Investment banking is a highly competitive field that attracts individuals with a strong interest in finance, strategic thinking, and a desire for a challenging work environment. When preparing to answer the question “Why investment banking?”, it is essential to articulate your motivations clearly and connect them to the skills and experiences that make you a suitable candidate for this demanding career path. This article provides a comprehensive overview of market trends, implementation strategies, risk considerations, regulatory aspects, and future outlooks in investment banking, along with practical advice on how to craft an effective response to this pivotal interview question.

| Key Concept | Description/Impact |

|---|---|

| Fast-Paced Environment | Investment banking offers a dynamic work setting where professionals are involved in high-stakes transactions and rapid decision-making processes. |

| Steep Learning Curve | New hires gain significant exposure to financial modeling, valuation techniques, and corporate finance from day one, fostering rapid professional development. |

| Networking Opportunities | Investment bankers build relationships with influential clients and colleagues, enhancing career prospects and industry knowledge. |

| Exit Opportunities | The skills acquired in investment banking are highly valued across various sectors, providing pathways to roles in private equity, hedge funds, and corporate finance. |

| Compensation Structure | Investment banking typically offers lucrative salaries complemented by bonuses and benefits, reflecting the demanding nature of the work. |

| Impact on Businesses | Investment bankers play a crucial role in facilitating mergers, acquisitions, and capital raising efforts that drive corporate growth and innovation. |

Market Analysis and Trends

The investment banking sector is currently experiencing significant growth. According to recent reports, the global investment banking market size is projected to increase from $131.25 billion in 2023 to $142.16 billion in 2024, reflecting a compound annual growth rate (CAGR) of 8.3%. This growth is driven by several factors:

- Rebounding M&A Activity: The merger and acquisition landscape is becoming increasingly active as companies seek strategic partnerships to enhance competitiveness. Major investment banks are expected to see a 30% rise in advisory revenues due to this uptick in M&A activity.

- Technological Advancements: The integration of technology in financial services is reshaping how investment banks operate. Digital transformation initiatives are enhancing efficiency and client engagement.

- Sustainable Finance Trends: There is a growing emphasis on sustainable investing practices, including environmental, social, and governance (ESG) criteria. Investment banks are adapting their services to meet these evolving client demands.

