Smart contract platforms are revolutionizing the way we conduct digital transactions, but their ability to handle high transaction volumes is crucial for widespread adoption. As blockchain technology continues to evolve, various solutions have emerged to address scalability challenges. This comprehensive analysis explores how leading smart contract platforms are tackling the issue of high transaction volumes, their current capabilities, and future prospects.

| Key Concept | Description/Impact |

|---|---|

| Scalability | The ability of a blockchain network to process an increasing number of transactions without compromising speed or cost-effectiveness |

| Layer 1 Solutions | Improvements made directly to the base blockchain protocol to enhance transaction processing capacity |

| Layer 2 Solutions | Off-chain scaling solutions that process transactions separately from the main blockchain to reduce congestion |

| Sharding | A method of splitting a blockchain network into smaller, more manageable pieces to increase overall throughput |

| Consensus Mechanisms | Protocols used to validate transactions and maintain network security, with varying impacts on scalability |

Market Analysis and Trends

The smart contract platform market has experienced explosive growth, with the global market size projected to reach $14.9 billion by 2033, growing at a CAGR of 25.8% from 2024 to 2033. This rapid expansion is driven by increasing adoption across various industries, particularly in finance, supply chain management, and real estate.

Ethereum, the pioneer of smart contract platforms, continues to dominate the market with a 52.4% share. However, newer platforms like Solana, Cardano, and Avalanche are gaining traction due to their innovative approaches to scalability. The market is characterized by intense competition and rapid technological advancements, with platforms constantly evolving to meet the growing demand for faster and more efficient transaction processing.

Implementation Strategies

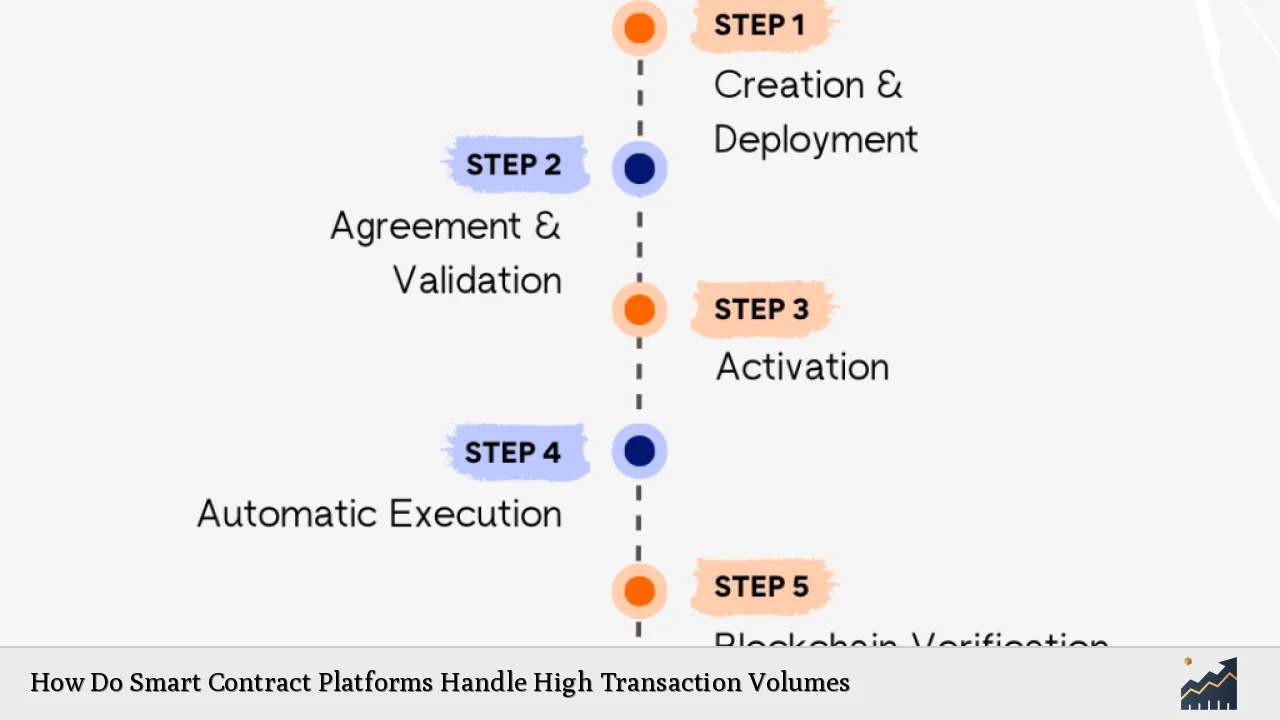

Smart contract platforms are employing various strategies to handle high transaction volumes:

Layer 1 Scaling Solutions

Layer 1 solutions involve direct improvements to the base blockchain protocol. Ethereum, for instance, is transitioning to Ethereum 2.0, which implements sharding and a Proof-of-Stake (PoS) consensus mechanism. This upgrade aims to significantly increase the network’s throughput from the current 15-45 transactions per second (TPS) to potentially thousands of TPS.

Solana takes a different approach, combining PoS with its innovative Proof-of-History (PoH) technology. This unique architecture allows Solana to process up to 65,000 TPS, making it one of the fastest blockchain networks currently available.

