Determining how much you need to invest to retire comfortably is a crucial aspect of financial planning. Retirement is a significant life milestone that requires careful consideration of various factors, including your current savings, expected expenses, and desired lifestyle. The amount you need to invest will vary based on personal circumstances, but understanding the fundamental principles can help guide your planning.

Several key factors influence how much you should invest for retirement:

- Current Age: The younger you start saving, the less you need to save each month due to the power of compounding interest.

- Retirement Age: The age at which you plan to retire affects how many years you have to save and how long your savings need to last.

- Lifestyle Choices: Your desired lifestyle in retirement will significantly impact your financial needs. Consider whether you plan to travel, downsize your home, or maintain your current lifestyle.

- Life Expectancy: With increasing life expectancies, it’s essential to plan for a retirement that could last 20 years or more.

- Investment Returns: The rate of return on your investments will affect how much you need to contribute. Higher returns can reduce the amount you need to save.

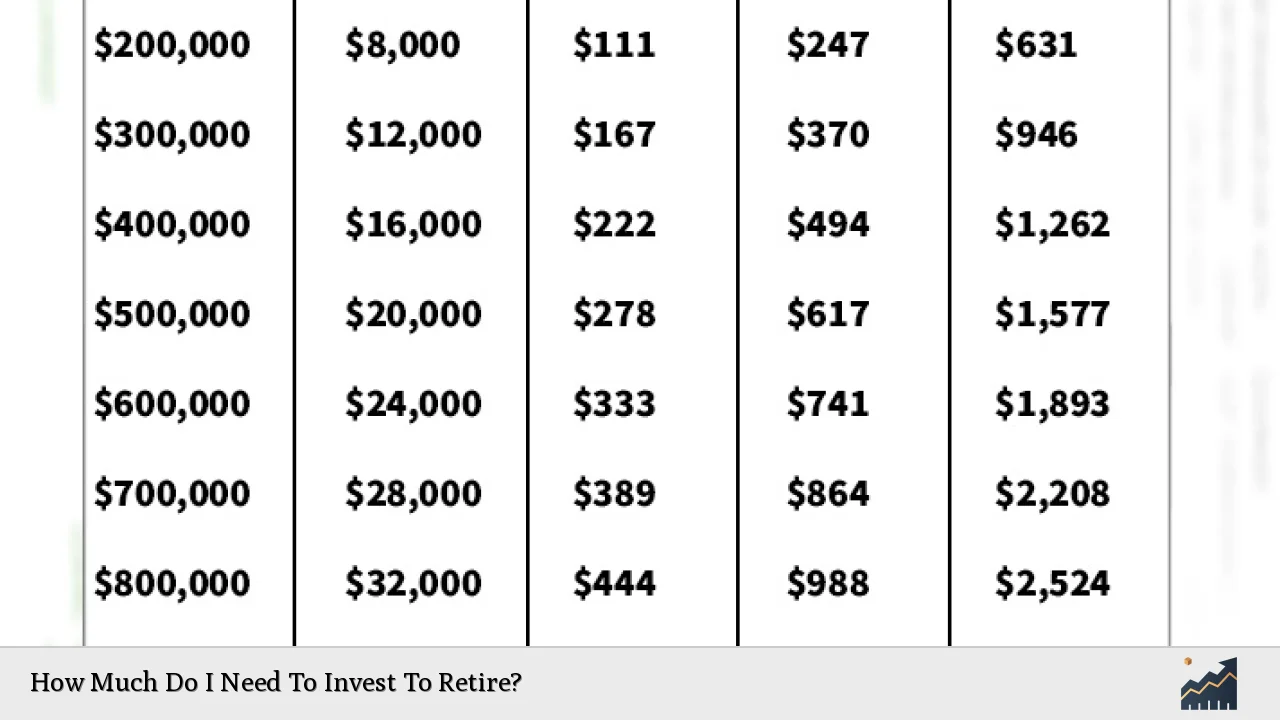

To give a clearer picture of retirement investment needs, here’s a concise overview:

| Factor | Impact on Investment Needs |

|---|---|

| Current Age | Younger savers benefit from compounding. |

| Retirement Age | Longer saving period decreases monthly contributions. |

| Lifestyle Choices | More expensive lifestyles require higher savings. |

| Life Expectancy | Longer retirements require more savings. |

| Investment Returns | Higher returns reduce required contributions. |

Understanding Retirement Expenses

Before calculating how much you need to invest, it’s essential to estimate your retirement expenses accurately. This includes not only daily living costs but also healthcare, travel, and any other discretionary spending.

