Conducting a security audit for a Layer 1 (L1) blockchain is a crucial process that ensures the integrity, security, and reliability of the blockchain network. As foundational platforms like Bitcoin and Ethereum serve as the backbone of the cryptocurrency ecosystem, their security is paramount. This article provides a comprehensive guide on conducting a security audit for L1 blockchains, addressing market trends, implementation strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Layer 1 Blockchain | The base layer of blockchain technology where transactions are processed directly on the blockchain. Examples include Bitcoin and Ethereum. |

| Security Audit | A systematic examination of the blockchain’s code and architecture to identify vulnerabilities and ensure compliance with security standards. |

| Consensus Mechanism | The protocol used to achieve agreement on a single data value among distributed processes or systems. Common mechanisms include Proof of Work (PoW) and Proof of Stake (PoS). |

| Smart Contracts | Self-executing contracts with the terms directly written into code. They require thorough auditing to prevent vulnerabilities. |

| Regulatory Compliance | Ensuring that the blockchain adheres to legal standards and regulations, which is increasingly scrutinized by authorities worldwide. |

| Market Trends | The growing adoption of L1 blockchains is reflected in their market capitalization, which exceeded $2.8 trillion in late 2024. |

Market Analysis and Trends

The landscape of Layer 1 blockchains is rapidly evolving, with significant market dynamics influencing their growth:

- Market Growth: The total market cap for L1 blockchains has surged dramatically, reaching approximately $2.8 trillion as of late 2024. This represents an increase of over 7,000% since January 2024, driven by renewed investor interest and technological advancements.

- Adoption Rates: Major L1 blockchains like Bitcoin and Ethereum dominate the market, accounting for nearly 70% of the total market share. The rise of decentralized finance (DeFi) applications and non-fungible tokens (NFTs) has further fueled this growth.

- Technological Innovations: Improvements in scalability solutions such as sharding and layer-2 solutions are critical for enhancing transaction speeds and reducing costs on L1 blockchains.

- Security Concerns: With increasing value comes heightened scrutiny regarding security vulnerabilities. In 2022 alone, losses due to smart contract hacks reached approximately $2.81 billion, underscoring the need for robust auditing practices.

Implementation Strategies

To effectively conduct a security audit on an L1 blockchain, organizations should adopt a structured approach:

