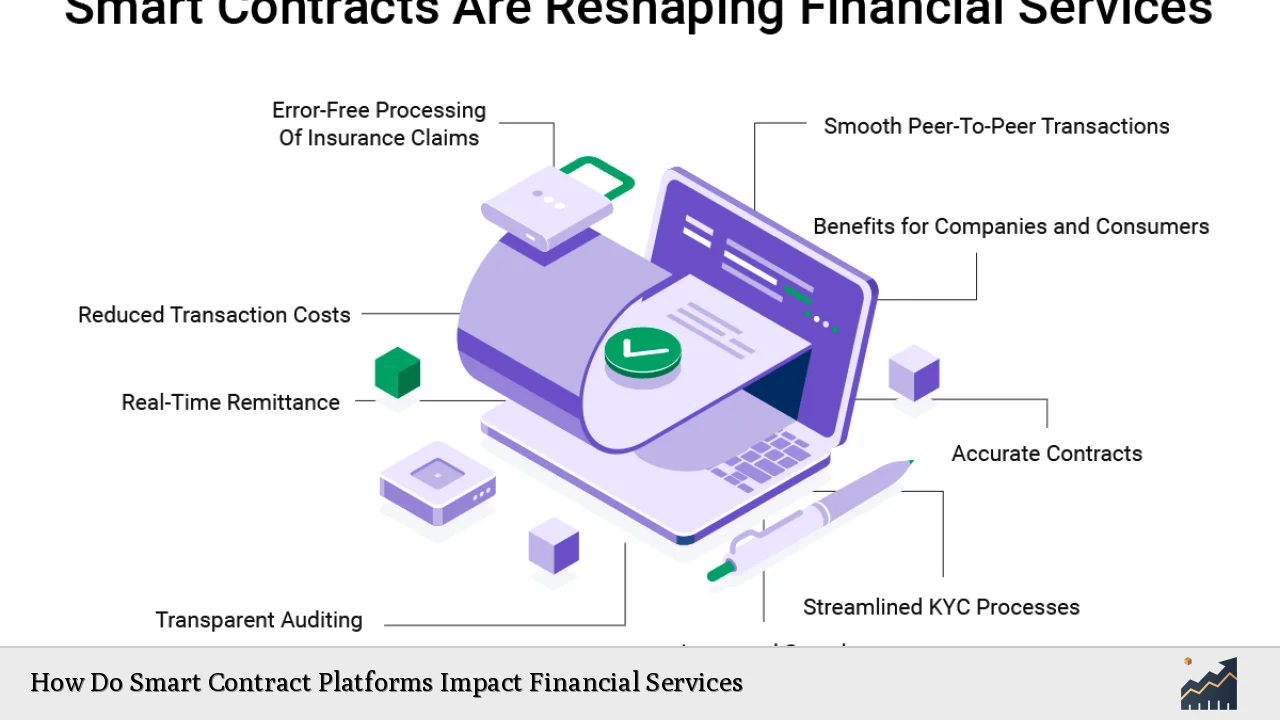

Smart contracts, self-executing agreements with the terms directly written into code on a blockchain, are revolutionizing financial services by enhancing efficiency, transparency, and security. As these platforms gain traction, they are reshaping traditional financial processes and creating new opportunities for innovation in various sectors. This article delves into the impact of smart contract platforms on financial services, exploring current market trends, implementation strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Efficiency Gains | Smart contracts automate processes, significantly reducing transaction times and operational costs by eliminating intermediaries. |

| Transparency | All transactions are recorded on a blockchain, providing an immutable and transparent record that enhances trust among parties. |

| Cost Reduction | By minimizing the need for manual processing and third-party verification, smart contracts lower transaction costs across various financial services. |

| Fraud Prevention | The use of cryptographic security measures in smart contracts reduces the risk of fraud and unauthorized access to sensitive information. |

| Real-Time Settlement | Smart contracts enable instant execution of transactions upon meeting predefined conditions, streamlining processes like trade settlements. |

| Decentralized Finance (DeFi) | The rise of DeFi platforms relies heavily on smart contracts to facilitate peer-to-peer transactions without traditional banking intermediaries. |

| Regulatory Challenges | The evolving legal landscape poses challenges for the enforceability and compliance of smart contracts with existing regulations. |

| Market Growth Potential | The global smart contracts market is projected to grow from $1.71 billion in 2023 to $12.55 billion by 2032, reflecting a CAGR of 24.7%. |

Market Analysis and Trends

The adoption of smart contracts in financial services is accelerating due to several key market trends:

- Rapid Market Growth: The global smart contracts market was valued at approximately $1.71 billion in 2023 and is expected to reach $12.55 billion by 2032, driven by increased adoption across various industries including finance, healthcare, and supply chain management.

