Analyzing the market capitalization of exchange-based tokens is crucial for investors looking to navigate the complex cryptocurrency landscape. Exchange-based tokens, often issued by centralized exchanges (CEXs), serve multiple purposes, including facilitating trading, providing discounts on fees, and enhancing liquidity. Understanding their market cap can provide insights into their value relative to other cryptocurrencies, investor sentiment, and potential future performance. This article delves into the methodologies for analyzing the market cap of these tokens, current market trends, and strategic considerations for investors.

| Key Concept | Description/Impact |

|---|---|

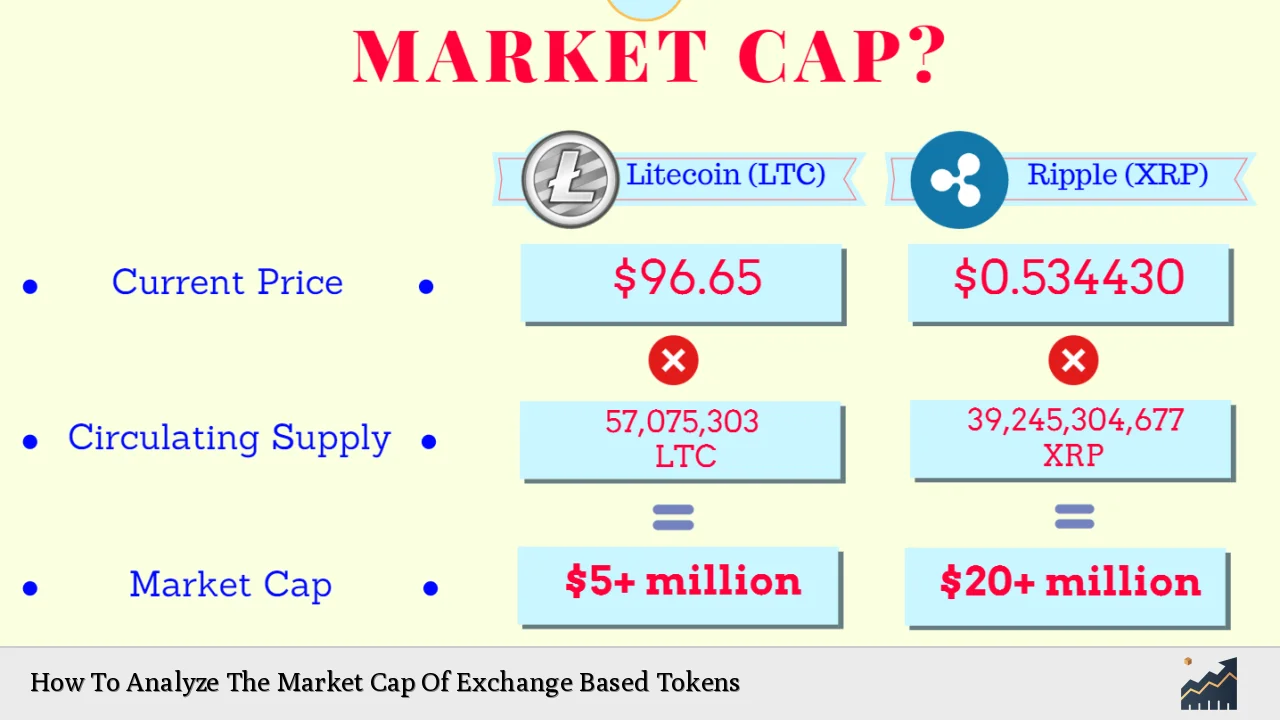

| Market Capitalization | The total value of a cryptocurrency calculated as the current price multiplied by the circulating supply. It serves as a primary indicator of a token’s size and market presence. |

| Market Value to Realized Value Ratio (MVRV) | A metric that compares the market cap to the realized cap (the value of tokens at the last active price). A high MVRV indicates overvaluation, while a low MVRV suggests undervaluation. |

| NVT Ratio | The ratio of market cap to daily transaction volume. A high NVT indicates potential overvaluation, whereas a low NVT suggests that a token may be undervalued based on its trading activity. |

| Liquidity Analysis | Examining trading volumes and liquidity helps gauge investor confidence and market health. Higher liquidity often correlates with better price stability and lower volatility. |

| Regulatory Environment | The legal landscape surrounding cryptocurrencies can significantly impact token valuations. Regulatory clarity can enhance investor confidence and market participation. |

| Future Growth Potential | Assessing the underlying technology and use cases of exchange tokens is essential for predicting long-term growth. Tokens tied to innovative platforms may offer better investment opportunities. |

Market Analysis and Trends

The cryptocurrency market has experienced significant fluctuations in recent years, with exchange-based tokens playing a pivotal role in this dynamic environment. As of December 2024, the total cryptocurrency market capitalization stands at approximately $3.6 trillion, with Bitcoin and Ethereum dominating over 50% of this value. Exchange tokens like Binance Coin (BNB), Huobi Token (HT), and others are increasingly recognized for their utility within their respective ecosystems.

