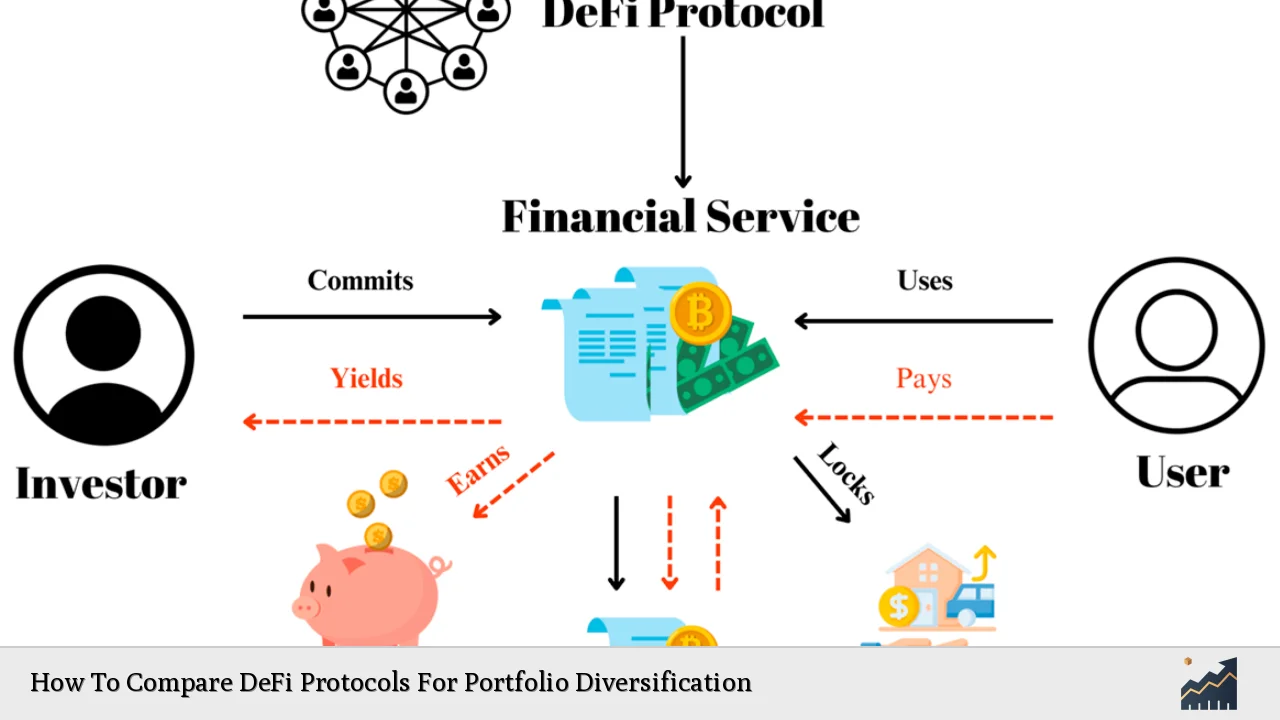

Decentralized Finance (DeFi) has emerged as a revolutionary force in the financial landscape, offering innovative solutions that challenge traditional banking and investment practices. With the rapid growth of DeFi protocols, investors are increasingly looking to diversify their portfolios within this space. However, comparing different DeFi protocols for effective portfolio diversification requires a nuanced understanding of their unique characteristics, risks, and potential returns. This comprehensive guide aims to equip individual investors and finance professionals with the knowledge needed to navigate the DeFi ecosystem effectively.

| Key Concept | Description/Impact |

|---|---|

| Decentralized Exchanges (DEXs) | Platforms that allow users to trade cryptocurrencies directly without intermediaries, enhancing liquidity and reducing fees. |

| Lending Protocols | DeFi platforms that facilitate peer-to-peer lending and borrowing, providing higher yields compared to traditional banks. |

| Yield Farming | A strategy where investors provide liquidity to DeFi protocols in exchange for rewards, often resulting in high returns but with significant risks. |

| Liquidity Pools | Collections of funds locked in smart contracts that enable trading on DEXs; crucial for maintaining market liquidity. |

| Smart Contracts | Self-executing contracts with the terms of the agreement directly written into code, which automate transactions and reduce reliance on intermediaries. |

| Total Value Locked (TVL) | A key metric indicating the total capital held within a DeFi protocol, reflecting its popularity and trustworthiness. |

| Security Audits | Independent evaluations of smart contracts to identify vulnerabilities; essential for assessing the risk of hacks and exploits. |

| Regulatory Compliance | The adherence of DeFi protocols to existing laws and regulations, which can significantly impact their operations and user trust. |

Market Analysis and Trends

The DeFi market is experiencing substantial growth, with Total Value Locked (TVL) in DeFi protocols exceeding $100 billion as of late 2024. This represents a significant recovery from previous lows, driven by increased asset prices and user adoption. Key trends shaping the market include:

- Rise of Decentralized Exchanges (DEXs): DEXs have become increasingly popular due to their ability to facilitate trades without intermediaries, offering lower fees and greater control over assets.

