Interest rates play a crucial role in shaping the financial landscape, influencing various asset classes, including cryptocurrencies. The relationship between interest rates and cryptocurrency values is complex and multifaceted, driven by investor behavior, market dynamics, and macroeconomic conditions. As central banks adjust interest rates to manage economic growth and inflation, the effects ripple through the cryptocurrency market, impacting prices and investor sentiment.

Understanding how interest rate changes affect cryptocurrencies is essential for investors aiming to navigate this volatile market effectively. Generally, lower interest rates tend to boost cryptocurrency prices as they encourage borrowing and investment in riskier assets. Conversely, higher interest rates often lead to decreased demand for cryptocurrencies as investors gravitate towards safer investments that offer guaranteed returns.

| Key Concept | Description/Impact |

|---|---|

| Interest Rate Cuts | Lower borrowing costs increase liquidity, encouraging investment in riskier assets like cryptocurrencies, often leading to price increases. |

| Interest Rate Hikes | Higher borrowing costs reduce liquidity and investor appetite for riskier assets, typically resulting in price declines for cryptocurrencies. |

| Market Sentiment | Investor sentiment shifts in response to interest rate changes; lower rates often lead to bullish sentiment, while higher rates can create bearish conditions. |

| Opportunity Cost | As interest rates rise, the opportunity cost of holding non-yielding assets like cryptocurrencies increases, leading to potential sell-offs. |

| Leverage and Margin Calls | Higher interest rates can lead to margin calls in leveraged positions, forcing investors to sell crypto holdings to meet obligations. |

| Global Economic Factors | The impact of U.S. interest rate changes can affect global capital flows, influencing demand for cryptocurrencies in emerging markets. |

Market Analysis and Trends

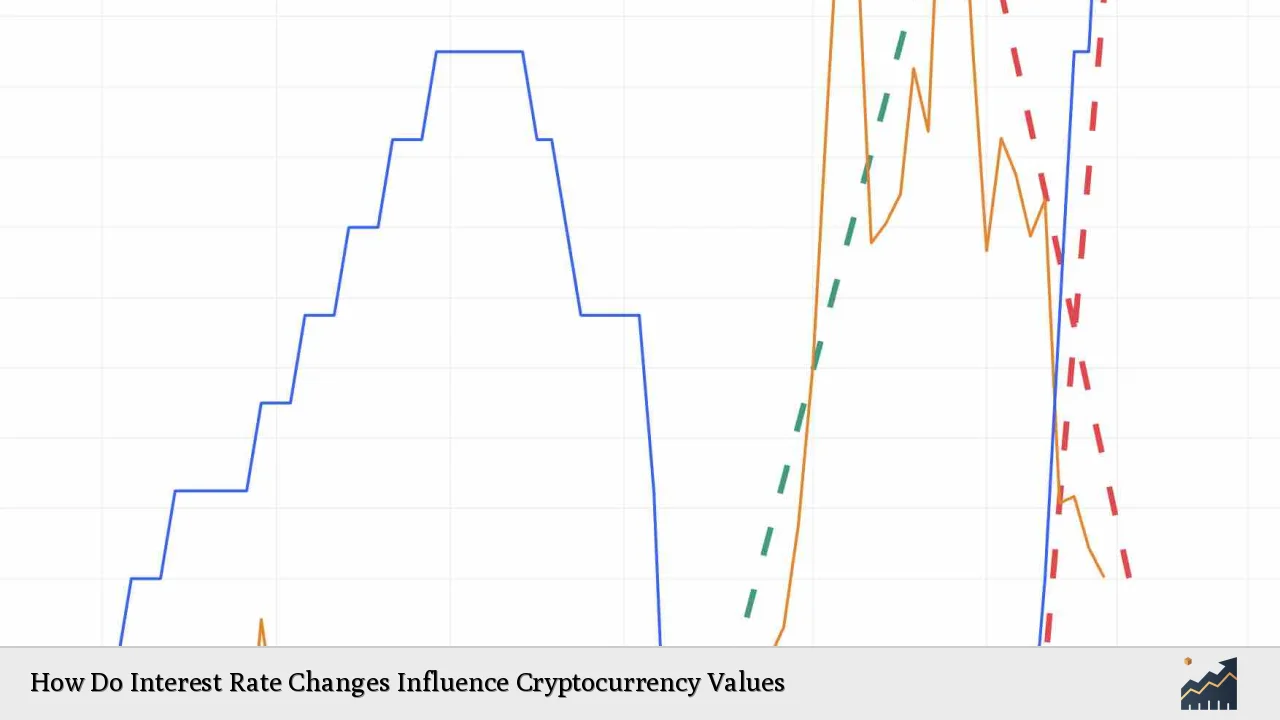

The cryptocurrency market has demonstrated significant sensitivity to changes in interest rates. In recent years, the Federal Reserve’s monetary policy has been a primary driver of market trends. For instance, during periods of rising interest rates, such as those seen in 2022 and early 2023, cryptocurrencies experienced sharp declines as investors moved towards safer assets. Conversely, when the Fed indicated a pause or reduction in rates later in 2023, cryptocurrencies rebounded sharply.

