Layer 1 (L1) blockchains serve as the foundational infrastructure for various digital assets, including Non-Fungible Tokens (NFTs). These blockchains provide the necessary security, scalability, and decentralization required for the minting, trading, and management of NFTs. The rise of NFTs has been significantly influenced by advancements in L1 blockchain technology, particularly through platforms like Ethereum and Solana, which have tailored their ecosystems to support NFT functionalities. This article explores how L1 blockchains facilitate NFTs, current market trends, implementation strategies, risk considerations, regulatory aspects, and future outlooks.

| Key Concept | Description/Impact |

|---|---|

| Smart Contracts | Layer 1 blockchains like Ethereum utilize smart contracts to automate NFT transactions, ensuring trust and reducing the need for intermediaries. |

| Decentralization | The decentralized nature of L1 blockchains enhances security and transparency in NFT transactions, protecting against fraud and manipulation. |

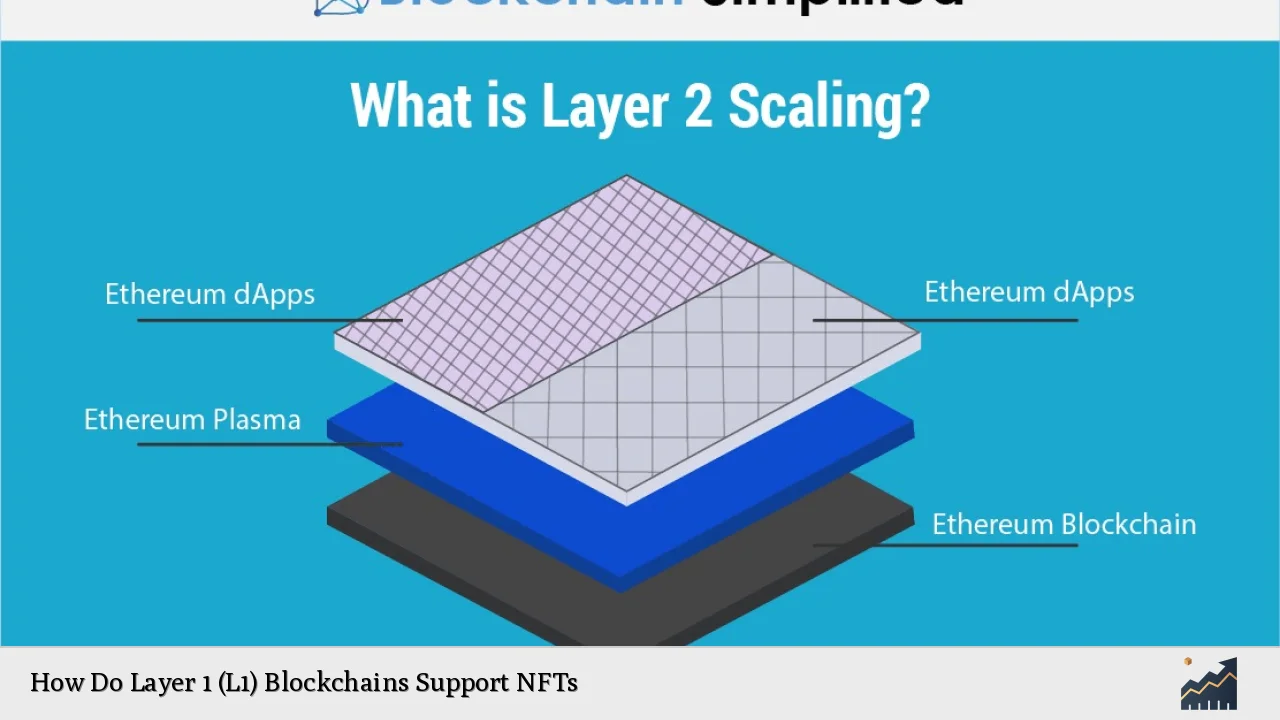

| Scalability Solutions | Many L1 blockchains are implementing scalability solutions to handle increased transaction volumes associated with NFT minting and trading. |

| Interoperability | Some L1 blockchains are designed to work seamlessly with other chains, enabling cross-chain NFT transactions and broader market access. |

| Market Demand | The growing interest in NFTs has led to increased transaction volumes on L1 blockchains, driving innovation and new use cases. |

Market Analysis and Trends

The NFT market has experienced exponential growth over the past few years. According to a report by CoinMarketCap, the NFT market capitalization reached approximately 4 million ETH in late 2023, with significant contributions from various categories such as profile pictures (PFPs) and digital art. The demand for NFTs is driven by their utility in representing ownership of unique digital assets, which has attracted both individual creators and institutional investors.

Recent statistics indicate that Layer 1 blockchains have surged dramatically in popularity. A CoinGecko report highlighted a staggering 7,000% increase in Layer 1 blockchain tokens in 2024, showcasing the transformative potential of these platforms. Ethereum remains a dominant force in the NFT space due to its robust smart contract capabilities and established ecosystem. However, other blockchains like Solana are gaining traction due to their lower transaction costs and faster processing times.

