Investing in dividend stocks is a popular strategy for generating passive income. Dividends are payments made by companies to their shareholders, typically on a quarterly basis, as a share of profits. Understanding how much you need to invest to receive dividends can help you plan your financial future effectively. This article will explore the factors influencing your investment amount, the types of dividend stocks available, and practical steps to start investing.

| Investment Type | Description |

|---|---|

| Dividend Stocks | Shares in companies that pay dividends regularly. |

| Dividend Funds | Mutual funds or ETFs that hold a portfolio of dividend-paying stocks. |

The amount you need to invest to receive dividends depends on several factors, including the dividend yield of the stocks or funds you choose and your income goals. Understanding these components is crucial for effective investment planning.

Understanding Dividend Yields

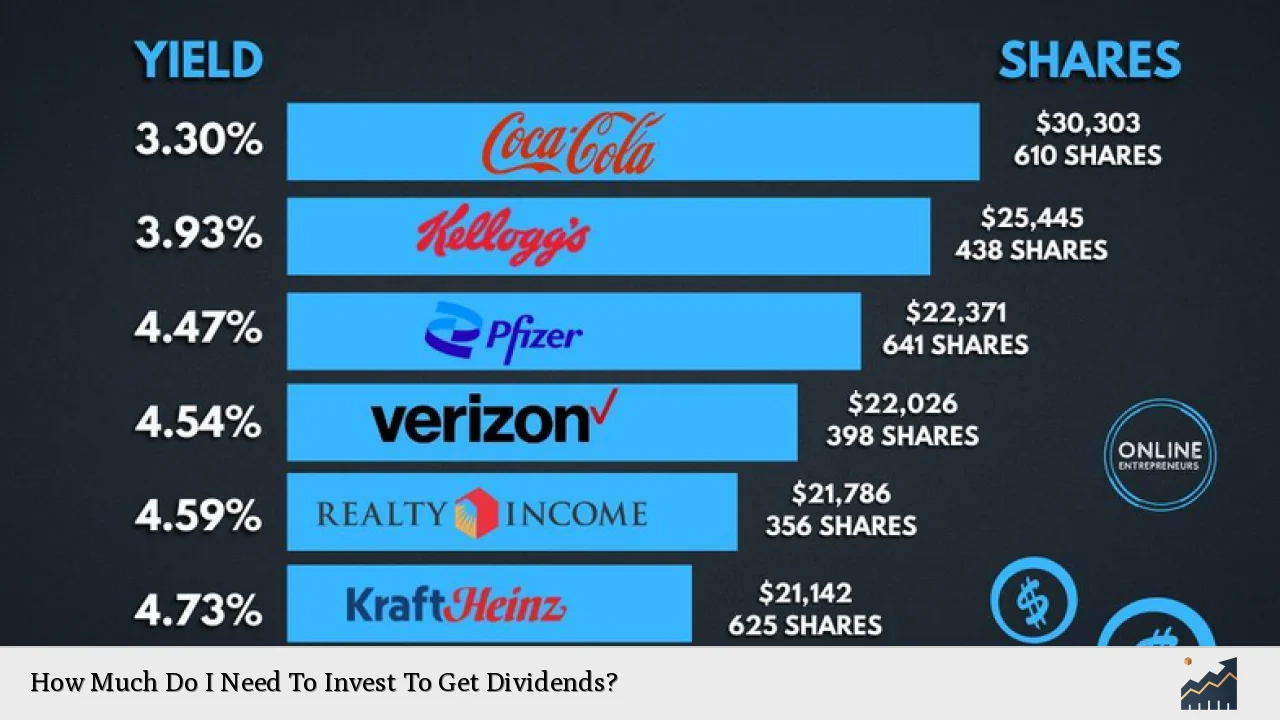

Dividend yield is a key metric that indicates how much a company pays in dividends relative to its stock price. It is expressed as a percentage and calculated by dividing the annual dividend payment by the stock’s current price. For example, if a stock pays an annual dividend of $1 per share and its current price is $20, the dividend yield would be $$ \frac{1}{20} \times 100 = 5\% $$.

Investors often look for stocks with high dividend yields as they can provide substantial income relative to the investment amount. However, it’s important to consider that not all high-yield stocks are safe investments. Companies with unsustainable payout ratios may cut dividends, impacting your income.

When planning your investment, consider your target income from dividends and the average yield of the stocks or funds you are interested in.

