Investing plays a crucial role in shaping wealth distribution within societies, influencing not only individual financial health but also broader economic stability. As the gap between the wealthy and the less affluent continues to widen, understanding how investment practices contribute to this inequality is vital. This article explores the intricate relationship between investing and wealth inequality, examining market trends, implementation strategies, risk considerations, regulatory aspects, and future outlooks.

| Key Concept | Description/Impact |

|---|---|

| Wealth Concentration | The wealthiest individuals hold a disproportionate share of assets, primarily in stocks and other investments, leading to greater financial gains compared to lower-income households. |

| Investment Accessibility | Barriers to entry in investment markets limit participation for lower-income individuals, exacerbating wealth inequality as they miss out on potential capital growth. |

| Market Volatility | Fluctuations in market conditions disproportionately affect lower-income investors who may lack the resources to weather downturns compared to wealthier individuals. |

| Financial Literacy | A lack of financial education among lower-income groups can hinder effective investment strategies, perpetuating cycles of poverty and limiting economic mobility. |

| Policy Implications | Regulatory frameworks often favor established investors, creating an uneven playing field that can entrench existing inequalities. |

Market Analysis and Trends

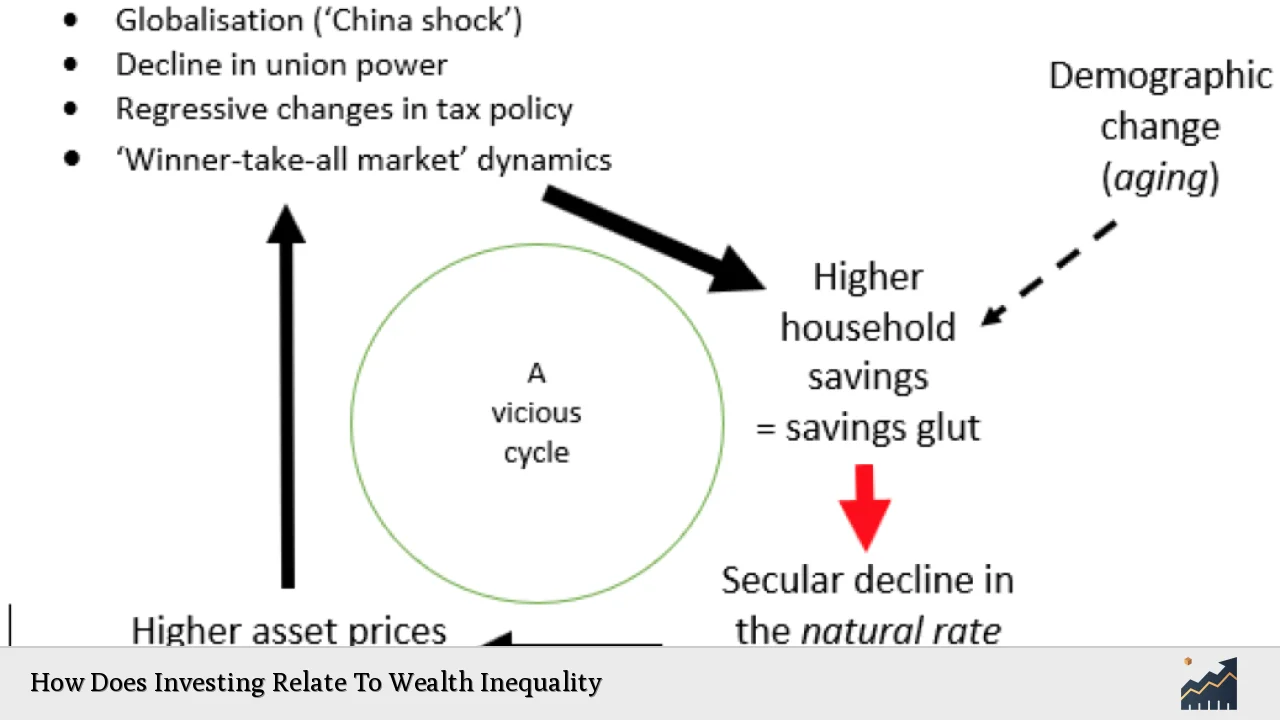

The dynamics of wealth inequality are closely tied to investment trends. Recent data indicates that since the 2008 financial crisis, U.S. household wealth has surged by 215%, reaching approximately $60 trillion by mid-2023. However, this growth has been highly uneven; affluent households have seen their investments grow significantly more than those of lower-income households. For instance, while mass affluent households experienced a 44% increase in investment gains, mass market households saw only an 8% increase.

