Stablecoins have emerged as a pivotal innovation in the cryptocurrency ecosystem, particularly in the realms of lending and borrowing. These digital currencies, pegged to stable assets like fiat currencies, provide a unique solution to the volatility typically associated with cryptocurrencies. By offering a stable medium of exchange, stablecoins facilitate various financial transactions, including lending and borrowing, thereby enhancing liquidity and accessibility in the decentralized finance (DeFi) landscape.

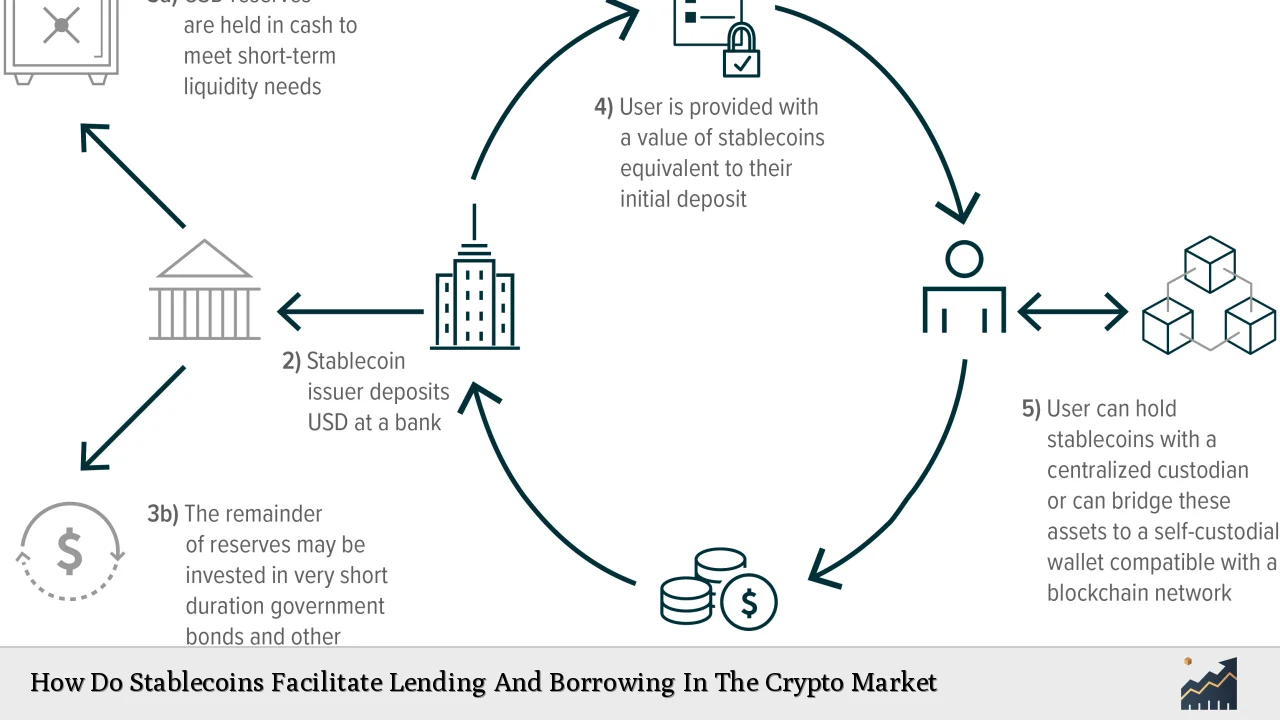

Stablecoins operate primarily through two mechanisms: collateralization and algorithmic stabilization. Collateralized stablecoins are backed by reserves of fiat currency or other assets, while algorithmic stablecoins use smart contracts to manage supply and demand dynamically. This stability is crucial for lending and borrowing activities, as it mitigates the risks associated with price fluctuations.

| Key Concept | Description/Impact |

|---|---|

| Collateralization | Stablecoins are often backed by reserves (e.g., fiat, commodities), ensuring their value remains stable and reliable for lending. |

| Liquidity Provision | Stablecoins enhance liquidity in DeFi platforms, enabling seamless transactions and efficient capital allocation. |

| Yield Generation | Lenders can earn higher interest rates on stablecoin deposits compared to traditional savings accounts, attracting more participants. |

| Overcollateralization | DeFi lending typically requires borrowers to deposit collateral exceeding the loan amount to mitigate default risk. |

| Smart Contracts | Automated agreements facilitate trustless transactions, reducing the need for intermediaries in lending processes. |

| Global Accessibility | Stablecoins allow users from economically unstable regions to access financial services without exposure to local currency volatility. |

| Regulatory Considerations | The growth of stablecoins raises regulatory concerns regarding consumer protection and financial stability, prompting calls for clearer frameworks. |

Market Analysis and Trends

The stablecoin market has witnessed exponential growth over recent years. As of late 2024, the total market capitalization of stablecoins reached approximately $150 billion, accounting for about 6.93% of the entire cryptocurrency market. Tether (USDT) remains the dominant player, representing over 60% of total stablecoin market cap. Other notable entrants include USD Coin (USDC) and Binance USD (BUSD), which have also gained significant traction due to their regulatory compliance and transparency.

Key trends influencing the market include:

- Increased Adoption: Stablecoins are increasingly used for cross-border payments, with projections suggesting that by 2024, $2.8 trillion in cross-border transactions will be settled using stablecoins.