Current Market Statistics

As of December 2024:

- Bitcoin: Trading around $100,000 after hitting six figures for the first time.

- Ethereum: Benefiting from increased institutional investment and ETF inflows.

- XRP: Recently surged above $1.50 following legal clarity from the SEC.

- Market Cap: The total cryptocurrency market cap has surpassed $3.6 trillion.

These trends indicate a strong correlation between interest rate expectations and cryptocurrency valuations. The anticipation of lower rates has historically led to increased investment flows into the crypto space.

Implementation Strategies

Investors can adopt various strategies to navigate the impacts of interest rate changes on cryptocurrency values:

- Diversification: Spread investments across multiple cryptocurrencies and asset classes to mitigate risks associated with rate fluctuations.

- Market Timing: Monitor central bank announcements and economic indicators closely to time entry and exit points effectively.

- Leverage Management: Be cautious with leveraged positions during periods of rising interest rates to avoid margin calls that could force liquidation of assets.

- Risk Assessment: Regularly assess the risk profile of crypto investments relative to changing economic conditions.

Risk Considerations

Investing in cryptocurrencies involves inherent risks that are exacerbated by fluctuations in interest rates:

- Volatility: Cryptocurrencies are known for their price volatility; sudden shifts in interest rates can lead to rapid price changes.

- Liquidity Risks: In a high-interest-rate environment, liquidity may dry up as investors pull back from riskier assets.

- Regulatory Risks: Changes in monetary policy can prompt regulatory scrutiny on digital assets, affecting their values.

- Economic Indicators: Keep an eye on broader economic indicators such as inflation rates and employment data that might influence central bank decisions on interest rates.

Regulatory Aspects

The interplay between interest rates and cryptocurrency values is also influenced by regulatory frameworks. As governments worldwide adapt their monetary policies, they also consider the implications for digital currencies:

- Central Bank Digital Currencies (CBDCs): The rise of CBDCs may alter traditional banking dynamics and influence how cryptocurrencies are perceived as alternatives.

- Taxation Policies: Changes in tax regulations related to capital gains from cryptocurrency investments can affect investor behavior based on prevailing interest rates.

- Compliance Requirements: Increased scrutiny from regulatory bodies may arise during periods of economic uncertainty or high inflation, impacting market confidence.

Future Outlook

Looking ahead, the relationship between interest rates and cryptocurrency values will likely remain significant. Several factors will shape this dynamic:

- Economic Recovery Post-Pandemic: As economies recover from COVID-19 disruptions, central banks may continue adjusting rates based on inflationary pressures.

- Technological Advancements: Innovations within blockchain technology could enhance the utility of cryptocurrencies, potentially offsetting negative impacts from rising interest rates.

- Investor Education: As more retail investors enter the market, understanding how macroeconomic factors influence asset prices will become increasingly important.

In summary, while lower interest rates generally boost cryptocurrency prices by increasing liquidity and risk appetite among investors, higher rates can dampen enthusiasm for these volatile assets. Investors must remain vigilant and adaptable in response to changing economic conditions.

Frequently Asked Questions About How Do Interest Rate Changes Influence Cryptocurrency Values

- How do interest rate cuts affect the price of cryptocurrencies?

When interest rates are lowered, borrowing becomes cheaper. This often leads investors to shift capital towards riskier assets like cryptocurrencies, resulting in price increases. - Why does the Federal Reserve change interest rates?

The Federal Reserve adjusts interest rates based on economic conditions. Lowering rates stimulates borrowing and investment; raising them helps control inflation. - How do interest rate changes impact Bitcoin in the short term?

Interest rate cuts usually lead to increased volatility initially but tend to result in rising Bitcoin prices due to enhanced liquidity and investor risk appetite. - Should I change my crypto investment strategy when interest rates change?

Yes, adjusting your strategy based on the prevailing interest rate environment is advisable; low-rate environments favor riskier investments like crypto. - What other factors besides interest rates impact crypto prices?

Factors such as technological advancements, regulatory changes, market sentiment, and macroeconomic indicators also significantly influence cryptocurrency prices. - Are there specific cryptocurrencies more affected by interest rate changes?

Generally, major cryptocurrencies like Bitcoin and Ethereum show significant sensitivity to rate changes due to their market dominance and liquidity profiles. - How can I mitigate risks associated with investing in cryptocurrencies during changing interest rates?

Diversification across asset classes, careful monitoring of market trends, managing leverage carefully, and maintaining a solid understanding of macroeconomic indicators can help mitigate risks. - What is the long-term outlook for cryptocurrencies with fluctuating interest rates?

The long-term outlook will depend on broader economic conditions; however, stable or declining long-term rates may support sustained growth in the cryptocurrency sector.

This comprehensive analysis underscores the importance of understanding how macroeconomic factors like interest rate changes influence cryptocurrency values. Investors should remain informed about these dynamics to make educated decisions within this rapidly evolving market.