Net Investment Income Tax (NIIT) is a tax imposed on certain types of investment income for individuals, estates, and trusts whose modified adjusted gross income (MAGI) exceeds specific thresholds. Established under the Affordable Care Act in 2013, this tax is set at a rate of 3.8% and applies to net investment income, which includes earnings from dividends, interest, capital gains, and rental income. Understanding how to calculate NIIT is essential for taxpayers who may be affected by this tax, as it can significantly impact their overall tax liability.

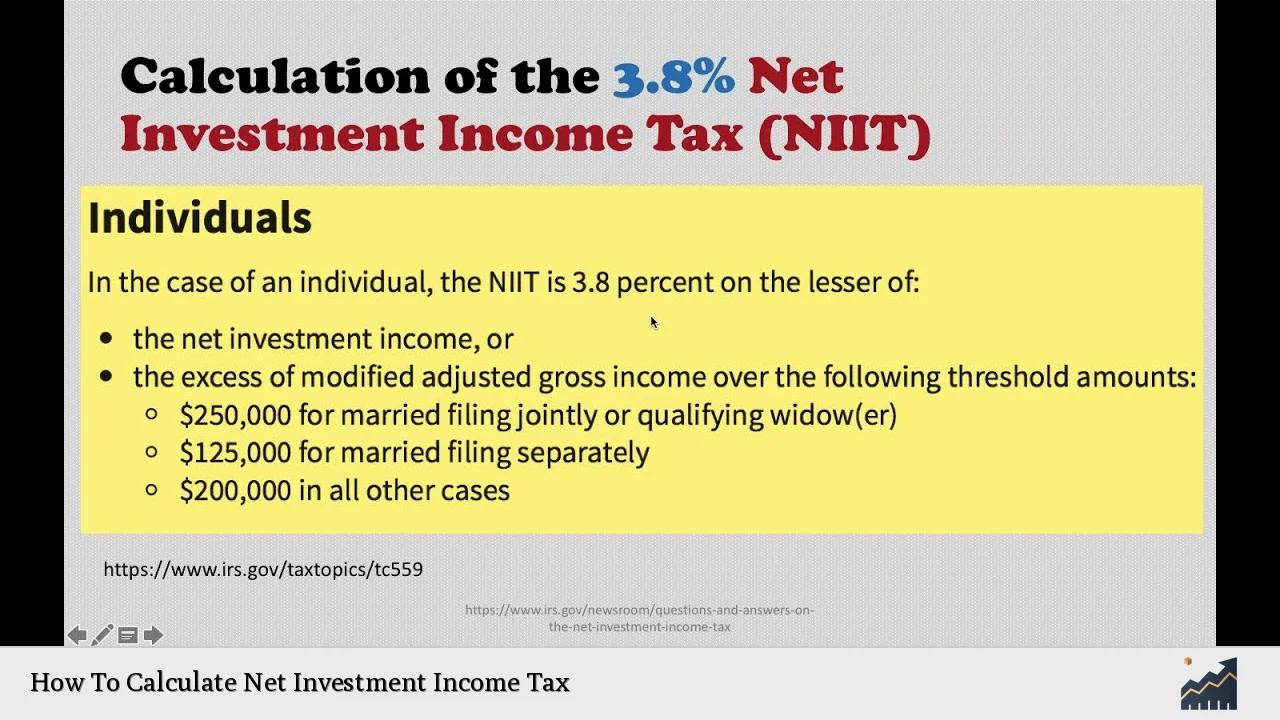

To calculate the NIIT, taxpayers need to determine their net investment income and compare their MAGI against the applicable threshold based on their filing status. The tax is calculated based on the lesser of the net investment income or the amount by which the MAGI exceeds the threshold.

| Filing Status | MAGI Threshold |

|---|---|

| Single or Head of Household | $200,000 |

| Married Filing Jointly | $250,000 |

| Married Filing Separately | $125,000 |

Understanding Net Investment Income

Net Investment Income refers to the total income derived from investments after deducting certain expenses directly related to earning that income. Common components of net investment income include:

- Taxable interest: Interest earned from savings accounts, bonds, and other investments.

- Dividends: Earnings distributed by corporations to shareholders.

- Capital gains: Profits from the sale of assets like stocks or real estate.

- Rental and royalty income: Earnings from leasing property or intellectual property.

- Business income: Income from trading financial instruments or commodities.

Certain types of income are excluded from NIIT calculations, such as wages, Social Security benefits, and most self-employment income. Understanding what constitutes net investment income is crucial as it forms the basis for calculating NIIT.

