Conflux Network is a high-performance, layer-1 blockchain designed to facilitate the seamless interaction of decentralized applications (dApps) across different protocols and borders. By addressing critical challenges such as scalability, security, and interoperability, Conflux plays a pivotal role in the evolution of the cryptocurrency ecosystem. Its innovative Tree-Graph consensus mechanism and unique economic model not only enhance transaction efficiency but also foster a thriving environment for developers and users alike.

| Key Concept | Description/Impact |

|---|---|

| Tree-Graph Consensus Mechanism | Combines Proof of Work (PoW) and Proof of Stake (PoS) to achieve high throughput (up to 4,000 transactions per second) while maintaining decentralization and security. |

| Interoperability | Facilitates cross-chain transactions, allowing assets to move seamlessly between different blockchains, which enhances user experience and expands market access. |

| Tokenomics | The native token, CFX, incentivizes participation in network governance, staking, and ecosystem development, ensuring a sustainable growth model. |

| Regulatory Compliance | As the only regulatory-compliant public blockchain in China, Conflux offers unique opportunities for projects looking to enter Asian markets. |

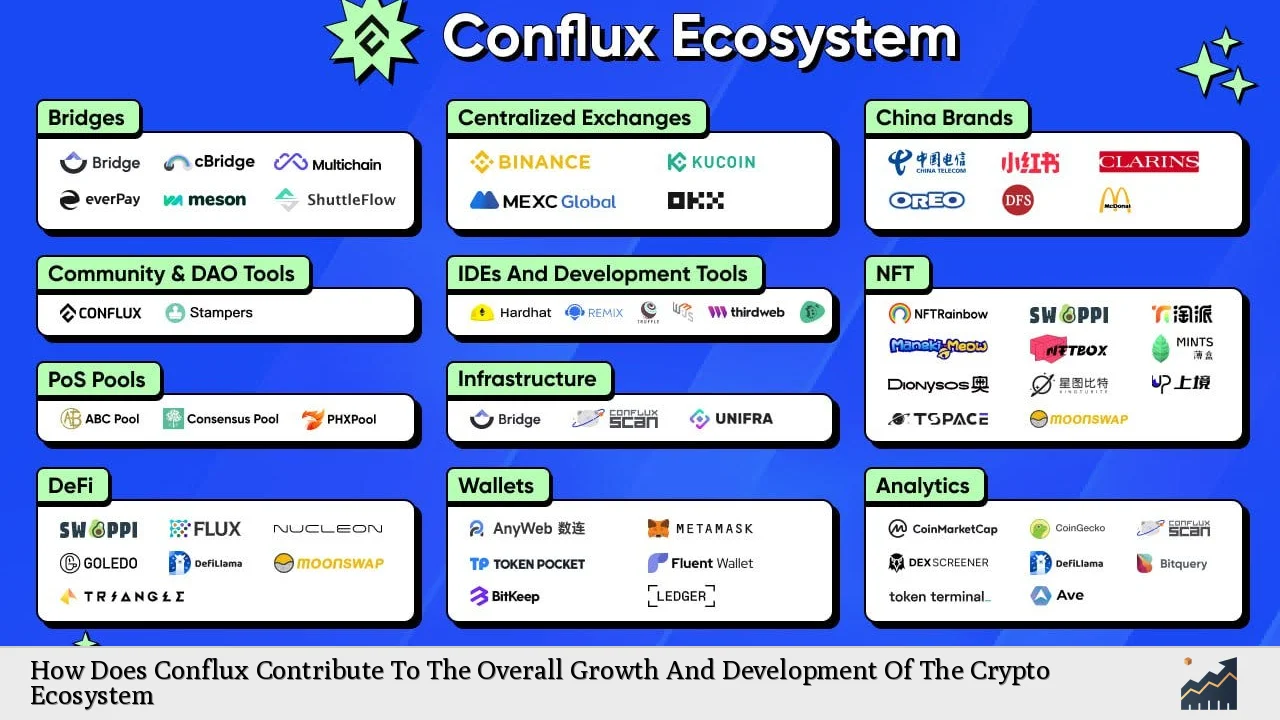

| Partnerships and Collaborations | Strategic alliances with major brands and government entities enhance Conflux’s credibility and expand its use cases in real-world applications. |

Market Analysis and Trends

The cryptocurrency market has experienced significant fluctuations over the past few years. As of December 2024, Conflux Network boasts a market capitalization of approximately $1.02 billion with a circulating supply of about 4.72 billion CFX tokens. The price of CFX currently stands at around $0.2163, reflecting a robust trading volume of approximately $123.98 million over the last 24 hours. This performance indicates a growing interest in Conflux amidst an evolving market landscape where scalability and interoperability are increasingly prioritized by investors and developers alike.

