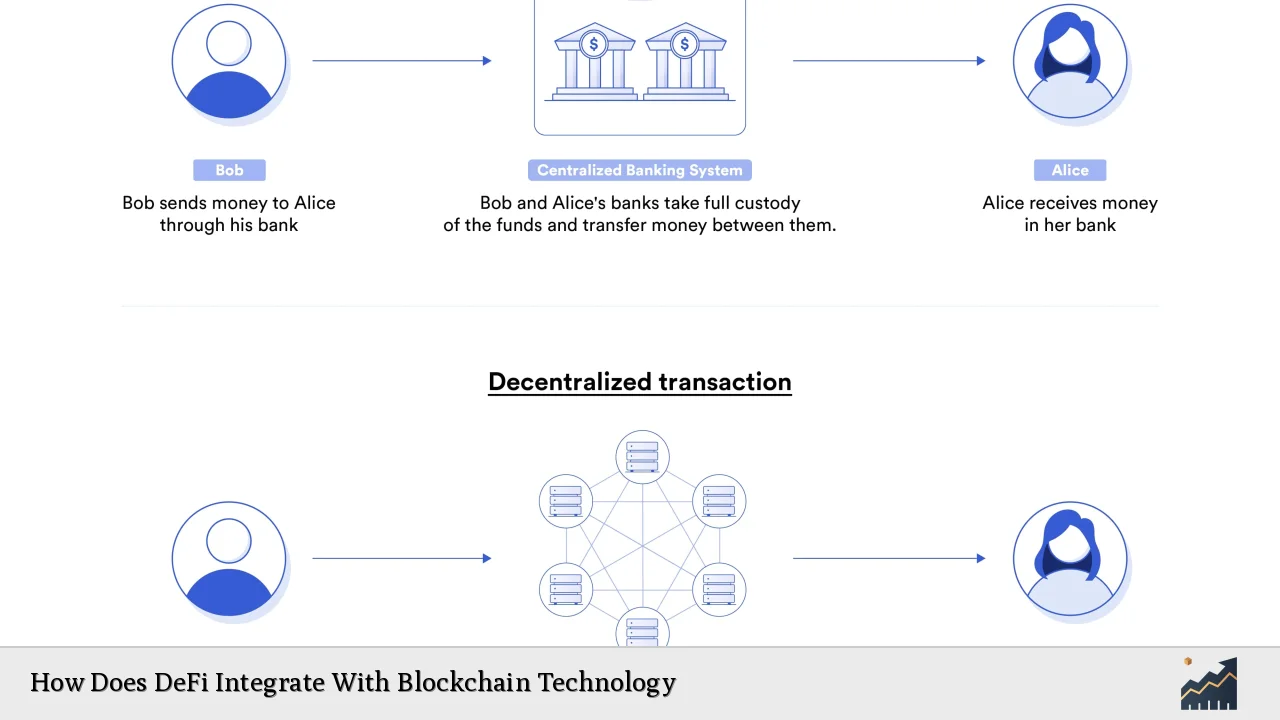

Decentralized Finance (DeFi) represents a transformative shift in the financial landscape, leveraging blockchain technology to create a more accessible, efficient, and transparent financial ecosystem. By eliminating intermediaries, DeFi allows individuals to engage directly in financial transactions through decentralized applications (dApps) powered by smart contracts. This integration not only enhances user autonomy but also fosters innovation in financial services, enabling a wide array of functionalities such as lending, borrowing, trading, and asset management.

| Key Concept | Description/Impact |

|---|---|

| Smart Contracts | Self-executing contracts with the terms directly written into code, automating transactions and reducing the need for intermediaries. |

| Decentralized Applications (dApps) | Software applications that run on a peer-to-peer network, allowing users to engage in financial activities without centralized control. |

| Interoperability | The ability of different DeFi protocols to work together seamlessly, enabling users to combine services and create new financial products. |

| Tokenization | The process of converting real-world assets into digital tokens on the blockchain, facilitating easier trading and ownership transfer. |

| Transparency | All transactions are recorded on public blockchains, providing an auditable trail that enhances trust and reduces fraud. |

| Financial Inclusion | DeFi provides access to financial services for unbanked populations globally, breaking down barriers imposed by traditional banking systems. |

Market Analysis and Trends

The DeFi market has experienced explosive growth over recent years. As of January 2024, the Total Value Locked (TVL) in DeFi platforms reached approximately $55.95 billion, reflecting a significant increase from previous years despite market fluctuations. This growth is indicative of a broader trend towards decentralized financial systems that prioritize user autonomy and transparency.

Key statistics include:

- The global blockchain market is projected to grow from $12.7 billion in 2022 to $67.4 billion by 2026.

- Ethereum continues to dominate the DeFi ecosystem, accounting for over 58% of total liquidity.