- Decentralized Finance (DeFi) Expansion: DeFi platforms utilize smart contracts to automate financial services such as lending, borrowing, and trading without intermediaries. This trend is reshaping how financial transactions are conducted and is expected to continue growing as more users seek decentralized solutions.

- Integration with Traditional Systems: Financial institutions are increasingly integrating smart contract technology with existing systems to enhance efficiency while maintaining some traditional processes. This hybrid approach allows for smoother transitions into more automated environments.

- Emerging Technologies: Innovations such as Layer 2 solutions and AI-powered smart contracts are being developed to improve scalability and transaction speeds within blockchain ecosystems.

Implementation Strategies

To effectively implement smart contract technology within financial services, organizations should consider the following strategies:

- Pilot Programs: Initiating pilot projects can help organizations test smart contract applications in controlled environments before full-scale implementation.

- Stakeholder Collaboration: Engaging with stakeholders—including regulators, technology providers, and industry experts—ensures that all perspectives are considered during the implementation process.

- Training and Education: Providing training for staff on how to develop and manage smart contracts can facilitate smoother integration into existing workflows.

- Focus on Interoperability: Ensuring that smart contract platforms can interact with various blockchain networks enhances flexibility and usability across different systems.

Risk Considerations

While the benefits of smart contracts are significant, there are also risks that must be managed:

- Security Vulnerabilities: Despite their advantages, smart contracts can be susceptible to coding errors or exploits. Regular audits and security assessments are essential to mitigate these risks.

- Legal Uncertainty: The legal status of smart contracts varies by jurisdiction. Organizations must stay informed about regulatory developments that could affect their enforceability.

- Market Volatility: The cryptocurrency markets can be highly volatile, which may impact the stability of assets tied to smart contracts. Risk management strategies should account for potential fluctuations in value.

Regulatory Aspects

The regulatory landscape surrounding smart contracts is evolving rapidly. Key considerations include:

- Compliance Requirements: Financial institutions must ensure that their use of smart contracts complies with existing laws regarding data protection, anti-money laundering (AML), and know-your-customer (KYC) regulations.

- Legal Framework Development: As regulators gain a better understanding of blockchain technology and its implications for financial services, clearer guidelines will emerge to govern the use of smart contracts.

- Consumer Protection Measures: Regulatory bodies may implement measures to protect consumers engaging with decentralized platforms that utilize smart contracts.

Future Outlook

The future of smart contract platforms in financial services looks promising:

- Increased Adoption Rates: As awareness grows regarding the benefits of automation and transparency offered by smart contracts, more financial institutions are likely to adopt this technology.

- Innovation in Financial Products: The development of new financial products leveraging smart contract capabilities will likely emerge as institutions seek competitive advantages in a rapidly changing market.

- Global Expansion: Smart contract technology will continue to expand globally as emerging markets adopt blockchain solutions to enhance their financial systems.

Frequently Asked Questions About How Do Smart Contract Platforms Impact Financial Services

- What are smart contracts?

Smart contracts are self-executing agreements where the terms are directly written into code on a blockchain. They automatically enforce contractual obligations without intermediaries. - How do smart contracts improve efficiency in finance?

By automating processes such as transaction execution and compliance checks, smart contracts reduce processing times and operational costs. - What role do smart contracts play in decentralized finance (DeFi)?

Smart contracts enable DeFi platforms to operate without traditional banks by facilitating peer-to-peer transactions securely and transparently. - What are the risks associated with using smart contracts?

Risks include security vulnerabilities from coding errors, legal uncertainties regarding enforceability, and market volatility affecting asset values. - How is regulation evolving around smart contracts?

The regulatory landscape is developing as authorities seek to establish clear guidelines for compliance, consumer protection, and legal recognition of smart contracts. - What is the future outlook for smart contract adoption?

The adoption rate is expected to increase significantly as more organizations recognize the benefits of automation and transparency offered by this technology. - Can traditional financial institutions benefit from using smart contracts?

Yes, traditional institutions can streamline operations, reduce costs, enhance security measures, and improve customer trust through the use of smart contracts. - How do I start implementing smart contract technology in my business?

Begin with pilot programs to test applications while collaborating with stakeholders for insights on best practices in development and deployment.

Smart contract platforms represent a transformative force in financial services. By enhancing efficiency, reducing costs, improving transparency, and enabling innovative financial products through automation, they pave the way for a more streamlined future in finance. However, organizations must navigate associated risks carefully while remaining attuned to regulatory developments that will shape this evolving landscape.