FTX Holdings, once a prominent player in the cryptocurrency exchange landscape, provided a variety of services tailored to institutional investors before its collapse in late 2022. This article explores how FTX aimed to support institutional investors, the implications of its operational model, and the lessons learned from its downfall.

| Key Concept | Description/Impact |

|---|---|

| Vertically Integrated Services | FTX combined trading, custody, and lending services into a single platform, simplifying access for institutional clients. |

| Regulatory Compliance | FTX sought to obtain necessary licenses to operate legally in various jurisdictions, enhancing its appeal to institutional investors concerned about compliance. |

| Institutional-Grade Custody Solutions | The platform offered advanced custody solutions aimed at mitigating counterparty risks associated with digital asset management. |

| Market Liquidity | FTX provided deep liquidity across various trading pairs, allowing institutional investors to execute large trades without significant price impact. |

| Innovative Financial Products | FTX introduced a range of products including futures, options, and tokenized stocks, catering to diverse investment strategies. |

| Educational Resources | The exchange offered insights and resources for institutional investors to better understand the crypto market dynamics. |

Market Analysis and Trends

The cryptocurrency market has experienced significant fluctuations since FTX’s inception in 2019. At its peak, FTX was valued at $32 billion and was recognized for its rapid growth and innovative offerings. However, the collapse of FTX in November 2022 sent shockwaves through the industry, leading to increased scrutiny and a reevaluation of investment strategies by institutional players.

Current Market Landscape

- Institutional Interest: Despite the turmoil caused by FTX’s collapse, interest from institutional investors in cryptocurrencies remains strong. Many are now seeking more robust regulatory frameworks and custodial solutions that ensure security and compliance.

- Shift Towards Custody: The FTX incident highlighted the need for reliable custody solutions. Institutions are increasingly gravitating towards established custodians that offer insurance and bankruptcy remoteness.

- Regulatory Developments: Regulatory bodies are moving towards clearer guidelines for cryptocurrency exchanges. This includes stricter requirements around capital reserves and customer fund management.

Implementation Strategies

To attract and retain institutional investors, FTX employed several strategies:

Comprehensive Trading Solutions

FTX provided a one-stop-shop for trading various digital assets through:

- Advanced Trading Tools: Offering APIs for algorithmic trading and comprehensive analytics tools helped institutions optimize their trading strategies.

- Liquidity Pools: By maintaining deep liquidity across numerous pairs, FTX allowed institutions to execute large trades efficiently.

Risk Management Framework

FTX implemented risk management practices that included:

- Real-Time Monitoring: Continuous monitoring of market conditions helped mitigate risks associated with high volatility.

- Multi-Signature Wallets: Enhanced security measures for asset custody reduced the risk of hacks or misappropriation of funds.

Risk Considerations

The collapse of FTX underscored several critical risks that institutional investors must consider when engaging with cryptocurrency platforms:

