FTX Holdings, once a prominent player in the cryptocurrency exchange landscape, faced significant challenges in managing market volatility, particularly highlighted by its dramatic collapse in November 2022. The exchange specialized in various trading products, including derivatives and leveraged tokens, which inherently expose traders to higher risks during periods of market turbulence. Understanding how FTX approached market volatility can provide valuable insights into both their operational strategies and the broader implications for the cryptocurrency market.

| Key Concept | Description/Impact |

|---|---|

| Market Dynamics | FTX operated in a highly volatile environment characterized by rapid price fluctuations and speculative trading. This volatility was exacerbated by external factors such as regulatory changes and macroeconomic trends. |

| Risk Management Strategies | The exchange employed various risk management tools, including real-time monitoring of user activities and a robust liquidation engine designed to manage margin calls effectively. However, these measures proved insufficient during extreme market conditions. |

| Liquidity Management | FTX maintained a liquidity reserve to facilitate withdrawals and trading. However, the mismanagement of customer funds and over-leverage led to a liquidity crisis that precipitated its downfall. |

| Regulatory Compliance | FTX’s operational practices often skirted regulatory scrutiny, which contributed to its rapid rise but ultimately left it vulnerable during crises. A lack of adequate regulatory oversight allowed risky practices to proliferate. |

| Market Sentiment Analysis | The exchange relied heavily on market sentiment indicators to gauge trader behavior, which influenced their decision-making processes. However, sudden shifts in sentiment could lead to rapid declines in asset values. |

| Impact of FTT Token | The FTT token was central to FTX’s operations, used for trading discounts and as collateral for loans. Its value was artificially inflated through buybacks and burning mechanisms but collapsed alongside the exchange’s reputation. |

Market Analysis and Trends

The cryptocurrency market is notoriously volatile, influenced by factors such as investor sentiment, regulatory news, technological advancements, and macroeconomic conditions. Following the COVID-19 pandemic, there was a surge in retail investor participation in cryptocurrencies, which led to unprecedented price increases across many digital assets.

Current Market Trends

- Increased Volatility: The cryptocurrency market has experienced significant fluctuations since 2020, with Bitcoin reaching an all-time high of nearly $69,000 in November 2021 before plummeting to around $20,000 by mid-2022.

- Regulatory Scrutiny: As incidents like the FTX collapse unfolded, regulatory bodies worldwide began tightening their oversight of cryptocurrency exchanges. The U.S. SEC has ramped up investigations into compliance with securities laws.

- Market Recovery: Post-collapse, there has been a gradual recovery in certain cryptocurrencies as investors seek safer assets amidst ongoing economic uncertainties.

Historical Context

FTX’s rise was marked by aggressive marketing strategies and partnerships with high-profile entities. However, its collapse highlighted systemic vulnerabilities within the crypto ecosystem. The interconnectedness of exchanges meant that FTX’s failure had ripple effects across the market, leading to increased volatility elsewhere.

Implementation Strategies

To handle market volatility effectively, FTX employed several strategies that ultimately proved inadequate:

Risk Management Framework

- Real-Time Monitoring: FTX utilized advanced algorithms for real-time monitoring of trading activities to identify unusual patterns that could indicate potential risks.

- Liquidation Engine: The platform had a sophisticated liquidation mechanism designed to automatically sell off assets when margin levels fell below certain thresholds. This aimed to prevent cascading liquidations but failed during extreme market conditions.