Layer 2 Scaling Solutions

Layer 2 solutions are becoming increasingly popular, especially for Ethereum-based projects. These off-chain scaling solutions process transactions separately from the main blockchain, reducing congestion and fees. Notable Layer 2 solutions include:

Optimistic Rollups: Projects like Arbitrum and Optimism use this technology to bundle multiple transactions and settle them on the Ethereum mainnet, significantly increasing throughput while maintaining security.

Zero-Knowledge Rollups: Platforms like zkSync and StarkNet utilize zero-knowledge proofs to validate transactions off-chain, offering even greater scalability potential.

State Channels and Sidechains: These solutions allow for off-chain transaction processing with periodic settlements on the main chain, enabling faster and cheaper transactions for specific use cases.

Interoperability and Cross-Chain Solutions

Platforms like Polkadot and Cosmos are focusing on interoperability, allowing different blockchains to communicate and share resources. This approach distributes the transaction load across multiple chains, effectively increasing overall capacity.

Risk Considerations

While scaling solutions offer promising improvements in transaction handling, they come with their own set of risks:

Security Trade-offs: Some scaling solutions may compromise on decentralization or security to achieve higher throughput. It’s crucial for investors and developers to understand these trade-offs.

Complexity and Technical Challenges: Implementing scaling solutions often involves complex technical processes that can introduce new vulnerabilities or bugs.

Regulatory Uncertainty: As blockchain technology evolves, regulatory frameworks struggle to keep pace, potentially impacting the adoption and implementation of certain scaling solutions.

Market Fragmentation: The proliferation of different scaling solutions could lead to market fragmentation, potentially hindering interoperability and widespread adoption.

Regulatory Aspects

The regulatory landscape for smart contract platforms and their scaling solutions is still evolving. Key considerations include:

Compliance with Existing Regulations: Platforms must ensure that their scaling solutions comply with existing financial regulations, particularly in areas like KYC/AML and data privacy.

Emerging Blockchain-Specific Regulations: Governments worldwide are developing blockchain-specific regulations that may impact how platforms implement scaling solutions.

Cross-Border Considerations: As smart contract platforms operate globally, they must navigate complex international regulatory environments.

Future Outlook

The future of smart contract platforms and their ability to handle high transaction volumes looks promising:

Continued Innovation: Ongoing research and development in areas like zero-knowledge proofs, sharding, and consensus mechanisms are likely to yield further improvements in scalability.

Increased Adoption: As scalability improves, we can expect to see broader adoption of smart contract platforms across various industries, potentially revolutionizing sectors like finance, supply chain management, and digital identity.

Convergence of Solutions: We may see a convergence of different scaling approaches, with platforms adopting hybrid solutions that combine the strengths of various techniques.

Focus on User Experience: As technical scalability improves, platforms will likely shift focus towards enhancing user experience and reducing the complexity of interacting with blockchain technology.

Regulatory Clarity: As the technology matures, we can expect more comprehensive and clear regulatory frameworks to emerge, providing greater certainty for developers and users.

In conclusion, smart contract platforms are rapidly evolving to meet the challenge of high transaction volumes. Through a combination of Layer 1 and Layer 2 solutions, along with innovative approaches to consensus and interoperability, these platforms are paving the way for widespread blockchain adoption. As the technology continues to mature, we can expect to see even more efficient, secure, and scalable solutions emerge, potentially transforming various aspects of our digital economy.

Frequently Asked Questions About How Do Smart Contract Platforms Handle High Transaction Volumes

- What is the current transaction capacity of major smart contract platforms?

Transaction capacities vary widely: Ethereum currently processes 15-45 TPS, Solana claims up to 65,000 TPS, while platforms like Cardano and Avalanche fall somewhere in between. However, these figures are constantly evolving as new scaling solutions are implemented. - How do Layer 2 solutions improve transaction handling?

Layer 2 solutions process transactions off the main blockchain, bundling them together before settling on the main chain. This reduces congestion and fees, allowing for higher transaction volumes without overloading the base layer. - What are the trade-offs between scalability, security, and decentralization?

Often referred to as the “blockchain trilemma,” platforms must balance these three aspects. Improving scalability can sometimes lead to reduced decentralization or security. The goal is to optimize all three, but trade-offs are often necessary. - How does sharding improve transaction handling?

Sharding splits the blockchain into smaller, more manageable pieces called shards. Each shard can process transactions independently, effectively multiplying the network’s overall capacity. - Are there any regulatory concerns with scaling solutions?

Yes, regulatory concerns include ensuring compliance with existing financial regulations, addressing cross-border legal issues, and adapting to emerging blockchain-specific regulations. Platforms must navigate these challenges while implementing scaling solutions. - How will improved scalability affect the adoption of smart contract platforms?

Improved scalability is expected to drive wider adoption across various industries. As platforms can handle higher transaction volumes more efficiently, they become viable for large-scale applications in finance, supply chain management, and other sectors. - What role does interoperability play in handling high transaction volumes?

Interoperability allows different blockchain networks to communicate and share resources. This can distribute transaction load across multiple chains, effectively increasing the overall capacity of the ecosystem and reducing congestion on individual networks.