Investing in the Invesco QQQ Trust (QQQ) ETF is a popular choice for those seeking exposure to the Nasdaq-100 index, which includes some of the world’s largest non-financial companies. The amount you need to invest in QQQ depends on various factors, including your financial goals, risk tolerance, and investment strategy. However, one of the advantages of ETFs like QQQ is that they offer flexibility in terms of investment amounts.

To start investing in QQQ, you typically need enough money to purchase at least one share. As of January 4, 2025, the price of QQQ is around $518 per share. However, some brokerages now offer fractional share investing, allowing you to start with even smaller amounts.

| Minimum Investment | Investment Type |

|---|---|

| $518 (approx.) | One full share of QQQ |

| $1 – $517 | Fractional share (if available) |

Determining Your QQQ Investment Amount

When deciding how much to invest in QQQ, consider the following factors:

1. Financial Goals: Your investment amount should align with your short-term and long-term financial objectives. Are you saving for retirement, a major purchase, or building wealth over time?

2. Risk Tolerance: QQQ is heavily weighted towards technology stocks, which can be volatile. Ensure your investment amount reflects your comfort level with market fluctuations.

3. Portfolio Diversification: Consider how QQQ fits into your overall investment strategy. It’s generally recommended not to allocate more than 5-10% of your portfolio to a single ETF.

4. Regular Investing: Many investors choose to invest a fixed amount regularly through dollar-cost averaging. This strategy can help mitigate the impact of market volatility over time.

5. Brokerage Minimums: While QQQ itself doesn’t have a minimum investment requirement beyond the share price, your chosen brokerage might have account minimums or trading fees to consider.

Investment Scenarios

Let’s explore different investment scenarios to give you a clearer picture:

- Small Starting Investment: If you’re new to investing or have limited funds, you could start with a fractional share. For example, investing $100 would give you approximately 0.19 shares of QQQ at the current price.

- Moderate Investment: A $1,000 investment would allow you to purchase about 1.93 shares of QQQ, giving you a more substantial stake in the fund.

- Larger Investment: For those with more capital, a $10,000 investment would buy approximately 19.3 shares, providing significant exposure to the Nasdaq-100 index.

- Regular Contributions: Investing $500 monthly would allow you to accumulate shares over time, potentially benefiting from dollar-cost averaging.

Strategies for Investing in QQQ

Once you’ve determined how much you can invest, consider these strategies to maximize your QQQ investment:

1. Lump Sum Investing: If you have a large amount to invest and believe in the long-term potential of the Nasdaq-100 index, investing a lump sum in QQQ could be beneficial. This approach allows you to fully participate in potential market gains from the start.

2. Dollar-Cost Averaging: This strategy involves investing a fixed amount at regular intervals, regardless of the share price. It can help reduce the impact of market volatility on your investment.

3. Portfolio Rebalancing: Regularly review and rebalance your portfolio to maintain your desired asset allocation. This might involve buying or selling QQQ shares to keep your investment aligned with your goals.

4. Dividend Reinvestment: QQQ pays dividends quarterly. Reinvesting these dividends can help compound your returns over time.

