The collapse of FTX in late 2022 marked a significant turning point in the cryptocurrency landscape, shaking investor confidence and leading to widespread repercussions across the market. Once a leading exchange, FTX’s downfall not only affected its own operations but also had a domino effect on various sectors within the cryptocurrency ecosystem. This article explores the multifaceted impacts of FTX’s collapse on the global cryptocurrency market, analyzing current trends, regulatory implications, and future outlooks.

| Key Concept | Description/Impact |

|---|---|

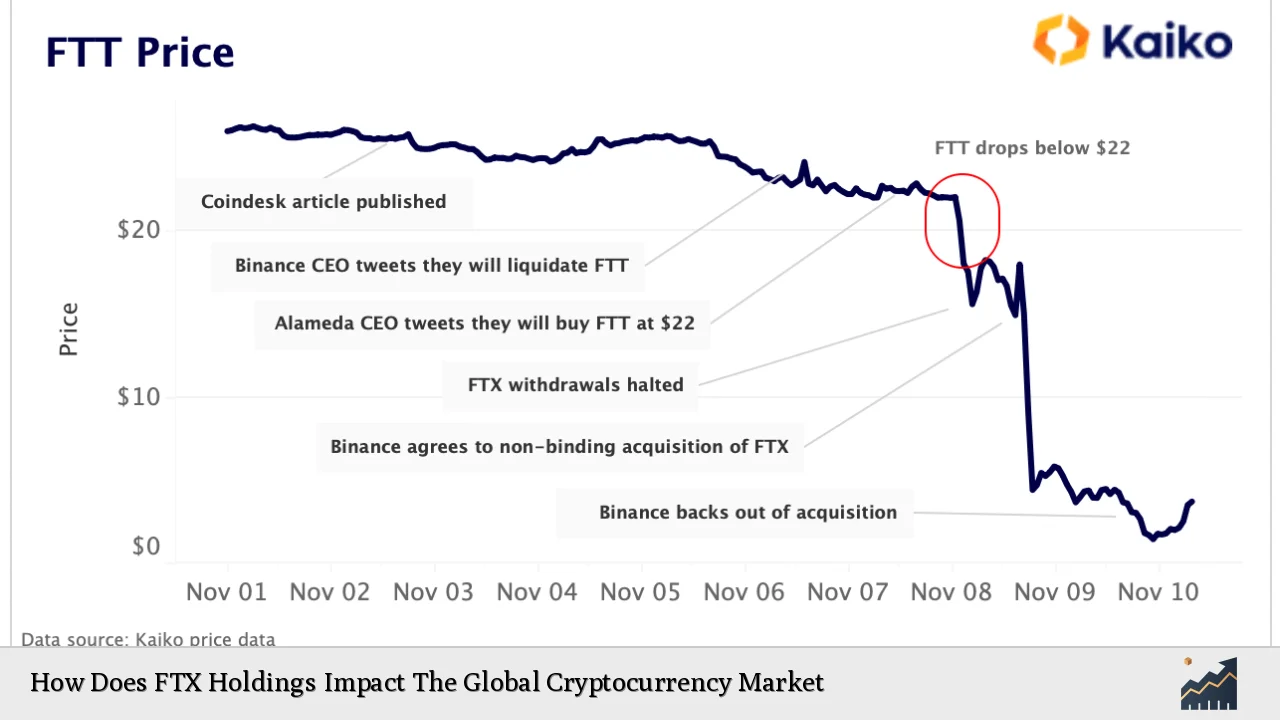

| FTX Collapse | The bankruptcy of FTX in November 2022 resulted from mismanagement and fraudulent activities, leading to a loss of over $8 billion in customer deposits. |

| Investor Confidence | The collapse significantly eroded trust in cryptocurrency exchanges, resulting in increased withdrawals and a decline in trading volumes across platforms. |

| Market Volatility | Following FTX’s downfall, major cryptocurrencies experienced sharp declines, contributing to an extended “crypto winter” characterized by reduced prices and market activity. |

| Regulatory Scrutiny | The incident prompted calls for stricter regulations within the cryptocurrency sector, pushing governments to consider frameworks that could enhance consumer protection. |

| Investment Landscape | The withdrawal of FTX as a major investment player has led to reduced funding for blockchain startups, impacting innovation and development within the industry. |

| Future Market Dynamics | The long-term effects of FTX’s collapse may include a shift towards more sustainable business models and increased focus on regulatory compliance among cryptocurrency firms. |

Market Analysis and Trends

The cryptocurrency market has undergone significant changes since the collapse of FTX. As of December 2024, the total market capitalization has rebounded to approximately $2.66 trillion, with Bitcoin recently surpassing its all-time high at $106,000. This resurgence can be attributed to several factors:

- Institutional Investment: There has been a marked increase in institutional participation, with firms like BlackRock and Fidelity launching Bitcoin ETFs that have attracted substantial capital.

