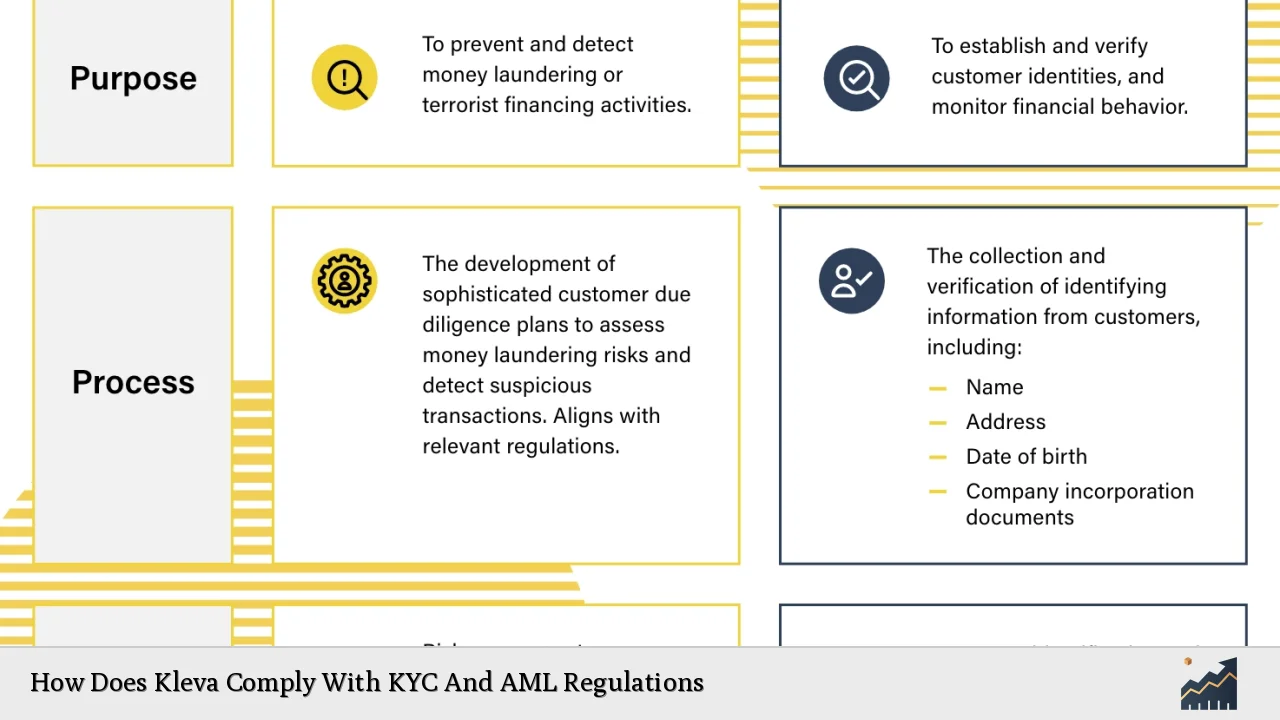

Kleva, a financial technology platform, operates in a highly regulated environment where compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations is critical. These regulations are designed to prevent financial crimes such as money laundering and fraud, ensuring that financial institutions verify the identities of their clients and monitor their transactions. This article delves into Kleva’s compliance strategies, market trends, implementation methods, risk considerations, regulatory frameworks, and future outlook regarding KYC and AML.

| Key Concept | Description/Impact |

|---|---|

| KYC (Know Your Customer) | A process to verify the identity of clients to prevent fraud and ensure compliance with financial regulations. |

| AML (Anti-Money Laundering) | Regulations aimed at preventing money laundering activities by requiring businesses to monitor their customers’ transactions. |

| Customer Due Diligence (CDD) | Involves assessing the risk associated with a customer based on their profile and transaction history. |

| Enhanced Due Diligence (EDD) | More rigorous scrutiny applied to high-risk customers or transactions to mitigate potential risks. |

| Continuous Monitoring | Ongoing assessment of customer transactions to detect suspicious activities in real-time. |

| Regulatory Compliance Costs | The financial burden associated with implementing KYC and AML measures, including technology investments and staffing. |

Market Analysis and Trends

The global market for KYC and AML compliance is rapidly evolving, driven by increasing regulatory scrutiny and the rise of digital banking. In 2024, global spending on AML KYC data and services is projected to reach $2.5 billion, reflecting a growth rate of 14.7% compared to the previous year. This growth is largely fueled by advancements in technology, including artificial intelligence and machine learning, which enhance the efficiency of compliance processes.