Recent trends show that blockchain technology is moving towards greater integration with traditional finance (TradFi), particularly in Asia where Conflux is strategically positioned. The network’s partnerships with entities like Shanghai’s municipal government and major corporations such as McDonald’s China signify its potential to bridge the gap between digital assets and mainstream adoption.

Implementation Strategies

Conflux employs several strategies to enhance its ecosystem:

- EVM Compatibility: By supporting Ethereum Virtual Machine (EVM), Conflux allows developers to easily port existing Ethereum dApps to its platform. This compatibility encourages innovation and reduces barriers for developers transitioning from Ethereum.

- Dual-Space Architecture: The network features two operational environments—Core Space and eSpace—catering to various developer needs while allowing atomic cross-chain interactions through internal contracts.

- Incentive Programs: Conflux has established various incentive programs aimed at attracting developers and projects. For instance, the Ecosystem Fund allocates 40% of CFX tokens for initiatives that promote growth within the network.

- DeFi Support: The platform actively supports decentralized finance applications by providing liquidity incentives and facilitating asset transfers across different blockchains through protocols like ShuttleFlow.

Risk Considerations

While Conflux presents numerous advantages, several risks must be considered:

- Market Volatility: Like all cryptocurrencies, CFX is subject to market fluctuations that can affect investor sentiment and token value.

- Regulatory Risks: Although Conflux is compliant with Chinese regulations, changes in government policy regarding cryptocurrencies could impact its operations.

- Technological Risks: As a relatively new technology, vulnerabilities in smart contracts or consensus mechanisms could pose risks to users’ assets.

- Competition: The blockchain space is highly competitive, with numerous platforms vying for dominance in scalability and interoperability. Conflux must continuously innovate to maintain its market position.

Regulatory Aspects

Conflux’s status as the only regulatory-compliant public blockchain in China provides it with a competitive edge in the Asian market. This compliance not only enhances trust among users but also facilitates partnerships with governmental bodies and enterprises looking to integrate blockchain technology into their operations. However, navigating the regulatory landscape remains crucial as changes in legislation can significantly impact operations.

Future Outlook

Looking ahead, Conflux is well-positioned for growth within the cryptocurrency ecosystem:

- Market Expansion: With ongoing developments in Asia’s blockchain-friendly environments, particularly Hong Kong’s push towards crypto adoption, Conflux could see increased usage among businesses seeking compliant solutions.

- Technological Advancements: Continuous improvements in its consensus mechanism could further enhance transaction speeds and security measures, making it more attractive to developers.

- Strategic Partnerships: Expanding collaborations with leading brands could bolster user engagement and broaden application use cases across various sectors.

- Community Engagement: By fostering community involvement through governance models that allow token holders to participate actively in decision-making processes, Conflux can build a loyal user base that contributes to its long-term sustainability.

Frequently Asked Questions About How Does Conflux Contribute To The Overall Growth And Development Of The Crypto Ecosystem

- What is Conflux Network?

Conflux Network is a high-performance layer-1 blockchain designed for scalability and interoperability across decentralized applications. - How does the Tree-Graph consensus mechanism work?

This mechanism combines PoW and PoS to enhance transaction throughput while maintaining decentralization. - What role does CFX play in the ecosystem?

The native token CFX is used for transaction fees, staking rewards, governance participation, and incentivizing developers. - Why is regulatory compliance important for Conflux?

Being compliant allows Conflux to operate within legal frameworks in China, attracting partnerships with governmental entities. - What are the main risks associated with investing in CFX?

The primary risks include market volatility, regulatory changes, technological vulnerabilities, and competition from other blockchain platforms. - How does Conflux support decentralized finance (DeFi)?

Conflux provides liquidity incentives for DeFi projects and facilitates cross-chain asset transfers through protocols like ShuttleFlow. - What are the future prospects for Conflux Network?

The future looks promising due to potential market expansion in Asia, ongoing technological advancements, strategic partnerships, and strong community engagement. - How can I buy CFX tokens?

You can purchase CFX tokens on various cryptocurrency exchanges like KuCoin or Binance after completing KYC verification.

In conclusion, Conflux Network significantly contributes to the growth of the crypto ecosystem by addressing core challenges such as scalability and interoperability while fostering an inclusive environment for innovation through its unique technological framework and strategic partnerships. Its focus on regulatory compliance positions it favorably within rapidly evolving markets, making it an attractive option for investors seeking exposure to emerging blockchain technologies.