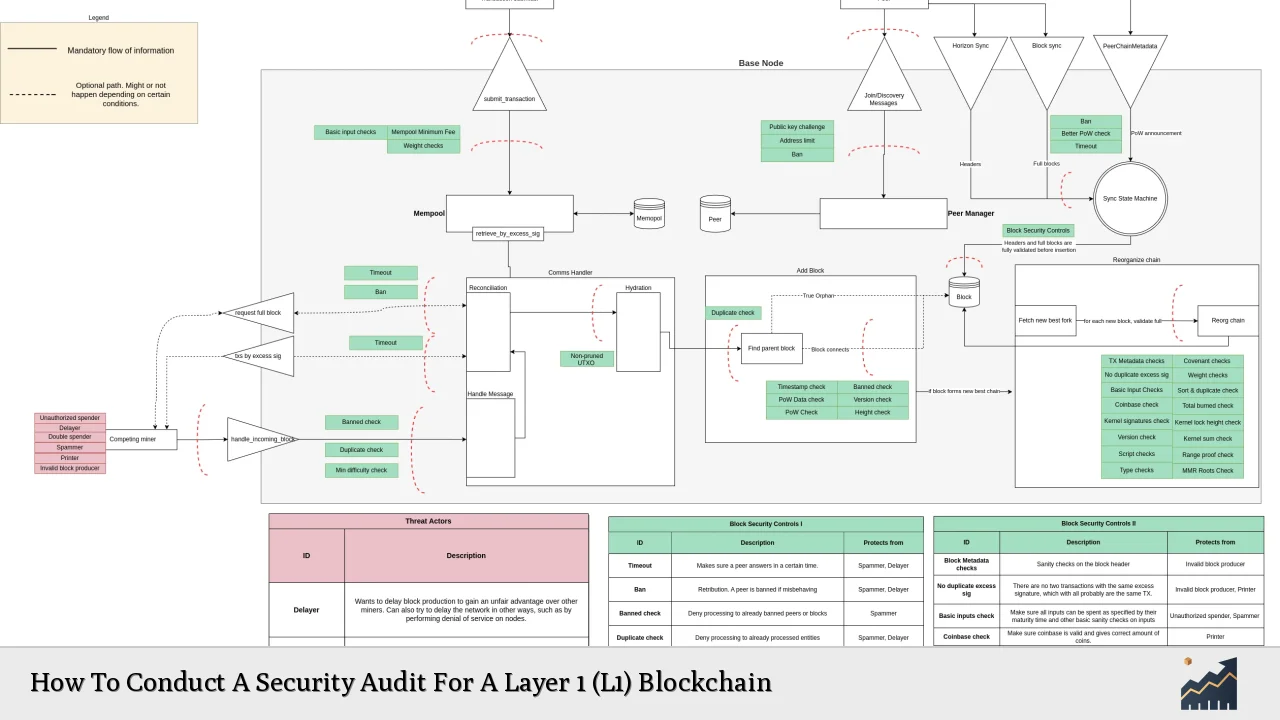

- Planning and Scoping: Define the objectives of the audit, including specific areas to focus on such as consensus mechanisms, smart contracts, and network architecture.

- Code Review: Perform a thorough examination of the blockchain’s codebase to identify vulnerabilities such as reentrancy attacks or arithmetic overflow issues.

- Architecture Assessment: Evaluate the overall design of the blockchain to ensure it can handle high transaction volumes while maintaining security.

- Security Analysis: Conduct penetration testing and threat modeling to identify potential attack vectors that could be exploited by malicious actors.

- Performance Optimization: Assess the performance metrics of the blockchain to identify bottlenecks that could hinder user experience or scalability.

- Reporting: Generate comprehensive reports detailing identified vulnerabilities along with recommended remediation steps.

Risk Considerations

When conducting a security audit for an L1 blockchain, it is essential to consider various risks:

- Technical Risks: These include vulnerabilities in smart contracts or flaws in consensus algorithms that could lead to unauthorized access or data breaches.

- Operational Risks: Ineffective governance or mismanagement can result in inadequate responses to identified vulnerabilities.

- Regulatory Risks: Non-compliance with emerging regulations can lead to legal repercussions and damage the reputation of the blockchain project.

- Market Risks: The volatility of cryptocurrency markets can impact investment in security measures, making it crucial for organizations to balance cost against potential losses from breaches.

Regulatory Aspects

The regulatory landscape surrounding blockchain technology is continually evolving:

- Compliance Requirements: Auditors must ensure that L1 blockchains comply with relevant financial regulations, including anti-money laundering (AML) laws and data protection standards.

- Global Standards: Organizations should stay informed about international regulatory frameworks as jurisdictions around the world develop their own guidelines for blockchain technology.

- Emerging Bodies: Initiatives like the Blockchain Security Standards Council aim to establish comprehensive standards for auditing practices within the industry.

Future Outlook

The future of L1 blockchains appears promising but requires ongoing vigilance regarding security:

- Increased Investment in Security Audits: As more projects launch on L1 blockchains, investment in comprehensive security audits will become essential for protecting assets and maintaining user trust.

- Adoption of Advanced Technologies: The integration of artificial intelligence and machine learning into auditing processes will enhance vulnerability detection capabilities.

- Focus on Decentralization: Future audits will need to address challenges associated with decentralized governance models while ensuring robust security measures are in place.

Frequently Asked Questions About How To Conduct A Security Audit For A Layer 1 Blockchain

- What is a Layer 1 blockchain?

A Layer 1 blockchain is a base-level protocol where transactions occur directly on its own chain without relying on other networks. - Why are security audits necessary?

Security audits help identify vulnerabilities that could be exploited by attackers, ensuring the integrity and reliability of the blockchain. - How often should audits be conducted?

Audits should be performed before deployment and regularly thereafter, especially after significant changes or updates. - What are common vulnerabilities found in L1 blockchains?

Common vulnerabilities include bugs in smart contracts, weaknesses in consensus mechanisms, and insufficient network security measures. - How do regulatory requirements affect audits?

Regulatory compliance ensures that blockchains adhere to laws governing financial transactions and data protection, impacting audit scope. - What tools are used in blockchain audits?

Tools like static analysis software, penetration testing frameworks, and formal verification methods are commonly employed during audits. - Can decentralized applications (dApps) affect L1 audits?

Yes, dApps built on L1 blockchains can introduce additional complexities that must be assessed during an audit. - What is the role of smart contracts in an L1 audit?

Smart contracts must be thoroughly audited as they are self-executing agreements that can contain critical vulnerabilities if not properly secured.

In conclusion, conducting a thorough security audit for Layer 1 blockchains is essential for safeguarding these foundational technologies against emerging threats. By understanding market dynamics, implementing effective strategies, considering risk factors, adhering to regulatory requirements, and preparing for future developments, organizations can enhance their blockchain’s resilience and maintain investor confidence.