Current Market Statistics

- Ethereum: Holds approximately $24 billion in Total Value Locked (TVL) within its DeFi ecosystem.

- Solana: Experienced a notable rise in NFT trading volume from $1.5 million to over $1.1 million weekly by December 2023.

- NFT Market Growth: The overall trading volume across various marketplaces has increased significantly, reflecting a growing interest in diverse NFT collections.

Implementation Strategies

To effectively leverage Layer 1 blockchains for NFT projects, developers and investors should consider the following strategies:

- Choosing the Right Blockchain: Depending on project requirements such as transaction speed and cost efficiency, selecting an appropriate L1 blockchain is crucial. Ethereum is ideal for projects requiring extensive smart contract functionalities, while Solana may be preferred for high-volume transactions due to its speed.

- Utilizing Smart Contracts: Implementing smart contracts allows for automated transactions and enhanced security. Developers can create unique minting processes tailored to their specific NFT projects.

- Engaging with Communities: Building a strong community around an NFT project can drive demand and engagement. Platforms that support community interaction can enhance visibility and foster loyalty among collectors.

- Cross-Chain Functionality: Exploring interoperability between different L1 blockchains can expand market reach. Projects that can operate across multiple chains may attract a broader audience.

Risk Considerations

Investing in NFTs through Layer 1 blockchains involves several risks:

- Market Volatility: The NFT market is highly speculative. Prices can fluctuate dramatically based on trends and collector interest.

- Regulatory Uncertainty: As governments worldwide develop regulations regarding cryptocurrencies and digital assets, compliance risks may arise for NFT creators and platforms.

- Technical Risks: Issues such as network congestion or smart contract vulnerabilities can impact transaction efficiency or lead to financial losses.

- Environmental Concerns: Some Layer 1 blockchains utilize energy-intensive consensus mechanisms (like Proof of Work), raising concerns about their environmental impact.

Regulatory Aspects

The regulatory landscape surrounding NFTs is evolving rapidly. In many jurisdictions, NFTs are classified under existing securities laws if they represent an investment contract or share profits. Regulatory bodies like the SEC are increasingly scrutinizing NFT projects for compliance with securities regulations.

Key regulatory considerations include:

- KYC/AML Compliance: Platforms facilitating NFT sales may need to implement Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols to comply with local laws.

- Tax Implications: Transactions involving NFTs may incur capital gains taxes depending on jurisdictional tax laws.

- Consumer Protection Laws: Regulations aimed at protecting consumers from fraud or misleading practices may apply to NFT sales.

Future Outlook

The future of Layer 1 blockchains supporting NFTs appears promising as technological advancements continue to evolve:

- Enhanced Scalability Solutions: Ongoing improvements in scalability will likely reduce transaction costs and enhance user experience on L1 networks.

- Integration with Traditional Finance: As traditional financial institutions explore blockchain technology, partnerships could facilitate the tokenization of real-world assets through NFTs.

- Innovative Use Cases: The development of new standards like ERC-1155 allows for more complex interactions between fungible tokens and NFTs, potentially leading to novel applications across industries such as gaming and real estate.

- Increased Adoption: As awareness of NFTs grows among consumers and businesses alike, broader adoption is expected across various sectors beyond art and collectibles.

Frequently Asked Questions About How Do Layer 1 (L1) Blockchains Support NFTs

- What is a Layer 1 blockchain?

A Layer 1 blockchain is a base-level blockchain that provides the foundational infrastructure for decentralized applications (dApps) and transactions without relying on other networks. - How do Layer 1 blockchains facilitate NFTs?

Layer 1 blockchains enable the creation, storage, and transfer of NFTs through smart contracts that automate processes while ensuring security and transparency. - Why is Ethereum popular for NFTs?

Ethereum’s robust ecosystem supports a wide range of decentralized applications (dApps) with established standards for creating NFTs (like ERC-721), making it a preferred choice for developers. - What are the risks associated with investing in NFTs?

The primary risks include market volatility, regulatory uncertainty, technical vulnerabilities, and environmental concerns related to blockchain operations. - Can NFTs be created on any blockchain?

Yes, while Ethereum is the most popular choice due to its features, other Layer 1 blockchains like Solana also support NFT creation with varying benefits. - What role does scalability play in NFT transactions?

Scalability affects how many transactions can be processed simultaneously; higher scalability reduces congestion and lowers transaction fees during peak demand periods. - Are there legal considerations when creating NFTs?

Yes, legal considerations include compliance with securities laws, tax implications from sales or trades of NFTs, and adherence to consumer protection regulations. - What does the future hold for Layer 1 blockchains supporting NFTs?

The future looks bright with ongoing technological advancements aimed at improving scalability, security features enhancing user experience, and increasing integration with traditional finance.

In conclusion, Layer 1 blockchains play a vital role in supporting the growth of NFTs by providing secure infrastructure that enables efficient transactions. As market dynamics evolve alongside technological advancements and regulatory frameworks develop further clarity around digital assets, both creators and investors will find new opportunities within this burgeoning landscape.