Cryptocurrency lending has emerged as a significant component of the decentralized finance (DeFi) ecosystem, allowing individuals and institutions to lend and borrow digital assets. This innovative financial service enables users to earn interest on their crypto holdings while providing borrowers access to liquidity without liquidating their assets. As the crypto market continues to evolve, understanding the mechanics of cryptocurrency lending, its benefits, risks, and regulatory landscape is crucial for investors and finance professionals.

| Key Concept | Description/Impact |

|---|---|

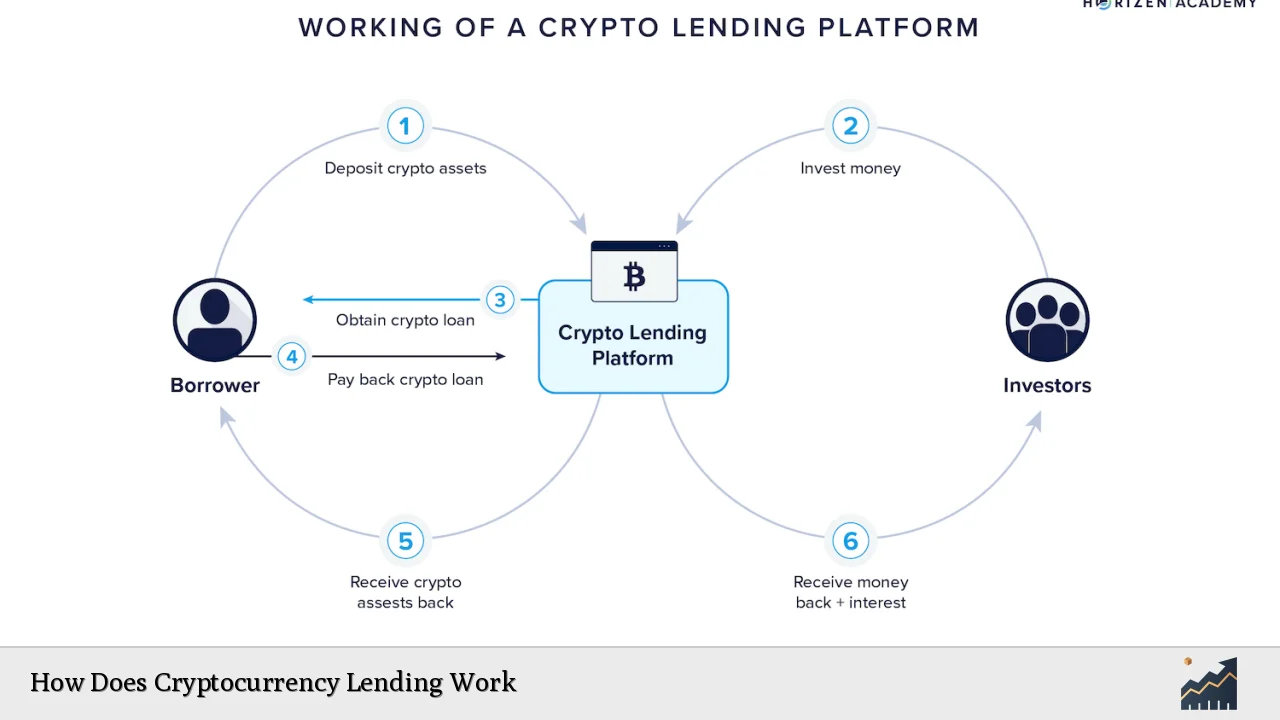

| Crypto Lending Platforms | Online platforms that connect lenders and borrowers, facilitating loans using cryptocurrencies as collateral. |

| Collateralization | Borrowers must provide collateral, usually in the form of cryptocurrencies, to secure their loans, with a typical loan-to-value (LTV) ratio determining the maximum loan amount. |

| Interest Rates | Interest rates on crypto loans can vary widely, often ranging from 5% to over 20%, depending on the platform and market conditions. |

| Decentralized vs. Centralized Lending | Decentralized platforms operate without intermediaries, while centralized platforms are managed by financial institutions or companies. |

| Market Volatility | The value of cryptocurrencies can fluctuate significantly, impacting collateral value and loan terms. |

| Regulatory Environment | The regulatory landscape for cryptocurrency lending is still developing, with varying rules across different jurisdictions. |

Market Analysis and Trends

The cryptocurrency lending market has seen substantial growth in recent years. As of 2023, the market was valued at approximately $12.98 billion and is projected to reach $22 billion by 2025, reflecting a robust compound annual growth rate (CAGR) of around 25%. This growth is driven by several factors:

- Increased Adoption of DeFi: The rise of decentralized finance platforms has made it easier for users to lend and borrow cryptocurrencies without traditional banking intermediaries.

- High Yield Opportunities: Crypto lending offers significantly higher annual percentage yields (APYs) compared to traditional savings accounts. Many platforms advertise APYs exceeding 10%, attracting investors seeking better returns on their holdings.

