Stock buybacks, or share repurchase programs, have become a prevalent strategy among publicly traded companies, particularly in the United States. By repurchasing their own shares, companies aim to reduce the number of outstanding shares on the market, which can lead to an increase in earnings per share (EPS) and potentially boost stock prices. This practice has significant implications for the overall stock market, influencing everything from corporate financial health to investor sentiment and market dynamics.

| Key Concept | Description/Impact |

|---|---|

| Increased Earnings Per Share (EPS) | By reducing the number of shares outstanding, buybacks can artificially inflate EPS, making companies appear more profitable on a per-share basis. |

| Stock Price Support | Buybacks can create upward pressure on stock prices by reducing supply, which may stabilize prices during market downturns. |

| Investor Sentiment | Announcements of buyback programs often signal management’s confidence in the company’s future prospects, which can positively influence investor sentiment and stock performance. |

| Impact on Dividends | Companies may prioritize buybacks over dividends, affecting income-focused investors who rely on dividend payments for returns. |

| Market Concentration | A significant portion of buybacks is concentrated among a few large companies, leading to potential disparities in market performance and wealth distribution. |

| Regulatory Scrutiny | The rise in buybacks has attracted regulatory attention due to concerns about their impact on long-term investment and income inequality. |

Market Analysis and Trends

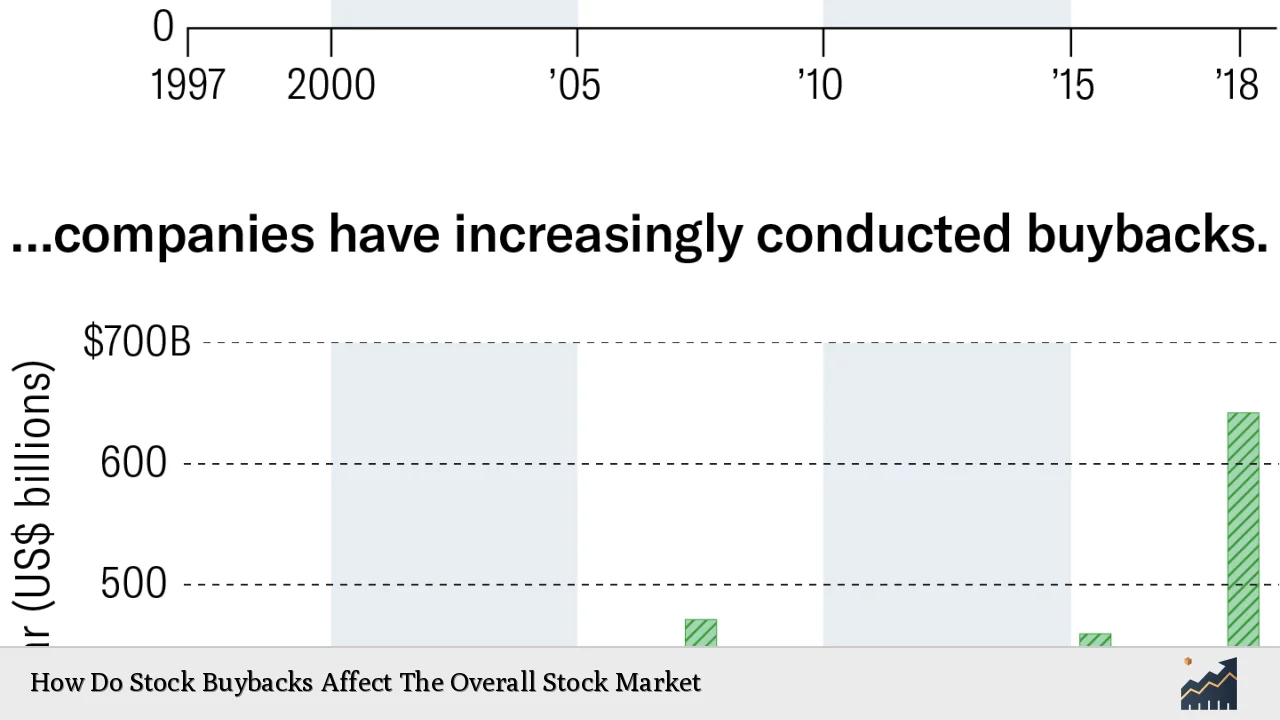

The trend of stock buybacks has been on the rise since the late 1990s. In 2024 alone, S&P 500 companies spent approximately $238.6 billion on share repurchases in the first quarter, marking a 10% increase compared to the same period in 2023. This surge reflects a broader trend where buybacks have consistently outpaced dividends as a method of returning capital to shareholders. For instance, in 2023, S&P 500 companies collectively engaged in buybacks totaling around $918.4 billion over a twelve-month period.