Implementation Strategies

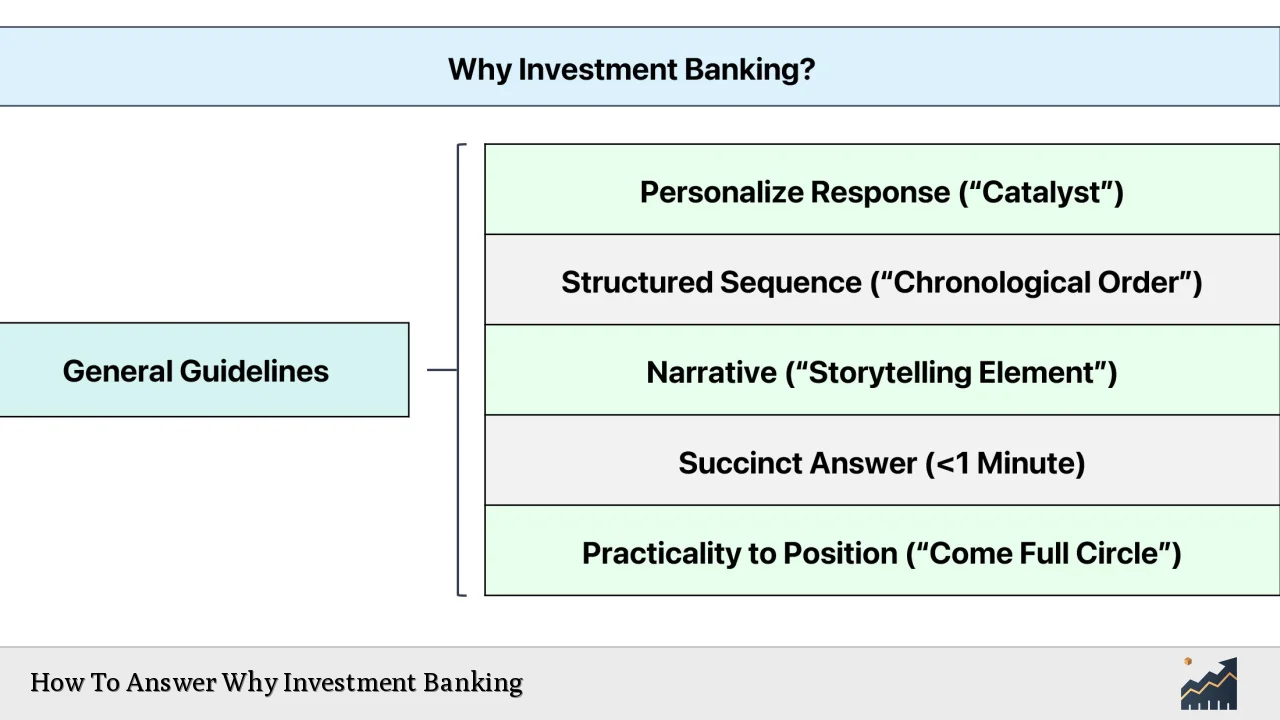

To effectively convey your reasons for pursuing a career in investment banking during an interview, consider the following strategies:

- Personal Connection: Share personal experiences or interests that led you to this career choice. For instance, discuss any relevant coursework or internships that sparked your passion for finance.

- Demonstrate Knowledge: Show that you understand the complexities of the investment banking industry. Discuss specific areas of interest such as M&A advisory or capital markets underwriting.

- Highlight Skills Development: Emphasize the skills you hope to gain through an investment banking role. Mention technical skills like financial modeling or soft skills such as teamwork and communication.

- Align with Company Values: Research the firm you are interviewing with and align your motivations with their values or recent projects they have undertaken.

Risk Considerations

Investment banking is not without its challenges. Candidates should be aware of the following risks associated with this career path:

- Work-Life Balance: The demanding nature of investment banking often leads to long hours and high stress. Candidates should be prepared for the lifestyle implications of this commitment.

- Market Volatility: Economic downturns can impact deal flow and revenue generation for investment banks. Understanding how market conditions affect the industry is crucial.

- Regulatory Compliance: Investment banks must navigate complex regulatory environments. Familiarity with regulations such as Dodd-Frank or MiFID II can be beneficial.

Regulatory Aspects

The regulatory landscape for investment banks has become increasingly stringent since the 2008 financial crisis. Key regulations include:

- Basel III: This framework establishes international standards for bank capital adequacy, stress testing, and market liquidity risk.

- Dodd-Frank Act: Enacted in response to the financial crisis, it aims to reduce risks in the financial system through increased transparency and accountability.

- MiFID II: This European regulation enhances investor protection and promotes transparency in financial markets.

Understanding these regulations can help candidates articulate their awareness of industry challenges during interviews.

Future Outlook

The future of investment banking appears promising due to several factors:

- Economic Growth: Global economic expansion is expected to drive demand for financial services. The World Bank forecasts a growth rate of 2.7% for 2024.

- Increased Private Equity Activity: With pent-up demand from private equity firms looking to exit investments, advisory services will likely see heightened activity in upcoming years.

- Emerging Markets: Regions like Asia-Pacific are projected to experience rapid growth in investment banking activities due to increasing economic development.

Frequently Asked Questions About How To Answer Why Investment Banking

- What should I emphasize when answering “Why Investment Banking?”

Focus on your passion for finance, desire for professional growth, and understanding of the industry’s challenges. - How can I prepare for this question?

Research the firm’s values and recent projects while reflecting on your personal experiences that align with those themes. - What if I have limited experience?

Highlight relevant coursework or extracurricular activities that demonstrate your interest in finance. - Is it important to mention compensation?

Mentioning compensation can be appropriate but should not be your primary focus; emphasize learning opportunities instead. - How can I show my understanding of market trends?

Cite current trends such as M&A activity or technological advancements impacting the industry during your response. - Should I discuss my long-term career goals?

Mentioning long-term goals can illustrate your commitment; connect them back to how investment banking fits into your plans. - What if I am unsure about my fit for this role?

Be honest about your interests while expressing a willingness to learn; demonstrate adaptability and enthusiasm. - How do I handle follow-up questions?

Be prepared to elaborate on any points made; practice articulating your thoughts clearly under pressure.

In conclusion, crafting an effective response to “Why Investment Banking?” requires introspection, research, and an understanding of both personal motivations and industry dynamics. By articulating clear reasons tied to market trends and personal experiences, candidates can distinguish themselves in interviews while demonstrating their suitability for this challenging yet rewarding career path.