Pablo, an experienced investor, is keen to understand how much interest he can expect from his investment. This inquiry involves several factors, including the amount invested (the principal), the interest rate, and the duration of the investment. By analyzing these components, we can provide a comprehensive overview of how interest is calculated and what Pablo might anticipate from his investment.

| Key Concept | Description/Impact |

|---|---|

| Principal Amount | The initial sum of money invested or loaned, which forms the basis for interest calculations. |

| Interest Rate | The percentage at which interest is calculated on the principal, typically expressed annually. |

| Compounding Frequency | The number of times interest is applied to the principal within a year, affecting total returns. |

| Investment Duration | The length of time the money is invested, which influences total interest accrued. |

| Interest Type | Simple vs. Compound Interest; compound interest earns interest on previously accrued interest. |

Market Analysis and Trends

Understanding current market trends is essential for predicting investment returns. As of late 2024, interest rates are influenced by central bank policies aimed at managing inflation and stimulating economic growth. For instance, the Federal Reserve has adjusted rates in response to fluctuating inflation rates, impacting fixed-income investments and savings accounts.

Current Interest Rate Environment

- Federal Reserve Rates: The Federal Reserve’s current benchmark rate stands at around 5.25%, reflecting a tightening monetary policy.

- Bond Yields: U.S. Treasury yields have risen, with the 10-year yield hovering around 4.2%, indicating investor expectations for higher future rates.

- Savings Accounts: High-yield savings accounts now offer rates between 4% and 5%, making them attractive for conservative investors.

Investment Product Trends

- Equities: Stock market volatility remains high due to geopolitical tensions and economic uncertainty. Investors are advised to consider diversification.

- Real Estate: With rising mortgage rates, real estate investments are becoming more complex but still offer potential for long-term appreciation.

Implementation Strategies

For Pablo to maximize his investment returns, he should consider various strategies based on his risk tolerance and investment goals.

Investment Strategies

- Diversification: Spreading investments across different asset classes (stocks, bonds, real estate) can mitigate risks.

- Dollar-Cost Averaging: Regularly investing a fixed amount can reduce the impact of market volatility.

- Reinvestment of Earnings: Utilizing dividends or interest earned to purchase additional shares can significantly enhance compound growth over time.