- Major DeFi platforms like Uniswap and Aave have revolutionized trading and lending respectively, showcasing the potential for innovative financial solutions.

The rise of decentralized exchanges (DEXs) has particularly influenced trading behaviors, allowing users to swap cryptocurrencies directly without relying on centralized entities. This shift is complemented by the growing popularity of yield farming and liquidity mining, where users earn rewards for providing liquidity to DeFi protocols.

Implementation Strategies

To successfully integrate DeFi with blockchain technology, several implementation strategies can be adopted:

- Developing Smart Contracts: Creating robust smart contracts that automate processes such as lending and trading without human intervention is crucial for operational efficiency.

- Building Interoperable Protocols: Ensuring that different DeFi applications can communicate with each other allows developers to create composite services that enhance user experience.

- User Education: Providing resources and support for users unfamiliar with blockchain technology can help bridge the knowledge gap and encourage wider adoption.

- Security Measures: Implementing rigorous security protocols is essential to protect against vulnerabilities inherent in smart contracts and dApps.

- Regulatory Compliance: Adhering to evolving regulatory frameworks will help legitimize DeFi projects and foster trust among users.

Risk Considerations

While DeFi offers numerous advantages, it also presents specific risks that investors should be aware of:

- Smart Contract Vulnerabilities: Bugs or exploits in smart contracts can lead to significant financial losses. Regular audits and testing are essential.

- Market Volatility: The cryptocurrency market is highly volatile; sudden price fluctuations can impact the value of assets locked in DeFi protocols.

- Regulatory Risks: As governments worldwide begin to scrutinize DeFi projects more closely, changes in regulations could affect operations or lead to compliance challenges.

- Liquidity Risks: Users may face difficulties withdrawing funds during periods of low liquidity or high demand for certain assets.

Regulatory Aspects

The regulatory landscape surrounding DeFi is rapidly evolving. Key considerations include:

- Compliance with Financial Regulations: Many jurisdictions are beginning to impose regulations on cryptocurrency exchanges and DeFi platforms to protect consumers and prevent illicit activities.

- Tax Implications: Investors must be aware of tax obligations related to cryptocurrency transactions and earnings generated through DeFi platforms.

- Consumer Protection: Regulatory bodies are increasingly focused on ensuring that consumers are protected against fraud and scams prevalent in the cryptocurrency space.

As regulatory frameworks become clearer, they may enhance institutional adoption of DeFi by providing guidelines that align with traditional finance practices while maintaining the innovative spirit of decentralized systems.

Future Outlook

The future of DeFi appears promising as it continues to attract attention from both retail investors and institutional players. Key trends shaping its development include:

- Increased Institutional Adoption: As regulatory clarity improves, more institutions are likely to explore DeFi opportunities for investment and operational efficiencies.

- Integration with Traditional Finance: Hybrid models that combine elements of traditional finance with DeFi capabilities will emerge, offering users a broader range of financial products.

- Enhanced User Experience: Ongoing advancements in user interface design and accessibility will make it easier for non-technical users to engage with DeFi platforms.

- Sustainable Yield Opportunities: The tokenization of real-world assets may provide new avenues for generating sustainable yields within the DeFi ecosystem.

Overall, as technological advancements continue to evolve within the blockchain space, the integration of DeFi with traditional finance systems will likely reshape how individuals interact with money and investments globally.

Frequently Asked Questions About How Does DeFi Integrate With Blockchain Technology

- What is Decentralized Finance (DeFi)?

DeFi refers to a system of financial applications built on blockchain technology that allows users to engage in peer-to-peer transactions without intermediaries. - How does blockchain technology support DeFi?

Blockchain provides a transparent, secure environment for executing smart contracts that automate financial transactions directly between parties. - What are smart contracts?

Smart contracts are self-executing agreements coded into the blockchain that automatically enforce terms when conditions are met. - What risks are associated with using DeFi?

The primary risks include smart contract vulnerabilities, market volatility, regulatory uncertainties, and liquidity issues. - How can I participate in DeFi?

You can participate by using decentralized applications (dApps) for lending, borrowing, trading cryptocurrencies, or providing liquidity on DEXs. - What is Total Value Locked (TVL) in DeFi?

Total Value Locked (TVL) refers to the total amount of assets staked or locked within a specific DeFi protocol or across all protocols. - Are there any regulatory concerns regarding DeFi?

Yes, regulatory bodies are increasingly scrutinizing DeFi projects for compliance with existing financial regulations aimed at protecting consumers. - What is the future outlook for DeFi?

The future looks promising with increased institutional adoption, enhanced user experiences, and potential integration with traditional finance systems.

This comprehensive overview highlights how decentralized finance integrates seamlessly with blockchain technology while addressing current trends, risks, regulatory aspects, and future developments. As this sector continues to evolve rapidly, understanding its dynamics will be crucial for investors looking to navigate this innovative landscape effectively.