about potential regulatory changes is crucial for strategic adjustments.

- Investment Horizon: Align your diversification strategy with your investment goals and time horizon. Short-term investors may need different strategies compared to those with a long-term outlook.

Regulatory Aspects

Investors must be aware of various regulatory requirements that impact portfolio diversification:

- SEC Regulations: The Securities and Exchange Commission (SEC) mandates transparency in investment products. Understanding these regulations can help investors make informed decisions about fund selections.

- Tax Considerations: Different asset classes have varying tax implications. For instance, capital gains from stocks held longer than a year are taxed at lower rates than short-term gains. Structuring your portfolio with tax efficiency in mind can enhance overall returns.

- Compliance Requirements: Institutional investors must adhere to specific guidelines regarding diversification to minimize risk exposure as mandated by regulatory bodies.

Future Outlook

Looking ahead, several trends may shape diversification strategies:

- Technological Advancements: Innovations in AI and biotechnology are expected to create new investment opportunities while altering existing market dynamics. Investors should consider sector exposure that aligns with these advancements.

- Sustainable Investing: Environmental, Social, and Governance (ESG) criteria are becoming increasingly important for investors. Incorporating ESG factors into investment decisions can enhance portfolio resilience against reputational risks.

- Inflationary Pressures: As inflation remains a concern globally, assets like commodities or real estate may become more attractive as hedges against inflationary pressures.

- Global Economic Recovery: As economies recover post-pandemic, emerging markets may offer substantial growth opportunities. Investors should remain vigilant about geopolitical developments that could affect these markets.

Frequently Asked Questions About How To Diversify A Portfolio In The Current Stock Market

- What is portfolio diversification?

Portfolio diversification is an investment strategy that involves spreading investments across various asset classes to reduce risk. - Why is diversification important in today’s market?

Diversification helps mitigate risks associated with market volatility and economic uncertainties by ensuring that not all investments are affected equally by downturns. - How can I diversify my portfolio effectively?

You can diversify by investing across different asset classes (stocks, bonds), sectors (technology, healthcare), geographic regions (domestic vs international), and including alternative investments. - What role do ETFs play in diversification?

ETFs provide an easy way to achieve diversification within specific sectors or asset classes while typically having lower fees compared to mutual funds. - How often should I rebalance my portfolio?

It’s advisable to review your portfolio at least annually or after significant market movements to ensure it aligns with your investment goals. - Are there any risks associated with diversification?

While diversification reduces risk overall, it does not eliminate it completely; correlations between assets can increase during market stress. - What should I consider when diversifying internationally?

When investing internationally, consider currency risks, political stability, economic conditions of the countries involved, and how they correlate with your domestic investments. - How does regulatory compliance affect my investment choices?

Regulatory compliance ensures that investment products meet certain standards for transparency and risk management; understanding these regulations helps you make informed choices.

In conclusion, diversifying a portfolio in the current stock market requires a thoughtful approach that considers various asset classes, geographic exposures, sector allocations, and alternative investments. By implementing these strategies while remaining aware of associated risks and regulatory considerations, investors can build resilient portfolios poised for long-term growth amidst ongoing market fluctuations.