- Diverse Collateralization: There is a growing trend towards backing stablecoins with a variety of assets beyond fiat currencies, including commodities like gold and other digital assets. This diversification aims to mitigate risks associated with reliance on a single asset class.

- Integration with Traditional Finance: Financial institutions are exploring partnerships with stablecoin issuers to enhance payment systems and improve transaction efficiency.

- Regulatory Scrutiny: As stablecoins grow in popularity, regulatory bodies are increasingly focused on establishing frameworks to ensure consumer protection and mitigate systemic risks.

Implementation Strategies

To effectively utilize stablecoins for lending and borrowing within the crypto market, several strategies can be adopted:

- Choosing the Right Platform: Investors should select between centralized finance (CeFi) platforms like Nexo or decentralized finance (DeFi) platforms such as Aave based on their risk tolerance and technical expertise.

- Understanding Yield Dynamics: Lenders can maximize returns by understanding how interest rates fluctuate based on supply-demand dynamics within different platforms. Interest rates on stablecoin deposits can range from 1% to over 8%, depending on platform competition and market conditions.

- Utilizing Overcollateralization: Borrowers should be prepared to provide collateral exceeding the loan amount. This practice safeguards lenders against default risks inherent in volatile crypto markets.

- Engaging with Smart Contracts: Users must familiarize themselves with smart contracts that govern lending processes in DeFi. This knowledge is crucial for managing risks associated with automated transactions.

Risk Considerations

While stablecoins offer numerous advantages in lending and borrowing scenarios, they are not without risks:

- Market Volatility: Although stablecoins aim for price stability, extreme market conditions can lead to temporary de-pegging from their underlying assets.

- Counterparty Risks: In CeFi environments, users face risks related to the exchange's solvency. If an exchange fails or experiences a security breach, recovering assets may be challenging.

- Regulatory Risks: The evolving regulatory landscape poses uncertainties for both issuers and users of stablecoins. Potential regulations could impact liquidity or operational models significantly.

- Smart Contract Vulnerabilities: DeFi platforms rely on smart contracts that are susceptible to bugs or exploits. Users must ensure they understand the underlying technology before engaging in lending or borrowing activities.

Regulatory Aspects

The regulatory environment surrounding stablecoins is rapidly evolving as authorities seek to balance innovation with consumer protection:

- Global Regulatory Frameworks: Various jurisdictions are developing comprehensive regulations tailored for digital currencies. In the U.S., calls for legislation focus on establishing clear guidelines for stablecoin issuers concerning reserve management and consumer protections.

- European Union Initiatives: The EU is advancing its Markets in Crypto-Assets (MiCA) regulation aimed at creating a uniform framework across member states, enhancing transparency and reducing systemic risks associated with stablecoin usage.

- Central Bank Digital Currencies (CBDCs): The rise of CBDCs poses both competition and collaboration opportunities for stablecoin issuers. Central banks worldwide are exploring digital currencies that could coexist alongside private sector innovations.

Future Outlook

The future of stablecoins appears promising as they continue to gain traction across various sectors:

- Expansion into New Markets: Stablecoins are likely to penetrate emerging markets where traditional banking services are limited, providing accessible financial solutions.

- Increased Institutional Adoption: As large financial institutions explore blockchain technology's potential, partnerships with stablecoin providers may become more common.

- Technological Advancements: Innovations such as Layer 2 solutions could enhance transaction speeds and reduce costs associated with using stablecoins in lending protocols.

- Enhanced Regulatory Clarity: As regulations mature globally, clearer guidelines will foster greater confidence among users and investors alike, potentially leading to increased adoption rates.

Frequently Asked Questions About How Do Stablecoins Facilitate Lending And Borrowing In The Crypto Market

- What are stablecoins?

Stablecoins are cryptocurrencies designed to maintain a fixed value by being pegged to a reserve asset like fiat currency or commodities. - How do stablecoins facilitate lending?

Stablecoins provide a reliable medium of exchange that reduces volatility concerns in lending protocols, making them attractive for both lenders and borrowers. - What is overcollateralization?

Overcollateralization refers to requiring borrowers to deposit collateral exceeding the loan amount as a safeguard against default risk. - Are there risks associated with lending using stablecoins?

Yes, risks include market volatility, counterparty risks from exchanges, regulatory uncertainties, and vulnerabilities in smart contracts. - How do interest rates on stablecoin loans compare to traditional loans?

Interest rates on stablecoin loans can be significantly higher than traditional loans due to demand exceeding supply in crypto markets. - What role do regulators play in the future of stablecoins?

Regulators aim to create frameworks that ensure consumer protection while fostering innovation within the crypto space. - Can I use stablecoins for cross-border transactions?

Yes, stablecoins facilitate faster and cheaper cross-border transactions compared to traditional banking methods. - What should I consider before engaging in crypto lending?

Consider platform security, interest rate dynamics, your understanding of smart contracts, and potential regulatory impacts before participating.

In conclusion, stablecoins serve as a critical component in the evolution of lending and borrowing within the cryptocurrency market. Their ability to provide stability amid volatility enhances liquidity while offering innovative financial solutions that cater to diverse user needs. As regulations evolve and technology advances, the role of stablecoins is poised to expand further within both decentralized finance ecosystems and traditional financial markets.