Example Calculation

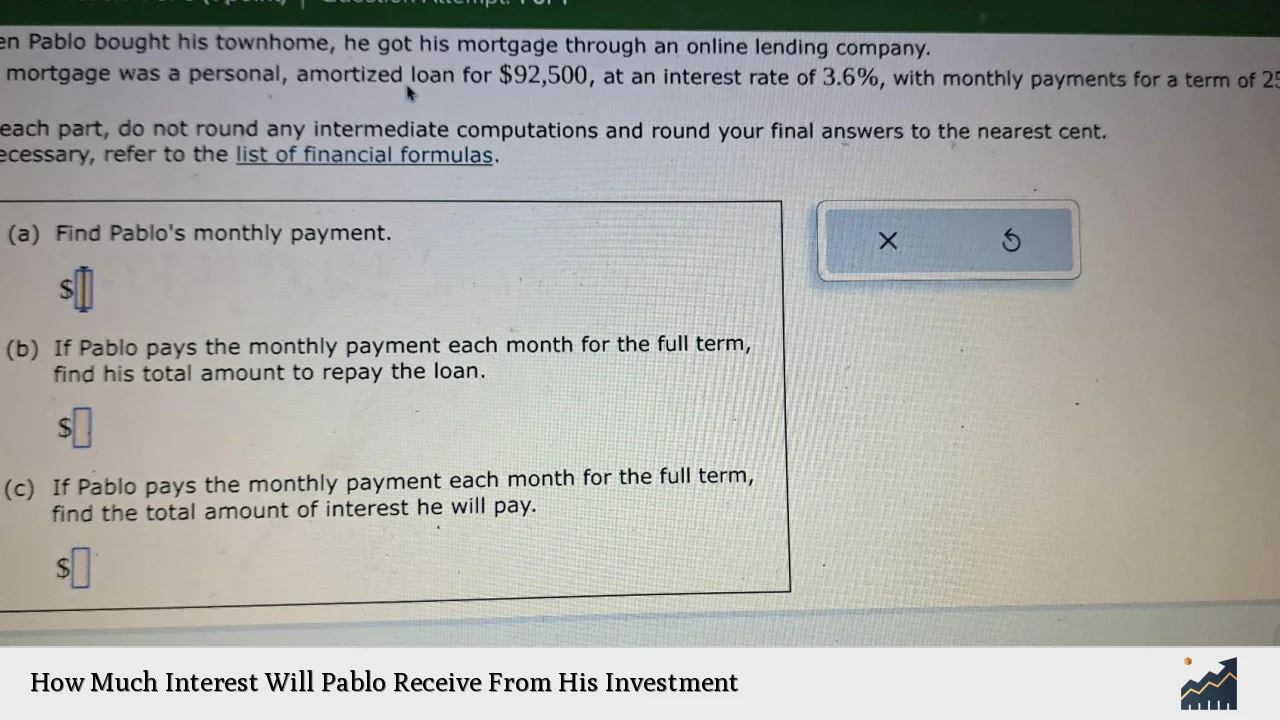

To illustrate how much interest Pablo might receive from an investment using compound interest:

- Principal (P): $10,000

- Annual Interest Rate (r): 5%

- Compounding Frequency (n): Annually

- Investment Duration (t): 5 years

Using the compound interest formula:

$$

A = P \left(1 + \frac{r}{n}\right)^{nt}

$$

Calculating:

$$

A = 10000 \left(1 + \frac{0.05}{1}\right)^{1 \times 5} = 10000 \left(1.27628\right) \approx 12762.81

$$

Thus, the total amount after 5 years would be approximately $12,762.81, yielding an interest of about $2,762.81.

Risk Considerations

Investing inherently involves risks that can affect returns. Understanding these risks allows Pablo to make informed decisions.

Types of Risks

- Market Risk: The risk of losses due to market fluctuations.

- Interest Rate Risk: Changes in interest rates can affect bond prices and fixed-income investments.

- Inflation Risk: The risk that inflation will erode purchasing power over time.

- Liquidity Risk: The risk that an asset cannot be quickly sold without a significant loss in value.

Mitigation Strategies

- Regular Portfolio Review: Adjusting asset allocation based on market conditions can help manage risks.

- Use of Stop-Loss Orders: Setting predetermined sell points can limit potential losses in volatile markets.

Regulatory Aspects

Investors must navigate various regulations that govern financial markets and investment products.

Key Regulations

- Securities Act of 1933: Requires transparency in securities offerings to protect investors.

- Investment Company Act of 1940: Regulates mutual funds and other investment companies to ensure investor protection.

- Dodd-Frank Act: Introduced reforms aimed at reducing systemic risk in financial markets post-2008 financial crisis.

Pablo should ensure compliance with these regulations when making investment decisions, particularly if he considers alternative investments or complex financial products.

Future Outlook

The future landscape for investments will likely be shaped by ongoing economic developments and technological advancements.

Economic Indicators

- GDP Growth: Forecasts suggest moderate growth in developed economies as they adjust to post-pandemic realities.

- Inflation Trends: Inflation is expected to stabilize but may remain elevated compared to historical norms.

Technological Impact

The rise of fintech solutions is transforming investment strategies:

- Robo-Advisors: Automated platforms provide tailored investment advice based on individual goals and risk tolerance.

- Blockchain Technology: Enhances transparency and security in transactions but poses regulatory challenges.

Frequently Asked Questions About How Much Interest Will Pablo Receive From His Investment

- What is compound interest?

Compound interest is calculated on the initial principal and also on the accumulated interest from previous periods. - How do I calculate my potential earnings?

You can use the formula $$A = P(1 + r/n)^{nt}$$ where $$A$$ is the amount after time $$t$$, $$P$$ is the principal, $$r$$ is the annual rate, $$n$$ is compounding frequency. - What factors influence my investment returns?

The principal amount, interest rate, duration of the investment, and compounding frequency all significantly impact returns. - Is it better to invest in stocks or bonds?

This depends on your risk tolerance; stocks generally offer higher returns but come with greater volatility compared to bonds. - How often should I review my investments?

A regular review (at least annually) helps ensure your portfolio aligns with your financial goals and market conditions. - What are high-yield savings accounts?

These accounts offer higher interest rates than traditional savings accounts but may require higher minimum balances. - How does inflation affect my investments?

Inflation decreases purchasing power; thus, investments need to yield returns greater than inflation rates to preserve value. - Should I seek professional advice for my investments?

If you’re unsure about your investment strategy or navigating complex products, consulting a financial advisor can be beneficial.

In conclusion, understanding how much interest Pablo will receive from his investment requires careful consideration of multiple factors including market conditions, investment strategies, risks involved, and regulatory compliance. By leveraging this knowledge and employing effective strategies, Pablo can optimize his investment outcomes while managing associated risks effectively.