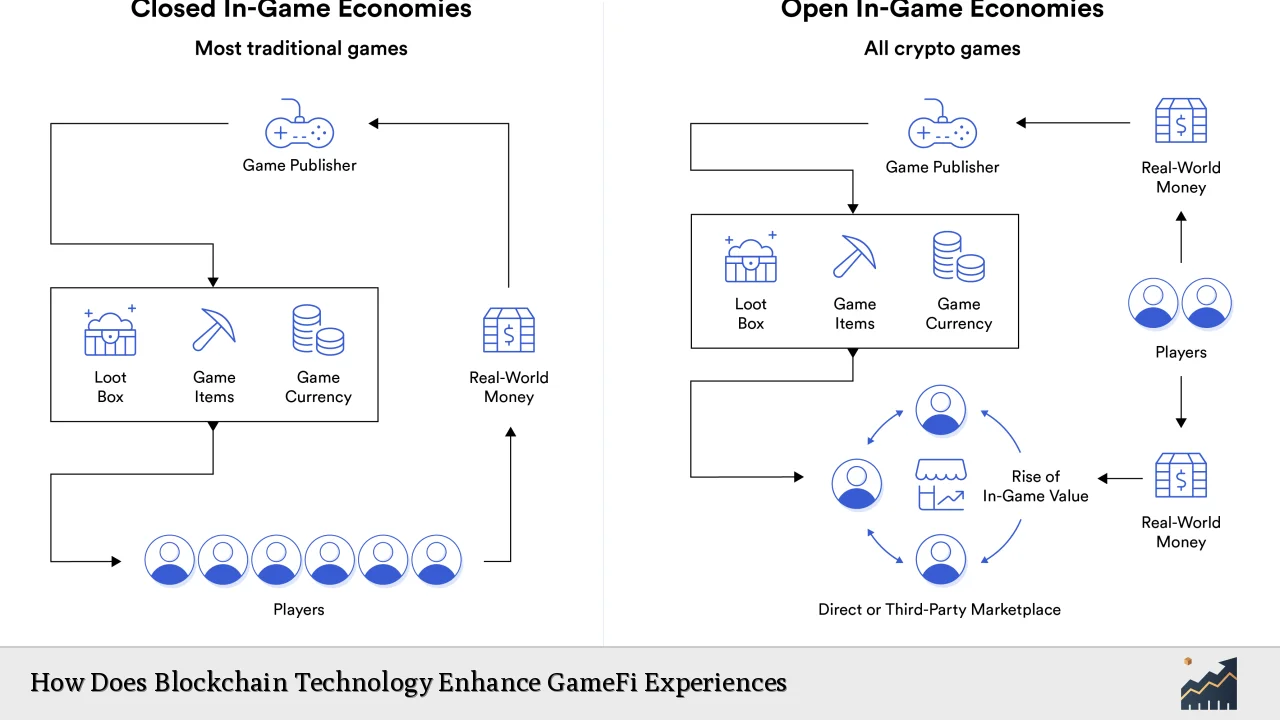

Blockchain technology is revolutionizing the gaming industry by integrating decentralized finance (DeFi) principles into gaming ecosystems, collectively known as GameFi. This innovative fusion allows players to earn real-world value through gameplay, fundamentally altering the relationship between players and games. Unlike traditional gaming, where players invest time and money without tangible returns, GameFi enables players to own, trade, and monetize in-game assets through blockchain technology. This article explores how blockchain enhances GameFi experiences, providing insights into market trends, implementation strategies, risks, regulatory aspects, and future outlooks.

| Key Concept | Description/Impact |

|---|---|

| Ownership of Assets | Blockchain allows players to have true ownership of their in-game assets via non-fungible tokens (NFTs), enabling them to trade or sell these assets freely. |

| Decentralization | GameFi platforms operate on decentralized networks, enhancing security and transparency while reducing the control of centralized entities over game mechanics. |

| Play-to-Earn Model | This model incentivizes players by allowing them to earn cryptocurrency or tokens through gameplay, creating economic opportunities within the gaming ecosystem. |

| Smart Contracts | Smart contracts automate transactions and game mechanics, ensuring fairness and trust in the distribution of rewards and in-game transactions. |

| Community Governance | Players can participate in governance through decentralized autonomous organizations (DAOs), influencing game development and decision-making processes. |

| Market Transparency | The immutable nature of blockchain provides a transparent ledger for all transactions, enhancing player trust in the game’s economy. |

Market Analysis and Trends

The GameFi market is experiencing rapid growth, driven by the increasing adoption of cryptocurrencies and blockchain technology. According to recent reports:

- The global GameFi market was valued at approximately $9.6 billion in 2023 and is projected to grow at a CAGR of 25.4%, reaching around $92.31 billion by 2033.

