Determining how much to invest each month can be a crucial decision for anyone looking to build wealth over time. The amount you choose to invest should align with your financial goals, risk tolerance, and current financial situation. Investing monthly allows you to take advantage of dollar-cost averaging, which can help mitigate the impact of market volatility. This approach involves regularly investing a fixed amount, regardless of market conditions, which can lead to purchasing more shares when prices are low and fewer shares when prices are high.

Investing regularly not only helps in building a habit but also makes investing more accessible. Many people believe that significant capital is required to start investing, but this is no longer the case. With various investment platforms available today, you can begin investing with as little as a few dollars each month. The key is to start early and remain consistent.

| Investment Strategy | Description |

|---|---|

| Dollar-Cost Averaging | Investing a fixed amount regularly to reduce the impact of market volatility. |

| Start Small | Begin with a manageable amount and increase it over time as your financial situation improves. |

Assessing Your Financial Situation

Before deciding how much to invest each month, it’s essential to assess your current financial situation. Start by evaluating your income and expenses. Create a budget that outlines your monthly income and all expenses, including fixed costs like rent or mortgage payments, utilities, groceries, and discretionary spending. This will help you identify how much disposable income you have available for investing.

Consider your existing debts as well. If you have high-interest debt, such as credit card balances, it might be wise to prioritize paying that down before allocating funds toward investments. Once you have a clear picture of your finances, you can determine an amount that feels comfortable for you to invest each month without compromising your essential living expenses or emergency savings.

It’s also important to consider liquidity needs. If you anticipate needing access to your funds in the near future, you may want to choose investments that are more liquid or less volatile.

Setting Financial Goals

Once you have assessed your financial situation, the next step is to set clear financial goals. Ask yourself what you are investing for: retirement, buying a home, funding education, or building wealth? Each goal may require different investment strategies and timelines.

Define your goals in terms of both amount and timeframe. For instance:

- Short-term goals (0-2 years): These might include saving for a vacation or purchasing a new car.

- Medium-term goals (3-5 years): This could involve saving for a down payment on a house.

- Long-term goals (5+ years): Typically focused on retirement savings or building significant wealth.

By breaking down your goals into specific categories, you can better determine how much you need to save monthly to reach them within your desired timeframe.

Understanding Risk Tolerance

Understanding your risk tolerance is crucial when deciding how much to invest each month. Risk tolerance refers to how comfortable you are with the potential for loss in your investments. Generally, younger investors can afford to take on more risk since they have time to recover from market downturns. Conversely, older investors nearing retirement may prefer safer investments that preserve capital.

To assess your risk tolerance:

- Consider how you would react if your investments lost value.

- Think about your investment timeline; longer timelines usually allow for more aggressive strategies.

- Evaluate your knowledge of various investment types; familiarity can influence comfort levels with riskier assets.

Once you’ve established your risk tolerance, you can select investment vehicles that align with it while determining an appropriate monthly investment amount.

Choosing Investment Vehicles

The next step is selecting the right investment vehicles based on your goals and risk tolerance. There are several options available:

- Stocks: Higher potential returns but come with increased volatility.

- Bonds: Generally safer than stocks but offer lower returns.

- Mutual Funds/ETFs: These provide diversification by pooling money from multiple investors to buy various assets.

- Real Estate: Investing in property can yield rental income and appreciation but requires significant capital upfront.

Once you’ve identified suitable investment options, consider how much money you’ll allocate monthly across these vehicles based on their respective risks and potential returns.

