The cryptocurrency exchange landscape has evolved dramatically over the past few years, with numerous platforms vying for dominance. Among these, FTX emerged as a significant player before its collapse in late 2022, raising questions about its operational model and how it compares to other major exchanges. This article aims to provide a comprehensive analysis of FTX’s holdings and operations in comparison to other leading crypto exchanges like Binance, Coinbase, and Kraken. We will explore market trends, implementation strategies, risk considerations, regulatory aspects, and future outlooks to give investors a clear understanding of the current crypto exchange environment.

| Key Concept | Description/Impact |

|---|---|

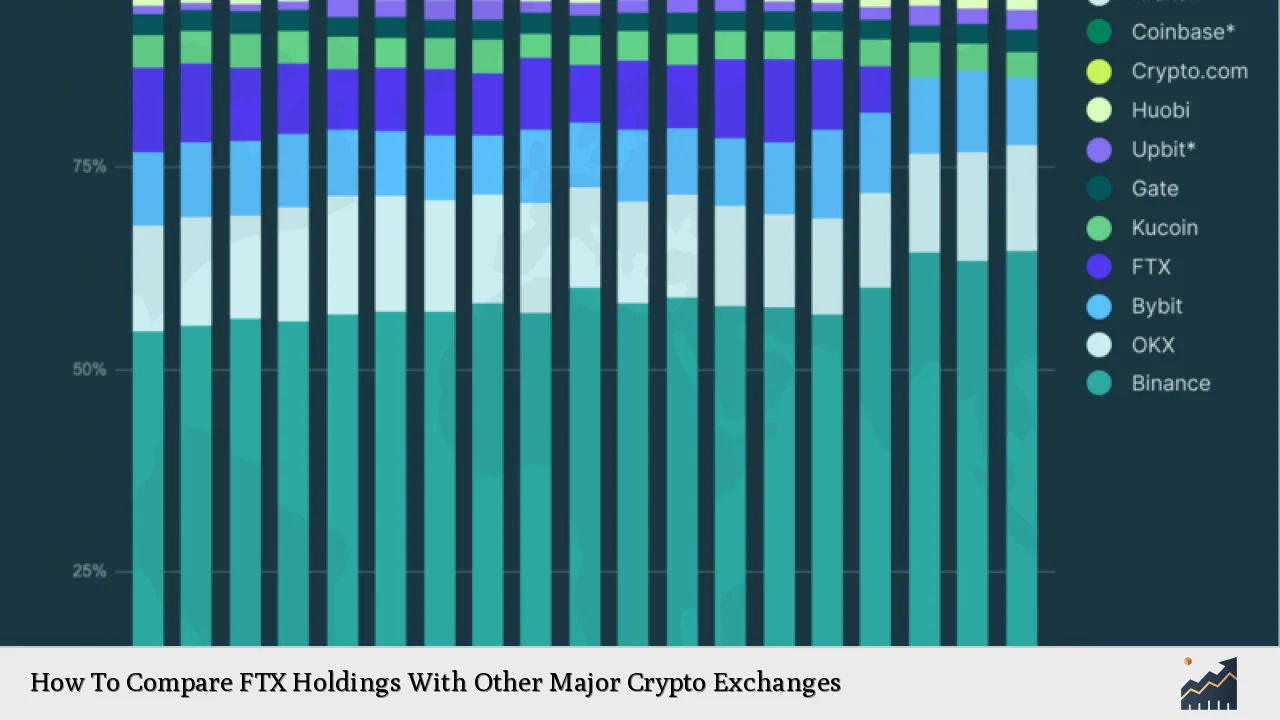

| Market Share | FTX held approximately 7.5% of the global crypto exchange market before its collapse, positioning it as a formidable competitor to Binance. |

| Trading Volume | FTX’s peak trading volume reached $21 billion in 2021, significantly lower than Binance’s $62 billion but competitive within the market. |

| Supported Assets | FTX supported around 300 cryptocurrencies compared to Binance’s over 600, limiting its diversification options for users. |

| Fee Structure | FTX offered lower trading fees (0.02% for makers and 0.07% for takers) than many competitors, making it attractive for high-frequency traders. |

| Security Features | FTX implemented robust security measures including two-factor authentication and asset locks, although concerns arose post-collapse regarding overall management practices. |

| Regulatory Compliance | FTX was noted for its compliance efforts compared to other exchanges but ultimately faced significant scrutiny leading to its downfall. |

| User Base Growth | FTX had over 1.2 million registered users at its peak, bolstered by aggressive marketing and partnerships. |

| Bankruptcy Impact | The collapse of FTX has led to increased scrutiny across the crypto exchange sector and has impacted user confidence significantly. |

Market Analysis and Trends

The cryptocurrency exchange market has seen exponential growth, projected to rise from $41.14 billion in 2023 to $50.95 billion in 2024. This growth is fueled by increased institutional investment, evolving regulatory landscapes, and heightened public awareness of digital assets. As of late 2023, Bitcoin prices have surged by approximately 270%, reflecting a renewed interest in cryptocurrencies following the FTX collapse.

