Web3 gaming represents a revolutionary shift in the gaming landscape, integrating decentralized finance (DeFi) to create immersive and economically rewarding experiences for players. This convergence allows gamers to not only play but also earn real-world value through their in-game activities, fundamentally altering traditional gaming models. By leveraging blockchain technology, Web3 games enable true ownership of digital assets, fostering a vibrant ecosystem where players can trade, stake, and earn cryptocurrencies. This article explores the intricate relationship between Web3 gaming and DeFi, highlighting market trends, implementation strategies, risks, regulatory considerations, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Decentralized Ownership | Players truly own their in-game assets through NFTs, allowing them to trade or sell these assets on open markets. |

| Play-to-Earn Model | Players earn cryptocurrency by completing tasks or achieving milestones within games, shifting the economic paradigm from “pay-to-play” to “play-to-earn.” |

| Tokenization of Assets | In-game items are tokenized as NFTs, providing liquidity and real-world value that can be traded or sold. |

| Staking and Yield Farming | Players can stake their in-game tokens to earn interest or rewards, similar to traditional DeFi mechanisms. |

| Decentralized Governance | Players participate in decision-making processes through governance tokens, influencing game development and economic policies. |

| Liquidity Pools | DeFi protocols enable players to provide liquidity for in-game economies, facilitating asset trading and enhancing market dynamics. |

Market Analysis and Trends

The Web3 gaming market is experiencing explosive growth. As of 2023, it was valued at approximately USD 4.6 billion and is projected to reach around USD 28.86 billion by 2030, growing at a compound annual growth rate (CAGR) of 30%. The increasing demand for digital ownership and economic incentives is a primary driver of this growth. Players are drawn to the ability to earn real-world value through gameplay, particularly in regions with limited economic opportunities.

Key Market Statistics

- Active Players: The number of active GameFi players is expected to exceed 50 million by 2024.

- Market Share: GameFi could account for up to 10% of the global gaming market by 2024, up from about 3% in 2023.

- Investment Surge: Venture capital investment in GameFi is projected to surpass $2 billion in 2024.

- Technological Integration: Around 80% of GameFi platforms will likely incorporate Layer 2 solutions by 2024 for improved scalability.

Implementation Strategies

To successfully integrate DeFi into Web3 gaming, developers can adopt several strategies:

- Token Design: Careful design of in-game currencies and tokens is crucial. Developers must ensure that tokenomics do not lead to inflationary spirals that could devalue player assets.

- Interoperability: Creating games that allow assets to be used across multiple platforms enhances player engagement and asset value.

- Community Engagement: Involving players in governance decisions fosters loyalty and investment in the game’s success.

- Innovative Gameplay Mechanics: Incorporating complex financial elements like lending and borrowing within gameplay can enhance player experience and create new revenue streams.

Risk Considerations

While the integration of DeFi into Web3 gaming presents numerous opportunities, it also introduces several risks:

- Market Volatility: The value of cryptocurrencies can fluctuate wildly, impacting players’ earnings and investments.

- Regulatory Uncertainty: As governments worldwide begin to regulate cryptocurrencies and DeFi activities, compliance becomes a critical concern for developers.

- Security Risks: Smart contracts are vulnerable to exploits; any vulnerabilities could lead to significant financial losses for players.

- Sustainability Challenges: The play-to-earn model must evolve to ensure long-term viability without leading to economic collapse within the game’s ecosystem.

Regulatory Aspects

The regulatory landscape surrounding DeFi and Web3 gaming is still developing. Key considerations include:

- Compliance with Financial Regulations: Developers must navigate complex regulations regarding securities laws as many in-game tokens may be classified as securities.

- Consumer Protection Laws: Ensuring that players are protected from fraud and scams is essential for maintaining trust in the ecosystem.

- Tax Implications: Players earning income through gameplay may face tax obligations depending on their jurisdiction.

As the industry matures, clearer regulatory frameworks are anticipated, which could facilitate broader adoption while ensuring consumer protection.

Future Outlook

The future of Web3 gaming integrated with DeFi looks promising:

- Increased Mainstream Adoption: As awareness grows about the potential for earning through gameplay, more players are likely to engage with Web3 games.

- Technological Advancements: Continued improvements in blockchain technology will enhance game scalability and user experience.

- New Economic Models: Developers will explore innovative monetization strategies that align player incentives with long-term sustainability.

- Collaborative Ecosystems: Partnerships between traditional gaming companies and blockchain projects are expected to increase, leading to more sophisticated GameFi offerings.

Frequently Asked Questions About How Does Web3 Gaming Leverage Decentralized Finance (DeFi)

- What is Web3 gaming?

