Stablecoins have emerged as a pivotal innovation within the cryptocurrency landscape, providing a stable digital asset that can be used in various applications, particularly smart contracts. These digital currencies are designed to maintain a stable value by pegging them to traditional fiat currencies or other assets. This stability is crucial for enabling the seamless execution of smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. The integration of stablecoins into smart contract applications not only enhances their functionality but also opens up new avenues for decentralized finance (DeFi), payments, and automated processes.

| Key Concept | Description/Impact |

|---|---|

| Stable Value Maintenance | Stablecoins are pegged to fiat currencies or commodities, ensuring that their value remains consistent, which is essential for executing contracts that require predictable financial outcomes. |

| Decentralization | Smart contracts operate on decentralized networks, allowing for trustless transactions without intermediaries, which is enhanced by the use of stablecoins. |

| Liquidity Provision | Stablecoins provide liquidity in DeFi applications, enabling users to engage in lending, borrowing, and trading without the volatility associated with traditional cryptocurrencies. |

| Cross-Border Transactions | Stablecoins facilitate faster and cheaper cross-border transactions through smart contracts, reducing reliance on traditional banking systems and their associated fees. |

| Programmability | The programmable nature of stablecoins allows developers to create complex financial products and services that can automatically execute based on predefined conditions. |

| Risk Mitigation | By using stablecoins, users can hedge against the volatility of other cryptocurrencies, providing a safer environment for executing financial agreements. |

Market Analysis and Trends

The market for stablecoins has experienced significant growth over recent years. As of early 2024, the total market capitalization of stablecoins reached approximately $171.63 billion, reflecting a robust increase in adoption and trust among investors. This growth is driven by several factors:

- Increased Demand: The demand for stablecoins has surged as they offer a reliable medium of exchange and store of value amid the volatility of traditional cryptocurrencies.

- Diverse Collateralization: Stablecoins are increasingly backed by a variety of assets beyond fiat currencies, including commodities like gold and real-world assets (RWAs). This diversification helps mitigate risks associated with specific asset classes.

- Integration into Payment Systems: Businesses are increasingly adopting stablecoins for payment solutions, particularly in cross-border transactions where they reduce costs and improve transaction speed.

- Regulatory Scrutiny: As the market matures, regulatory bodies are beginning to establish clearer frameworks around stablecoin usage, which could foster further adoption and innovation.

The trend towards integrating stablecoins into various sectors indicates their potential to reshape financial systems globally. For instance, projections suggest that by 2024, cross-border stablecoin payments could reach $2.8 trillion.

Implementation Strategies

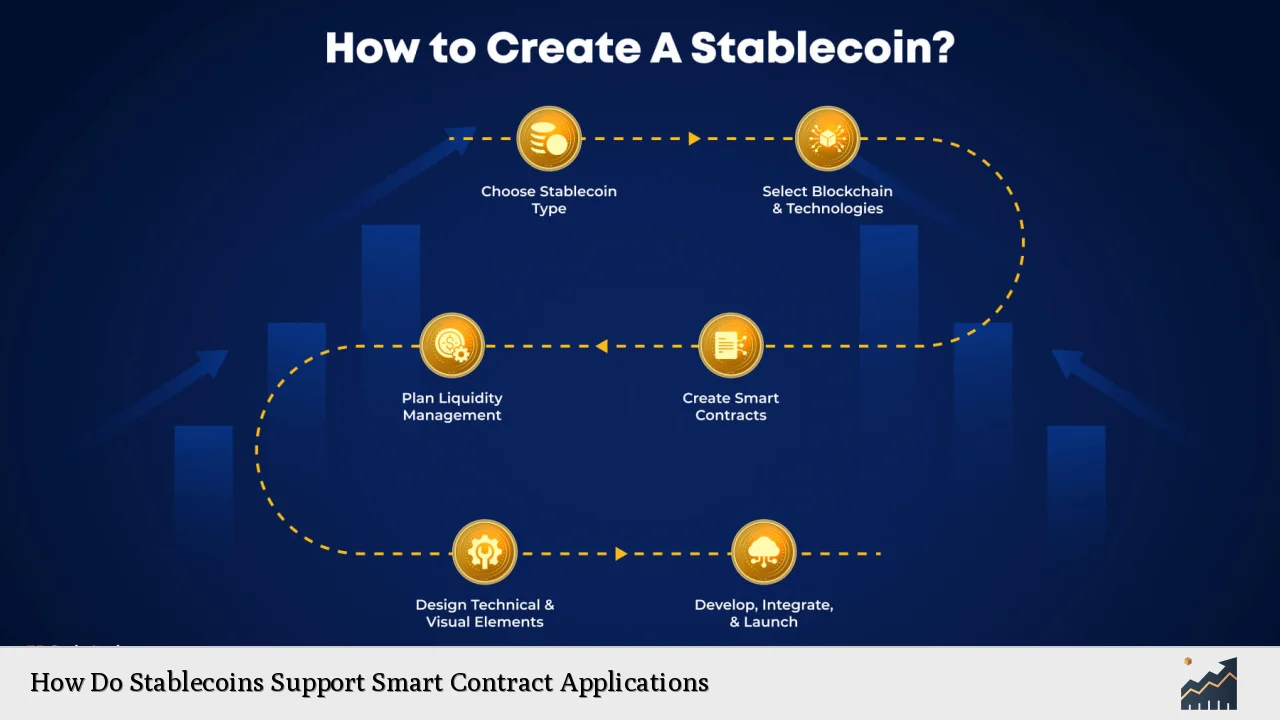

To effectively leverage stablecoins within smart contract applications, several implementation strategies can be adopted:

- Utilizing Existing Protocols: Developers can build on established protocols like Ethereum or Binance Smart Chain that support smart contracts and have robust ecosystems for stablecoin integration.