The concentration of wealth among the top tiers is stark:

- The top 10% of American households own over 70% of all U.S. assets.

- The wealthiest 1% alone hold more than half of all stock market investments.

- In contrast, lower-income families primarily rely on home equity as their main asset, which has proven less lucrative during economic downturns.

These trends highlight how investment opportunities are often dictated by initial wealth levels—those with more capital can invest more effectively and reap greater returns.

Implementation Strategies

To address wealth inequality through investing, several strategies can be considered:

- Promoting Financial Literacy: Enhancing education around investing can empower lower-income individuals to participate more actively in financial markets. Programs focusing on basic investment principles and risk management are essential.

- Encouraging Inclusive Investment Platforms: Development of low-cost investment platforms that cater specifically to low-income investors can help bridge the gap. Robo-advisors and no-fee index funds have already begun to democratize access to investment opportunities.

- Policy Interventions: Governments can implement policies that encourage equitable access to investment opportunities, such as tax incentives for investing in community development projects or supporting small businesses.

- Community Investment Initiatives: Encouraging collective investment strategies within communities can help pool resources and provide greater access to investment opportunities for those who might otherwise be excluded.

Risk Considerations

Investing inherently carries risks that can disproportionately affect lower-income individuals:

- Market Volatility: Lower-income investors often lack the financial cushion to absorb losses during market downturns. This vulnerability can lead to a cycle of debt and reduced savings capacity.

- Access to Credit: Wealthier individuals typically have better access to credit at lower interest rates, enabling them to leverage investments more effectively than poorer investors who may face higher borrowing costs or outright denial.

- Behavioral Risks: Emotional responses to market fluctuations can lead to poor decision-making. Lower-income investors may panic sell during downturns due to financial pressures, while wealthier investors might be able to hold onto their investments longer.

Regulatory Aspects

Regulatory frameworks significantly influence how investments are made and who benefits from them:

- Investment Regulations: Current regulations often favor established players in the market. For instance, accredited investor requirements restrict access to certain high-yield investment opportunities for those without substantial net worth.

- Tax Policies: Tax structures that favor capital gains over ordinary income disproportionately benefit the wealthy since they derive a larger share of their income from investments rather than wages.

- Financial Inclusion Efforts: Regulatory bodies must prioritize initiatives aimed at increasing financial inclusion for underrepresented populations. This includes supporting community banks and credit unions that serve low-income areas.

Future Outlook

The future landscape of investing and its relation to wealth inequality will likely be shaped by several factors:

- Technological Advancements: Innovations in fintech could further democratize access to investing. As technology reduces costs associated with trading and managing investments, it may become easier for lower-income individuals to participate.

- Policy Changes: Ongoing discussions about wealth taxes or reforms in capital gains taxation could alter the current dynamics of wealth accumulation through investments.

- Cultural Shifts: As awareness around social justice and economic equity grows, there may be increased pressure on companies and investors alike to adopt socially responsible investing practices that consider long-term impacts on communities rather than short-term profits alone.

Frequently Asked Questions About How Does Investing Relate To Wealth Inequality

- What is wealth inequality?

Wealth inequality refers to the unequal distribution of assets among residents of an economy. It highlights disparities in ownership of resources like property, stocks, and other investments. - How does investing contribute to wealth inequality?

Investing often favors those with existing capital; wealthy individuals can leverage their resources for higher returns compared to those with limited means who may not have access or knowledge about investing. - What role does financial literacy play?

A lack of financial literacy among lower-income populations limits their ability to invest effectively, perpetuating cycles of poverty and exclusion from wealth-building opportunities. - Are there policies aimed at reducing this inequality?

Yes, various policies such as tax reforms aimed at capital gains or initiatives promoting financial education seek to create a more equitable investment landscape. - What are some strategies for inclusive investing?

Strategies include promoting community investment initiatives, developing low-cost investment platforms, and enhancing financial literacy programs. - How does market volatility affect different income groups?

Market volatility tends to impact lower-income investors more severely as they often lack the financial buffer needed to withstand losses compared to wealthier investors. - What is the future outlook for investing and wealth inequality?

The future will likely see technological advancements democratizing access to investing alongside potential policy changes aimed at addressing systemic inequalities. - How can individual investors contribute to reducing inequality?

Individual investors can support inclusive businesses or community-focused funds that aim for social impact alongside financial returns.

Understanding how investing relates to wealth inequality is crucial for fostering a fairer economic landscape. By addressing barriers faced by lower-income individuals while promoting inclusive practices within investment markets, society can work towards reducing disparities in wealth accumulation and ensuring broader economic stability.