Calculating the annual yield on investment is essential for understanding how well your investments are performing over time. The annual yield gives you insight into the return you can expect from your investments, helping you make informed financial decisions. It is particularly useful for comparing different investment options, such as stocks, bonds, and savings accounts.

The annual yield can be expressed as a percentage, representing the income generated from an investment relative to its initial cost. To calculate this yield, you need to consider various factors such as the initial investment amount, total returns, and the duration of the investment. This article will guide you through the steps required to calculate your annual yield effectively.

| Key Term | Description |

|---|---|

| Annual Yield | The percentage return on an investment over one year. |

| Total Return | The overall profit from an investment, including income and capital gains. |

Understanding Annual Yield

The annual yield is a critical metric in investing that helps investors gauge how much they are earning from their investments annually. It includes income generated from interest, dividends, or capital gains divided by the initial investment amount. This metric allows investors to compare different assets and assess their performance over time.

There are different types of yields that can be calculated based on the nature of the investment. For example, dividend yield applies to stocks that pay dividends, while interest yield applies to fixed-income securities like bonds. Understanding these distinctions is crucial for accurately calculating and interpreting yields.

Investors often look for a higher annual yield as it indicates better performance of their investments. However, it is also essential to consider the risks associated with higher yields, as they may indicate more volatile investments. Therefore, a comprehensive analysis of both yield and risk is necessary when evaluating investment opportunities.

Steps to Calculate Annual Yield

Calculating the annual yield involves several straightforward steps. Follow these steps to determine your investment’s annual yield accurately:

- Determine Initial Investment Amount: Identify how much money you initially invested in the asset.

- Calculate Total Return: Add up all income generated from the investment over a specific period (including dividends or interest) along with any capital gains realized during that time.

- Identify Holding Period: Determine how long you held the investment (in years).

- Calculate Annual Yield: Divide the total return by the initial investment amount and multiply by 100 to express it as a percentage.

- Adjust for Holding Period: If your holding period is longer than one year, divide the annual yield by the number of years held to find the average annual yield.

By following these steps, you can accurately assess your investment’s performance and make informed decisions about future investments.

Example Calculation of Annual Yield

To illustrate how to calculate annual yield, let’s consider a practical example:

Suppose you invested $10,000 in a mutual fund at the beginning of the year. Over that year, you received $600 in dividends and realized a capital gain of $1,200 when you sold your shares.

1. Initial Investment Amount: $10,000

2. Total Return Calculation:

- Dividends: $600

- Capital Gains: $1,200

- Total Return: $600 + $1,200 = $1,800

3. Holding Period: 1 year

4. Annual Yield Calculation:

$$

\text{Annual Yield} = \left( \frac{\text{Total Return}}{\text{Initial Investment}} \right) \times 100 = \left( \frac{1800}{10000} \right) \times 100 = 18\%

$$

In this example, your annual yield would be 18%, indicating a healthy return on your investment.

Different Types of Yields

Understanding various types of yields can enhance your ability to evaluate investments effectively. Here are some common types of yields:

- Dividend Yield: This measures how much a company pays out in dividends each year relative to its stock price. It’s calculated by dividing annual dividends per share by the stock’s current market price.

- Interest Yield: This applies primarily to bonds and fixed-income securities. It reflects the interest earned on an investment relative to its price or face value.

- Average Annual Yield: This metric considers total income generated over multiple years divided by the number of years held. It provides a broader perspective on an asset’s performance.