Trading Products

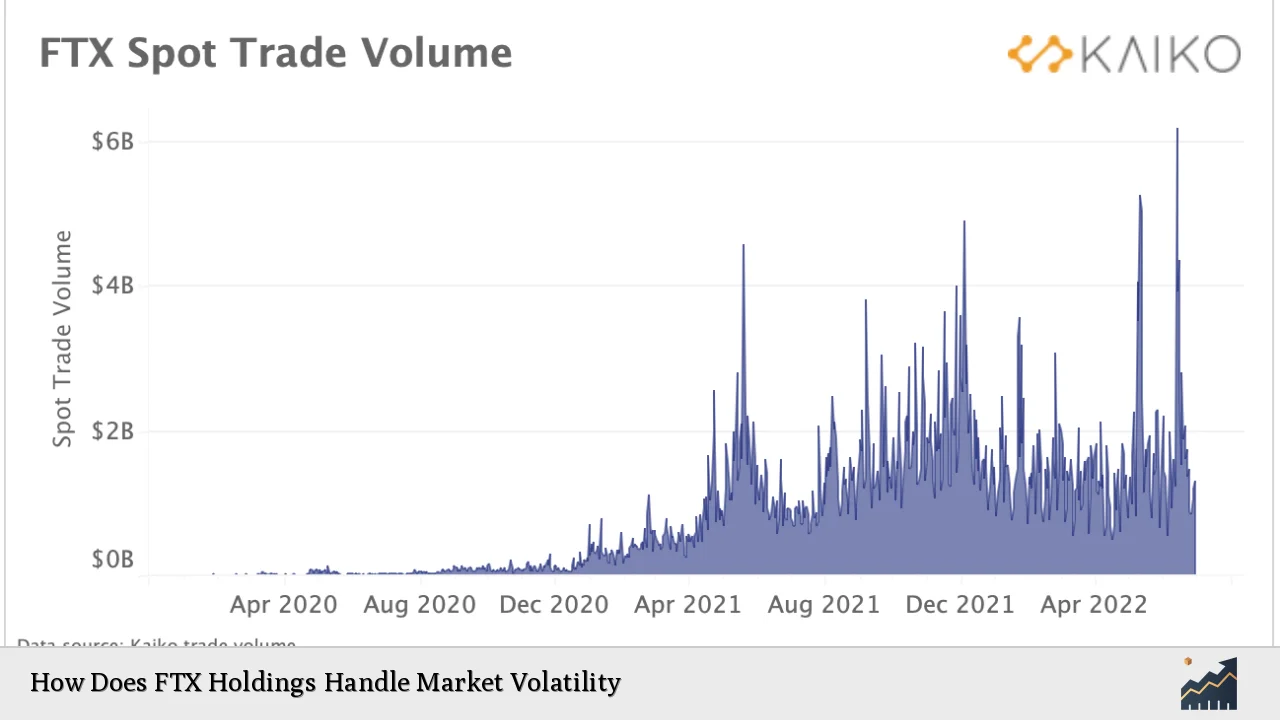

- Derivatives and Leverage: FTX offered a wide range of products including leveraged tokens and derivatives that allowed traders to amplify their exposure. While this attracted high volumes of trading activity, it also increased risk exposure significantly.

- Volatility Products: The platform provided products specifically designed for betting on volatility (e.g., MOVE contracts), which were intended to capitalize on price swings but also contributed to risk accumulation when markets turned against traders.

Risk Considerations

The collapse of FTX underscores several critical risk factors associated with cryptocurrency exchanges:

Over-Leverage

FTX’s business model relied heavily on leveraging customer deposits for trading activities. This practice created an environment ripe for disaster when asset prices began to decline sharply.

Lack of Transparency

The opaque nature of FTX’s financial practices raised concerns about its solvency. The use of its native token (FTT) as collateral for loans led to inflated balance sheets that did not accurately reflect actual liquidity.

Systemic Risk

The interconnectedness between FTX and other entities like Alameda Research created systemic risks within the crypto ecosystem. When FTX collapsed, it triggered a chain reaction affecting multiple exchanges and tokens.

Regulatory Aspects

The regulatory landscape surrounding cryptocurrencies is evolving rapidly:

Regulatory Gaps

FTX operated in a largely unregulated space, which allowed it to engage in risky practices without sufficient oversight. The lack of regulatory frameworks contributed significantly to its eventual failure.

Recent Developments

In response to the collapse, regulators have begun implementing stricter guidelines for cryptocurrency exchanges globally. This includes requirements for transparency in financial reporting and enhanced consumer protection measures.

Future Regulatory Trends

As the industry matures, it is likely that more comprehensive regulations will emerge aimed at preventing similar incidents. This could include stricter capital requirements for exchanges and enhanced scrutiny on trading practices.

Future Outlook

Looking ahead, the future of cryptocurrency exchanges like FTX will depend on several factors:

Market Recovery Potential

While some analysts predict a gradual recovery for cryptocurrencies post-FTX collapse, others caution against potential further downturns due to lingering investor skepticism and regulatory pressures.

Evolving Investor Sentiment

Investor confidence may take time to rebuild as individuals reassess their risk tolerance following high-profile failures like FTX. Educational initiatives around responsible investing will be crucial.

Technological Innovations

Advancements in blockchain technology may pave the way for more secure and transparent trading platforms that can better withstand market volatility.

Frequently Asked Questions About How Does FTX Holdings Handle Market Volatility

- What caused the collapse of FTX?

The collapse was primarily due to mismanagement of customer funds, excessive leverage, and lack of adequate risk controls. - How did FTX manage liquidity?

FTX maintained liquidity reserves but failed to manage them effectively during periods of high withdrawal demands. - What role did the FTT token play?

The FTT token was used as collateral for loans and provided trading discounts; however, its value was artificially inflated. - What are the key lessons from FTX’s failure?

The importance of transparency, effective risk management practices, and regulatory compliance are critical lessons from FTX’s downfall. - How does market volatility affect cryptocurrency investments?

Market volatility can lead to significant price swings which can result in both substantial gains or losses for investors. - What are regulators doing post-FTX?

Regulators are tightening oversight on cryptocurrency exchanges with new rules aimed at enhancing consumer protection and financial transparency. - Can we expect another exchange collapse?

While future collapses are possible due to inherent risks in crypto markets, increased regulation may help mitigate these risks. - How should investors approach volatile markets?

Investors should conduct thorough research, diversify their portfolios, and be prepared for rapid price fluctuations when investing in cryptocurrencies.

The case of FTX serves as a stark reminder of the complexities involved in managing market volatility within the cryptocurrency sector. It underscores the need for robust risk management frameworks and regulatory oversight as this dynamic landscape continues to evolve.