Investment analysts play a crucial role in the financial sector, providing insights and recommendations based on extensive research and analysis of market trends, companies, and economic conditions. Their compensation reflects the complexity of their responsibilities, varying significantly based on factors such as experience, location, and the specific sector they work in. This article explores the current salary landscape for investment analysts, delving into market trends, implementation strategies, risk considerations, regulatory aspects, and future outlooks.

| Key Concept | Description/Impact |

|---|---|

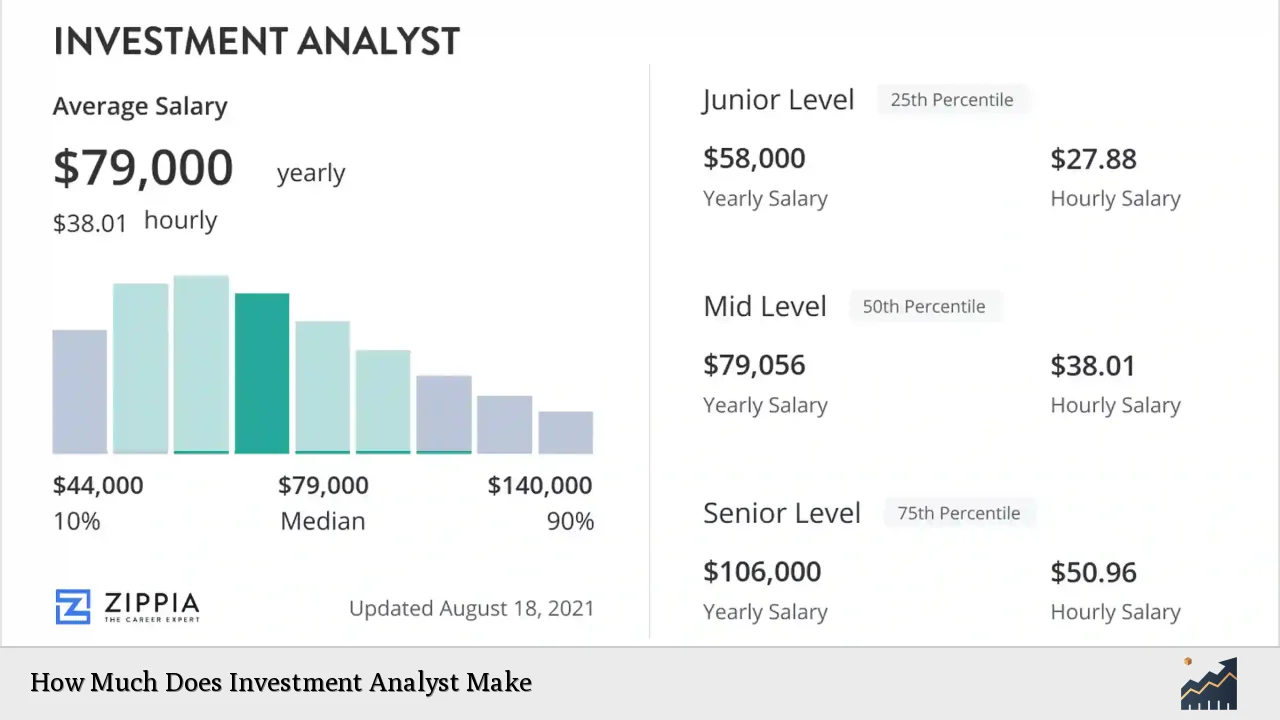

| Average Salary | The average salary for an investment analyst in the U.S. is approximately $79,056 annually, with entry-level positions starting around $60,000 to $90,000. |

| Salary Range | Salaries can range from $44,000 at the 10th percentile to over $140,000 at the 90th percentile, depending on experience and location. |

| Top Paying Cities | New York, San Francisco, and Stamford are among the highest-paying locations for investment analysts. |

| Job Growth Rate | The projected job growth rate for investment analysts is 9% from 2018 to 2028, indicating strong demand in the field. |

| Sector Variability | Salaries vary significantly between sectors; analysts in investment banking typically earn more than those in corporate finance or asset management. |

Market Analysis and Trends

The financial services industry has seen a steady increase in demand for investment analysts. According to recent data, the average salary for an investment analyst is around $79,056 per year. Entry-level positions generally start between $60,000 and $90,000 annually. As analysts gain experience (3-5 years), salaries typically rise to between $90,000 and $140,000. Senior analysts with over five years of experience can earn upwards of $140,000 to $180,000 annually.

