Stablecoins have emerged as a crucial component of the cryptocurrency ecosystem, offering the benefits of digital assets while maintaining a stable value. As their adoption grows, the ability to handle increasing transaction volumes and maintain high speeds has become paramount. This comprehensive analysis delves into the scalability and transaction speed challenges faced by stablecoins and the innovative solutions being implemented to address these issues.

| Key Concept | Description/Impact |

|---|---|

| Scalability | The ability of a stablecoin network to handle an increasing number of transactions without compromising performance or security |

| Transaction Speed | The time taken for a stablecoin transaction to be processed and confirmed on the network |

| Layer 1 Solutions | Improvements made directly to the underlying blockchain to enhance scalability and speed |

| Layer 2 Solutions | Off-chain scaling solutions that process transactions separately from the main blockchain |

Market Analysis and Trends

The stablecoin market has experienced remarkable growth, with the total market capitalization reaching $200 billion by the end of 2024. This surge in adoption has put increased pressure on stablecoin networks to maintain efficient operations at scale. Tether (USDT) leads the market with a capitalization of $139 billion, followed by USD Coin (USDC) at $41 billion.

Daily transaction volumes for stablecoins have consistently increased throughout 2024, indicating growing comfort with digital assets among both retail and institutional users. This trend underscores the critical need for scalable solutions to handle the rising demand.

Latin America and Sub-Saharan Africa have emerged as the fastest-growing regions for stablecoin adoption, with year-over-year growth exceeding 40%. This rapid expansion in emerging markets highlights the potential of stablecoins to provide financial services in areas with limited access to traditional banking.

Implementation Strategies

To address scalability and transaction speed challenges, stablecoin projects are implementing various strategies:

Layer 1 Solutions

Layer 1 solutions involve direct improvements to the underlying blockchain infrastructure. These include:

Sharding: This technique divides the blockchain network into smaller, more manageable parts called shards. Each shard processes its own set of transactions in parallel, significantly increasing the overall processing capacity of the network. Ethereum 2.0, which supports many stablecoins, is implementing sharding to boost its scalability.

Consensus Mechanism Optimization: Some stablecoin projects are adopting more efficient consensus mechanisms, such as Proof of Stake (PoS) or Delegated Proof of Stake (DPoS), which can process transactions faster than traditional Proof of Work (PoW) systems.

Block Size and Time Adjustments: Increasing block size or reducing block time can allow for more transactions to be processed in a given timeframe. However, these adjustments must be carefully balanced to maintain network security and decentralization.

Layer 2 Solutions

Layer 2 solutions are built on top of existing blockchains to improve scalability without compromising the security of the main chain. Key Layer 2 technologies include:

Lightning Network: Originally designed for Bitcoin, the Lightning Network concept has been adapted for some stablecoin implementations. It allows for off-chain transactions that are later settled on the main blockchain, significantly increasing transaction speed and reducing fees.

Rollups: This technology bundles multiple transactions into a single transaction on the main chain, reducing congestion and fees. Optimistic rollups and ZK-rollups are two popular variants being explored by stablecoin projects.

State Channels: Similar to the Lightning Network, state channels allow for off-chain transactions between parties, with only the final settlement recorded on the blockchain.

