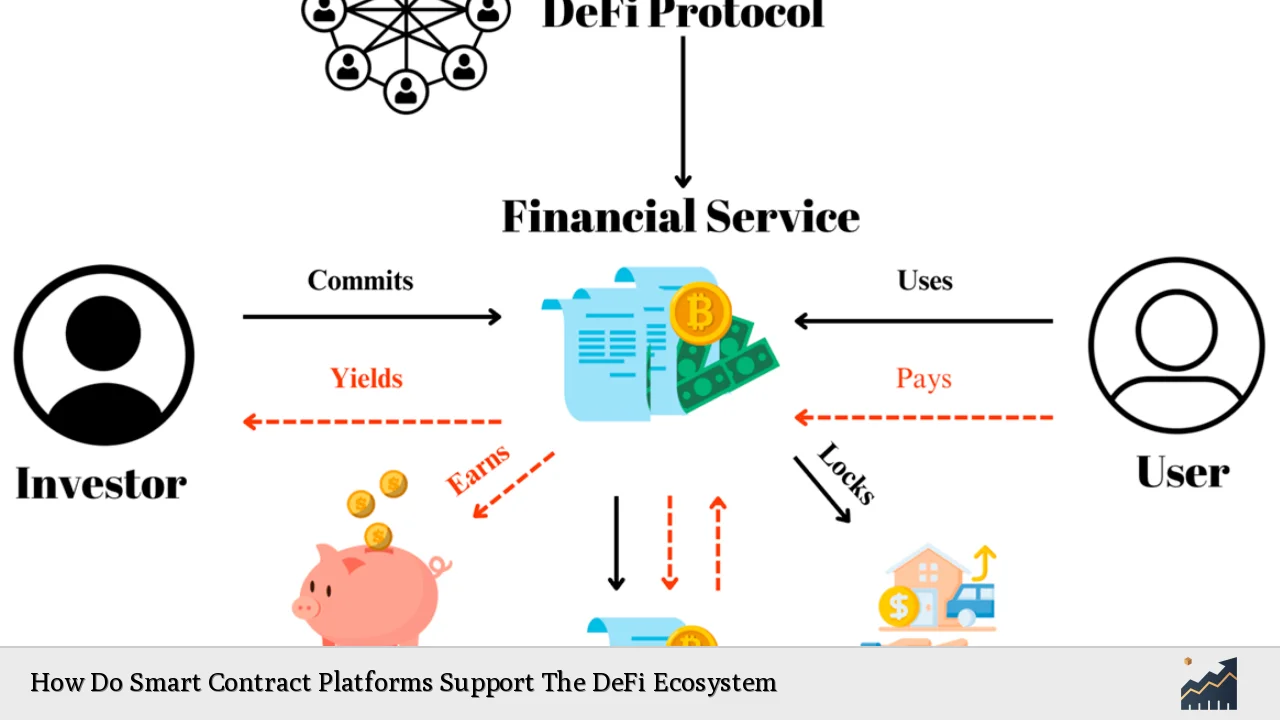

The rise of decentralized finance (DeFi) has transformed the financial landscape, enabling individuals to engage in a wide array of financial activities without traditional intermediaries. Central to this transformation are smart contract platforms, which automate and facilitate transactions on blockchain networks. Smart contracts are self-executing agreements coded to execute automatically when predefined conditions are met, thus eliminating the need for intermediaries such as banks and brokers. This innovation not only enhances efficiency and transparency but also democratizes access to financial services globally.

| Key Concept | Description/Impact |

|---|---|

| Smart Contracts | Self-executing contracts with terms directly written into code, enabling automated transactions and processes without intermediaries. |

| Decentralized Finance (DeFi) | A financial ecosystem built on blockchain technology that allows for peer-to-peer transactions without traditional financial institutions. |

| Automation | Smart contracts automate complex financial transactions, reducing execution times and minimizing human error. |

| Interoperability | Smart contracts enable different DeFi protocols to interact seamlessly, enhancing the overall functionality of the ecosystem. |

| Cost Efficiency | By removing intermediaries, smart contracts significantly reduce transaction costs, particularly in cross-border transactions. |

| Transparency and Security | All transactions executed by smart contracts are recorded on a public ledger, increasing accountability and reducing fraud risks. |

Market Analysis and Trends

The DeFi market is experiencing rapid growth, driven by the increasing adoption of blockchain technology. As of 2023, the DeFi market was valued at approximately $14.35 billion and is projected to grow at a compound annual growth rate (CAGR) of over 46.8%, reaching about $78.47 billion by 2029. This growth is fueled by several key trends:

- Rise of Decentralized Exchanges (DEXs): DEXs allow users to trade cryptocurrencies directly without a central authority, enhancing privacy and control over assets.

- Yield Farming: Users can earn rewards by providing liquidity to DeFi protocols, incentivizing participation in the ecosystem.

- Integration of Non-Fungible Tokens (NFTs): The incorporation of NFTs into DeFi applications is creating new opportunities for asset collateralization.

- Interoperability Solutions: The development of cross-chain technologies is facilitating seamless interactions between different blockchain networks, enhancing user experience and expanding market opportunities.

