Investing in the Vanguard Total Stock Market Index Fund Admiral Shares, commonly referred to as VTSAX, is a popular choice for many investors looking to gain broad exposure to the U.S. stock market. Understanding how much you need to invest in VTSAX is crucial for both novice and experienced investors. This guide will provide you with essential information about the minimum investment requirements, benefits, and strategies for investing in VTSAX.

VTSAX is designed to track the performance of the CRSP U.S. Total Market Index, which includes a wide array of stocks from various sectors and market capitalizations. The fund offers a low-cost way to invest in nearly the entire U.S. stock market, making it an attractive option for those seeking long-term growth.

To invest in VTSAX, you need to be aware of the initial investment requirements and the potential benefits of including this fund in your portfolio. Below is a concise overview of what you need to know before diving into your investment.

| Investment Requirement | Details |

|---|---|

| Minimum Initial Investment | $3,000 |

Understanding VTSAX and Its Benefits

VTSAX is one of Vanguard's flagship index funds and is known for its broad market exposure and low expense ratio. The fund invests in thousands of stocks across various sectors, providing investors with a diversified portfolio that mitigates risks associated with individual stocks.

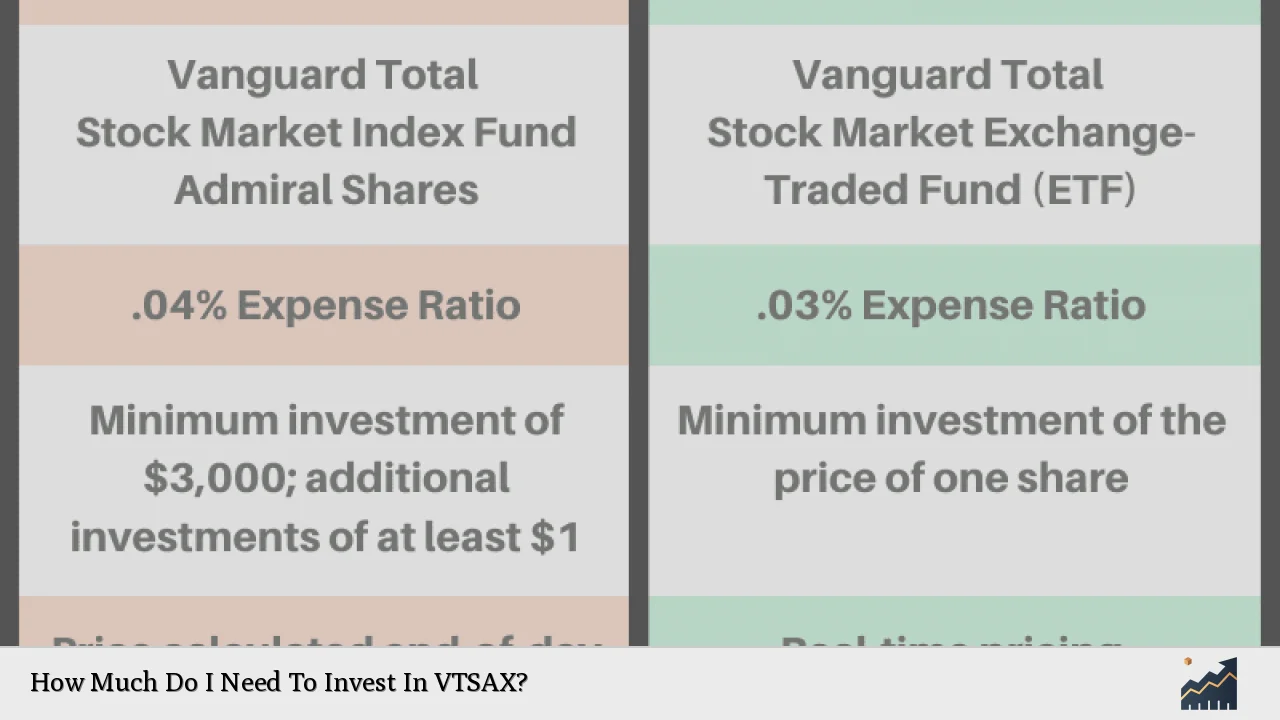

One of the primary advantages of investing in VTSAX is its cost efficiency. With an expense ratio of only 0.04%, investors can retain more of their returns compared to funds with higher fees. This efficiency is particularly beneficial over long investment horizons, where even small differences in fees can lead to significant variations in overall returns.