Counterparty Risk

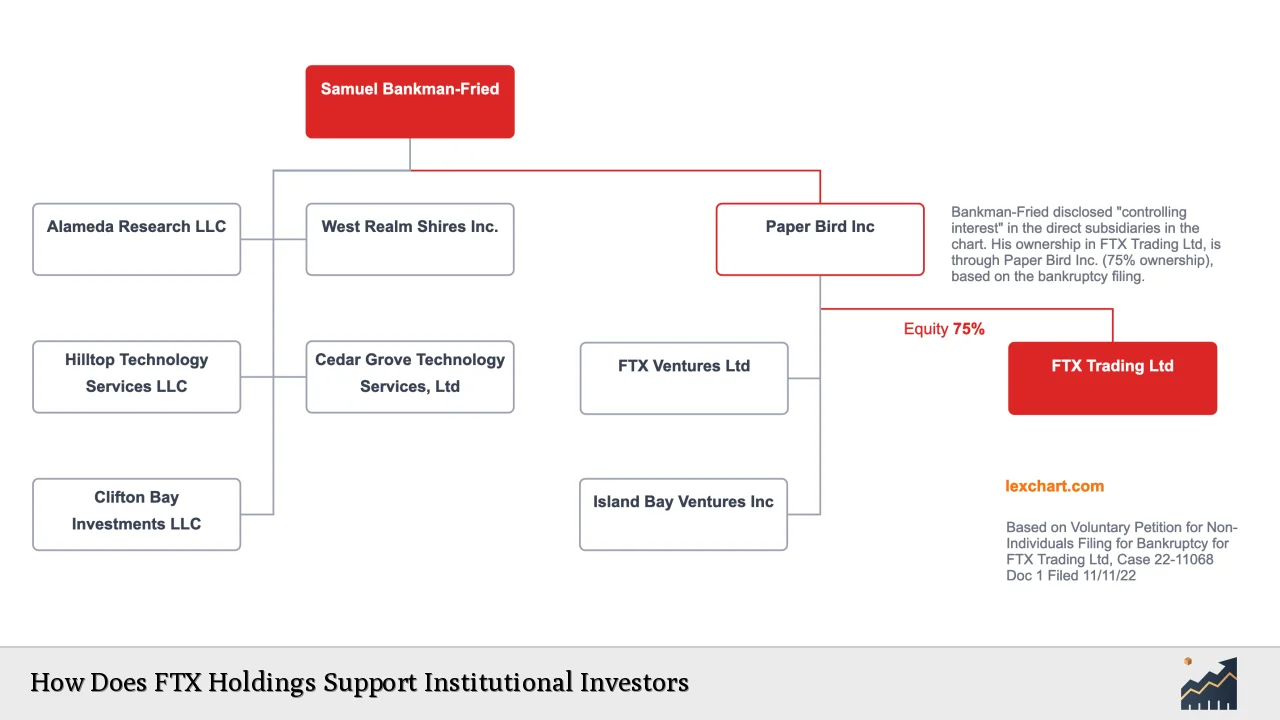

The interconnectedness between FTX and Alameda Research raised concerns about counterparty risk. Institutions must now prioritize platforms with transparent operational structures.

Regulatory Risks

With ongoing regulatory scrutiny following FTX’s bankruptcy, institutions need to remain vigilant about compliance issues that could impact their investments.

Market Volatility

Cryptocurrencies are inherently volatile. Institutions must develop robust strategies to manage exposure effectively.

Regulatory Aspects

The fallout from the FTX collapse has prompted regulatory bodies worldwide to reconsider their approach to cryptocurrency exchanges:

Increased Scrutiny

Regulators are focusing on:

- Licensing Requirements: Stricter licensing requirements are being discussed to ensure that exchanges maintain adequate capital reserves.

- Consumer Protection Laws: Enhanced regulations aimed at protecting consumer funds from mismanagement or misuse are being implemented.

Global Regulatory Frameworks

Countries are moving towards harmonizing regulations on digital assets to create a safer environment for institutional investment. This includes:

- Anti-Money Laundering (AML) Compliance: Institutions must ensure that their partners comply with AML regulations to avoid legal repercussions.

- Know Your Customer (KYC) Protocols: Enhanced KYC measures are being adopted by exchanges to verify the identity of their users thoroughly.

Future Outlook

The future of cryptocurrency exchanges post-FTX is likely to be characterized by increased regulation and a focus on security:

Institutional Adoption

As regulatory frameworks solidify, more institutions may enter the crypto space but will prioritize platforms that demonstrate robust compliance and risk management practices.

Technological Advancements

Emerging technologies such as decentralized finance (DeFi) may reshape how institutions engage with digital assets. Platforms offering innovative solutions will likely gain traction among institutional players.

Continued Education

Ongoing education about digital assets will be crucial for institutions looking to navigate this evolving landscape effectively.

Frequently Asked Questions About How Does FTX Holdings Support Institutional Investors

- What services did FTX offer institutional investors?

FTX provided trading, custody solutions, lending services, and educational resources tailored specifically for institutional clients. - How did FTX ensure regulatory compliance?

FTX sought various licenses across jurisdictions and implemented strict KYC/AML protocols to adhere to regulatory requirements. - What were the main risks associated with investing in FTX?

The primary risks included counterparty risk due to interconnections with Alameda Research, market volatility, and regulatory uncertainties. - How has the collapse of FTX affected institutional trust in crypto?

The collapse has led institutions to demand more transparency and robust custodial solutions before engaging with crypto platforms. - What is the future outlook for institutional investment in cryptocurrencies?

The future is likely characterized by increased regulation, enhanced security measures, and continued interest from institutions as they adapt to new frameworks. - Are there safer alternatives for institutional investors post-FTX?

Yes, many established custodians now offer secure storage solutions and compliant trading platforms that can mitigate risks associated with crypto investments. - What role does education play in institutional investment in crypto?

Education is vital as it helps institutions understand market dynamics, regulatory changes, and best practices for managing digital assets effectively. - How can institutions manage risks when investing in cryptocurrencies?

Institutions can manage risks by diversifying their portfolios, employing robust risk management frameworks, and choosing compliant platforms for their transactions.

The lessons learned from FTX’s rise and fall will shape the future landscape of cryptocurrency exchanges and their relationship with institutional investors. As the market matures, it is essential for all stakeholders to prioritize security, compliance, and transparency.