- If you want to earn $1,000 annually from dividends and you find a stock with a 5% yield, you would need to invest:

$$

\text{Investment Amount} = \frac{\text{Desired Income}}{\text{Dividend Yield}} = \frac{1000}{0.05} = 20,000

$$

This means you would need to invest $20,000 in that stock at a 5% yield to achieve $1,000 in annual dividends.

Types of Dividend Stocks

There are various types of dividend-paying investments available:

- Blue-Chip Stocks: These are shares in large, well-established companies known for stable earnings and consistent dividend payments. They often have lower volatility and are considered safer investments.

- Dividend Aristocrats: These companies have increased their dividends for at least 25 consecutive years. Investing in these stocks can provide a reliable income stream.

- REITs (Real Estate Investment Trusts): These companies invest in real estate and must distribute at least 90% of their taxable income as dividends. They often offer higher yields compared to traditional stocks.

- ETFs and Mutual Funds: These funds pool money from multiple investors to buy a diversified portfolio of dividend-paying stocks. They offer instant diversification and reduce individual stock risk.

Choosing the right type of dividend investment depends on your financial goals and risk tolerance.

Factors Influencing Your Investment Amount

Several factors will influence how much you need to invest to achieve your desired dividend income:

- Dividend Yield: Higher yields require less capital for the same income but may come with increased risk.

- Investment Goals: Determine whether you want regular income or long-term growth through reinvestment.

- Market Conditions: Economic factors can affect stock prices and yields; thus, it’s essential to stay informed about market trends.

- Company Performance: A company’s financial health directly impacts its ability to maintain or increase dividends.

- Diversification Needs: Spreading your investments across various sectors can mitigate risks but may require more capital.

Understanding these factors will help you make informed decisions about how much to invest in dividend stocks or funds.

Steps to Start Investing in Dividend Stocks

To begin investing in dividend stocks effectively, follow these steps:

1. Set Clear Investment Goals: Define whether you’re looking for immediate income or long-term growth through reinvestment.

2. Research Dividend-Paying Companies: Look for companies with strong financials and a history of consistent or increasing dividends.

3. Evaluate Dividend Stability Over Yield: Prioritize companies with stable dividends over those with high yields but unstable payment histories.

4. Open a Brokerage Account: Choose an online broker that offers access to dividend stocks and funds without high fees.

5. Fund Your Account: Deposit money into your brokerage account through bank transfer or other methods.

6. Select Your Investments: Use stock screeners provided by brokers to filter for high-dividend stocks or funds that meet your criteria.

7. Monitor Your Investments Regularly: Keep an eye on company performance and market conditions that may affect your investments.

8. Consider Reinvesting Dividends: Utilize Dividend Reinvestment Plans (DRIPs) to automatically reinvest dividends into additional shares, compounding your returns over time.

By following these steps, you can effectively start building a portfolio focused on generating dividend income.

Risks Associated with Dividend Investing

While investing in dividend stocks can be rewarding, it also comes with risks:

- Market Risk: Stock prices can fluctuate due to market conditions, affecting your investment value even if dividends remain stable.

- Company-Specific Risk: If a company faces financial difficulties, it may reduce or eliminate its dividend payments.

- Interest Rate Risk: Rising interest rates can make bonds more attractive compared to dividend stocks, potentially leading to decreased demand for equity dividends.

- Inflation Risk: If inflation outpaces dividend growth, your purchasing power may decline despite receiving regular payments.

Understanding these risks will help you make more informed decisions about your investments and manage potential downsides effectively.

Building a Diversified Dividend Portfolio

To mitigate risks associated with investing in individual stocks, consider building a diversified portfolio:

- Invest across various sectors such as utilities, consumer goods, healthcare, and technology.

- Include both high-yielding stocks and those with strong growth potential.

- Consider using ETFs that focus on dividend-paying companies for instant diversification.

A diversified approach helps reduce reliance on any single investment while providing exposure to different market segments.

FAQs About How Much Do I Need To Invest To Get Dividends

- What is the minimum amount needed to start investing in dividends?

You can start investing with as little as $500 depending on the brokerage’s requirements. - How often do I receive dividends?

Dividends are typically paid quarterly but can vary by company. - Can I reinvest my dividends?

Yes, many brokers offer DRIPs that allow automatic reinvestment of dividends. - What is considered a good dividend yield?

A yield above 4% is generally considered attractive for income-focused investors. - Are all high-yield stocks safe investments?

No, high yields can indicate risk; it’s essential to evaluate the company’s financial health.

Investing in dividends requires careful planning and consideration of various factors affecting both potential returns and risks involved. By understanding how much you need to invest based on your goals and the types of investments available, you can create a strategy that aligns with your financial objectives while providing reliable income over time.