Conflux Network has emerged as a notable player in the blockchain space, primarily due to its innovative approach to achieving high transaction throughput and low confirmation times. Its unique architecture, which combines elements of traditional blockchain technology with advanced consensus mechanisms, positions it as a scalable solution capable of handling thousands of transactions per second (TPS). This article delves into the mechanisms behind Conflux’s performance, market trends, implementation strategies, regulatory considerations, and future outlook.

| Key Concept | Description/Impact |

|---|---|

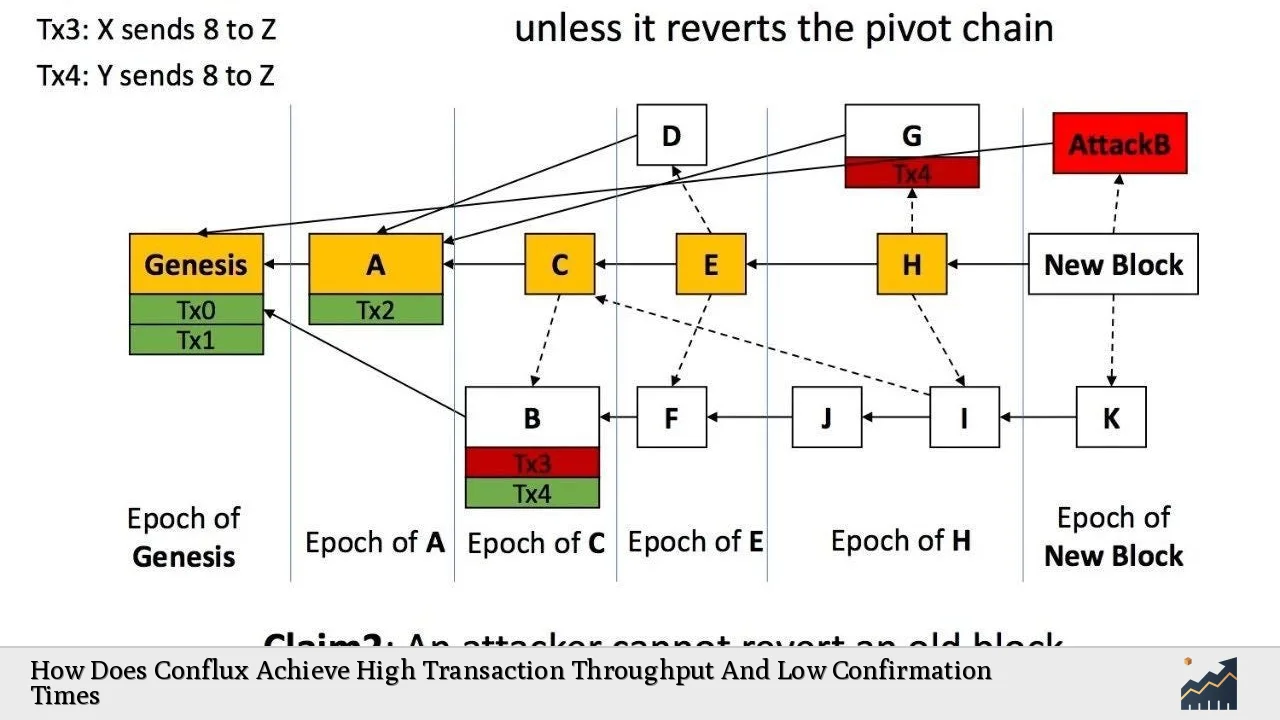

| Tree-Graph Consensus Mechanism | A hybrid model that allows parallel processing of transactions, significantly improving throughput and reducing latency. |

| Directed Acyclic Graph (DAG) | This structure enables concurrent transaction propagation, enhancing speed and efficiency compared to traditional blockchains. |

| Deferred Execution | This technique stabilizes transaction order before execution, minimizing computational waste and optimizing resource use. |

| Dual-Token Economy | CFX as the native token for transaction fees and governance, promoting active participation in the network. |

| Compatibility with Ethereum Virtual Machine (EVM) | This feature allows seamless integration of Ethereum-based applications, attracting developers to build on Conflux. |

| Fee Sponsorship Mechanism | This system allows users with negative balances to engage with the network, thereby broadening user access and participation. |

Market Analysis and Trends

The blockchain industry is witnessing a paradigm shift with the increasing demand for scalable solutions that can handle high volumes of transactions efficiently. Conflux stands out in this landscape due to its ability to process between 3,000 to 6,000 TPS, with confirmation times averaging under one minute. This performance is crucial as it addresses the scalability issues faced by older networks like Bitcoin and Ethereum.