Additionally, VTSAX has a strong historical performance record, often closely mirroring the overall U.S. stock market's performance. This characteristic makes it a reliable option for those looking to grow their wealth over time.

Investors should also consider that VTSAX requires a minimum initial investment of $3,000. This amount may seem daunting for some, but it allows access to a diversified fund that would otherwise require substantial capital if investing in individual stocks.

Investment Strategies for VTSAX

When considering how much to invest in VTSAX, it's essential to have a clear investment strategy. Here are some effective strategies that can help you make the most out of your investment:

- Dollar-Cost Averaging: This strategy involves investing a fixed amount regularly over time, regardless of market conditions. By doing so, you can reduce the impact of market volatility on your investments.

- Reinvesting Dividends: VTSAX pays dividends that can be reinvested back into the fund. This practice can significantly enhance your overall returns through compound growth over time.

- Long-Term Holding: Given its historical performance and diversified nature, holding VTSAX for the long term can yield substantial returns. Investors should focus on their long-term financial goals rather than short-term market fluctuations.

- Periodic Contributions: After meeting the initial investment requirement, you can contribute additional amounts as small as $1 at any time. This flexibility allows you to adapt your investment strategy based on your financial situation.

By employing these strategies, investors can effectively manage their investments in VTSAX while working towards their financial goals.

How to Invest in VTSAX

Investing in VTSAX is straightforward and can be accomplished by following these steps:

1. Open an Account with Vanguard: Visit Vanguard's website and create an account by providing your personal information and selecting an account type that suits your needs.

2. Fund Your Account: Choose how you want to fund your account—most investors opt for an electronic bank transfer from their checking account.

3. Make Your Initial Investment: Once your account is funded, select VTSAX as your investment choice and make sure you meet the minimum requirement of $3,000.

4. Set Up Automatic Contributions: If desired, you can set up automatic contributions to ensure consistent investment over time without needing to remember each transaction.

5. Monitor Your Investment: Regularly check your investment's performance and adjust your strategy as necessary based on your financial goals.

By following these steps, you can easily start investing in VTSAX and take advantage of its benefits.

Comparing VTSAX with Other Investment Options

When considering an investment in VTSAX, it's beneficial to compare it with other similar options available in the market. Below are some key comparisons between VTSAX and other popular index funds:

| Fund | Minimum Investment |

|---|---|

| Vanguard Total Stock Market Index Fund (VTI) | No minimum (ETF) |

| Schwab Total Stock Market Index Fund (SWTSX) | No minimum |

| Fidelity Total Market Index Fund (FSKAX) | No minimum |

While VTSAX has a minimum initial investment requirement of $3,000, other funds like Schwab’s SWTSX and Fidelity’s FSKAX have no minimums at all. This aspect may appeal to new investors who are hesitant about committing a large sum upfront.

However, despite this barrier, many investors prefer VTSAX due to its low expense ratio and strong historical performance compared to its peers.

FAQs About How Much Do I Need To Invest In VTSAX

- What is the minimum investment required for VTSAX?

The minimum initial investment required for VTSAX is $3,000. - Can I invest less than $3,000 in VTSAX?

No, the first transaction must meet the $3,000 minimum requirement. - What are the benefits of investing in VTSAX?

VTSAX offers broad market exposure, low fees, and strong historical performance. - How often can I contribute after my initial investment?

After the initial investment, contributions can be as low as $1 at any time. - Is there an alternative if I can't afford $3,000?

You may consider investing in Vanguard's ETF version (VTI), which has no minimum investment requirement.

Investing in VTSAX provides an opportunity for individuals seeking broad exposure to the U.S. stock market through a low-cost index fund structure. Understanding how much you need to invest initially and developing a solid strategy will help ensure that you are well-equipped for long-term financial success.