The COVID-19 pandemic has profoundly impacted the cryptocurrency landscape, altering market dynamics, investor behavior, and regulatory perspectives. As traditional financial systems faced unprecedented challenges, cryptocurrencies emerged as both a refuge and a speculative asset class. This article explores the multifaceted changes brought about by the pandemic, including market trends, implementation strategies, risk considerations, regulatory aspects, and future outlooks.

| Key Concept | Description/Impact |

|---|---|

| Market Volatility | The pandemic increased volatility across cryptocurrency markets due to heightened uncertainty and panic selling, particularly in March 2020. |

| Increased Adoption | Many businesses began accepting cryptocurrencies for transactions as digital payments surged during lockdowns. |

| Investment Shifts | Institutional investors began entering the cryptocurrency space, viewing it as a hedge against inflation and economic instability. |

| Regulatory Scrutiny | The pandemic prompted regulators to reconsider their approaches to cryptocurrencies, leading to tighter regulations in some jurisdictions. |

| Technological Advancements | The rise of decentralized finance (DeFi) platforms accelerated as users sought alternatives to traditional banking during the crisis. |

| Market Correlation | The relationship between cryptocurrencies and traditional assets like stocks became more pronounced during market downturns. |

| Investor Behavior | Pandemic-induced economic uncertainty led to a surge in retail investors entering the cryptocurrency market. |

| Global Crypto Adoption | Countries with lower income levels saw significant increases in crypto adoption as a means of financial inclusion. |

Market Analysis and Trends

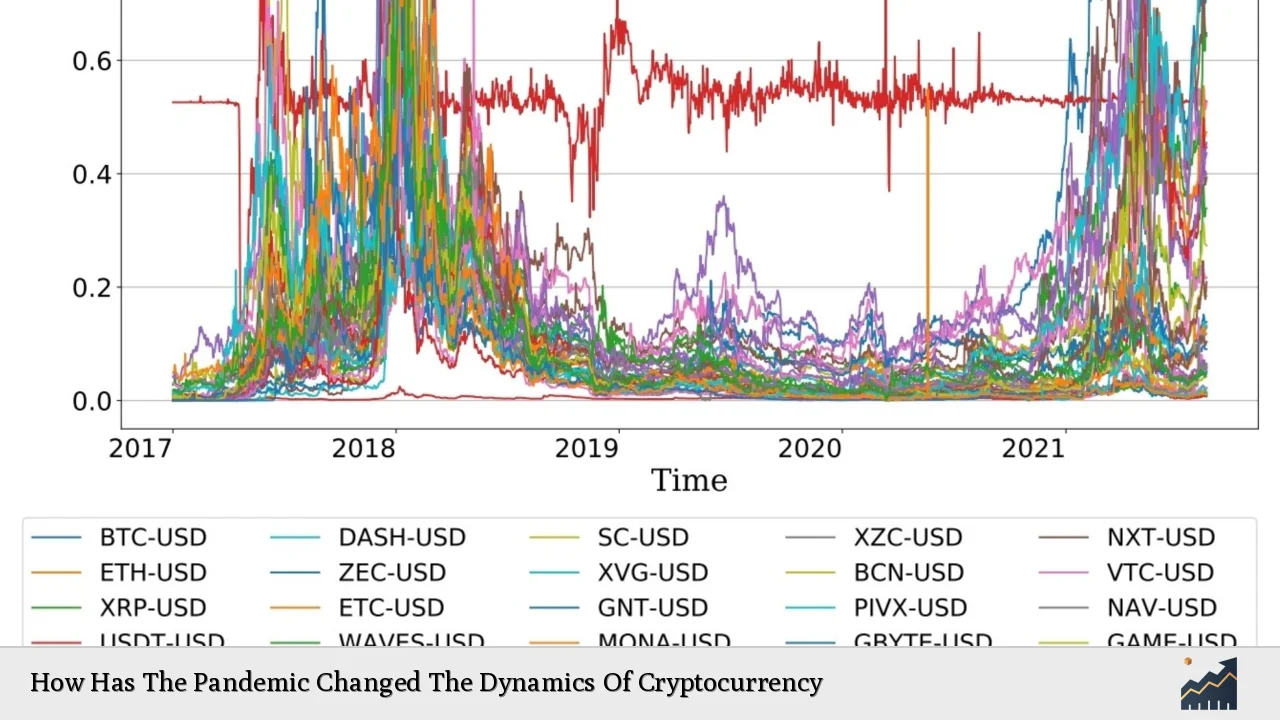

The onset of the COVID-19 pandemic marked a significant turning point for cryptocurrency markets. In early 2020, as global markets plummeted due to lockdowns and economic uncertainty, cryptocurrencies initially followed suit but soon diverged.

Volatility Patterns

Research indicates that cryptocurrency volatility spiked during the early months of the pandemic. For instance, Bitcoin’s price dropped sharply in March 2020 but rebounded quickly, highlighting its potential as a speculative asset. By mid-2021, Bitcoin had reached new all-time highs, driven by increased institutional investment and public interest.

