FTX Holdings, once a prominent cryptocurrency exchange, faced significant scrutiny regarding its user data privacy practices, especially following its dramatic collapse in late 2022. The handling of user data privacy is critical in the financial services sector, particularly in the volatile world of cryptocurrency. This analysis delves into how FTX managed user data privacy, the implications of its practices, and the broader context of data privacy in the financial industry.

| Key Concept | Description/Impact |

|---|---|

| Data Collection Practices | FTX collected extensive personal data from users during account creation and transaction processes, including identification documents and transaction histories. |

| Data Retention Policies | User data was retained for five years post-relationship termination unless legal obligations required longer retention. |

| Privacy Policy Compliance | FTX’s privacy policies aimed to comply with applicable legal requirements but were criticized for lack of transparency and user control over their data. |

| Security Measures | The exchange implemented basic security protocols but lacked robust cybersecurity measures, which ultimately led to significant breaches. |

| Regulatory Scrutiny | The collapse of FTX prompted investigations by regulatory bodies like the SEC and CFTC, focusing on its data handling and user protection practices. |

| User Consent Mechanisms | FTX required user consent for data processing but did not adequately inform users about how their data would be used or shared. |

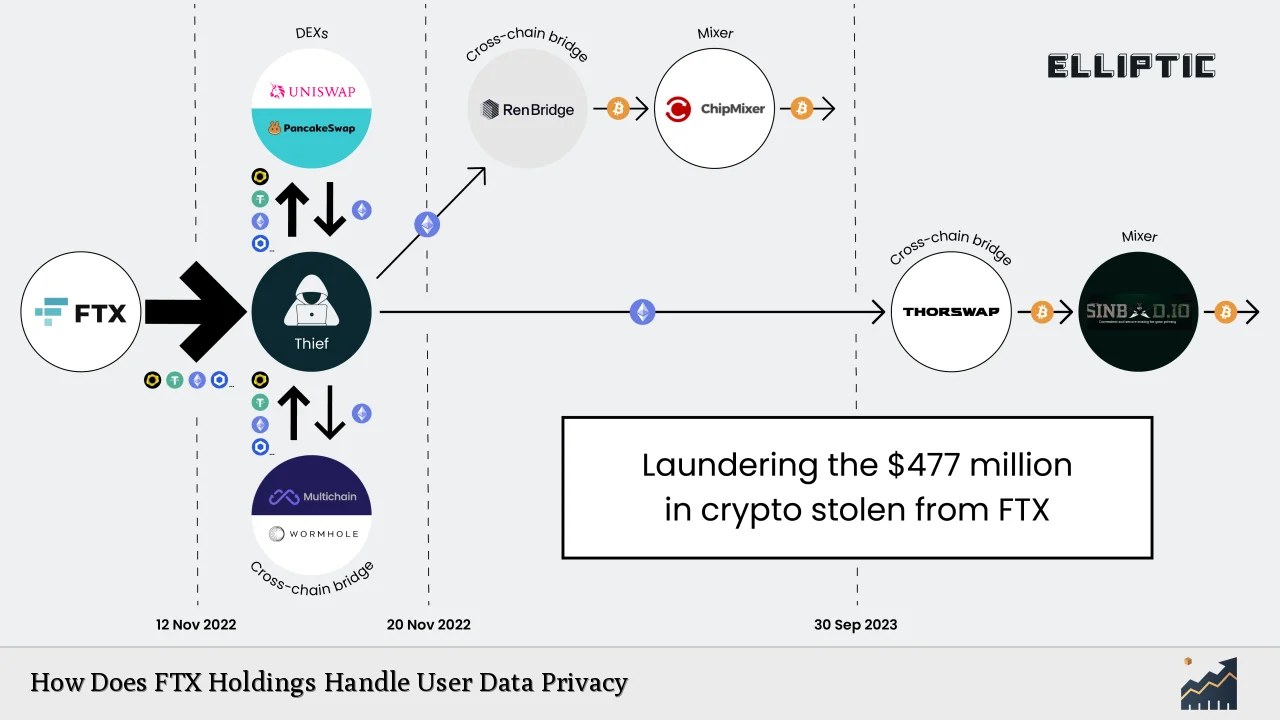

| Impact of Cybersecurity Breaches | FTX’s inadequate cybersecurity led to significant breaches, compromising user data and funds, which severely damaged trust in the platform. |

Market Analysis and Trends

The cryptocurrency market is characterized by rapid innovation and significant regulatory challenges. As of late 2023, the market capitalization of cryptocurrencies has shown volatility, reflecting investor sentiment and regulatory developments. The collapse of FTX has heightened awareness regarding the importance of user data privacy and security in financial transactions.

