The relationship between the bond market and the stock market is a complex interplay that significantly affects investment strategies and economic conditions. Generally, these two markets exhibit an inverse correlation; when bond yields rise, stock prices tend to fall, and vice versa. This dynamic is influenced by various factors including interest rates, inflation expectations, and overall economic health. Understanding this relationship is crucial for investors seeking to optimize their portfolios and manage risk effectively.

| Key Concept | Description/Impact |

|---|---|

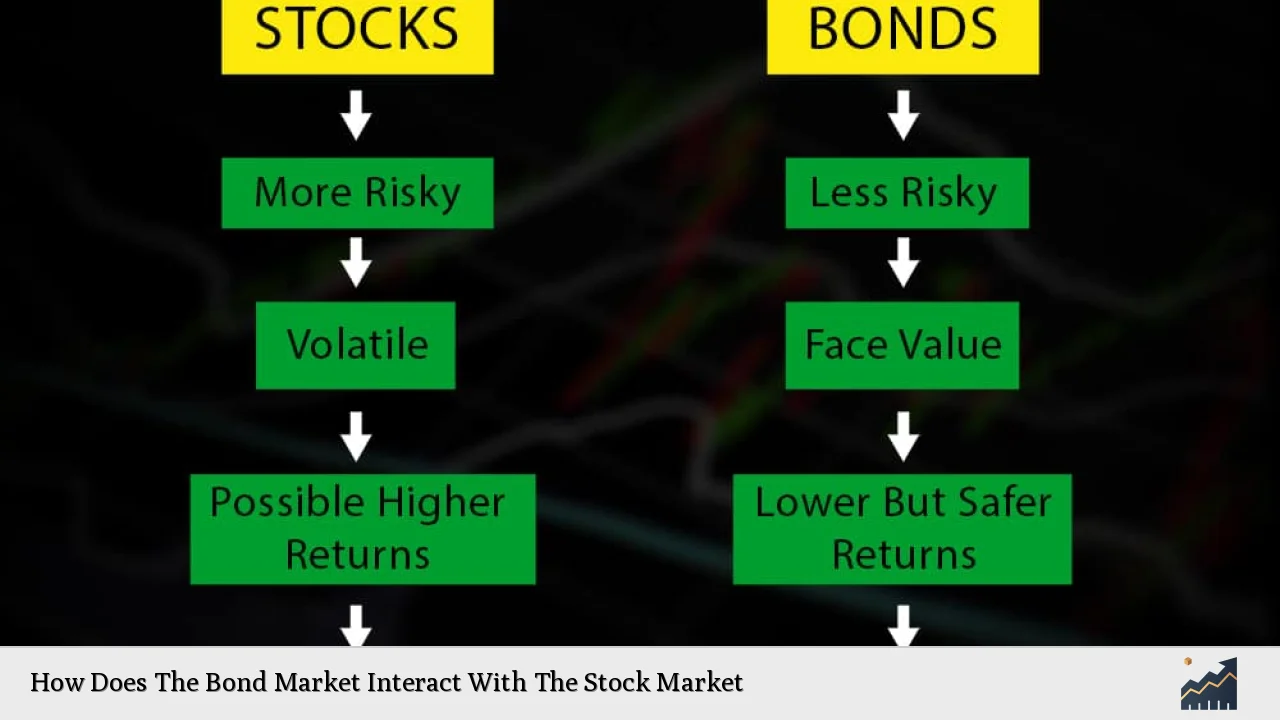

| Inverse Correlation | The bond market typically moves inversely to the stock market. When bond yields increase, stocks often decline as investors shift their preferences towards higher-yielding bonds. |

| Interest Rates | Rising interest rates lead to higher bond yields, making bonds more attractive compared to stocks. This can reduce corporate profits as borrowing costs increase, further impacting stock prices negatively. |

| Inflation Impact | High inflation erodes the purchasing power of fixed-income investments like bonds, leading to increased yields and decreased bond prices. Conversely, stocks may benefit from rising nominal income during inflationary periods. |

| Risk Assessment | Investor sentiment towards risk can shift between stocks and bonds based on market conditions. A “flight to quality” occurs when investors prefer safer bonds over riskier stocks during periods of uncertainty. |

| Market Sentiment | The overall economic outlook influences investor behavior. Positive economic data can lead to higher stock prices while negative data may prompt a sell-off in equities in favor of bonds. |

Market Analysis and Trends

The bond and stock markets are interrelated through various economic indicators and investor behaviors. Recent trends indicate that the correlation between these two markets can shift depending on macroeconomic conditions.