- Integration with Traditional Finance: More financial institutions are exploring ways to incorporate DeFi solutions into their operations, leading to hybrid products that blend traditional finance with decentralized elements.

- Emergence of Real-World Assets (RWAs): DeFi protocols are beginning to integrate RWAs like real estate and commodities into their offerings, expanding investment opportunities beyond digital assets.

- Increased Focus on Security: As the DeFi space matures, there is a growing emphasis on security measures such as insurance products against smart contract vulnerabilities.

- Dynamic Market Conditions: The volatility inherent in cryptocurrencies necessitates active portfolio management strategies, with frequent rebalancing based on market trends.

Implementation Strategies

To effectively compare and select DeFi protocols for portfolio diversification, investors should consider several implementation strategies:

- Diversification Across Protocol Types: Allocate investments across various types of protocols such as DEXs (e.g., Uniswap, PancakeSwap), lending platforms (e.g., Aave, Compound), and yield farming opportunities. This approach mitigates risk by spreading exposure across different functionalities within the DeFi ecosystem.

- Utilizing Portfolio Management Tools: Leverage tools like Zerion or DeBank to track investments across multiple protocols. These platforms provide insights into performance metrics, including TVL and yield rates.

- Dynamic Allocation Based on Risk Tolerance: Adjust portfolio allocations dynamically based on individual risk profiles. Investors with a higher risk appetite may allocate more towards volatile assets like small-cap tokens or yield farming opportunities.

- Regular Rebalancing: Implement a systematic rebalancing strategy to maintain desired asset allocation percentages. This helps manage risks associated with price fluctuations in highly volatile markets.

Risk Considerations

Investing in DeFi carries inherent risks that must be carefully evaluated:

- Smart Contract Vulnerabilities: Bugs or exploits in smart contracts can lead to significant financial losses. Investors should prioritize protocols with thorough security audits.

- Market Volatility: The crypto market is known for its price swings. Proper risk management strategies should be employed to protect against sudden downturns.

- Regulatory Risks: The evolving regulatory landscape poses uncertainties for DeFi protocols. Compliance with local laws is crucial for long-term viability.

- Liquidity Risks: Some DeFi assets may lack sufficient liquidity, making it difficult to execute trades without impacting prices significantly.

Regulatory Aspects

The regulatory environment surrounding DeFi is complex and varies by jurisdiction. Key considerations include:

- Compliance Requirements: Many jurisdictions are developing regulations specific to cryptocurrency and DeFi activities. Investors should stay informed about compliance requirements that may affect protocol operations.

- Tax Implications: Transactions involving cryptocurrencies may have tax consequences depending on local laws. Understanding these implications is essential for accurate reporting and compliance.

- Consumer Protection Laws: As DeFi grows, regulators may introduce consumer protection measures aimed at safeguarding investors from fraud or exploitation within decentralized systems.

Future Outlook

The future of DeFi appears promising but will be shaped by several factors:

- Technological Advancements: Continued innovation in blockchain technology will enhance the functionality and security of DeFi protocols.

- Institutional Adoption: As more institutions enter the space, increased capital inflows could stabilize markets and enhance liquidity across platforms.

- Integration with Traditional Financial Systems: The blending of DeFi solutions with traditional finance could lead to new product offerings that appeal to a broader range of investors.

- Focus on User Experience: Improving user interfaces and simplifying access to DeFi services will be crucial for attracting new users who may be intimidated by complex processes.

Frequently Asked Questions About How To Compare DeFi Protocols For Portfolio Diversification

- What are the key metrics to consider when comparing DeFi protocols?

Key metrics include Total Value Locked (TVL), yield rates, security audit results, transaction fees, and user interface quality. - How can I assess the risk associated with a particular DeFi protocol?

Evaluate security audits conducted by reputable firms, review community feedback, assess historical performance data, and consider regulatory compliance status. - What role do smart contracts play in DeFi?

Smart contracts automate transactions without intermediaries but can pose risks if not properly audited or if vulnerabilities exist. - How often should I rebalance my DeFi portfolio?

The frequency of rebalancing depends on market conditions; however, regular reviews (monthly or quarterly) are advisable to align with changing market dynamics. - Can I use traditional financial principles for my DeFi investments?

Yes, many traditional investment principles apply; however, they must be adapted for the unique characteristics of the decentralized landscape. - What are some common mistakes when investing in DeFi?

Common mistakes include neglecting security audits, failing to diversify adequately, ignoring market volatility, and misunderstanding protocol mechanics. - Is it necessary to have technical knowledge before investing in DeFi?

A basic understanding of blockchain technology and how different protocols operate can significantly enhance investment decisions; however, many user-friendly tools exist for beginners. - What should I do if I encounter issues with a DeFi protocol?

If you experience issues such as lost funds or technical problems, contact customer support if available; otherwise, engage with community forums for assistance.

In conclusion, comparing DeFi protocols for portfolio diversification requires careful analysis of various factors including market trends, implementation strategies, risk considerations, regulatory aspects, and future outlooks. By leveraging this comprehensive understanding along with robust tools and strategies, investors can effectively navigate the complexities of the decentralized finance landscape while optimizing their portfolios for growth and stability.