- North America holds a significant share of the market, accounting for about 43% of revenue in 2023 due to its technological advancements and high-speed internet infrastructure.

- The integration of blockchain gaming with the metaverse is creating interconnected virtual worlds where players can trade digital assets across platforms.

The rise of play-to-earn models has further fueled interest in GameFi, as these models provide financial incentives for players to engage with games. However, despite this growth potential, the industry faces challenges such as project failures; reports indicate that 93% of GameFi projects are abandoned within months of launch.

Implementation Strategies

To successfully implement blockchain technology in GameFi, developers should consider the following strategies:

- Developing Robust Smart Contracts: Smart contracts should be designed to automate game mechanics and ensure fair distribution of rewards without requiring intermediaries.

- Creating Interoperable Assets: Assets should be designed as NFTs that can be used across multiple games, enhancing their value and utility for players.

- Engaging Community Governance: Incorporating DAOs allows players to have a say in game development decisions, fostering a sense of community ownership and engagement.

- Ensuring Security Measures: Implementing strong cybersecurity protocols is essential to protect user data and digital assets from potential threats.

- Building User-Friendly Interfaces: Simplifying the onboarding process for new users unfamiliar with blockchain technology can enhance player engagement and retention.

Risk Considerations

Investing in GameFi comes with inherent risks that potential investors should consider:

- Market Volatility: The value of cryptocurrencies and NFTs can fluctuate significantly, leading to potential losses for investors.

- Project Viability: With a high failure rate among GameFi projects (93% abandonment rate), investors must conduct thorough due diligence before investing.

- Regulatory Risks: As governments worldwide begin to regulate cryptocurrencies and blockchain technologies, compliance with evolving regulations is crucial for project sustainability.

- Cybersecurity Threats: The decentralized nature of blockchain does not eliminate risks related to hacking or fraud; thus, robust security measures are essential.

Regulatory Aspects

The regulatory landscape for GameFi is still developing. Key considerations include:

- Compliance with Financial Regulations: GameFi projects must adhere to regulations set by financial authorities like the SEC regarding token sales and securities classification.

- Consumer Protection Laws: Ensuring that players are protected from fraud and scams is vital for maintaining trust in the ecosystem.

- Tax Implications: Players earning cryptocurrency through gameplay may face tax liabilities depending on their jurisdiction; understanding these implications is essential for participants.

Future Outlook

The future of GameFi appears promising but requires careful navigation through its challenges. Key trends expected to shape the sector include:

- Increased Adoption of NFTs: As more games integrate NFTs into their ecosystems, player ownership will become more pronounced, driving engagement.

- Integration with DeFi Protocols: The blending of DeFi features into gaming will create more complex economic systems where players can earn rewards through various financial activities.

- Expansion into Emerging Markets: Regions with growing internet access and mobile penetration are likely to see increased participation in GameFi platforms.

- Technological Innovations: Advancements in AI and machine learning could enhance gameplay experiences by personalizing interactions based on player behavior.

Frequently Asked Questions About How Does Blockchain Technology Enhance GameFi Experiences

- What is GameFi?

GameFi combines gaming with decentralized finance (DeFi), allowing players to earn real-world value through gameplay using blockchain technology. - How does blockchain ensure asset ownership?

Blockchain uses non-fungible tokens (NFTs) to grant players true ownership over their digital assets, which can be traded or sold independently. - What are smart contracts?

Smart contracts are self-executing contracts with terms directly written into code that automate transactions within the GameFi ecosystem. - What risks should investors consider?

Investors should be aware of market volatility, project viability risks, regulatory compliance issues, and cybersecurity threats. - How does community governance work in GameFi?

Players can participate in governance through decentralized autonomous organizations (DAOs), influencing decisions about game development. - What are the future trends in GameFi?

Future trends include increased NFT adoption, integration with DeFi protocols, expansion into emerging markets, and technological innovations. - Why is transparency important in GameFi?

The transparency provided by blockchain enhances player trust by allowing them to verify transactions and game mechanics independently. - How can developers ensure security in their games?

Developers should implement robust cybersecurity measures and regularly audit their smart contracts to protect against vulnerabilities.

In conclusion, blockchain technology significantly enhances GameFi experiences by providing true ownership of assets, fostering decentralization, enabling play-to-earn models, automating processes through smart contracts, and promoting community engagement. As this sector continues to evolve amidst challenges such as project viability and regulatory scrutiny, it presents unique opportunities for investors looking to capitalize on the intersection of gaming and finance.