Starting Small and Increasing Over Time

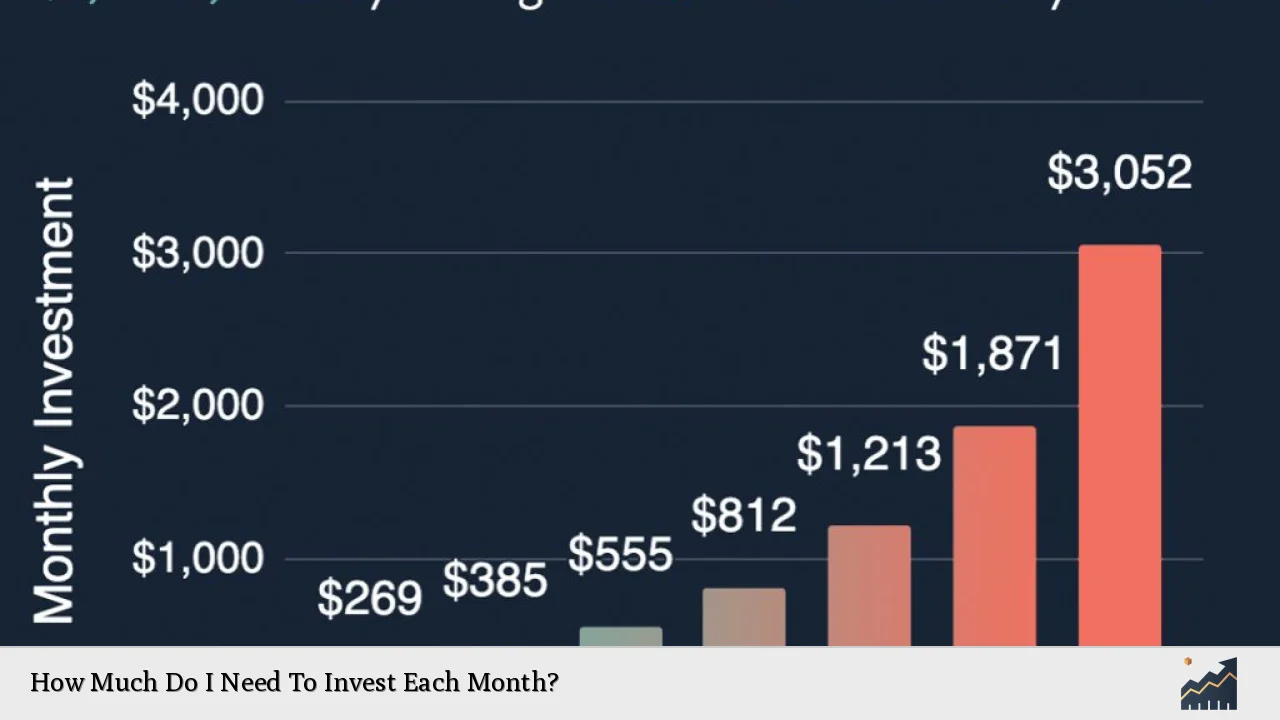

If you’re unsure about how much to invest initially, start small. Many experts suggest aiming for 10% to 15% of your income annually as a general guideline for retirement savings. However, if this seems overwhelming at first, begin with an amount that feels manageable—this could be as little as $50 or $100 per month.

The important thing is consistency; once you’ve established a routine of investing regularly, consider increasing the amount over time as your financial situation improves or as you become more comfortable with investing.

Automating Your Investments

One effective way to ensure that you stick to your monthly investment plan is by automating the process. Many investment platforms allow you to set up automatic transfers from your checking account into your investment account each month. This method not only simplifies the process but also removes the temptation to spend the money elsewhere.

By automating investments:

- You ensure consistency in contributions.

- You take advantage of dollar-cost averaging without needing constant attention.

- You build good financial habits over time.

Monitoring Your Progress

After establishing a monthly investment routine, it’s essential to monitor your progress regularly. Review your investments periodically—this could be quarterly or annually—to see if you’re on track toward meeting your financial goals. Adjustments may be necessary based on changes in market conditions or personal circumstances.

Consider rebalancing your portfolio if certain investments grow disproportionately compared to others or if you find that you’re not achieving the desired asset allocation according to your risk tolerance.

FAQs About How Much Do I Need To Invest Each Month

- What is dollar-cost averaging?

Dollar-cost averaging is the strategy of investing a fixed amount regularly regardless of market conditions. - How do I determine my risk tolerance?

Your risk tolerance can be determined by assessing how comfortable you are with potential losses and considering your investment timeline. - Is there a minimum amount I need to start investing?

No minimum amounts exist; many platforms allow starting with as little as $10. - How often should I review my investments?

You should review your investments periodically—typically quarterly or annually—to ensure alignment with your goals. - Can I increase my investment amount later?

Yes, it’s advisable to increase contributions over time as financial situations improve.

Deciding how much to invest each month is not just about numbers; it’s about creating a sustainable plan that aligns with personal financial goals and circumstances. By assessing current finances, setting clear goals, understanding risk tolerance, choosing appropriate vehicles, starting small, automating investments, and monitoring progress regularly, anyone can effectively manage their investment journey toward achieving long-term financial success.