The cryptocurrency market has witnessed explosive growth over the last decade, evolving into a complex ecosystem characterized by diverse regional dynamics. Among the most significant players in this arena are Europe and Asia, two regions that showcase contrasting approaches to cryptocurrency adoption, regulation, and market behavior. As of 2024, Europe has emerged as the second-largest cryptocurrency economy globally, while Asia maintains its position as a dominant force, particularly in trading volume and mining activities. This article delves into a comprehensive analysis of these two markets, exploring their current trends, regulatory environments, and future outlooks.

| Key Concept | Description/Impact |

|---|---|

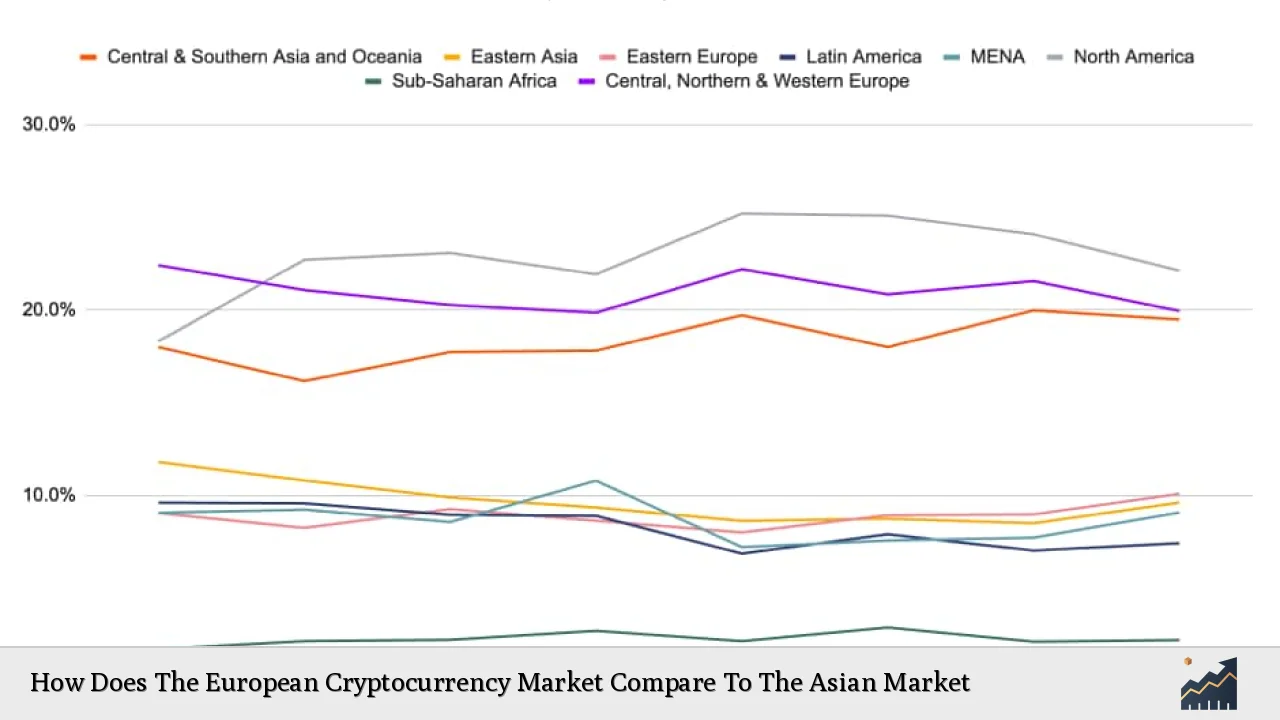

| Market Size | Europe accounts for approximately 21.7% of global transaction volume, while East Asia holds about 31%. |

| Trading Volume | East Asia’s trading volume is significantly higher due to its robust professional trading environment and mining dominance. |

| Regulatory Environment | The EU’s MiCA regulation aims to provide comprehensive oversight, whereas Asia’s regulations vary widely by country. |

| Institutional Adoption | Both regions are seeing increased institutional interest; however, Asia leads in professional-sized transfers. |

| Consumer Engagement | Europe has around 31 million crypto users compared to Asia’s 263 million. |

| Market Trends | Europe is witnessing growth in decentralized finance (DeFi) and stablecoins, while Asia focuses on altcoins and speculative trading. |

Market Analysis and Trends

Current Market Landscape

As of late 2023, the European cryptocurrency market has been characterized by a steady increase in transaction volumes and user engagement. The region accounted for approximately 21.7% of global cryptocurrency transactions, translating to nearly $987 billion in on-chain value received between July 2023 and June 2024. This growth is largely attributed to the rise of decentralized finance (DeFi) platforms and the increasing popularity of stablecoins, which have gained significant traction across Central, Northern, and Western Europe (CNWE)【1】【5】.