Salary Breakdown by Experience Level

- Entry-Level (0-2 years): $60,000 – $90,000

- Mid-Level (3-5 years): $90,000 – $140,000

- Senior-Level (5+ years): $140,000 – $180,000+

The highest salaries are often found in competitive markets such as New York City where average salaries can exceed $107,445. Other high-paying states include Connecticut and Maryland.

Geographic Influence

Location plays a significant role in determining salary levels for investment analysts. The following table highlights average salaries across various states:

| State | Average Salary |

|---|---|

| New York | $107,445 |

| Connecticut | $107,392 |

| Maryland | $104,452 |

| California | $98,348 |

| Texas | $76,944 |

Implementation Strategies

For individuals aspiring to enter the field of investment analysis or seeking advancement within their careers, several strategies can enhance earning potential:

- Advanced Education: Obtaining a Master’s degree or professional certifications (such as CFA or CAIA) can significantly boost salary prospects.

- Networking: Building connections within the industry through professional organizations or alumni networks can lead to better job opportunities.

- Specialization: Focusing on niche areas such as quantitative analysis or specific sectors (e.g., technology or healthcare) may result in higher compensation due to specialized knowledge.

- Performance-Based Bonuses: Many firms offer performance bonuses which can substantially increase total compensation. For instance, top-performing analysts at hedge funds may see total compensation packages reach between $150,000 and $250,000.

Risk Considerations

Investment analysts face various risks that can impact their careers:

- Market Volatility: Analysts must navigate unpredictable market conditions that can affect job stability and performance evaluations.

- Regulatory Changes: Adapting to new regulations imposed by bodies like the SEC can be challenging and may require ongoing education.

- Job Competition: The field is competitive; thus continual skill development is necessary to remain relevant.

Regulatory Aspects

Investment analysts must comply with various regulations that govern financial reporting and analysis:

- SEC Regulations: Analysts must adhere to guidelines set forth by the Securities and Exchange Commission regarding transparency and ethical standards.

- Compliance Training: Ongoing training is essential to ensure compliance with evolving regulations affecting investment practices.

Future Outlook

The future for investment analysts appears promising with a projected job growth rate of 9% from 2018 to 2028. This growth is driven by increasing demand for financial services as companies seek to optimize their investments amidst complex market conditions.

Key Factors Influencing Future Salaries

- Technological Advancements: Automation and AI are changing how analysis is conducted; those who adapt will likely find new opportunities.

- Globalization: As markets become more interconnected, analysts with global perspectives will be increasingly valuable.

- Evolving Investment Strategies: Analysts who understand emerging trends such as ESG (Environmental Social Governance) investing may command higher salaries due to specialized expertise.

Frequently Asked Questions About How Much Does Investment Analyst Make

- What is the average salary for an entry-level investment analyst?

The average salary for entry-level investment analysts typically ranges from $60,000 to $90,000 annually. - How much do senior investment analysts make?

Senior investment analysts can earn between $140,000 and $180,000 per year depending on their experience and location. - Which states pay the highest salaries for investment analysts?

New York, Connecticut, and Maryland are among the highest-paying states for investment analysts. - What factors influence an investment analyst’s salary?

Key factors include experience level, geographic location, type of employer (investment bank vs. boutique firm), and performance-based bonuses. - Is there a demand for investment analysts?

Yes! The job market for investment analysts is projected to grow by 9% over the next decade. - What additional qualifications can increase my earning potential?

Obtaining advanced degrees or certifications like CFA can significantly enhance earning potential. - Do investment analysts receive bonuses?

Yes! Many firms offer performance-based bonuses that can substantially increase total compensation. - What is the impact of technology on investment analyst roles?

Technological advancements are changing analysis methods; those who adapt will find new opportunities in this evolving landscape.

In conclusion, while becoming an investment analyst can be lucrative with significant earning potential based on various factors including experience and location, it requires dedication to continuous learning and adaptation to industry changes. Understanding these dynamics will help aspiring professionals navigate their career paths effectively while maximizing their earning potential.