Current Market Statistics

- Q1 2024 Buybacks: $238.6 billion (up 10% year-over-year)

- 12-Month Buyback Expenditure: $918.4 billion (up 16.7% from previous year)

- Top Contributors: Apple ($23.5 billion), Meta Platforms ($18.2 billion), Alphabet ($15.7 billion).

The concentration of buybacks among top firms is notable; the largest 20 companies accounted for about half of all buyback expenditures in recent quarters. This concentration raises concerns about market stability and equitable wealth distribution since these large firms disproportionately influence overall market performance.

Implementation Strategies

Companies typically engage in stock buybacks when they believe their shares are undervalued or when they have excess cash that they do not wish to reinvest into growth opportunities. The strategies for implementing buybacks include:

- Open Market Purchases: Companies buy shares directly from the market at prevailing prices.

- Tender Offers: A company offers to purchase shares at a specified price directly from shareholders.

- Accelerated Share Repurchase (ASR): A company buys back shares quickly through a financial institution that borrows shares to sell back to the company.

These strategies are often influenced by various factors including market conditions, interest rates, and company performance metrics.

Risk Considerations

While stock buybacks can enhance shareholder value, they also present several risks:

- Market Manipulation Accusations: Critics argue that buybacks can be used as tools for manipulating stock prices, especially if conducted during periods of declining share prices.

- Debt Financing Risks: Companies may finance buybacks through debt, increasing their leverage and financial risk if market conditions deteriorate.

- Neglecting Long-Term Growth: Funds allocated for buybacks might otherwise be invested in research and development or capital expenditures that could foster long-term growth.

- Income Inequality: Buybacks primarily benefit wealthier shareholders and executives with stock options, potentially exacerbating income inequality.

Regulatory Aspects

Regulatory bodies have begun scrutinizing stock buyback practices due to their implications for market integrity and economic equity. In 2023, new regulations were introduced requiring companies to disclose more information about their share repurchase activities. Additionally, a 1% excise tax was implemented on stock buybacks as part of broader fiscal reforms aimed at encouraging companies to invest more in their workforce and capital projects rather than solely focusing on returning cash to shareholders.

Future Outlook

Looking ahead, several factors are likely to influence the trajectory of stock buybacks:

- Interest Rates: The Federal Reserve’s monetary policy will play a crucial role in shaping corporate financing decisions. If interest rates decrease, it may encourage more companies to engage in buybacks.

- Economic Conditions: Economic uncertainty or downturns may lead companies to adopt more conservative financial strategies, potentially reducing the scale of future buyback programs.

- Regulatory Changes: Ongoing discussions regarding regulations surrounding corporate governance and share repurchases could reshape how companies approach buybacks.

Overall, while stock buybacks remain a popular tool for enhancing shareholder value, their long-term impact on the overall stock market will depend significantly on regulatory developments and broader economic trends.

Frequently Asked Questions About How Do Stock Buybacks Affect The Overall Stock Market

- What is a stock buyback?

A stock buyback occurs when a company purchases its own shares from the marketplace, reducing the number of outstanding shares. - How do stock buybacks affect share prices?

Buybacks typically increase share prices by reducing supply; fewer shares available can lead to higher demand and price appreciation. - Are stock buybacks good for investors?

Buybacks can be beneficial as they often lead to higher EPS and potentially increased share prices; however, they may also prioritize short-term gains over long-term growth. - What are the risks associated with stock buybacks?

Risks include potential accusations of market manipulation, increased debt levels if financed through borrowing, and neglecting long-term investments. - How do regulators view stock buybacks?

Regulators are increasingly scrutinizing buyback practices due to concerns about their impact on income inequality and long-term corporate investment strategies. - What sectors are most active in stock buybacks?

The technology sector has historically led in share repurchases; however, sectors like finance and healthcare also engage significantly in this practice. - How might future economic conditions affect stock buyback trends?

Evolving economic conditions such as interest rates and inflation will likely influence how aggressively companies pursue share repurchase programs. - Can stock buybacks lead to income inequality?

Yes, since they primarily benefit shareholders—who tend to be wealthier individuals—they can exacerbate existing income disparities within the economy.

This comprehensive analysis highlights how stock buybacks affect not just individual companies but also the broader dynamics of the stock market. Understanding these implications is crucial for investors looking to navigate an increasingly complex financial landscape.