In contrast, East Asia remains the largest player in the global cryptocurrency market, accounting for about 31% of all transactions. The region’s dominance is bolstered by its substantial mining operations—China alone historically controlled approximately 65% of Bitcoin’s global hashrate【2】【4】. Furthermore, East Asia is distinguished by a high concentration of professional traders who engage in frequent transactions, with about 90% of the volume attributed to trades exceeding $10,000【2】.

User Demographics

The user base in Asia dwarfs that of Europe significantly. As of early 2024, there are approximately 263 million cryptocurrency users in Asia compared to around 31 million in Europe【11】. This disparity highlights not only the popularity of cryptocurrencies in Asia but also reflects cultural attitudes towards digital assets as alternative investments.

Implementation Strategies

Investment Strategies

Investors in both regions are adopting various strategies tailored to their respective market conditions:

- In Europe:

- A growing focus on long-term holding strategies (HODLing), particularly with Bitcoin and Ethereum.

- Increased interest in DeFi products as platforms like Uniswap gain traction.

- Adoption of euro-denominated futures contracts to hedge against volatility【1】【3】.

- In East Asia:

- A more speculative approach where traders frequently buy and sell a diverse range of cryptocurrencies beyond Bitcoin.

- High engagement with altcoins, driven by innovative projects within the region【2】【4】.

- Utilization of advanced trading technologies and automated systems for rapid execution【12】.

Risk Considerations

Market Volatility

Both markets face significant risks associated with volatility:

- European Market Risks:

- Regulatory uncertainty remains a concern as new frameworks like MiCA are implemented【10】.

- The high concentration of trading volumes on a few exchanges increases systemic risk【9】.

- Asian Market Risks:

- Regulatory crackdowns in countries like China have led to capital flight and uncertainty among investors【8】.

- The speculative nature of trading can lead to sharp price swings that may deter long-term investments【2】【4】.

Regulatory Aspects

Regulatory Frameworks

The regulatory landscape for cryptocurrencies varies greatly between Europe and Asia:

- Europe:

- The introduction of the Markets in Crypto-Assets Regulation (MiCA) aims to create a comprehensive regulatory framework that enhances consumer protection while fostering innovation【10】.

- MiCA will require all crypto service providers operating within the EU to obtain licenses by January 2026【10】.

- Asia:

- Regulatory approaches differ significantly across countries; for example, Singapore promotes a favorable environment for crypto businesses while China maintains strict restrictions【8】【9】.

- Countries like South Korea exhibit increasing regulatory clarity which is fostering institutional adoption【4】.

Future Outlook

Growth Projections

Looking ahead, both regions are poised for growth but face unique challenges:

- In Europe:

- The European market is expected to continue expanding with increasing institutional participation and user adoption driven by regulatory clarity【3】【5】.

- There is potential for further integration of cryptocurrencies into traditional financial systems as more institutions explore digital assets【12】.

- In East Asia:

- The region will likely maintain its dominance due to ongoing innovations in blockchain technology and continued high levels of trading activity【4】【8】.

- However, regulatory pressures may shape market dynamics significantly as governments seek to impose stricter controls on crypto transactions【9】【10】.

Frequently Asked Questions About How Does The European Cryptocurrency Market Compare To The Asian Market

- What are the main differences between European and Asian cryptocurrency markets?

The primary differences lie in market size, user demographics, regulatory environments, and trading behaviors. Europe focuses more on long-term holding strategies while Asia engages heavily in speculative trading. - How does regulation impact cryptocurrency adoption?

Regulatory clarity can enhance consumer confidence and institutional investment. Europe’s MiCA regulation aims to provide such clarity, while varying regulations across Asian countries can either promote or hinder adoption. - What role do stablecoins play in these markets?

Stablecoins have gained significant traction in Europe as traders seek stability amid volatility. In contrast, Asian markets show a preference for altcoins alongside Bitcoin due to their speculative nature. - Why does East Asia have more cryptocurrency users than Europe?

The cultural acceptance of cryptocurrencies as alternative investments and the presence of robust trading infrastructures contribute to East Asia’s larger user base. - What are the risks associated with investing in cryptocurrencies?

Investors face risks from market volatility, regulatory changes, and concentration of trading volumes on few exchanges which can lead to systemic risks. - How can investors navigate these markets effectively?

Diverse investment strategies tailored to each region’s characteristics—such as focusing on DeFi products in Europe or engaging with altcoins in Asia—can help mitigate risks. - What future trends should investors watch for?

Investors should monitor regulatory developments closely as they will shape market dynamics significantly. Additionally, trends such as increased institutional participation and technological advancements will be crucial. - Is it advisable to invest in cryptocurrencies now?

While potential exists for high returns, it is essential for investors to conduct thorough research and consider their risk tolerance before investing.

The comparison between the European and Asian cryptocurrency markets reveals distinct characteristics that reflect broader economic trends and cultural attitudes towards digital assets. As both regions continue to evolve within this dynamic landscape, understanding these differences will be crucial for investors seeking opportunities across global markets.