Who Is Subject to Net Investment Income Tax?

The NIIT applies to individuals, estates, and trusts with net investment income exceeding the specified MAGI thresholds. The thresholds are designed to target higher-income earners:

- For single filers and heads of household, the threshold is $200,000.

- For married couples filing jointly, it is $250,000.

- For those filing married separately, the threshold is $125,000.

Taxpayers whose MAGI exceeds these amounts and who have net investment income must calculate their NIIT liability. It’s important to note that if an individual has no net investment income but exceeds the MAGI threshold, they are not subject to NIIT.

Steps to Calculate Net Investment Income Tax

Calculating NIIT involves several steps that ensure accuracy in determining tax liability. Here’s a straightforward approach:

1. Determine Net Investment Income (NII): Add up all sources of investment income and subtract any allowable deductions related to that income. This includes expenses like investment interest expenses and advisory fees.

2. Calculate Modified Adjusted Gross Income (MAGI): Adjust your gross income by adding back certain deductions that were previously excluded from your AGI.

3. Compare MAGI Against Thresholds: Identify your filing status and compare your MAGI against the corresponding threshold amount.

4. Calculate NIIT Liability: The NIIT is applied at a rate of 3.8% on the lesser of:

- Your net investment income.

- The amount by which your MAGI exceeds the applicable threshold.

5. Report on Tax Returns: Use IRS Form 8960 to report your NIIT liability when filing your taxes.

By following these steps carefully, taxpayers can accurately determine their obligation under the NIIT.

Example Calculation of Net Investment Income Tax

To illustrate how to calculate NIIT effectively, consider this example:

A single taxpayer earns $180,000 in wages and has $90,000 in net investment income from various sources. Their total modified adjusted gross income (MAGI) would be:

$$

\text{MAGI} = \text{Wages} + \text{Net Investment Income} = 180,000 + 90,000 = 270,000

$$

Since this taxpayer’s MAGI of $270,000 exceeds the threshold for single filers ($200,000) by $70,000:

$$

\text{Excess over Threshold} = 270,000 – 200,000 = 70,000

$$

Now we compare this excess with the net investment income:

- Net Investment Income: $90,000

- Excess over Threshold: $70,000

The lesser amount is $70,000. Therefore:

$$

\text{NIIT} = 70,000 \times 0.038 = 2,660

$$

In this scenario, the taxpayer would owe $2,660 in net investment income tax.

Reporting and Paying Net Investment Income Tax

Once you have calculated your NIIT liability using Form 8960, it must be reported on your annual tax return (Form 1040). The calculated amount should be added to line 17 of Form 1040 under “Other Taxes.”

It’s crucial to ensure that all calculations are accurate before submitting your tax return to avoid penalties or additional interest charges due to underpayment.

Taxpayers can make payments for their NIIT along with their regular federal tax payments through withholding or estimated tax payments throughout the year.

Strategies for Minimizing Net Investment Income Tax

While some taxpayers may find themselves subject to NIIT due to high earnings from investments, there are strategies available to potentially reduce their exposure:

- Tax-Loss Harvesting: Selling losing investments can offset gains realized during the year.

- Investing in Tax-Advantaged Accounts: Utilizing accounts such as IRAs or Roth IRAs can help shield some investment earnings from taxation.

- Adjusting Asset Allocation: Consider investing in municipal bonds or other assets that generate tax-exempt interest.

Implementing these strategies requires careful planning and consultation with a financial advisor or tax professional who can provide personalized advice based on individual circumstances.

FAQs About How To Calculate Net Investment Income Tax

- What types of income are considered net investment income?

Net investment income includes taxable interest, dividends, capital gains, rental and royalty income. - Who must pay the Net Investment Income Tax?

Individuals with MAGI exceeding specific thresholds who also have net investment income must pay this tax. - How do I report my Net Investment Income Tax?

You report your NIIT using IRS Form 8960 when filing your annual tax return. - Can I reduce my Net Investment Income Tax liability?

Yes, strategies like tax-loss harvesting and investing in tax-advantaged accounts can help minimize liability. - What happens if I fail to pay my Net Investment Income Tax?

Failure to pay may result in penalties and interest charges on unpaid amounts.

Understanding how to calculate and manage your Net Investment Income Tax is essential for effective financial planning. By following these guidelines and utilizing available strategies for reduction where applicable, taxpayers can navigate this aspect of taxation more effectively while ensuring compliance with IRS regulations.