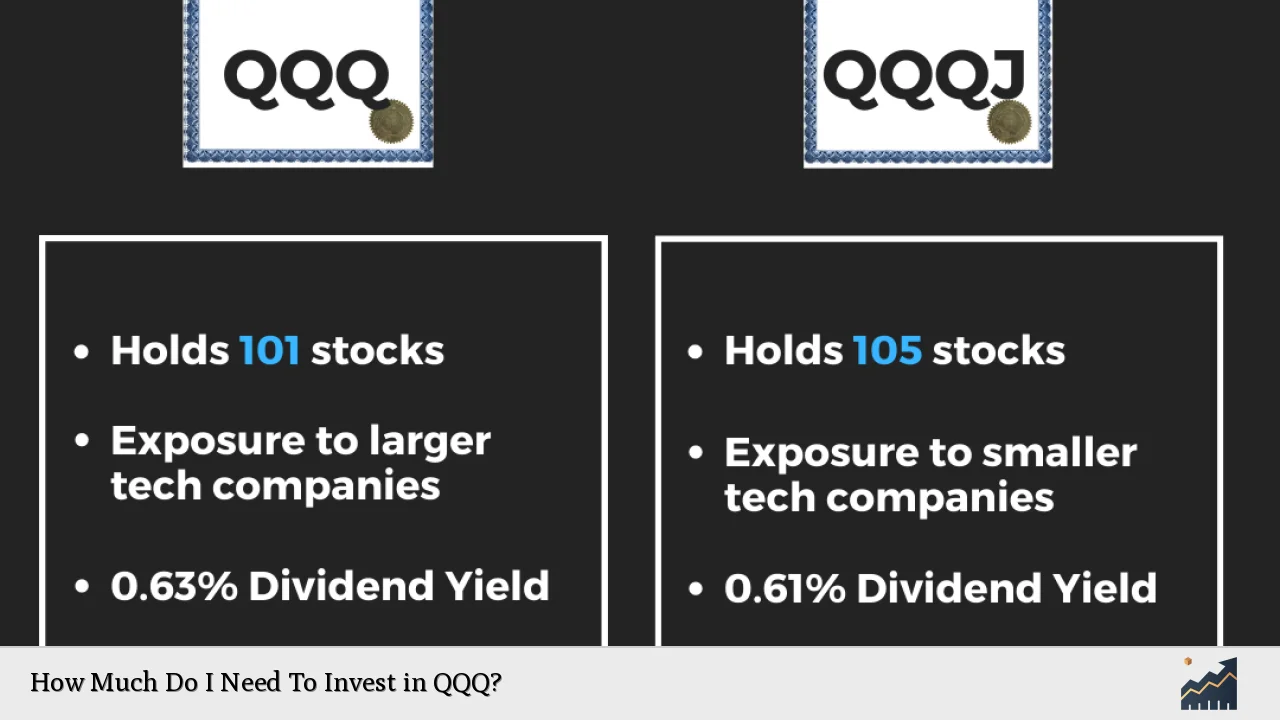

5. Combining with Other ETFs: Consider pairing QQQ with other ETFs to create a diversified portfolio. For example, you might combine it with a broad market ETF or a bond ETF for balance.

Costs Associated with Investing in QQQ

When determining your investment amount, it’s crucial to consider the costs associated with investing in QQQ:

- Expense Ratio: QQQ has an expense ratio of 0.20%, which means you’ll pay $2 annually for every $1,000 invested.

- Brokerage Fees: Many brokerages offer commission-free trading for ETFs, but some may charge fees. Check your broker’s fee structure.

- Bid-Ask Spread: The difference between the buying and selling price of QQQ can impact your returns, especially for frequent traders.

- Taxes: Consider the tax implications of your investment, particularly if you plan to sell shares in the short term.

Monitoring and Adjusting Your QQQ Investment

After investing in QQQ, it’s important to monitor your investment and make adjustments as needed:

- Regular Review: Assess your QQQ investment at least quarterly to ensure it aligns with your financial goals.

- Performance Tracking: Compare QQQ’s performance to relevant benchmarks like the S&P 500 to gauge its effectiveness in your portfolio.

- Risk Assessment: Periodically reassess your risk tolerance and adjust your QQQ allocation if necessary.

- Rebalancing: If QQQ’s performance causes it to become a larger portion of your portfolio than intended, consider rebalancing to maintain your desired asset allocation.

- Stay Informed: Keep up with news and developments related to the Nasdaq-100 index and its component companies, as these can impact QQQ’s performance.

FAQs About Investing in QQQ

- What is the minimum amount I can invest in QQQ?

The minimum is typically the price of one share, around $518, but some brokers offer fractional shares for lower amounts. - How often should I invest in QQQ?

This depends on your strategy, but regular investments (e.g., monthly) can be beneficial for dollar-cost averaging. - Is QQQ a good investment for beginners?

QQQ can be suitable for beginners due to its diversification, but it’s important to understand its tech-heavy composition and associated risks. - Can I lose money investing in QQQ?

Yes, like all investments, QQQ carries risk, and its value can decrease based on market conditions and the performance of its component stocks. - How does QQQ compare to other popular ETFs?

QQQ often outperforms broad market ETFs in bull markets but may underperform during tech sector downturns. Compare it with ETFs like SPY for a balanced view.

In conclusion, the amount you need to invest in QQQ depends on your individual financial situation and goals. Whether you’re starting with a small fractional share or making a substantial investment, QQQ offers a way to gain exposure to some of the world’s leading non-financial companies. Remember to consider your overall investment strategy, risk tolerance, and the costs associated with investing when determining your QQQ investment amount. As with any investment decision, it’s advisable to consult with a financial advisor to ensure your QQQ investment aligns with your broader financial plan.