Determining how much money you need to invest is a crucial step for anyone looking to grow their wealth. The amount varies based on individual financial goals, risk tolerance, and investment strategies. Understanding your personal financial situation and investment objectives will help you establish a clear investment plan.

Investing can be daunting, especially for beginners. However, it is essential to realize that you don’t need a large sum of money to start investing. Many investment platforms today allow individuals to begin with small amounts, making it accessible for everyone. The key is to start where you are and gradually build your portfolio over time.

To effectively plan your investments, consider the following factors:

- Financial Goals: What do you want to achieve with your investments? This could range from saving for retirement to buying a home or funding education.

- Investment Time Frame: How long do you plan to keep your money invested? Short-term goals may require different strategies compared to long-term objectives.

- Risk Tolerance: How much risk are you willing to take? Understanding your comfort level with risk will help guide your investment choices.

| Factor | Description |

|---|---|

| Financial Goals | Defines what you want to achieve through investing. |

| Investment Time Frame | Indicates how long you plan to invest before needing the funds. |

| Risk Tolerance | Assesses how much risk you are willing to take with your investments. |

Assessing Your Financial Situation

Before deciding how much money to invest, it’s essential to assess your current financial situation. This involves evaluating your income, expenses, debts, and savings. By understanding where you stand financially, you can determine how much disposable income is available for investing.

Start by creating a budget that outlines your monthly income and expenses. This will help identify any surplus funds that can be allocated towards investments. Additionally, ensure that you have an emergency savings fund in place—typically covering three to six months of living expenses—before committing significant amounts of money into investments.

It’s also important to pay off high-interest debts, such as credit card balances, before investing. This is because the interest on these debts often exceeds the potential returns from investments, making it more financially sound to eliminate them first.

Setting Clear Investment Goals

Having clear investment goals is vital for determining how much money you need to invest. Your goals will dictate the types of investments suitable for your situation and the amount of capital required.

Common investment goals include:

- Retirement Savings: Aiming to accumulate enough funds for a comfortable retirement.

- Buying a Home: Saving for a down payment on a property.

- Education Funding: Setting aside money for children’s education or personal development.

When setting goals, consider both short-term and long-term objectives. For example, if you’re saving for a vacation next year, you’ll need a different strategy than if you’re planning for retirement in 30 years.

Understanding Investment Options

The amount of money needed to invest can also depend on the type of investment vehicles you choose. Here are some common options:

- Stocks: Buying shares in individual companies can require varying amounts depending on the stock price.

- Mutual Funds: These allow investors to pool their money together; many have low minimum investment requirements.

- Exchange-Traded Funds (ETFs): Similar to mutual funds but traded like stocks; they often have lower fees and no minimum investment limits.

- Bonds: Fixed-income securities that can be purchased in various denominations.

Each of these options has different requirements and risks associated with them. Understanding these will help you determine how much capital is necessary based on your financial goals and risk tolerance.

Starting Small: Micro-Investing

For those who are hesitant about investing large sums of money initially, micro-investing platforms allow individuals to invest small amounts regularly. This approach makes it easier for beginners to start building an investment portfolio without the pressure of committing significant funds upfront.

Micro-investing typically involves:

- Investing spare change from purchases.

- Regularly contributing small amounts (e.g., $5 or $10) into diversified portfolios.

These platforms often provide educational resources that help new investors understand market dynamics while gradually increasing their investments over time.

Dollar-Cost Averaging Strategy

One effective method for investing smaller amounts over time is known as dollar-cost averaging. This strategy involves regularly investing a fixed amount of money regardless of market conditions.

Benefits include:

- Reducing the impact of market volatility by spreading out purchases over time.

- Encouraging disciplined investing habits without the need for timing the market.

For example, if you decide to invest $200 each month into an index fund, you’ll buy more shares when prices are low and fewer when prices are high. Over time, this strategy can lead to significant growth in your investment portfolio without requiring large upfront capital.