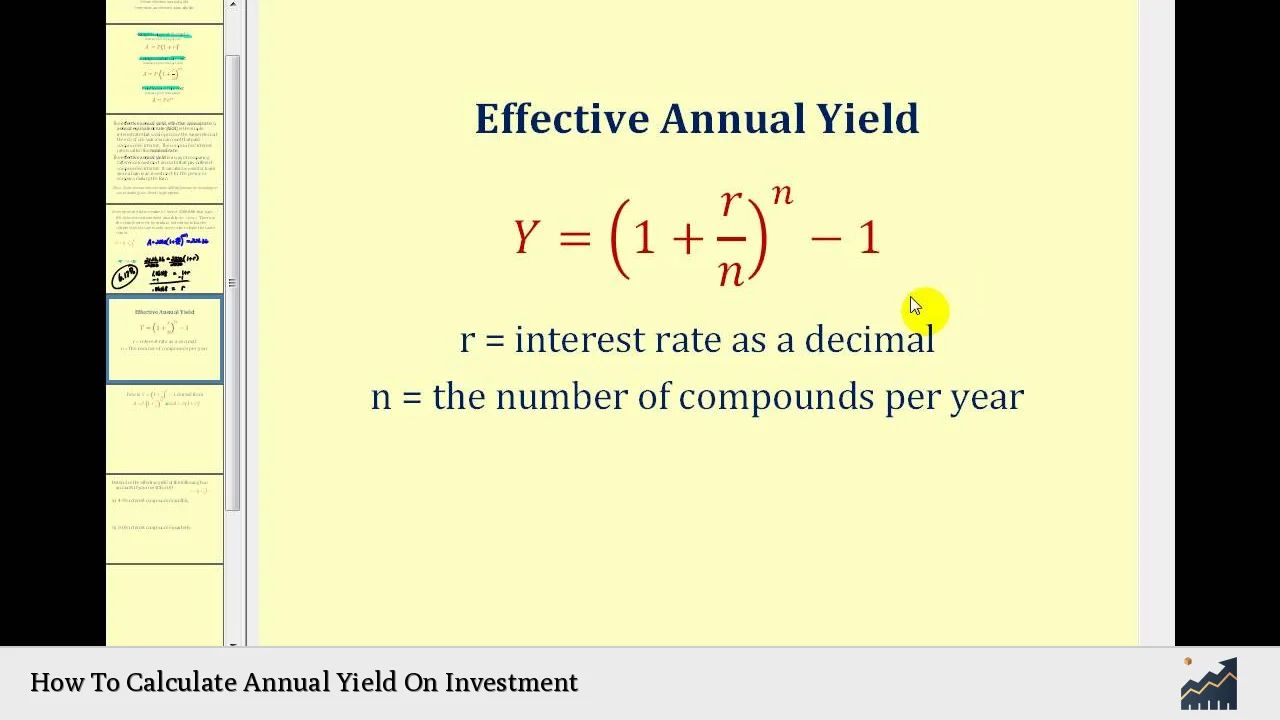

- Annual Percentage Yield (APY): This accounts for compounding interest over time and is often used for savings accounts or other interest-bearing investments.

Understanding these different types of yields allows investors to choose suitable investments based on their financial goals and risk tolerance.

Factors Influencing Annual Yield

Several factors can influence an investment’s annual yield:

- Market Conditions: Economic fluctuations can affect stock prices and bond yields significantly.

- Investment Type: Different asset classes have varying risk profiles and potential returns; stocks generally offer higher yields than bonds but come with increased volatility.

- Time Horizon: The length of time you hold an investment can impact its overall yield due to compounding effects or market changes.

- Fees and Expenses: Management fees or transaction costs can reduce net returns and thus lower your effective annual yield.

Being aware of these factors will help you make better-informed decisions about where to allocate your funds for optimal returns.

Common Mistakes in Calculating Annual Yield

When calculating annual yield, investors often make several common mistakes that can lead to inaccurate assessments:

- Ignoring Fees: Failing to account for management fees or transaction costs can inflate perceived yields.

- Miscalculating Total Returns: Not including all sources of income (like dividends or interest) in total return calculations can lead to underestimating actual performance.

- Overlooking Holding Periods: Not adjusting calculations based on how long an asset was held may misrepresent its true performance over time.

By being mindful of these potential pitfalls, investors can ensure more accurate calculations and better understand their investment performance.

FAQs About How To Calculate Annual Yield On Investment

- What is annual yield?

The annual yield is a measure of how much income an investment generates relative to its initial cost over one year. - How do I calculate my total return?

Total return includes all income generated from an investment plus any capital gains realized during the holding period. - What factors affect my annual yield?

Market conditions, type of investment, holding period length, and fees can all influence your annual yield. - Why is understanding yield important?

Yield helps investors assess performance and compare different investment options effectively. - Can I calculate average annual yield?

Yes, average annual yield is calculated by dividing total returns by the number of years held.

Calculating your annual yield on investments is crucial for understanding your financial growth and making informed decisions about future investments. By following structured steps and being aware of various influencing factors, you can gain valuable insights into your portfolio’s performance.