- Market Recovery: Following a prolonged downturn known as “crypto winter,” renewed interest from retail and institutional investors has spurred a bullish trend.

- Technological Advancements: Innovations in blockchain technology continue to drive interest, particularly in areas such as decentralized finance (DeFi) and non-fungible tokens (NFTs).

However, despite these positive indicators, the shadow of FTX looms large. Many investors remain cautious due to lingering concerns about market stability and regulatory oversight.

Implementation Strategies

Investors looking to navigate the post-FTX landscape should consider several strategies:

- Diversification: Spreading investments across various cryptocurrencies and blockchain projects can mitigate risks associated with individual asset volatility.

- Research and Due Diligence: Thoroughly vetting exchanges and projects before investing is crucial. Investors should prioritize platforms with transparent operations and robust security measures.

- Long-Term Perspective: Given the cyclical nature of cryptocurrency markets, adopting a long-term investment strategy may yield better results than attempting to time short-term market movements.

Risk Considerations

The collapse of FTX highlights several risks inherent in the cryptocurrency market:

- Regulatory Risks: As governments worldwide increase scrutiny on cryptocurrencies, new regulations could impact how exchanges operate and how assets are traded.

- Market Manipulation: The lack of oversight can lead to price manipulation by large players or coordinated groups, which can significantly affect asset values.

- Technological Risks: Security breaches or failures in blockchain technology can result in substantial financial losses for investors.

Regulatory Aspects

In response to the fallout from FTX’s collapse, regulatory bodies are actively working on frameworks aimed at enhancing consumer protection. Key developments include:

- U.S. Legislation: The Digital Commodities Consumer Protection Act is under consideration, which aims to establish clearer guidelines for cryptocurrency exchanges.

- EU Regulations: The European Union is set to implement its Markets in Crypto Assets (MiCA) regulation by 2024, which will introduce comprehensive rules governing crypto assets across member states.

These regulatory efforts are expected to bring greater legitimacy to the cryptocurrency market but may also impose stricter compliance requirements on exchanges and projects.

Future Outlook

Looking ahead, the global cryptocurrency market is poised for transformation influenced by several key factors:

- Sustainable Business Models: The need for more robust financial practices will likely lead many companies to adopt sustainable business models that prioritize transparency and consumer trust.

- Increased Institutional Adoption: As more institutional investors enter the space through regulated vehicles like ETFs, the overall market stability may improve.

- Technological Integration: Continued advancements in blockchain technology will foster innovation while addressing existing challenges related to scalability and security.

In conclusion, while the impact of FTX Holdings continues to reverberate through the global cryptocurrency market, there are signs of recovery and adaptation. Investors must remain vigilant but also open to opportunities that arise from this evolving landscape.

Frequently Asked Questions About How Does FTX Holdings Impact The Global Cryptocurrency Market

- What caused the collapse of FTX?

The collapse was primarily due to mismanagement and fraudulent activities that led to significant losses of customer funds. - How did FTX’s collapse affect investor confidence?

It severely eroded trust in cryptocurrency exchanges, causing many investors to withdraw their funds from other platforms. - What are the current trends in the cryptocurrency market?

The market has seen a resurgence with increased institutional investment and technological advancements driving growth. - What strategies should investors consider post-FTX?

Investors should focus on diversification, thorough research, and maintaining a long-term perspective. - What regulatory changes are expected following FTX’s collapse?

Stricter regulations are anticipated globally as governments seek to enhance consumer protection within the crypto space. - Will FTX’s impact lead to better practices in crypto?

Yes, it is likely that companies will adopt more sustainable business models emphasizing transparency and accountability. - How can investors protect themselves from future risks?

Investors should conduct due diligence on exchanges and projects while being aware of regulatory developments affecting their investments. - What is the future outlook for cryptocurrencies?

The outlook remains positive with potential for growth driven by institutional adoption and ongoing technological innovation.

This comprehensive analysis outlines how FTX Holdings has impacted the global cryptocurrency market while providing insights into current trends, strategies for investors, risk considerations, regulatory aspects, and future outlooks.