Investing in real estate can be a lucrative venture, but determining how much you need to invest can be complex. The required investment amount varies significantly based on multiple factors, including the type of property, location, and your investment strategy. Understanding these variables is crucial for anyone looking to enter the real estate market.

Real estate investment can take many forms, from purchasing residential properties to investing in commercial spaces or real estate investment trusts (REITs). Each option has different capital requirements and potential returns. For instance, buying a single-family home may require a smaller upfront investment compared to purchasing an apartment complex or commercial property.

To help you understand the financial commitment involved in real estate investing, this article will break down the essential factors that influence your investment amount. We will also discuss strategies for entering the market with varying budgets.

| Investment Type | Typical Initial Investment |

|---|---|

| Single-Family Home | $20,000 – $50,000 |

| Multi-Family Property | $50,000 – $200,000 |

| Commercial Property | $100,000 – $500,000+ |

| REITs | As low as $1,000 |

Understanding Your Investment Goals

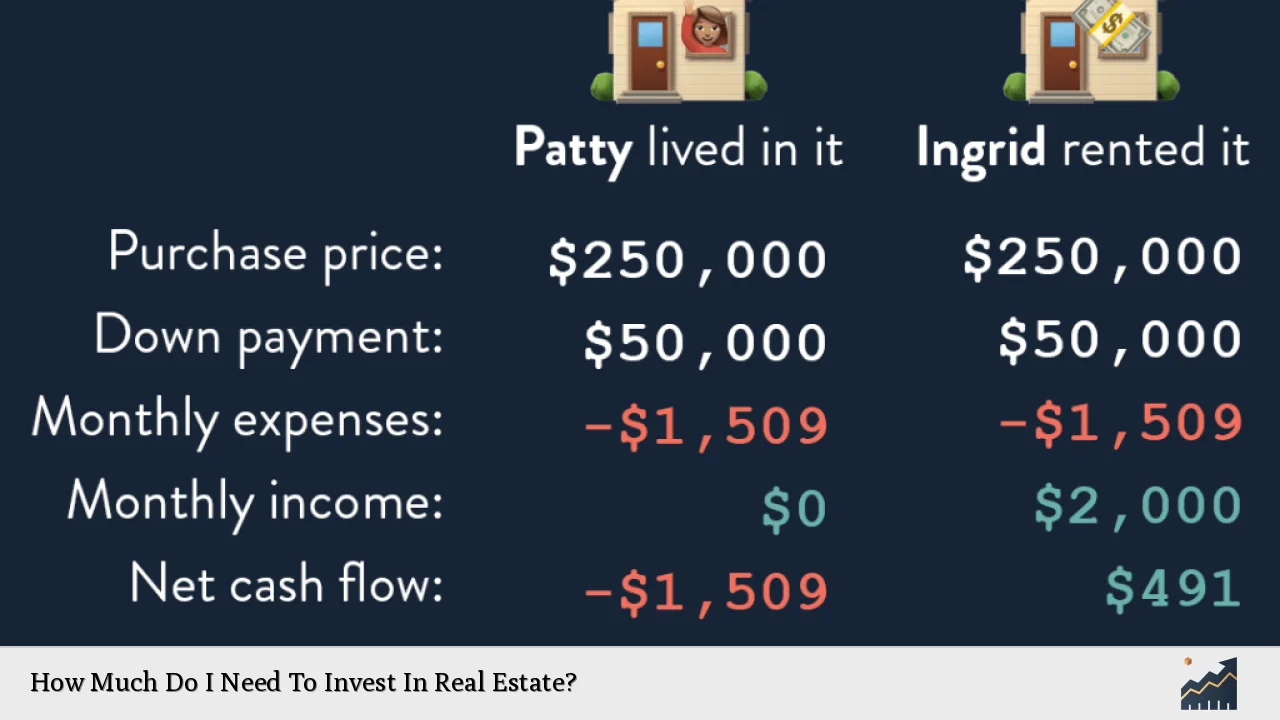

Before diving into real estate investing, it’s essential to define your investment goals. Are you looking for short-term gains through flipping properties or long-term wealth accumulation via rental income? Your objectives will significantly influence how much you need to invest.

- Short-Term Goals: If you aim to flip houses quickly for profit, you may need a larger initial investment for renovations and purchase costs. This strategy often requires a budget of $50,000 to $100,000 or more.

- Long-Term Goals: For those interested in rental properties, the initial investment can vary widely based on location and property type. A single-family rental might require $20,000 to $50,000, while multi-family units could demand $100,000 or more.