Blockchain Selection

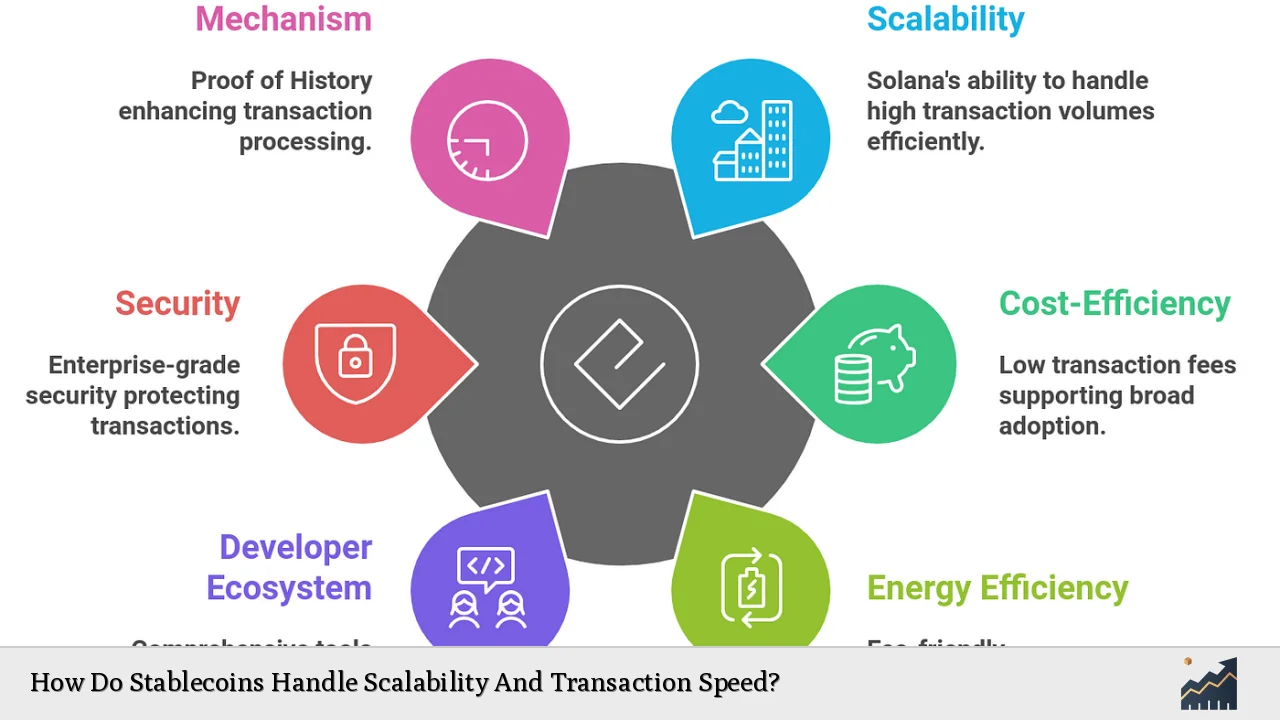

Some stablecoin issuers are opting to launch their tokens on more scalable blockchain networks. Solana, for instance, has gained popularity due to its ability to process up to 65,000 transactions per second with very low fees. This makes it an attractive option for stablecoins aiming to achieve high scalability and speed.

Risk Considerations

While pursuing scalability and speed, stablecoin projects must navigate several risks:

Security Trade-offs: Some scaling solutions may introduce new attack vectors or centralization risks. It’s crucial to maintain a balance between scalability and security.

Complexity: Advanced scaling solutions can increase the complexity of the system, potentially leading to unforeseen vulnerabilities or operational challenges.

Regulatory Compliance: As scalability improves and adoption increases, stablecoins may face greater scrutiny from regulators, particularly concerning anti-money laundering (AML) and know-your-customer (KYC) requirements.

Interoperability Issues: Different scaling solutions may not be compatible across all platforms, potentially limiting the usability of stablecoins in certain ecosystems.

Regulatory Aspects

The regulatory landscape for stablecoins is evolving rapidly, with implications for scalability and transaction speed:

Reporting Requirements: Increased regulatory oversight may require stablecoin issuers to implement more robust transaction monitoring systems, which could impact processing speeds.

Reserve Requirements: Regulations mandating specific reserve ratios or compositions could affect the scalability of fiat-backed stablecoins.

Cross-border Transactions: As stablecoins become more prevalent in international transfers, they may need to comply with various national regulations, potentially affecting transaction speeds across borders.

Central Bank Digital Currencies (CBDCs): The development of CBDCs could either compete with or complement existing stablecoins, influencing their scalability strategies.

Future Outlook

The future of stablecoin scalability and transaction speed looks promising, with several developments on the horizon:

Advanced Consensus Mechanisms: Research into more efficient consensus algorithms could lead to significant improvements in transaction throughput and speed.

Cross-chain Interoperability: Projects like Polkadot and Cosmos are working on solutions that allow for seamless transactions across different blockchains, potentially enhancing the scalability of stablecoins.

AI and Machine Learning Integration: These technologies could be employed to optimize transaction routing and predict network congestion, improving overall efficiency.

Quantum-resistant Cryptography: As quantum computing advances, stablecoin projects may need to implement quantum-resistant algorithms to maintain security while preserving scalability.

Regulatory Technology (RegTech): The development of RegTech solutions could help stablecoins comply with regulatory requirements more efficiently, reducing the impact on transaction speeds.

As the stablecoin market continues to mature, we can expect to see ongoing innovations in scalability and speed. These advancements will be crucial in supporting the growing adoption of stablecoins in various financial applications, from remittances to decentralized finance (DeFi) protocols.

Frequently Asked Questions About How Do Stablecoins Handle Scalability And Transaction Speed?

- What is the current transaction speed of major stablecoins?

Transaction speeds vary depending on the underlying blockchain. For example, stablecoins on Ethereum typically process transactions in about 15 seconds, while those on Solana can be completed in less than a second. - How do stablecoin transaction speeds compare to traditional payment systems?

Stablecoins generally offer faster transaction speeds than traditional bank transfers, especially for cross-border payments. While credit card transactions appear instant to users, settlement can take days, whereas stablecoin transactions are typically settled within minutes or seconds. - Can stablecoins handle the same volume of transactions as major payment networks?

Currently, most stablecoin networks cannot match the transaction volumes of major payment networks like Visa or Mastercard. However, with ongoing scalability improvements, some blockchain networks are approaching comparable throughput levels. - How do gas fees affect stablecoin transaction speeds?

Gas fees on networks like Ethereum can slow down transactions during periods of high congestion, as users may need to pay higher fees for faster processing. Layer 2 solutions and more efficient blockchains are addressing this issue. - Are there any stablecoins specifically designed for high scalability?

Yes, some stablecoins are being developed with a focus on scalability. For example, stablecoins launched on high-throughput blockchains like Solana or using advanced Layer 2 solutions are designed to handle a large number of transactions quickly. - How does the choice of blockchain affect a stablecoin’s scalability?

The underlying blockchain significantly impacts a stablecoin’s scalability. Blockchains with higher transaction throughput and lower fees, such as Solana or Algorand, can offer better scalability compared to more congested networks. - What role do Layer 2 solutions play in improving stablecoin scalability?

Layer 2 solutions like rollups and state channels can dramatically improve stablecoin scalability by processing transactions off the main chain, reducing congestion and fees while maintaining the security of the underlying blockchain.