Typically, retirees can expect their expenses to be lower than during their working years due to no longer commuting or saving for retirement. However, healthcare costs tend to increase with age. A common rule of thumb is that retirees may need about 70% to 80% of their pre-retirement income annually.

When considering expenses, think about:

- Housing Costs: Will you downsize or move? What are the property taxes and maintenance costs?

- Healthcare Expenses: Medicare may cover some costs, but out-of-pocket expenses can be significant.

- Travel and Leisure Activities: Many retirees want to travel or engage in hobbies that may incur additional costs.

- Inflation: Over time, inflation can erode purchasing power. Plan for rising costs in your calculations.

Understanding these expenses will help you create a more accurate picture of how much you need to save for retirement.

Calculating Your Retirement Savings Goal

Once you’ve estimated your annual retirement expenses, the next step is calculating your total savings goal. A popular method is the 25x rule, which suggests that you should aim to have 25 times your annual expenses saved by the time you retire. For example, if you expect to spend $50,000 per year in retirement, you should aim for a nest egg of $1.25 million ($50,000 x 25).

This approach assumes that you’ll withdraw about 4% of your savings annually, which is considered a sustainable withdrawal rate for many retirees. However, individual circumstances may vary; some may choose a more conservative approach based on market conditions or personal preferences.

Key Considerations

- Withdrawal Rate: Adjust your withdrawal rate based on market performance and personal needs.

- Social Security Benefits: Factor in any expected Social Security payments when calculating how much you’ll need to save.

- Pension Income: If you have a pension plan, include this as part of your income during retirement.

Investment Strategies for Retirement

Investing wisely is crucial for building the necessary nest egg for retirement. Here are some strategies:

- Start Early: The earlier you begin investing, the more time your money has to grow through compounding interest.

- Diversify Investments: Spread investments across various asset classes (stocks, bonds, real estate) to mitigate risk.

- Maximize Tax-Advantaged Accounts: Contribute as much as possible to accounts like 401(k)s and IRAs for tax benefits.

- Consider Risk Tolerance: Adjust your investment strategy based on your risk tolerance and time horizon. Younger investors can typically afford more risk than those nearing retirement.

- Regular Contributions: Make consistent contributions regardless of market conditions. Dollar-cost averaging can help reduce the impact of volatility.

These strategies can help ensure that your investments grow sufficiently over time and align with your retirement goals.

Adjusting Your Plan Over Time

Retirement planning is not a one-time event; it requires ongoing adjustments based on life changes and market conditions. Regularly review and adjust your investment strategy as needed:

- Reassess Goals Annually: Life changes such as marriage, children, or career shifts may impact your financial goals.

- Monitor Investment Performance: Keep an eye on how your investments are performing relative to your goals and make adjustments as necessary.

- Stay Informed About Market Trends: Economic changes can affect investment strategies; staying informed helps in making timely decisions.

By actively managing your retirement plan and making adjustments as needed, you’ll be better positioned to meet your financial goals.

Seeking Professional Help

If navigating retirement planning feels overwhelming or if you’re unsure about investment options, consider seeking professional advice. Financial advisors can provide personalized guidance tailored to your specific circumstances:

- Comprehensive Financial Planning: Advisors can help create a detailed plan covering all aspects of retirement planning.

- Investment Management Services: They can manage investments on your behalf based on agreed-upon strategies and risk tolerance levels.

- Ongoing Support and Adjustments: A financial advisor can offer ongoing support and help adjust plans as needed over time.

While hiring an advisor involves costs, their expertise can lead to better long-term outcomes for your retirement savings.

FAQs About How Much Do I Need To Invest To Retire?

- What is the average amount needed for retirement?

The average amount needed varies widely but generally ranges from $1 million to $3 million depending on lifestyle choices. - How much should I save each month for retirement?

A common recommendation is saving at least 15% of your income each month toward retirement. - Is it too late to start saving for retirement?

No matter when you start saving, it’s never too late; even small contributions can add up over time. - What are the best investment options for retirement?

Diversified portfolios including stocks, bonds, mutual funds, and real estate are often recommended. - How do I calculate my retirement needs?

You can calculate needs by estimating annual expenses in retirement and multiplying by 25.

In conclusion, understanding how much you need to invest for a comfortable retirement involves careful planning and consideration of various factors including age, lifestyle choices, and expected expenses. By following sound investment strategies and regularly adjusting plans as necessary, individuals can work towards achieving their financial goals for a secure future.