- Creating Custom Smart Contracts: Organizations can develop tailored smart contracts that incorporate stablecoin functionalities to automate processes such as payroll, invoice payments, and supply chain management.

- Integrating Oracles: To enhance the functionality of smart contracts using stablecoins, integrating decentralized oracles can provide real-time data feeds necessary for executing conditional agreements based on external market conditions.

- Cross-Chain Compatibility: Implementing solutions that allow interoperability between different blockchain networks can expand the usability of stablecoins across various platforms.

Risk Considerations

While stablecoins offer numerous advantages, there are inherent risks associated with their use in smart contract applications:

- Regulatory Risks: The evolving regulatory landscape poses risks as governments may impose restrictions or requirements that affect how stablecoins can be used.

- Counterparty Risks: Depending on the structure of the stablecoin (centralized vs. decentralized), there may be risks related to the issuer’s solvency or operational integrity.

- Smart Contract Vulnerabilities: Flaws in smart contract code can lead to exploits or unintended consequences. Rigorous testing and audits are essential to mitigate these risks.

- Market Liquidity Risks: In times of market stress, liquidity for certain stablecoins may diminish, potentially impacting their ability to maintain their peg.

Regulatory Aspects

The regulatory environment surrounding stablecoins is complex and varies significantly by jurisdiction. Key considerations include:

- Compliance Requirements: Stablecoin issuers must navigate compliance with anti-money laundering (AML) and know your customer (KYC) regulations to prevent illicit activities.

- Consumer Protection Laws: Regulators are increasingly focused on protecting consumers from potential losses associated with unstable or poorly managed stablecoin projects.

- Tax Implications: The treatment of transactions involving stablecoins may differ from traditional currencies under tax laws, necessitating clear guidance from tax authorities.

As regulatory clarity improves globally, it could enhance confidence in stablecoin usage within smart contracts and broader financial applications.

Future Outlook

The future of stablecoins appears promising as they continue to gain traction across various sectors. Key trends likely to shape their evolution include:

- Increased Adoption in DeFi: As decentralized finance grows, so will the role of stablecoins as foundational assets for lending protocols, liquidity pools, and yield farming strategies.

- Emergence of Central Bank Digital Currencies (CBDCs): The development of CBDCs may influence the competitive landscape for stablecoins by providing government-backed alternatives that could coexist or compete with existing digital assets.

- Technological Innovations: Advances in blockchain technology will enhance the efficiency and security of transactions involving stablecoins while expanding their use cases across industries.

- Global Financial Inclusion: Stablecoins hold potential as tools for fostering financial inclusion in underbanked regions by providing access to digital financial services without traditional banking barriers.

As these trends unfold, individual investors and finance professionals should remain informed about developments in the stablecoin market to capitalize on emerging opportunities while managing associated risks effectively.

Frequently Asked Questions About How Do Stablecoins Support Smart Contract Applications

- What are stablecoins?

Stablecoins are digital currencies designed to maintain a fixed value by pegging them to traditional assets like fiat currencies or commodities. - How do smart contracts work?

Smart contracts are self-executing agreements where the terms are written into code on a blockchain. They automatically enforce and execute contractual obligations based on predefined conditions. - Why are stablecoins important for DeFi?

Stablecoins provide stability in volatile markets, enabling reliable transactions and serving as collateral for loans within decentralized finance applications. - What risks should I consider when using stablecoins?

The main risks include regulatory changes, counterparty risks related to issuers, vulnerabilities in smart contract code, and liquidity issues during market stress. - How do regulations impact the use of stablecoins?

Regulations can dictate how stablecoin issuers operate, enforce compliance measures like KYC/AML protocols, and affect consumer protections. - Can I use multiple types of collateral with stablecoins?

Yes, many modern stablecoin protocols allow for diverse collateral types beyond fiat currency to enhance stability and risk management. - What is the future outlook for stablecoins?

The future looks bright with increasing adoption in DeFi applications, potential integration with CBDCs, technological advancements enhancing security and efficiency, and promoting global financial inclusion. - How do I choose a reliable stablecoin?

Consider factors such as market capitalization, transparency regarding reserves backing the coin, regulatory compliance status, and historical performance stability.

In conclusion, as the landscape of digital finance evolves rapidly with innovations like blockchain technology and decentralized finance mechanisms gaining traction globally, understanding how stablecoins support smart contract applications will be crucial for investors looking to navigate this dynamic environment effectively.