Foreign investment can play a pivotal role in the development of transitioning economies, providing essential capital, technology, and expertise. However, it also presents significant challenges that can undermine the economic stability and growth of these nations. This article explores the complexities of foreign investment in transitioning economies, highlighting potential pitfalls and offering insights into effective management strategies.

| Key Concept | Description/Impact |

|---|---|

| Dependency on Foreign Capital | Transitioning economies may become overly reliant on foreign investment, leading to vulnerability during global economic downturns. A sudden withdrawal of foreign capital can destabilize local markets. |

| Loss of Sovereignty | Significant foreign ownership in key sectors may result in diminished control over national resources and strategic industries, limiting the government’s ability to implement policies aligned with domestic interests. |

| Economic Leakage | Profits generated by foreign companies are often repatriated to their home countries, which can lead to a net outflow of capital and limit the reinvestment potential within the host economy. |

| Uneven Development | Foreign investments tend to concentrate in specific sectors or regions, exacerbating regional disparities and neglecting rural or less developed areas. |

| Labor Market Disruption | The influx of foreign firms may lead to job displacement as local businesses struggle to compete. Additionally, foreign companies might prefer to employ expatriates over local workers. |

| Environmental Concerns | Foreign investors may prioritize profit over environmental sustainability, leading to practices that harm local ecosystems and contradict national environmental goals. |

| Cultural Erosion | Heavy foreign influence can dilute local cultures and traditions as global brands overshadow indigenous businesses and practices. |

| Technological Dependence | While foreign investment can facilitate technology transfer, it may also create a dependency on foreign technologies that stifles local innovation and development. |

| Vulnerability to External Shocks | A high dependency on foreign investment makes transitioning economies susceptible to global market fluctuations and changes in investor sentiment. |

Market Analysis and Trends

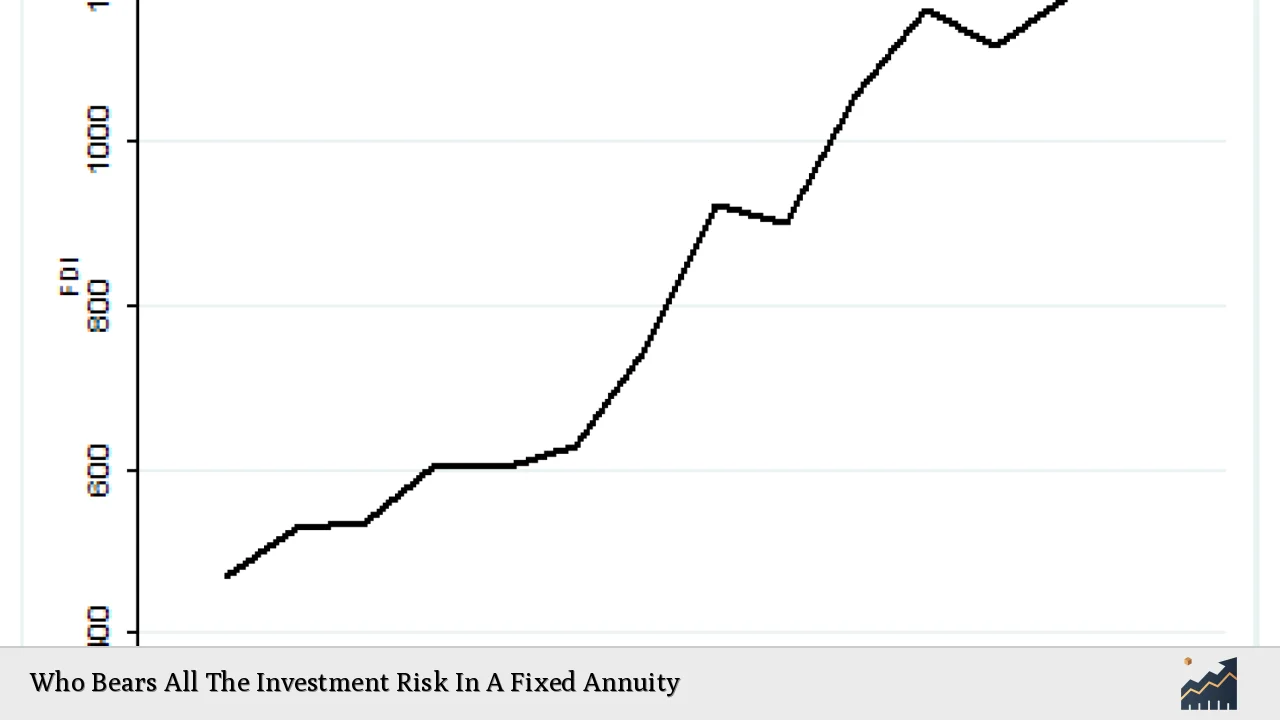

The landscape of foreign direct investment (FDI) has shifted significantly over recent years. In 2022, global FDI flows decreased by 12% to $1.3 trillion, primarily due to reduced financial transactions in developed economies. However, developing countries saw a marginal increase in FDI inflows, highlighting a complex relationship between global economic conditions and local investment climates. Notably, emerging markets like India have continued to attract substantial foreign investments despite global uncertainties.