Key Market Trends

- Increased Institutional Adoption: Institutional investors are increasingly entering the crypto space, driving demand for reliable exchanges.

- Regulatory Developments: The aftermath of FTX’s bankruptcy has prompted regulators worldwide to tighten their oversight of cryptocurrency exchanges.

- Emergence of Decentralized Finance (DeFi): Many investors are exploring DeFi platforms as alternatives to traditional exchanges due to perceived higher risks associated with centralized platforms like FTX.

- Technological Innovations: Exchanges are adopting advanced technologies such as AI and machine learning to enhance security and user experience.

Implementation Strategies

Investors considering participation in cryptocurrency exchanges should evaluate various implementation strategies based on their individual goals and risk tolerance.

Strategies for Engaging with Crypto Exchanges

- Diversification: Investors should consider using multiple exchanges (like Binance for trading and Coinbase for holding) to mitigate risks associated with any single platform.

- Utilizing Advanced Trading Features: Platforms like FTX offered derivatives trading which can be beneficial for sophisticated traders looking to leverage their positions.

- Monitoring Regulatory Changes: Staying informed about regulatory developments can help investors avoid potential pitfalls associated with non-compliant exchanges.

- Adopting Security Best Practices: Utilizing features such as two-factor authentication and cold storage options can enhance asset security across exchanges.

Risk Considerations

Investing in cryptocurrencies through exchanges carries inherent risks that must be carefully considered:

- Market Volatility: Cryptocurrency prices can fluctuate wildly; understanding market trends is crucial for risk management.

- Regulatory Risks: The evolving regulatory landscape poses risks; non-compliance can lead to severe penalties or operational shutdowns.

- Security Risks: Despite enhanced security measures, exchanges remain targets for cyberattacks; investors should remain vigilant about their asset protection strategies.

- Operational Risks: The operational integrity of an exchange is paramount; the FTX collapse highlighted how mismanagement can lead to catastrophic consequences for users.

Regulatory Aspects

The regulatory environment surrounding cryptocurrency exchanges is complex and varies significantly across jurisdictions:

- Increased Scrutiny Post-FTX: Regulatory bodies have intensified their oversight of crypto exchanges following the collapse of FTX. This includes stricter compliance requirements regarding user funds management and transparency.

- Licensing Requirements: Many countries are implementing licensing frameworks that require exchanges to adhere to specific operational standards.

- Consumer Protection Laws: Regulations aimed at protecting consumers from fraudulent activities are becoming more common within the crypto space.

Future Outlook

The future of cryptocurrency exchanges will likely be shaped by several key factors:

- Continued Growth of Digital Assets: As public awareness increases and technology improves, more users are expected to enter the cryptocurrency market.

- Regulatory Evolution: Ongoing regulatory developments will likely create a more secure trading environment but may also impose additional burdens on smaller exchanges.

- Technological Advancements: Innovations in blockchain technology and trading platforms will continue to enhance user experience and security measures.

- Market Consolidation: The fallout from FTX may lead to consolidation within the exchange market as smaller players struggle to compete against larger platforms with more robust financial backing.

Frequently Asked Questions About How To Compare FTX Holdings With Other Major Crypto Exchanges

- What happened with FTX?

The exchange collapsed in November 2022 due to mismanagement and allegations of embezzlement involving customer funds. - How does FTX compare with Binance?

While Binance has a larger market share and supports more cryptocurrencies, FTX offered lower trading fees before its collapse. - What are the key risks associated with using crypto exchanges?

The primary risks include market volatility, regulatory changes, security breaches, and operational failures. - Are there safer alternatives to centralized exchanges?

Decentralized finance (DeFi) platforms provide alternatives but come with their own set of risks related to smart contracts. - How can I ensure my investments are secure on an exchange?

Utilize strong passwords, enable two-factor authentication, and consider using hardware wallets for long-term storage. - What should I look for when choosing a crypto exchange?

Consider factors such as security features, supported assets, fee structures, user experience, and regulatory compliance. - Will regulations impact the future of cryptocurrency trading?

Yes, increased regulation is expected to create a more secure trading environment but could also limit certain trading practices. - Can I recover my funds if an exchange collapses?

Recovery depends on the specific circumstances of the collapse; some users may receive partial refunds depending on the exchange’s assets at liquidation.

This comprehensive analysis provides insights into comparing FTX holdings with other major crypto exchanges. By understanding market dynamics, risks involved, regulatory frameworks, and strategic approaches, investors can make informed decisions in this rapidly evolving landscape.