Understanding your risk tolerance is also critical. Higher potential returns often come with increased risk and capital requirements.

Types of Real Estate Investments

The type of real estate investment you choose will greatly affect your initial outlay. Here are some common options:

- Direct Property Purchase: This involves buying physical properties to rent or sell later at a profit. The costs can range from $20,000 for a small home to several hundred thousand dollars for larger properties.

- Real Estate Investment Trusts (REITs): These are companies that own or finance income-producing real estate. They allow investors to buy shares and typically require a minimum investment of around $1,000.

- Crowdfunding Platforms: These platforms enable multiple investors to pool resources for larger projects. Minimum investments can start as low as $500, making it accessible for beginners.

Each type has its pros and cons regarding liquidity, management responsibilities, and potential returns.

Location Matters

The location of your investment plays a significant role in determining how much you need to invest. Real estate prices vary dramatically across different regions and even within neighborhoods.

- Urban Areas: Properties in major cities often have higher price tags but can provide better rental yields due to demand. Expect to invest more upfront—often exceeding $200,000 for multi-family units.

- Suburban Areas: Investments here may be more affordable but could yield lower rental income compared to urban properties. Initial investments might range from $100,000 to $150,000 for decent multi-family options.

- Rural Areas: These properties tend to be less expensive but may come with risks related to lower demand and potential vacancies. You might find opportunities starting at around $50,000.

Researching local market trends will help you make informed decisions about where to invest your money.

Financing Your Investment

Understanding your financing options is crucial when determining how much you need to invest in real estate:

- Traditional Mortgages: Most investors finance their purchases through mortgages. Generally, lenders require a down payment ranging from 3% to 20%, depending on the loan type and property.

- Hard Money Loans: These are short-term loans secured by real estate and often come with higher interest rates. They can be useful for quick flips but usually require significant upfront costs.

- Partnerships: Teaming up with other investors can reduce individual financial burdens while allowing access to larger deals that would otherwise be unattainable alone.

Exploring these financing avenues can help you enter the market without needing all the capital upfront.

Hidden Costs of Real Estate Investing

When budgeting for real estate investments, it’s essential not only to consider the purchase price but also additional costs that may arise:

- Closing Costs: Typically range from 2% to 5% of the property price and include fees for inspections, appraisals, and title insurance.

- Property Management Fees: If you’re renting out your property but don’t want to manage it yourself, hiring a property manager usually costs around 8% to 12% of monthly rent.

- Maintenance and Repairs: Setting aside funds for ongoing maintenance is crucial; a good rule of thumb is about 1% of the property’s value per year.

Being aware of these hidden costs will help you prepare financially and avoid unexpected expenses that could jeopardize your investment strategy.

Building Your Portfolio Gradually

If you’re new to real estate investing or have limited capital, consider starting small:

- Begin with a single-family home or a small multi-family unit. This approach allows you to gain experience without overwhelming financial risk.

- Explore options like REITs or crowdfunding platforms that require minimal investments but still offer exposure to real estate markets.

- As you gain confidence and experience in managing properties or understanding market dynamics, gradually increase your investments into larger properties or more complex ventures.

This step-by-step approach helps build a solid foundation while minimizing risk exposure initially.

The Importance of Education

Investing in real estate requires knowledge about market trends, financing options, and property management strategies:

- Consider taking courses offered by reputable institutions focused on real estate investing fundamentals.

- Networking with experienced investors can provide valuable insights into navigating challenges and identifying opportunities in the market.

Staying informed about industry changes will empower you as an investor and enhance your decision-making capabilities regarding how much money you’ll need over time.

FAQs About How Much Do I Need To Invest In Real Estate?

- How much money do I need as a down payment?

A typical down payment ranges from 3% to 20% of the property’s purchase price. - What are some low-cost ways to start investing?

You can start with REITs or crowdfunding platforms that allow investments as low as $500. - Are there hidden costs in real estate investing?

Yes, costs such as closing fees, maintenance expenses, and property management fees should be considered. - How does location affect my investment?

Location significantly impacts property prices and potential rental income; urban areas typically demand higher investments. - Can I invest in real estate without significant capital?

Yes, options like partnerships or REITs allow you to invest with minimal capital.

Understanding how much you need to invest in real estate involves careful consideration of various factors including goals, types of investments available, location choices, financing options available as well as hidden costs associated with ownership. By approaching this venture with knowledge and strategic planning tailored specifically towards personal financial situations—investors can effectively navigate their path towards successful outcomes within this rewarding field!