- Institutional Interest: Institutional players are increasingly entering the crypto lending space, contributing to market stability and liquidity. In Q3 2024 alone, venture capitalists invested over $462 million in crypto lending companies.

- Technological Advancements: Improvements in blockchain technology facilitate more secure and efficient lending processes, enhancing user trust and participation.

Despite these positive trends, the market remains volatile. Current projections indicate a potential decline of approximately 20% in market volume for 2024-2025 due to fluctuating prices and regulatory uncertainties.

Implementation Strategies

For individual investors interested in cryptocurrency lending, several strategies can enhance their experience:

- Choosing the Right Platform: Investors should compare various platforms based on interest rates, collateral requirements, security features, and user reviews. Popular platforms include Aave for decentralized options and BlockFi for centralized services.

- Understanding Loan-to-Value Ratios: Knowing the LTV ratio is crucial as it determines how much can be borrowed against collateral. A typical LTV might range from 50% to 80%, meaning if you stake $10,000 worth of crypto as collateral at an 80% LTV ratio, you could borrow up to $8,000.

- Diversifying Collateral: Using multiple types of cryptocurrencies as collateral can mitigate risks associated with price volatility.

- Monitoring Market Conditions: Keeping an eye on market trends can help investors make informed decisions about when to lend or borrow.

Risk Considerations

While cryptocurrency lending presents attractive opportunities, it also carries inherent risks:

- Market Volatility: The prices of cryptocurrencies can be highly volatile. A sudden drop in the value of collateral can lead to liquidation if it falls below a certain threshold relative to the loan amount.

- Counterparty Risk: There is always a risk that borrowers may default on their loans. While platforms often have measures in place to manage this risk (such as over-collateralization), losses can still occur.

- Security Risks: Crypto lending platforms are potential targets for hackers. Users should ensure that they use platforms with strong security protocols and consider using hardware wallets for additional safety.

- Regulatory Risks: The evolving regulatory landscape poses uncertainties for crypto lending practices. Changes in laws could impact how these services operate or their availability in certain regions.

Regulatory Aspects

The regulatory environment surrounding cryptocurrency lending varies significantly across jurisdictions:

- United States: In the U.S., regulatory bodies like the SEC are increasingly scrutinizing crypto lending practices. Some platforms have faced legal challenges regarding whether their products qualify as securities.

- European Union: The EU is working towards comprehensive regulations that would provide clearer guidelines for crypto assets and services, including lending.

- Asia-Pacific Region: Countries like Singapore have established frameworks that encourage innovation while ensuring consumer protection.

As regulations continue to evolve, participants in the crypto lending space must stay informed about legal requirements applicable to their activities.

Future Outlook

The future of cryptocurrency lending appears promising but will depend on several factors:

- Continued Market Growth: As more individuals and institutions embrace cryptocurrencies, demand for lending services will likely increase.

- Technological Innovations: Advancements in blockchain technology will enhance security and efficiency in lending processes.

- Regulatory Clarity: Clearer regulations could foster greater participation from traditional financial institutions while protecting consumers.

- Integration with Traditional Finance: As banks begin adopting crypto services (like custody solutions), we may see a convergence between traditional finance and cryptocurrency lending.

Overall, while challenges remain, the potential for growth in cryptocurrency lending is significant as it becomes an integral part of the broader financial ecosystem.

Frequently Asked Questions About Cryptocurrency Lending

- What is cryptocurrency lending?

Cryptocurrency lending allows users to lend their digital assets to borrowers in exchange for interest payments. Borrowers typically use their crypto holdings as collateral. - How do I earn interest through crypto lending?

You can earn interest by depositing your cryptocurrencies into a lending platform that pays you interest based on the amount you lend out. - What are flash loans?

Flash loans are uncollateralized loans that must be borrowed and repaid within a single transaction block. They are typically used for arbitrage opportunities. - What happens if my collateral's value drops?

If your collateral's value falls below a certain threshold relative to your loan amount, you may face liquidation where your collateral is sold off to cover the loan. - Are there any tax implications for crypto lending?

Yes, earnings from crypto lending may be subject to capital gains taxes or income taxes depending on your jurisdiction's tax laws. - Can I take out a loan without collateral?

Some platforms offer unsecured loans; however, these are rare and typically come with higher interest rates or strict eligibility criteria. - Is cryptocurrency lending safe?

The safety of cryptocurrency lending depends on various factors including platform security measures and market conditions. Always conduct thorough research before engaging with any platform. - What should I look for in a crypto lending platform?

Consider factors such as interest rates offered, security features (like insurance against hacks), user reviews, supported cryptocurrencies, and regulatory compliance.

In conclusion, cryptocurrency lending represents a rapidly evolving segment within the financial landscape that offers unique opportunities alongside significant risks. By understanding its mechanics and staying informed about market trends and regulations, investors can make educated decisions regarding their participation in this innovative financial service.