Current Market Statistics

- Market Cap: Approximately $1 billion

- Current Price: Around $0.216

- 24-hour Trading Volume: Exceeds $100 million

- Circulating Supply: 94% of a total supply of 5.28 billion CFX tokens

The growing interest in Conflux is also reflected in its partnerships within China, where it is recognized as the only public blockchain compliant with local regulations. This regulatory compliance enhances its attractiveness to institutional investors looking for secure blockchain solutions.

Implementation Strategies

Conflux employs several key strategies to maintain its high performance:

- Tree-Graph Structure: This innovative architecture allows for multiple blocks to be created simultaneously rather than sequentially. This parallel processing capability is critical for achieving high TPS rates.

- Consensus Protocol: The consensus mechanism combines Proof-of-Work (PoW) and Proof-of-Stake (PoS), ensuring network security while allowing users to stake their tokens for rewards.

- Deferred Execution: By postponing the execution of transactions until a stable order is established, Conflux minimizes potential conflicts and reduces computational overhead.

These strategies not only enhance throughput but also ensure that the network remains decentralized and secure.

Risk Considerations

While Conflux presents significant advantages, potential investors should be aware of several risks:

- Regulatory Risks: As blockchain technology evolves, regulatory frameworks may change. Conflux must remain agile to adapt to new regulations that could impact its operations.

- Market Competition: The blockchain space is highly competitive. Conflux faces challenges from established players like Ethereum and emerging platforms that may offer similar or improved functionalities.

- Technological Risks: As with any technology-driven platform, there is a risk of bugs or vulnerabilities that could undermine network security or performance.

Regulatory Aspects

Conflux’s compliance with Chinese regulations provides it with a unique advantage in a market where many blockchain projects struggle with legal uncertainties. This compliance not only enhances credibility but also facilitates partnerships with major corporations like China Telecom. These collaborations are essential for driving adoption and expanding the ecosystem around Conflux.

Future Outlook

The future prospects for Conflux appear promising:

- Expansion Opportunities: With ongoing developments in Web 3.0 and decentralized finance (DeFi), Conflux is well-positioned to capture market share by facilitating dApp development through its EVM compatibility.

- Increased Adoption: As more developers recognize the benefits of building on a high-throughput platform, we can expect an influx of innovative applications that leverage Conflux’s capabilities.

- Price Predictions: Analysts forecast steady growth for CFX, projecting potential price increases over the next few years as adoption rises and market conditions improve.

In summary, Conflux’s innovative approach to blockchain technology addresses critical challenges faced by earlier platforms. Its ability to achieve high transaction throughput and low confirmation times positions it as a viable solution for developers and businesses looking to leverage decentralized technologies effectively.

Frequently Asked Questions About How Does Conflux Achieve High Transaction Throughput And Low Confirmation Times

- What is the Tree-Graph consensus mechanism?

The Tree-Graph consensus mechanism allows for multiple blocks to be processed concurrently, significantly increasing transaction throughput. - How does Conflux compare to Ethereum in terms of transaction speed?

Conflux can process 3,000 to 6,000 TPS compared to Ethereum’s typical rate of around 20 TPS. - What role does the dual-token economy play?

The dual-token economy incentivizes participation; CFX is used for transaction fees while FC facilitates governance. - What are the risks associated with investing in Conflux?

Investors should consider regulatory risks, market competition, and technological vulnerabilities. - How does deferred execution work?

This process delays transaction execution until their order stabilizes, optimizing resource utilization. - Is Conflux compliant with regulations?

Yes, it is recognized as compliant within China, enhancing its credibility and partnership opportunities. - What future developments can we expect from Conflux?

Expect continued growth in dApp development and potential price increases as adoption rises. - How does Conflux support developers?

The platform’s compatibility with EVM allows developers familiar with Ethereum tools to easily transition their projects.

Conflux Network exemplifies how innovative blockchain solutions can address scalability challenges while maintaining security and decentralization. Its strategic positioning within the evolving digital landscape offers promising opportunities for investors and developers alike.