- Regulatory Engagement: As DeFi continues to grow, regulatory bodies are exploring frameworks to ensure consumer protection while fostering innovation.

Implementation Strategies

To effectively leverage smart contract platforms within the DeFi ecosystem, several strategies can be employed:

- Developing Robust Smart Contracts: Focus on creating secure and efficient smart contracts that minimize vulnerabilities. Regular audits and testing should be conducted to ensure reliability.

- Utilizing Layer-2 Solutions: Implementing Layer-2 scaling solutions can help manage network congestion and reduce transaction fees, improving user experience.

- Enhancing User Education: Providing educational resources about DeFi principles and smart contract functionalities can empower users to navigate the ecosystem confidently.

- Building Interoperable Protocols: Developing protocols that can easily integrate with various blockchain networks will enhance composability and expand functionality across platforms.

- Adopting Governance Models: Implementing decentralized autonomous organizations (DAOs) can facilitate community-driven governance, promoting transparency and inclusivity in decision-making processes.

Risk Considerations

While smart contracts offer numerous advantages, they also present certain risks that must be managed:

- Smart Contract Vulnerabilities: Bugs or flaws in smart contract code can lead to significant financial losses. Continuous auditing and testing are essential to mitigate these risks.

- Market Volatility: The cryptocurrency market is highly volatile, which can impact the value of assets involved in DeFi transactions. Users should be aware of potential price fluctuations.

- Regulatory Risks: As governments around the world begin to regulate DeFi activities, compliance with emerging regulations will be crucial for sustainability.

- Liquidity Risks: Inadequate liquidity on certain platforms can lead to slippage during trades or difficulties in executing large transactions.

- Security Concerns: Hacks and exploits targeting DeFi protocols have occurred in the past. Employing robust security measures is vital for protecting user assets.

Regulatory Aspects

The regulatory landscape surrounding DeFi is evolving rapidly as authorities seek to balance innovation with consumer protection. Key considerations include:

- Compliance Requirements: DeFi projects may need to adhere to existing financial regulations regarding anti-money laundering (AML) and know your customer (KYC) protocols.

- Tax Implications: Understanding the tax treatment of cryptocurrency transactions within DeFi is essential for users engaging in trading or yield farming activities.

- Consumer Protection Measures: Regulatory bodies are exploring ways to protect users from fraud and ensure transparency in DeFi operations.

- Global Regulatory Variations: Different countries have varying approaches to regulating cryptocurrencies and DeFi platforms. Awareness of local regulations is crucial for compliance.

Future Outlook

The future of smart contract platforms within the DeFi ecosystem appears promising, with several developments on the horizon:

- Increased Adoption of AI Technologies: Integrating artificial intelligence into smart contracts could enhance decision-making processes and improve risk assessment capabilities.

- Expansion of Financial Products: As developers continue to innovate, we can expect a wider range of financial products built on smart contracts, including derivatives and insurance products.

- Enhanced Interoperability: Continued advancements in cross-chain technologies will facilitate smoother interactions between different blockchain networks, expanding user access to diverse financial services.

- Greater Institutional Participation: As traditional financial institutions explore DeFi opportunities, we may see increased collaboration between centralized entities and decentralized platforms.

- Focus on Sustainability: The growing emphasis on sustainable finance may drive the development of eco-friendly DeFi solutions that align with environmental goals.

Frequently Asked Questions About How Do Smart Contract Platforms Support The DeFi Ecosystem

- What are smart contracts?

Smart contracts are self-executing agreements with terms directly written into code on a blockchain. They automatically execute actions when predefined conditions are met. - How do smart contracts enhance security in DeFi?

Smart contracts increase security by automating transactions without intermediaries, reducing points of failure and fraud risks associated with traditional finance. - What role do decentralized exchanges play in the DeFi ecosystem?

Decentralized exchanges (DEXs) facilitate peer-to-peer trading of cryptocurrencies without a central authority, allowing users greater control over their assets. - What risks are associated with using smart contracts?

Risks include vulnerabilities in code leading to hacks or exploits, market volatility affecting asset values, regulatory uncertainties, liquidity issues, and security concerns. - How can users ensure their investments are safe in DeFi?

Users should conduct thorough research on platforms before investing, utilize secure wallets, enable two-factor authentication, and stay informed about potential risks. - What is yield farming?

Yield farming involves providing liquidity to DeFi protocols in exchange for rewards or interest payments on deposited assets. - How does regulation impact the future of DeFi?

Regulation can shape the development of DeFi by ensuring consumer protection while fostering innovation; compliance with regulations will be crucial for sustainable growth. - What trends should investors watch in the DeFi space?

Investors should monitor trends such as increased institutional participation, advancements in interoperability solutions, AI integration into smart contracts, and the emergence of new financial products.

This comprehensive overview highlights how smart contract platforms support the burgeoning DeFi ecosystem through automation, security enhancements, cost efficiency, and innovative financial solutions while addressing potential risks and regulatory considerations. As this landscape continues to evolve rapidly, staying informed about trends will be essential for investors looking to navigate this dynamic environment successfully.