Recent trends indicate:

- Increased Regulatory Oversight: Regulatory bodies are tightening rules around data privacy and security in the fintech sector. The SEC and CFTC have increased scrutiny on exchanges to ensure compliance with consumer protection laws.

- Consumer Awareness: Users are becoming more aware of their rights concerning personal data. There is a growing demand for transparency from financial institutions regarding how they handle user information.

- Technological Advancements: Innovations such as blockchain technology offer potential solutions for enhancing data security and privacy through decentralized systems.

Implementation Strategies

FTX’s approach to implementing user data privacy measures included several strategies that ultimately proved insufficient:

- Know Your Customer (KYC) Protocols: FTX required users to undergo KYC verification to enhance security. However, this process was criticized for being cumbersome and not sufficiently protecting user data.

- Data Minimization Principles: While FTX claimed to adhere to principles of data minimization, in practice, it collected extensive information that exceeded what was necessary for service provision.

- User Education Initiatives: FTX attempted to educate users about security practices; however, these efforts were often overshadowed by the platform’s operational failures.

Risk Considerations

The risks associated with inadequate user data privacy measures are profound:

- Data Breaches: The lack of robust cybersecurity protocols led to significant breaches where sensitive user information was compromised.

- Legal Repercussions: Following its collapse, FTX faced numerous lawsuits related to mishandling customer funds and inadequate protection of personal data.

- Reputational Damage: The fallout from FTX’s operational failures has led to a loss of trust in cryptocurrency exchanges broadly, impacting market dynamics.

Regulatory Aspects

Regulatory frameworks governing data privacy in financial services have evolved significantly:

- General Data Protection Regulation (GDPR): Although primarily applicable in Europe, GDPR principles influence global standards for data protection. Companies like FTX were expected to comply with these regulations but often fell short.

- Consumer Financial Protection Bureau (CFPB): In the U.S., the CFPB has proposed new rules enhancing consumer access to their financial data. Such regulations could have impacted how FTX managed user information had it remained operational.

- Anti-Money Laundering (AML) Compliance: FTX utilized AML practices to monitor transactions but faced criticism for not adequately safeguarding customer information during these processes.

Future Outlook

The future landscape for user data privacy in cryptocurrency exchanges will likely be shaped by several factors:

- Enhanced Regulatory Frameworks: As governments worldwide respond to the challenges posed by digital currencies, we can expect stricter regulations regarding user data handling and protection.

- Technological Solutions: Advances in cryptographic technologies may offer more secure methods for managing user identities and transactions without compromising privacy.

- Increased Demand for Transparency: Consumers will likely continue demanding greater transparency from exchanges regarding their data use practices, influencing how companies structure their operations.

Frequently Asked Questions About How Does FTX Holdings Handle User Data Privacy

- What types of personal data did FTX collect from users?

FTX collected various personal information including identification documents, transaction histories, and contact details as part of its KYC processes. - How long did FTX retain user data?

User data was retained for five years after the termination of business relationships unless legal obligations required longer retention periods. - What were the main security measures implemented by FTX?

FTX implemented basic security protocols such as two-factor authentication but lacked comprehensive cybersecurity measures leading to vulnerabilities. - What regulatory bodies investigated FTX?

The SEC and CFTC investigated FTX following allegations of fraud and inadequate consumer protections related to user data handling. - How did FTX’s collapse impact consumer trust?

The collapse significantly diminished consumer trust across the cryptocurrency market, leading to increased scrutiny on other exchanges regarding their security practices. - What lessons can be learned from FTX’s approach to data privacy?

The importance of robust cybersecurity measures, transparent communication with users about data usage, and adherence to regulatory standards are critical lessons from FTX’s experience. - Will future regulations affect how exchanges handle user data?

Yes, as regulatory frameworks evolve globally, exchanges will need to adopt stricter policies regarding user data management and protection. - What can consumers do to protect their own data when using exchanges?

Consumers should choose exchanges that prioritize transparency and security, utilize strong passwords, enable two-factor authentication, and stay informed about their rights related to personal data.

The case of FTX Holdings serves as a cautionary tale highlighting the critical importance of robust user data privacy practices within the financial services sector. As the industry continues to evolve amidst regulatory changes and technological advancements, ensuring the protection of personal information will remain paramount for maintaining consumer trust and confidence.