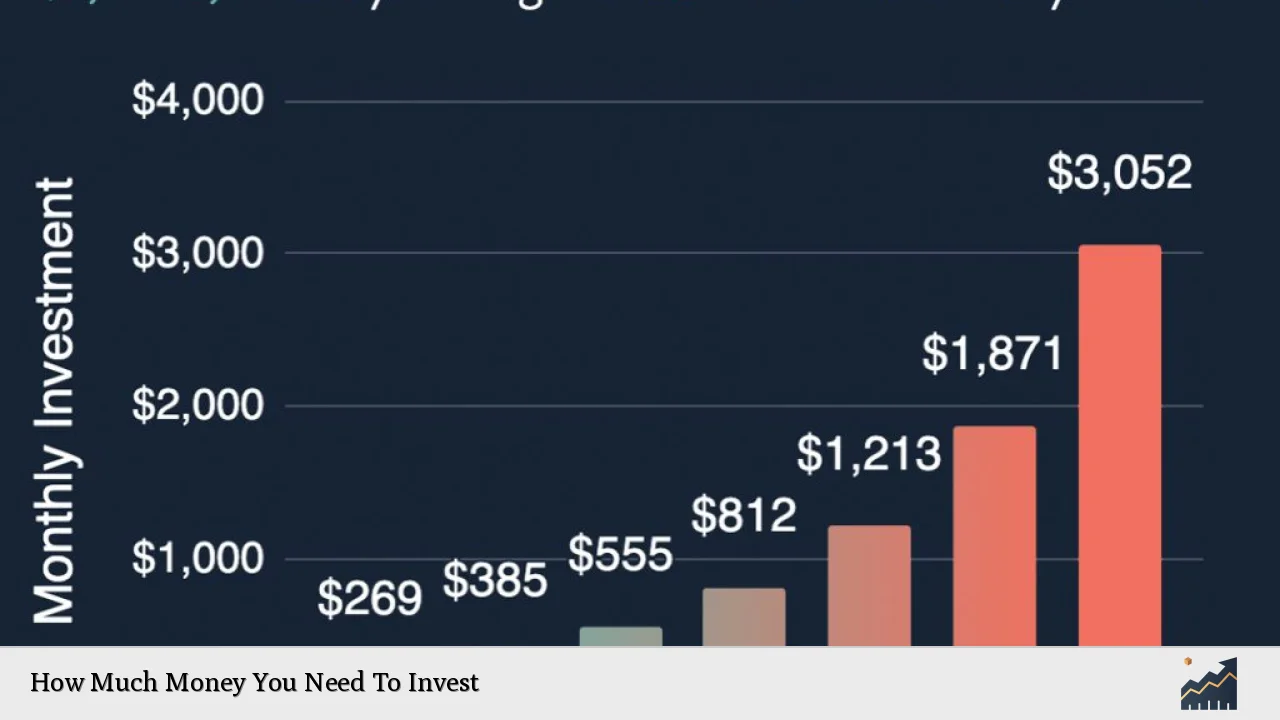

Determining Your Investment Amount

To decide how much money you should invest initially, consider these steps:

1. Evaluate Your Financial Health: Understand your income, expenses, debts, and savings.

2. Set Clear Goals: Define what you want to achieve through investing.

3. Choose Investment Vehicles: Research which types of investments align with your goals.

4. Start Small: Begin with an amount that feels manageable and gradually increase as your financial situation improves.

5. Monitor Progress: Regularly review your investments and adjust contributions based on performance and changing goals.

By following these steps, you’ll be able to establish a solid foundation for your investment journey without feeling overwhelmed by the amount needed upfront.

Diversification: Spreading Your Investment

Once you’ve decided how much money you’re ready to invest, it’s crucial to diversify your portfolio. Diversification helps mitigate risk by spreading investments across various asset classes rather than concentrating on one area.

Consider these strategies for diversification:

- Invest in different sectors (technology, healthcare, finance).

- Include various asset types (stocks, bonds, real estate).

- Explore international markets alongside domestic investments.

By diversifying, you’re less likely to suffer significant losses if one sector underperforms; instead, gains in other areas can offset those losses.

FAQs About How Much Money You Need To Invest

- What is the minimum amount needed to start investing?

Many platforms allow starting with as little as $5 or $10. - Should I pay off debt before investing?

Yes, especially high-interest debt like credit cards. - How often should I invest?

It’s beneficial to invest regularly using strategies like dollar-cost averaging. - Can I invest without a lot of knowledge?

Yes, many resources are available for beginners; consider starting with index funds or ETFs. - What if I can’t afford large contributions?

You can start small; even minor contributions can grow significantly over time.

In conclusion, determining how much money you need to invest depends on various personal factors including financial goals, current financial health, risk tolerance, and chosen investment vehicles. Starting small and gradually increasing contributions while diversifying investments can lead to successful wealth accumulation over time.