- Current Yield Trends: As of late 2024, U.S. Treasury yields have fluctuated significantly due to Federal Reserve policies aimed at controlling inflation. The 10-year Treasury yield recently hovered around 4.15%, reflecting a cautious approach by investors amid mixed economic signals.

- Economic Indicators: Key indicators such as employment rates, consumer spending, and inflation rates are critical in determining market movements. For instance, a stronger-than-expected jobs report can lead to rising interest rates, which typically depresses stock prices as borrowing costs increase.

- Investor Behavior: Historically, during periods of economic uncertainty or recession, investors tend to move their capital from equities to bonds, seeking safety in fixed-income securities. This behavior reinforces the negative correlation observed between the two markets.

Implementation Strategies

To navigate the complexities of the bond-stock relationship, investors can adopt various strategies:

- Diversification: Maintaining a balanced portfolio that includes both stocks and bonds can help mitigate risks associated with market volatility. This strategy allows investors to take advantage of the inverse relationship between these asset classes.

- Tactical Asset Allocation: Investors may adjust their asset allocation based on prevailing economic conditions. For example, in a rising interest rate environment, reducing exposure to stocks while increasing bond holdings could be beneficial.

- Monitoring Economic Indicators: Keeping an eye on key economic indicators such as inflation rates and employment data can provide insights into potential shifts in the correlation between stocks and bonds.

Risk Considerations

Investing in both stocks and bonds involves inherent risks that must be carefully managed:

- Interest Rate Risk: Rising interest rates can negatively impact both asset classes but affect them differently. While bond prices generally fall with rising yields, higher borrowing costs can squeeze corporate profits, leading to declining stock prices.

- Inflation Risk: Inflation poses a dual threat; it erodes the real return on bonds while potentially boosting nominal earnings for stocks. However, if inflation rises too quickly, it can lead to increased interest rates that hurt both markets.

- Market Volatility: Sudden shifts in market sentiment can lead to rapid changes in asset values. Understanding how external factors like geopolitical events or changes in monetary policy influence investor behavior is crucial for risk management.

Regulatory Aspects

Regulatory frameworks play a significant role in shaping the interactions between the bond and stock markets:

- Federal Reserve Policies: The Fed’s monetary policy decisions directly impact interest rates and subsequently influence both markets. Investors must stay informed about potential rate changes and their implications for asset pricing.

- Securities Regulation: Compliance with regulations set forth by bodies like the SEC ensures transparency in trading practices within both markets. Understanding these regulations helps investors navigate potential pitfalls.

- Market Structure Changes: Innovations such as exchange-traded funds (ETFs) have altered how investors access both markets. These products can provide greater liquidity and diversification but also introduce new risks.

Future Outlook

Looking ahead, several factors will likely influence the bond-stock interaction:

- Economic Recovery: As economies recover from downturns or recessions, shifts in consumer behavior and business investment will affect both markets’ performance. A robust recovery could lead to rising interest rates as demand for credit increases.

- Technological Advancements: The rise of fintech and algorithmic trading could change how investors approach asset allocation between stocks and bonds. Enhanced analytics may allow for more precise timing in capital allocation decisions.

- Global Economic Trends: International developments such as trade policies or geopolitical tensions will continue to impact investor sentiment globally, affecting capital flows between asset classes.

Frequently Asked Questions About How Does The Bond Market Interact With The Stock Market

- What is the primary relationship between stocks and bonds?

The primary relationship is typically an inverse correlation; when bond yields rise, stock prices tend to fall due to shifting investor preferences. - How do interest rates affect stock prices?

Higher interest rates increase borrowing costs for companies, which can reduce profits and lead to lower stock prices. - What role does inflation play in this interaction?

Inflation affects both markets; while it erodes fixed income returns from bonds, it can boost nominal earnings for stocks if managed properly. - Can both markets rise simultaneously?

Yes, there are instances where both markets may rise together due to strong economic growth or favorable monetary policies. - How should I diversify my portfolio considering these interactions?

A balanced approach including both asset classes tailored to your risk tolerance is recommended; consider adjusting allocations based on economic outlooks. - What are some indicators I should monitor?

Key indicators include interest rates set by central banks, inflation rates, employment data, and overall economic growth metrics. - Is it advisable to invest heavily in one market over the other?

This depends on individual risk tolerance; however, over-concentration in one market can expose investors to greater volatility risks. - How do regulatory changes impact these markets?

Regulatory changes can affect market liquidity and investor confidence; staying informed about these changes is crucial for making sound investment decisions.

Understanding the intricate dynamics between the bond market and stock market is essential for effective investment decision-making. By analyzing current trends and employing strategic approaches while considering risks and regulatory aspects, investors can better position themselves for future opportunities in these interconnected financial realms.