Current Trends

- Increased Focus on Sustainability: Investors are increasingly prioritizing sustainable projects, particularly in infrastructure and renewable energy sectors.

- Geopolitical Factors: Tensions between major economies have led to shifts in investment patterns. For instance, FDI into China has plummeted due to regulatory uncertainties and geopolitical tensions.

- Sectoral Disparities: While sectors like technology and renewable energy are attracting significant investments, traditional industries are experiencing stagnation.

Implementation Strategies

To mitigate the potential downsides of foreign investment, transitioning economies should adopt comprehensive strategies:

- Diversification of Investment Sources: Reducing reliance on a limited number of investors or sectors can help stabilize the economy against external shocks.

- Strengthening Regulatory Frameworks: Establishing clear regulations that protect national interests while encouraging foreign participation is crucial for sustainable development.

- Promoting Local Participation: Encouraging joint ventures between local firms and foreign investors can enhance technology transfer while ensuring that benefits are retained locally.

- Investment Incentives: Offering targeted incentives for investments in underdeveloped regions or sectors can promote balanced economic growth.

Risk Considerations

Transitioning economies face several risks associated with foreign investment:

- Economic Volatility: Rapid changes in investor sentiment can lead to sudden capital flight, destabilizing local economies.

- Regulatory Risks: Inconsistent or unclear regulations can deter potential investors or lead to conflicts with existing investors.

- Social Unrest: Displacement of local businesses and labor market disruptions can lead to social tensions if not managed properly.

Regulatory Aspects

Effective regulation is essential for balancing the benefits and drawbacks of foreign investment:

- Transparency: Clear guidelines regarding foreign ownership limits and operational practices can foster a more stable investment environment.

- Bilateral Agreements: Establishing treaties that protect investors while ensuring that host countries retain control over their resources is vital for sustainable relationships.

- Monitoring Mechanisms: Implementing systems to monitor the impact of foreign investments on local economies can help policymakers make informed decisions.

Future Outlook

Looking ahead, the dynamics of foreign investment in transitioning economies will continue to evolve. The following trends are likely to shape the future landscape:

- Increased Competition for FDI: As more countries pursue aggressive strategies to attract foreign capital, transitioning economies must enhance their value propositions.

- Focus on Innovation: Emphasizing technological advancements and innovation will be critical for attracting high-quality investments that contribute meaningfully to economic growth.

- Sustainability as a Priority: Investors will increasingly seek opportunities that align with global sustainability goals, making it imperative for transitioning economies to adapt accordingly.

Frequently Asked Questions About How Might Foreign Investment Be Problematic For A Transitioning Economy

- What are the main risks associated with foreign investment in transitioning economies?

The primary risks include economic volatility due to sudden capital flight, regulatory uncertainties that may deter investors, and social unrest stemming from labor market disruptions. - How can transitioning economies manage their dependency on foreign investment?

Diversifying investment sources, strengthening regulatory frameworks, promoting local participation through joint ventures, and offering targeted incentives can help manage dependency. - What role does government policy play in attracting foreign investment?

Government policies that ensure transparency, protect investor rights while safeguarding national interests, and provide clear guidelines significantly influence the attractiveness of an economy for foreign investors. - How does cultural erosion occur due to foreign investment?

Cultural erosion may occur when global brands dominate local markets, leading to a decline in traditional practices and businesses as consumers gravitate towards familiar international products. - What measures can be taken to ensure environmental sustainability amidst foreign investments?

Implementing strict environmental regulations for foreign companies, promoting sustainable business practices, and encouraging investments in green technologies are essential measures. - Can foreign investment contribute positively despite its risks?

Yes, if managed effectively through strategic partnerships and robust regulatory frameworks, foreign investment can bring capital inflows, technology transfer, and job creation beneficial for economic growth. - What is economic leakage in the context of foreign investment?

Economic leakage refers to profits generated by foreign companies being repatriated back to their home countries instead of being reinvested into the local economy. - How do geopolitical factors influence foreign investment trends?

Geopolitical tensions can create uncertainty for investors; thus affecting their willingness to invest in certain regions based on perceived risks associated with political stability or regulatory environments.

In conclusion, while foreign investment holds significant potential for fostering growth in transitioning economies, it requires careful management. By addressing inherent risks through strategic planning and robust regulatory frameworks, these nations can harness the benefits of foreign capital while safeguarding their economic sovereignty.