Key trends influencing this market include:

- Technological Integration: Financial institutions are increasingly adopting automated solutions for KYC and AML compliance. These technologies improve identity verification processes through biometric checks and real-time monitoring of transactions.

- Regulatory Changes: The introduction of stricter regulations, such as the European Union’s 6th Anti-Money Laundering Directive (6AMLD), mandates enhanced customer due diligence measures. Institutions must adapt quickly to comply with these evolving standards.

- Increased Penalties: In 2023, global fines for non-compliance with AML regulations totaled approximately $6.6 billion, highlighting the significant financial risks associated with inadequate compliance measures.

Implementation Strategies

Kleva employs a multi-faceted approach to ensure compliance with KYC and AML regulations:

- Customer Identification Program (CIP): This program involves verifying customer identities through official documents such as passports or driver’s licenses. Additionally, Kleva utilizes third-party databases to confirm the authenticity of these documents.

- Risk-Based Approach: Kleva categorizes customers based on their risk profiles. High-risk customers undergo Enhanced Due Diligence (EDD), which includes more thorough background checks and ongoing monitoring.

- Ongoing Monitoring: Continuous transaction monitoring is essential for detecting suspicious activities. Kleva implements advanced analytics tools that flag unusual transaction patterns for further investigation.

- Training and Awareness: Regular training sessions for employees ensure that they are up-to-date on regulatory requirements and best practices for identifying potential risks.

Risk Considerations

Despite robust compliance measures, Kleva faces several risks:

- Technological Risks: As reliance on technology increases, so does vulnerability to cyber threats. Ensuring data security while maintaining compliance is paramount.

- Regulatory Risks: Non-compliance can lead to severe penalties, including hefty fines or loss of operating licenses. Staying abreast of regulatory changes is crucial for mitigating this risk.

- Reputational Risks: Any association with fraudulent activities can severely damage a company’s reputation. Maintaining stringent KYC and AML processes helps safeguard against this risk.

Regulatory Aspects

Kleva’s compliance framework is guided by various regulatory bodies:

- Financial Action Task Force (FATF): Sets international standards for combating money laundering and terrorist financing. Kleva aligns its policies with FATF recommendations.

- European Union Directives: Compliance with EU directives such as the AMLD ensures that Kleva meets local regulatory requirements across member states.

- National Regulations: Depending on operational jurisdictions, Kleva adheres to specific national laws governing KYC and AML practices.

These frameworks necessitate comprehensive policies that encompass customer identification, transaction monitoring, reporting suspicious activities, and maintaining detailed records for audits.

Future Outlook

Looking ahead, the landscape for KYC and AML compliance will continue to evolve:

- Increased Automation: The trend towards automation will likely accelerate as companies seek efficiency in compliance processes while reducing operational costs.

- Focus on Data Privacy: Stricter data protection laws will require companies like Kleva to balance compliance with customer privacy concerns.

- Emerging Technologies: Innovations such as blockchain may offer new solutions for secure identity verification and transaction tracking, enhancing overall compliance efforts.

As regulatory environments become more complex globally, firms must remain agile in adapting their strategies to ensure ongoing compliance while fostering customer trust.

Frequently Asked Questions About How Does Kleva Comply With KYC And AML Regulations

- What is KYC?

KYC stands for Know Your Customer; it refers to the process of verifying the identity of clients to prevent fraud. - What are AML regulations?

AML refers to Anti-Money Laundering regulations aimed at preventing money laundering activities in financial systems. - How does Kleva implement KYC?

Kleva implements KYC through a Customer Identification Program that verifies client identities using official documents. - What is Enhanced Due Diligence (EDD)?

EDD involves more rigorous checks on high-risk customers or transactions to mitigate potential risks. - Why is continuous monitoring important?

Continuous monitoring helps detect suspicious activities in real-time, ensuring prompt action can be taken against potential fraud. - What are the consequences of non-compliance?

Non-compliance can lead to significant fines, reputational damage, and potential loss of business licenses. - How does technology impact KYC/AML compliance?

Technology enhances efficiency in identity verification processes and transaction monitoring through automation and advanced analytics. - What future trends should we expect in KYC/AML compliance?

The future will likely see increased automation, a focus on data privacy, and the adoption of emerging technologies like blockchain.

In summary, Kleva’s adherence to KYC and AML regulations is critical not only for legal compliance but also for maintaining trust within the financial ecosystem. As regulations evolve alongside technological advancements, continuous adaptation will be essential for success in this dynamic environment.