Adoption Rates

The pandemic catalyzed a shift in consumer behavior towards digital payments. A report highlighted that major retailers began accepting cryptocurrencies, contributing to a broader acceptance of digital currencies for everyday transactions. This trend is expected to continue as businesses recognize the benefits of blockchain technology and digital assets.

Institutional Investment

Institutional interest in cryptocurrencies surged during the pandemic. Notably, firms like MicroStrategy and Tesla made significant Bitcoin purchases, signaling confidence in its long-term value as a hedge against inflation. By 2024, the total market value of crypto assets had soared to approximately $2.3 trillion, reflecting this growing institutional adoption.

Implementation Strategies

Investors looking to navigate the post-pandemic cryptocurrency landscape should consider several strategies:

Diversification

Investing across various cryptocurrencies can mitigate risks associated with volatility. While Bitcoin remains dominant, altcoins like Ethereum and Chainlink have shown strong performance and potential for growth.

Utilizing DeFi

Decentralized finance platforms have gained traction during the pandemic. These platforms allow users to lend, borrow, and earn interest on their crypto holdings without intermediaries. Engaging with DeFi can provide opportunities for higher returns compared to traditional savings accounts.

Staying Informed on Regulations

As governments worldwide reassess their regulatory frameworks for cryptocurrencies, staying informed is crucial for compliance and strategic planning. Investors should monitor developments from regulatory bodies such as the SEC or local financial authorities.

Risk Considerations

While opportunities abound in the cryptocurrency market post-pandemic, several risks remain:

Market Volatility

Cryptocurrencies are known for their price volatility. Investors must be prepared for significant price swings that can occur within short timeframes.

Regulatory Risks

The evolving regulatory landscape poses risks for crypto investors. Changes in legislation can affect market access and operational capabilities of exchanges and wallets.

Security Risks

Cybersecurity threats continue to challenge the cryptocurrency ecosystem. Investors should prioritize security measures such as using hardware wallets and enabling two-factor authentication on exchanges.

Regulatory Aspects

The pandemic has prompted regulators to take a closer look at cryptocurrencies:

Increased Scrutiny

Regulatory bodies have intensified their scrutiny of cryptocurrency exchanges and Initial Coin Offerings (ICOs). This scrutiny aims to protect investors from fraud while ensuring compliance with existing financial regulations.

Global Variations

Regulatory responses vary significantly across jurisdictions. Some countries have embraced cryptocurrencies with open arms, while others have imposed strict restrictions or outright bans. Understanding these differences is vital for investors considering international exposure.

Future Outlook

Looking ahead, several trends are likely to shape the future of cryptocurrency:

Continued Institutional Adoption

As more institutional players enter the market, cryptocurrencies may become increasingly integrated into traditional investment portfolios. This trend could stabilize prices over time as institutional capital flows into digital assets.

Technological Innovations

Advancements in blockchain technology will likely drive further growth in decentralized finance (DeFi) and non-fungible tokens (NFTs). These innovations may attract new users seeking alternatives to conventional financial systems.

Market Integration

The correlation between cryptocurrencies and traditional financial markets is expected to persist. Economic events affecting stock markets may also impact crypto prices as investor sentiment shifts.

Frequently Asked Questions About How Has The Pandemic Changed The Dynamics Of Cryptocurrency

- What impact did COVID-19 have on cryptocurrency prices?

The COVID-19 pandemic initially caused a sharp decline in cryptocurrency prices but led to significant rebounds as investors sought alternatives amid economic uncertainty. - How has institutional investment changed during the pandemic?

Institutional investment surged during the pandemic as companies recognized Bitcoin’s potential as a hedge against inflation. - What risks should investors consider in cryptocurrency?

Investors should be aware of market volatility, regulatory changes, and cybersecurity threats when investing in cryptocurrencies. - Are cryptocurrencies becoming more regulated?

Yes, many governments are increasing their scrutiny of cryptocurrencies to protect investors and ensure compliance with financial regulations. - How can I invest safely in cryptocurrencies?

Investing safely involves diversifying your portfolio, using secure wallets, enabling two-factor authentication, and staying informed about market trends. - What role do DeFi platforms play post-pandemic?

DeFi platforms provide opportunities for users to earn returns on their crypto holdings without traditional banking intermediaries. - Will cryptocurrency adoption continue to grow?

The trend towards increased adoption is likely to continue as more businesses accept cryptocurrencies for transactions. - How does global economic uncertainty affect cryptocurrency?

Global economic uncertainty often drives investors towards cryptocurrencies as alternative assets during times of crisis.

The COVID-19 pandemic has irrevocably altered the dynamics of cryptocurrency markets. As we move forward into an increasingly digital future, understanding these changes will be essential for both individual investors and finance professionals navigating this evolving landscape.