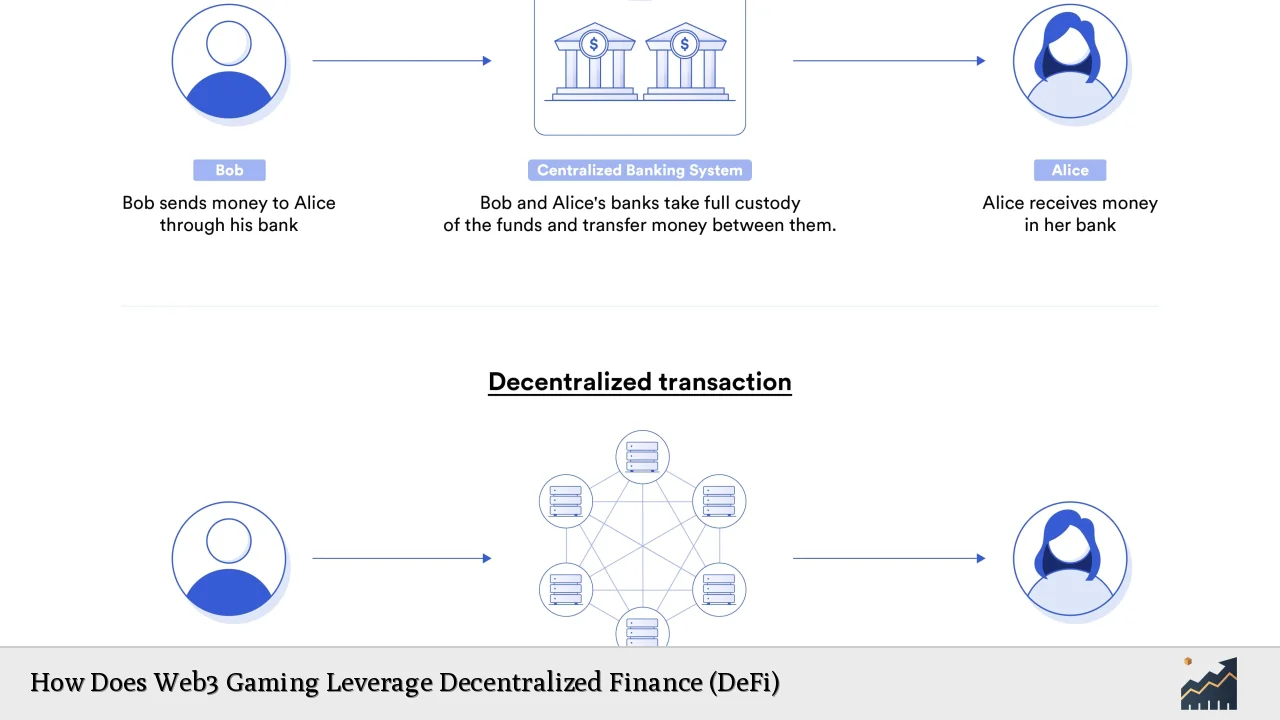

Web3 gaming refers to games built on blockchain technology that allow players true ownership of their assets through decentralized systems. - How does DeFi enhance Web3 gaming?

DeFi provides financial tools such as staking, yield farming, and liquidity pools that allow players to earn real-world value from their gameplay. - What are NFTs in gaming?

Non-fungible tokens (NFTs) are unique digital assets representing ownership of in-game items or characters that can be traded on open markets. - What risks are associated with Web3 gaming?

Risks include market volatility, regulatory uncertainty, security vulnerabilities in smart contracts, and sustainability challenges within the game’s economy. - How can I start playing a Web3 game?

To start playing a Web3 game, you typically need a digital wallet to store cryptocurrencies and NFTs required for gameplay. - Are there any legal implications for players?

Yes, players may face tax obligations on earnings from gameplay depending on local laws; compliance with regulations is essential. - What does the future hold for Web3 gaming?

The future looks bright with expected mainstream adoption, technological advancements, innovative economic models, and increased collaboration between traditional gaming companies and blockchain projects. - Can traditional gamers benefit from transitioning to Web3?

Yes! Traditional gamers can benefit from new monetization opportunities and true ownership of their in-game assets by transitioning to Web3 games.

In conclusion, the intersection of Web3 gaming and decentralized finance represents a transformative opportunity for both industries. By enabling true ownership of digital assets and creating new economic models through innovative gameplay mechanics, this fusion not only enhances player engagement but also opens up new avenues for investment and financial growth. As the market continues to evolve amidst regulatory developments and technological advancements, stakeholders must remain vigilant about risks while capitalizing on emerging opportunities.