Current Market Statistics

- Bitcoin Dominance: 55.11%

- Total Cryptocurrency Trading Volume: $213.24 billion in the past 24 hours

- Market Growth: The Centralized Exchange Token (CEX) market is projected to grow from $14.5 billion in 2022 to $41.8 billion by 2030, reflecting a compound annual growth rate (CAGR) of 16.3%.

Key Trends

- Increased Institutional Investment: Major financial institutions are beginning to invest in cryptocurrencies, leading to greater liquidity and stability in the market.

- Regulatory Developments: Governments worldwide are implementing clearer regulations regarding cryptocurrencies, which can influence token valuations positively.

- Technological Innovations: Advances in blockchain technology are enhancing the functionality of exchange tokens, making them more appealing to investors.

Implementation Strategies

Investors looking to analyze the market cap of exchange-based tokens should consider several strategies:

- Conduct Fundamental Analysis: Evaluate the underlying fundamentals of each token, including its use case, team expertise, and technological innovations.

- Utilize Technical Analysis Tools: Employ tools such as moving averages and Relative Strength Index (RSI) to assess price trends and potential entry or exit points.

- Monitor Market Sentiment: Keep an eye on social media trends and news articles that could impact investor sentiment towards specific tokens.

- Diversify Investments: Spread investments across multiple exchange tokens to mitigate risks associated with volatility in any single asset.

Risk Considerations

Investing in exchange-based tokens carries inherent risks that must be evaluated:

- Market Volatility: Cryptocurrency markets are known for their rapid price fluctuations, which can lead to significant losses if not managed properly.

- Regulatory Risks: Changes in regulations can affect token prices dramatically; thus, staying informed about regulatory developments is essential.

- Security Risks: Centralized exchanges can be vulnerable to hacks; therefore, understanding the security measures in place is crucial for protecting investments.

Regulatory Aspects

The regulatory landscape surrounding cryptocurrency is evolving rapidly:

- Compliance Requirements: Exchanges must adhere to anti-money laundering (AML) and know-your-customer (KYC) regulations. Non-compliance can lead to severe penalties and loss of investor trust.

- Global Regulatory Trends: Different regions have varying approaches to cryptocurrency regulation. Investors should be aware of local regulations affecting their investments.

Future Outlook

The future of exchange-based tokens appears promising due to several factors:

- Growing Adoption: As more individuals and businesses adopt cryptocurrencies for transactions, demand for exchange tokens is expected to rise.

- Technological Advancements: Innovations such as decentralized finance (DeFi) integrations may enhance the utility of exchange tokens, driving up their value.

- Institutional Support: Increased participation from institutional investors will likely lead to more stable prices and greater acceptance of cryptocurrencies in mainstream finance.

Frequently Asked Questions About How To Analyze The Market Cap Of Exchange Based Tokens

- What is market capitalization?

Market capitalization is calculated by multiplying the current price of a cryptocurrency by its circulating supply, representing its total market value. - How do I calculate the market cap of an exchange token?

The formula is simple: Market Cap = Current Price × Circulating Supply. - What does a high NVT ratio indicate?

A high NVT ratio suggests that a token may be overvalued compared to its daily transaction volume. - Why is liquidity important in analyzing exchange tokens?

Higher liquidity indicates better trading conditions and lower volatility, which can enhance investment stability. - How do regulatory changes affect exchange-based tokens?

Regulatory changes can impact investor confidence and token valuations significantly; staying informed is crucial. - What are some common risks associated with investing in exchange tokens?

Risks include market volatility, regulatory uncertainties, and security vulnerabilities related to centralized exchanges. - What should I look for when evaluating an exchange token?

Consider factors such as utility within its ecosystem, technological advancements, team expertise, and overall market sentiment. - How can I stay updated on market trends for exchange-based tokens?

Follow financial news outlets, subscribe to cryptocurrency analysis platforms, and engage with online communities focused on crypto investing.

In conclusion, analyzing the market cap of exchange-based tokens requires a comprehensive understanding of various financial metrics, current trends, regulatory environments, and strategic investment approaches. By integrating these elements into your investment strategy, you can make informed decisions that align with your financial goals while navigating this dynamic marketplace effectively.